Update: Nov. 14, 2016 – SBA Communications Corp. provided an update to its exposure to both companies in a Securities and Exchange Commission filing. In the papers, SBA said that as of the end of Q3, T-Mobile and Sprint each represented around 16% of its total site leasing revenue. Revenue generated from each of T-Mobile and Sprint overlapping sites represents less than 5% of the company’s total site leasing revenue for the third quarter. In addition, the overlapping sites have an average remaining current term of approximately three years and five years with T-Mobile and Sprint, respectively, it said in the filing.

Update: Nov. 11, 2016 – An earlier headline said that American Tower’s announcement was “unprecedented”, when in fact on Dec. 16, 2013 the tower company made a similar announcement after a Dec. 13, 2013 article in The Wall Street Journal headlined “Sprint Working on a Bid for T-Mobile” was picked up by other media.

At that time American Tower said that Sprint and T-Mobile accounted for approximately 16% and 10%, respectively, of American Tower’s consolidated operating revenues. The numbers released today accounted for approximately 10% and 8% of their consolidated property revenues.

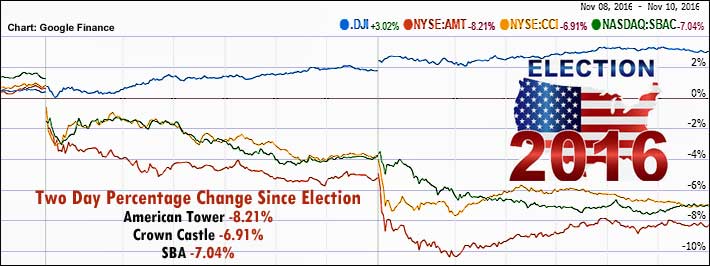

During the week of American Tower’s 2013 announcement, its stock rose 2%. This Thursday, American Tower was trading down 11%.

Recent rumors of a merger were solely based upon media speculation. Donald Trump’s election and its potential impact on a merger with T-Mobile did not come up Wednesday when Sprint’s chief financial officer Tarek Robbiati fielded questions at a telecommunications industry conference in New York.

American Tower Corporation this morning released information about its business in light of speculation regarding the possibility of a merger between Sprint and T-Mobile USA. The Sprint and T-Mobile rumor may be one of the reasons that American Tower’s stock has been in a free fall during the past two days, requiring their announcement tourniquet.

American Tower said in a statement, “For the quarter ended September 30, 2016, Sprint and T-Mobile USA accounted for approximately 10% and 8%, respectively, of American Tower’s consolidated property revenues.”

“American Tower currently has separate leases for antenna space with Sprint and T-Mobile USA on the same site at approximately 5,500 communications sites it owns or operates. The revenue generated from each of Sprint and T-Mobile USA on these sites represented approximately 4% of American Tower’s consolidated property revenues for the quarter ended September 30, 2016. The average remaining non-cancellable current lease term on these sites with Sprint and T-Mobile USA is approximately 5 years.”

Crown Castle, SBA Communications and Crown Castle International stocks were slightly lower this morning after two days of deep dives that saw American at one point yesterday down almost 11%.