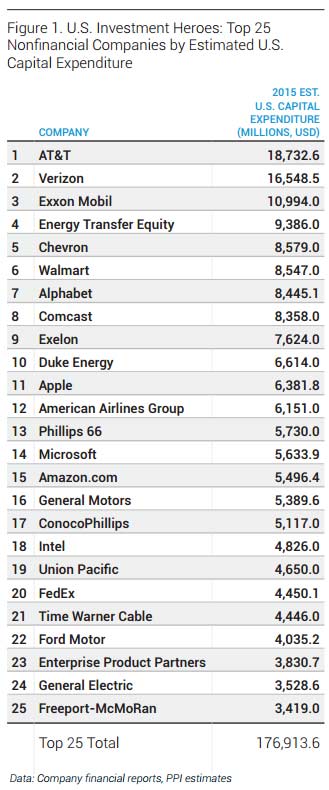

According to recent data from the Progressive Policy Institute, AT&T and Verizon outspent every other non-financial company in the nation in domestic capital expenditures in 2015. AT&T totaled $18.7 billion versus Verizon’s $16.5 billion.

Noticeably absent from the bottom of the top 25 list were T-Mobile and Sprint, with Freeport-McMoRan at $3.4 billion, just behind General Electric at $3.5 billion.

The report said that AT&T and Verizon invested large sums to maintain and expand their networks again this year. However, according to their estimates, AT&T’s capital expenditure was down by 11.6 percent as compared to the previous year.

The report said that AT&T and Verizon invested large sums to maintain and expand their networks again this year. However, according to their estimates, AT&T’s capital expenditure was down by 11.6 percent as compared to the previous year.

“Verizon boosted domestic capital expenditures in its wireless operations in 2015 in order to increase the capacity of its 4G LTE network. However, this rise in investment was largely offset by a decrease in their wireline segment capital spending, resulting in a net increase in investment of only 3.4 percent as compared to 2014,” the report noted.

But the study’s authors, Michelle Di Ionno and Dr. Michael Mandel, said that the two carriers have continued to tighten their capex in 2016. AT&T’s capex spending in the first half of 2016 was down 16.7 percent from the first half of 2014, and Verizon’s is down 14.4 percent from the same period two years prior.

“AT&T and Verizon invested large sums to maintain and expand their networks again this year,” the 16-page report said. “AT&T’s capital expenditure was down by 11.6 percent as compared to the previous year. Verizon boosted domestic capital expenditures in its wireless operations in 2015 in order to increase the capacity of its LTE network. However, this rise in investment was largely offset by a decrease in their wireline segment capital spending, resulting in a net increase of only 3.4 percent as compared to 2014.”

The PPI study believes the decline in capital spending is particularly notable in the telecom and energy sectors, due to a combination of cyclical factors, increased regulatory uncertainty in the telecom industry and falling oil prices.

“And, while it’s far too soon to draw a direct connection between regulatory changes by the FCC and spending by the telecom industry, it seems possible that the prospect of continued regulatory upheavals – including the potential for rate regulation – is influencing capital investment in the U.S. Still, capital spending trends are best judged over longer periods,” Ionno and Mandel said.

The full report is available here.