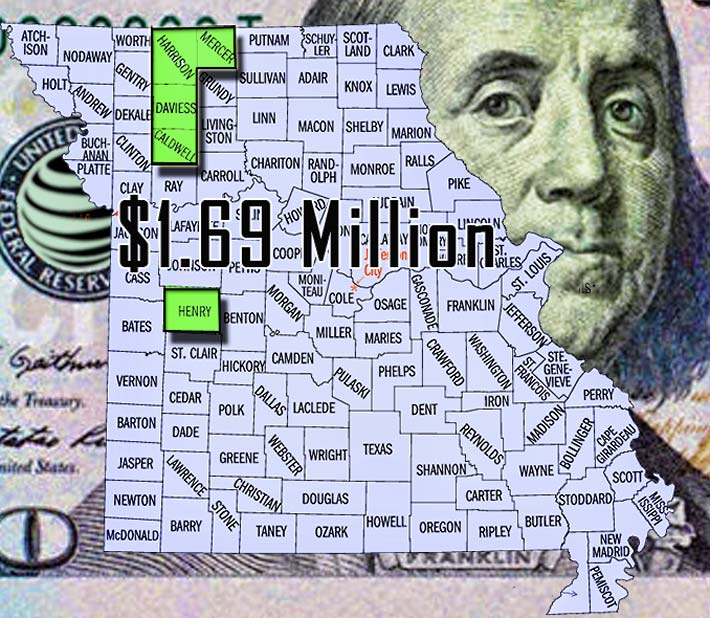

An April 2019 hearing officer’s $1.7 million assessment reduction was upheld by the Missouri State Tax Commission in its decision. available here.

The Missouri State Tax Commission (STC) affirmed a $1.7 million assessment reduction for 23 AT&T Mobility LLC cell towers, rejecting arguments from five county assessors that a hearing officer last year erroneously applied a “revenue procedure” rather than a depreciation table that is only used “for purposes of mass depreciation.”

The tax court also found that the record supported that the AT&T’s appraisal reports were “credible and convincing.”

“The STC finds that a reasonable mind could have conscientiously reached the same result as the Hearing Officer based on a review of the entire record,” the panel wrote in its decision.

During the April 2019 hearing it was identified that the counties’ appraiser had no credentials or previous experience.

On cross examination, appraiser Christopher Shrewsbury admitted that he had never before testified as a witness in a property tax case before an administrative tribunal, state court, or federal court in Missouri or any other state. Shrewsbury also admitted that he had never been qualified as an expert witness on original cost opinions by any tax commission, tribunal, or court.

Shrewsbury also admitted that he was not a real property or personal property appraiser and that he had no education or specialized training in real property or personal property appraisal.

Hearing officer Amy S. Westermann said she found Shrewsbury’s valuation ‘flawed’ and reduced AT&T’s appraised value of the sites in April 2019, as detailed below.

| Appeal No. | County | Respondents Assessed Value | Tax Commission Valuation Order | Valuation Difference |

| 16-46002 | Caldwell | $163,816 | $60,296 | $103,520 |

| 16-46003 | Caldwell | $870 | $111 | $759 |

| 16-46004 | Caldwell | $263,534 | $66,716 | $196,818 |

| TOTAL | Caldwell | $428,220 | $127,123 | $301,097 |

| 16-54514 | Daviess | $159,937 | $37,115 | $122,822 |

| 16-54515 | Daviess | $235,995 | $57,543 | $178,452 |

| 16-54516 | Daviess | $137,879 | $74,780 | $63,099 |

| 16-54517 | Daviess | $125,899 | $66,312 | $59,587 |

| 16-54518 | Daviess | $161,482 | $150,864 | $10,618 |

| TOTAL | Daviess | $821,192 | $386,614 | $434,578 |

| 16-59000 | Harrison | $150,705 | $60,017 | $90,688 |

| 16-59001 | Harrison | $147,255 | $60,344 | $86,911 |

| 16-59002 | Harrison | $152,625 | $79,278 | $73,347 |

| 16-59003 | Harrison | $148,395 | $76,318 | $72,077 |

| 16-59004 | Harrison | $141,464 | $68,658 | $72,806 |

| TOTAL | Harrison | $740,444 | $344,615 | $395,829 |

| 16-59500 | Henry | $59,904 | $133,759 | ($73,855) |

| 16-59501 | Henry | $189,109 | $82,089 | $107,020 |

| 16-59502 | Henry | $186,565 | $81,165 | $105,400 |

| 16-59503 | Henry | $174,887 | $137,388 | $37,499 |

| 16-59504 | Henry | $126,836 | $83,633 | $43,203 |

| 16-59505 | Henry | $201,878 | $121,787 | $80,091 |

| 16-59506 | Henry | $156,565 | $78,241 | $78,324 |

| 16-59507 | Henry | $187,615 | $91,099 | $96,516 |

| 16-59508 | Henry | $205,881 | $102,358 | $103,523 |

| TOTAL | Henry | $1,489,240 | $911,519 | $577,721 |

| 16-70002 | Mercer | $166,517 | $61,841 | $104,676 |

| TOTAL | Mercer | $166,517 | $61,841 | $104,676 |

| GRAND TOTAL | $3,518,777 | $1,831,712 | $1,687,065 |