|

Shining backhaul star tarnishes Crown Castle's fourth quarter, but don't write off FiberTower

February 25, 2008 - Crown Castle International's President and Chief Executive Officer, John Kelly, was enthusiastic about his company's additional investment of $55 million in FiberTower Corporation during an analysts' conference call during August of 2005. August of 2005.

Kelly said that they were very interested in increasing FiberTower's backhaul services for carriers and were "very happy with our current investment level and will continue to grow it and report to you on how that business looks on future calls."

"So we're very excited about what the potential of that particular company is and the reason we have maintained our interest in it at about a third of the total company," Kelly said.

Ben Moreland, Crown Castle's Chief Financial Officer, informed analysts that Crown Castle was focusing upon the long term and he saw a tremendous opportunity to grow value in the investment and consider liquidity options down the road.

One of those options was exercised earlier this month when CCI reported that it had reduced the value of its FiberTower investment by taking a $75.6 million write-down during Q4 2007.

However, FiberTower is still a strong candidate for taking a financially healthy bite out of the $17 billion cell site backhaul market.

FiberTower's backhaul system for wireless carriers, the company says, decreases service outages by 50 to 60 percent while costing the provider considerably less. The company uses point-to-point microwave radio links to move cellular traffic from the tower to a central aggregation point; multiplexes and grooms it; then sends it on its way to the provider's main switch via a leased fiber line.

American Tower provided early funding

In addition to venture capitalists, in 2005 the company's business model also caught the attention of two major tower owners that provided funding, American Tower Corporation (7%) and SpectraSite Communications (6%). SpectraSite was later acquired by American Tower.

Initially, all three companies pledged access to their tower sites, seeing the joint venture being able to enable their carrier tenants the ability to get back to the public network or getting back to their switch as efficiently and inexpensively as possible.

FiberTower's share price was trading around the $12 level in early May of 2006, soaring to an intraday high of $15.90 in mid-May after the announcement of a merger agreement that would combine the spectrum assets of First Avenue Networks with FiberTower's transport abilities in a $1.5 billion all-stock transaction.

The stock quickly settled back down to levels just below $12, but then ended the year with more than a 50% shave.

Although FiberTower's (FTWR) revenues have grown very rapidly over the past three years, the company hasn't displayed an expected level of earnings growth or provided any indication that it was moving quickly enough towards critical mass during 2007. The stock price has been on a downslide ever since, closing Friday at $1.48, slightly above its 52-week low of $1.41 last month.

In August, the company announced that it had entered into an agreement with Sprint to provide backhaul services in seven of the wireless carrier's initial WiMAX launch markets. FiberTower said it was unable to disclose terms of the agreement as it is subject to confidentiality agreements. However, the company did reveal that Sprint's deployment is based on providing Ethernet-based backhaul, a first for any mobile backhaul provider.

Buoyed by a late July statement from Sprint Nextel and Clearwire that they would build a joint national WiMax network, the FiberTower announcement raised its stock 25% overnight, to $4.40, but the increase was short-lived as the Sprint / Clearwire engagement hit the rocks when the companies said they were calling it off because of business complexities.

On January 21, Fiber Tower announced that Michael Gallagher had resigned, as President, Chief Executive Officer and Director to pursue other interests. The release stated that the board of directors had begun a search for a new CEO and had retained an executive search firm to assist in its recruiting efforts. The news further depressed the stock another 17% to $1.56.

But John D. Beltic, FiberTower's Executive Chairman, says the company is poised for continued growth, citing a record number T-1 additions they have received during the fourth quarter and a record order backlog as of December 31, 2007. During Gallagher's tenure, the company signed MSA's with five of the top seven carriers.

During the third quarter of 2007, FiberTower saw service revenues increase $1.1 million or 17%, to $7.3 million as compared to $6.2 million for the previous quarter. Billing T-1s grew 18% from 10, 207 at the end of the second quarter to 12,030, and billing sites grew 8% from 1,848 to 1,991 during the same period.

New customer locations sales in the third quarter saw a marked improvement of 183% from the previous quarter. The new sales totaling 1,816 were 21% greater than the total for all of 2006. FiberTower's co-location rate improved to 1.63 carriers per site, representing the third consecutive quarter of growth.

Marriage could be a ménage à trois

Although it is not known how it will affect FiberTower, on Wednesday, wall street reports said Sprint and Clearwire had revived talks after Sprint backed away in November. That earlier plan had called for Sprint to contribute $2.75 billion toward the expansion of WiMax networks to 19 cities by the end of this year, but the company pulled out of that pact in an effort to undo the work of former CEO Gary Forsee.

However, Intel might be the broadband venture's savior, following reports that it is close to announcing that it will fund $2 billion of the project. If that marriage doesn't happen, analysts believe that an option for Sprint would be to spin off its WiMax unit, called Xohm, and merge it with Clearwire, which operates WiMax networks in 46 US markets. Clearwire also needs the financial infusion, having burned through $400 million in the third quarter.

As two large wireless carriers, AT&T and Verizon, start moving forward using long term evolution (LTE) as their next network upgrade, Intel is being pressured to find someone to build a national WiMax network so it can sell WiMax chips for new devices.

Sprint and Clearwire are refusing to comment about the revival of the joint venture. "Rumors are just kicking around again. It's rumor," Sprint spokesman John Polivka said. "We don't comment on rumors. There's nothing going on."

Intel Capital holds about a 25% stake in Clearwire, whose founder, Craig McCaw, is the company's largest single shareholder.

Combining wireless Ethernet over microwave is ideal for WiMax backhaul, and Sprint selected FiberTower last August as the first backhaul provider to deploy commercial Ethernet services. Unlike the rigid structure of T-1 connections, Ethernet's scalability features and support for ultra-high data rates, Sprint found that Ethernet makes for "flatter", more cost efficient network arrangements.

FiberTower positioned for backhaul opportunities

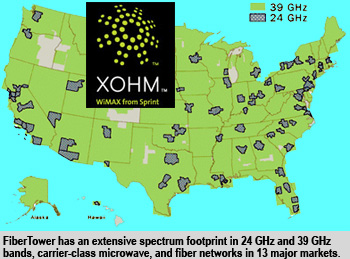

With an extensive spectrum footprint in the 24 GHz and 39 GHz bands, microwave and fiber networks in 13 major markets, customer commitments from six of the leading cellular carriers, and partnerships with the largest tower operators in the U.S, FiberTower is considered to be one of the leading alternative carriers for wireless backhaul.

Though some U.S. carriers may have easy and fairly inexpensive access to T-1 lines, especially if their parent is a local exchange, those monthly leased line fees add up. A typical T-1 costs between $250 to $500 or more per month, depending upon the geographic region, and most cell sites require four T-1 lines.

A study by Nokia Networks found that operators spend almost one-third of their network technical operations budgets on backhaul.

The high cost of installing one mile of fiber in an urban area can run from $250 thousand to $1 million. Bridging the same distance using a microwave link might be as economical as $65,000.

Although copper T-1 lines might cost the carrier considerably less, they have a limited capacity of 1.544 Mb. Even if a carrier uses four T-1s, the maximum bandwidth they are able to support is 6 Mbps, falling short of the bandwidth that will be required by future WiMax and carrier networks.

Within a few years it is expected that the average cell site is going to need from 16 to 32 T-1 equivalents. With the average cell site presently having from 4 to 8 copper T-1s, the revenue possibilities are considerable for the San Francisco-based backhaul provider.

|