|

Cingular's cold fourth quarter could be terminal for some wireless construction contractors

October 24, 2006 - Casualties of a Cingular slowdown are beginning to surface as some construction contractors find that they're unable to keep their crews active with expected, but cancelled projects in their UMTS pipeline.

Mid-size and large construction companies such as WesTower Communications, Andrew Corporation and Radian Communication Services will not feel Cingular's budgetary belt tightening as much due to their diversified client base, but smaller contractors whose businesses primarily rely upon the build projects of one customer are already feeling the carrier's shutdown in some markets.

Last week, contractors were informed that ongoing installations and projects affecting service were to be completed, but new construction projects were on hold until the first quarter of 2007and NTPs were being cancelled.

Although Cingular had said four months ago that there would be a reduction in their capital expense budget towards the end of this year, contractors were staffing for awarded projects recently issued by the nation's largest wireless carrier.

Unchecked UMTS build blamed

Reportedly caused by an unbridled UMTS build-out that went over budget this year, Cingular was forced to tighten the reins on their spending at a time when end-of-year projects are typically a robust part of a contractor's business.

As a result of the slowdown, some of Cingular's project managers provided by staffing companies have been terminated. In addition, to minimize cap ex spending, materials purchased for projects that are on hold are being used to build new sites, reducing orders expected by some suppliers.

Cash flow concerns will surface

On the same day that Cingular's site development group was announcing the cancellation of hundreds of Q4 new builds, the carrier's CFO informed the financial community of the company's tripling of third-quarter profits on a lower customer turnover rate and strong sales.

Cingular is secure in its ability to pay its suppliers and contractors with Q3 revenue at a record $9.55 billion, compared with $8.7 billion recorded in the same quarter a year ago. However, its reduction in site builds can have a domino effect upon large and small contractors.

Some third-tier subcontractors will suffer the most since they will be the last to be paid in an industry that is burdened with under-capitalized companies relying upon the business of carriers and management companies that reluctantly release funds at 60 days to the prime contractor. Onerous paid when paid clauses add to their financial dilemma.

Companies were forced to scramble for work when Cingular had a short stand down last March. In order to keep their crews from leaving for any extended length of inactivity - for some employees a one week hiatus will have them leave for the competition, no matter how well they have been compensated - contractors will be forced to buy projects in a market that already operates at thin margins.

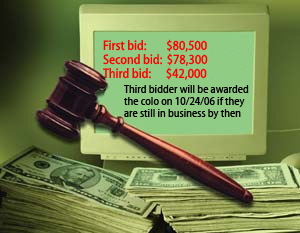

Line and antenna companies have been calling around the industry this week to see if there are any project openings for multi-crew mobilizations. Two service companies employing a total of 19 field personnel told WirelessEstimator.com that they will be forced to file for bankruptcy if they cannot obtain immediate funding and work for their employees. One of the contractor's problems was directly attributed to the Cingular slowdown; the other, although not doing Cingular work, suffered from the inherently poor business plan of having the majority of its income come from one customer.

A number of contractors see a shakeout as inevitable and find carrier slowdowns to be beneficial. They say that there are companies that are still trying to solicit talented field and management personnel and this will provide that opportunity.

Bechtel's management of Cingular's site builds will also suffer in an environment that has already seen the country's largest private contractor lose some of its market share. Although Bechtel is still strong in key markets such as Chicago, their position is weakening in California and other areas where new sites are being handed off to Cingular staffing.

Management companies such as Lucent, Bechtel, General Dynamics and others will be awarded projects as the low bidder and will expect contractors to meet their target prices.

E-bid's popularity is waning

To the enjoyment of construction contractors and the benefit of the industry at large, e-bidding, where the bidder can only provide a lower bid to obtain the project, is slowing as an already busy industry begins to ramp up for an expected workload fueled by the recent AWS spectrum auction.

However, as the labor force becomes an essential and sought after part of an infrastructure build, companies are finding that it is difficult to use reverse bidding, a process that barely works for commodities and has proven not to be beneficial for service companies that must employ multiple skill sets that are not capable of being reduced in price by volume considerations.

During earlier years Bechtel and T-Mobile found projected savings to be compelling, but oftentimes the anticipated savings were illusory, some of their managers have found after having to expend the time and dollars to rehabilitate projects that were done incorrectly by low bid contractors.

Contractor relationships suffer

Also, they'll privately admit that the auctions have inflicted real damage on contractor relationships in a process that is almost coercive…by informing the bidder that they would lose all of their work if they did not participate.

Squeezing contractors because they are in a buyer's market is dangerous. When the economy turns around and demand exceeds supply, studies identify that contractors will retaliate against buyers that they feel have taken advantage of them by charging higher prices.

Recently, numerous contractors have been providing e-bids that are considerably higher than they would normally charge due to their current workload and their disdain for the process; oftentimes being successful although they are charging an additional 30% or more.

Ironically, online reverse auctions violate the ethics policies of some companies that utilize them in regards to fair competition, building long-term relationships, trust, respect, and conducting business free of deception or coercion.

Multiple contractors believe that 2007 is going to be a banner year for the industry, but do not see an explosive Q4 this year. They believe that it would have been more encouraging if carriers and other clients were further advanced with their system architectures and had the ability to manage their ambitious rollouts.

Cingular's slowdown will clearly have an effect upon many of the industry's suppliers and service companies, but consolidation could have an even greater consequence.

Tower owners and carriers have recently extolled the benefits of industry mergers. Upon the completion of planned acquisitions there will be four major carriers with a similar complement of tower owners.

The carrier side could shrink even further. Sprint Nextel Corp. is expected to report the worst quarterly results by a top-tier U.S. wireless provider in two years this Thursday, and may become an acquisition target due to a bleak near-term outlook, according to analysts.

Suppliers and service companies do not view the bundling of companies as beneficial since it could provide for power-based bargaining that would rival e-bids.

|