|

Offer is on the table only until this Friday

ADC's dropping share price opens door for CommScope to acquire Andrew for $1.7 billion

August 8, 2006 - One cable giant is courting another coaxial Goliath in a triangular love fest that is being closely watched by industry observers, stockholders and employees of both companies.

Less than three months into the announced engagement of ADC and Andrew Corporation, CommScope has decided that if there are going to be acquisition vows, the Hickory, North Carolina cable manufacturer should be the selected suitor.

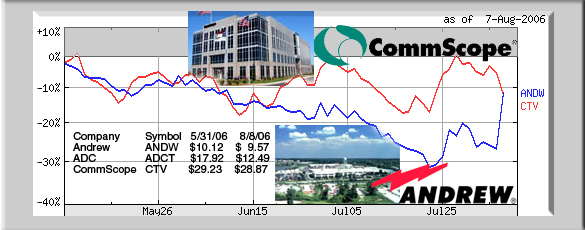

CommScope announced yesterday that its marriage proposal included acquiring all of the outstanding shares of Andrew Corporation for $9.50 per share in cash. CommScope's all-cash proposal represents a premium of approximately 36% over the $6.97 per share value Andrew's shareholders would receive under the existing merger agreement between Andrew and ADC Telecommunications, Inc. based on the closing price of ADC's common stock on August 4, 2006, the last trading day before CommScope's proposal was made public.

CommScope's proposal also represents a premium of approximately 20% over

|

Refresh this page

for updated quotes

|

|

|

Andrew's per share closing price of $7.89 on August 4, 2006. The market welcomed the news and Andrew's stock soared almost $2.00, but remained flat today. CommScope saw a loss on the announcement yesterday, but recovered most of the drop at today's closing.

Some Andrew shareholders have voiced opposition to the ADC offer after ADC's stock took a nose dive since the May 31, 2006 offer to buy Andrew.

CommScope has given Andrew until this Friday at 5:00 p.m. to accept their proposal or it will be withdrawn. It is not known whether ADC will provide a counter offer.

Andrew's up, ADC is down

Andrew recently reported record sales of $551 million for its third quarter ended June 30, 2006, an increase of 13% compared to $487 million in the prior year quarter. ADC, however, announced reduced guidance for the current quarter.

The ADC Telecommunications, Inc. merger was approved by the Federal Trade Commission on July 5. Andrew has not provided any public comments on the proposed acquisition.

The proposal, which was unanimously approved by CommScope's Board of Directors, is valued at approximately $1.7 billion, including assumption of approximately $186 million of Andrew net debt. This represents aggregate additional consideration of approximately $404 million over the current value provided to Andrew's shareholders under the existing ADC / Andrew merger agreement. The merger is expected to be accretive to CommScope's earnings per share in the first year after closing, excluding any related special items. Assuming the timeline set forth in the proposal letter, it is anticipated that the proposed transaction would close in early 2007.

In a conference call, CommScope executives said they believe that Andrew's manufacturing performance can be improved by substituting aluminum in place of copper for some products, a cheaper, more stable and in some cases easier to work with commodity.

CommScope's 1,000,000+ sq. ft. Catawba, NC facility is the largest coaxial cable manufacturing facility in the world and has been CommScope's flagship facility for over 30 years. The company has additional manufacturing facilities throughout the U.S. and abroad.

CommScope expects the combined company to be a leader in virtually every aspect of "last mile" communications: structured cabling solutions for the business enterprise, broadband cable for HFC applications and wireless communications infrastructure. In addition to the compelling strategic fit of Andrew and CommScope, the combination of the companies' respective operations is expected to result in meaningful sales, operating and cost synergies. CommScope has a strong global track record of managing its businesses to create shareholder value. Moreover, CommScope's executive management team has extensive experience in all the product areas in which Andrew currently operates. Given CommScope's manufacturing discipline and commitment to operational excellence, and based on its review of publicly available information, the Company expects to achieve annual cost savings of approximately $30 million to $50 million in the first full year after completion of the transaction and approximately $70 million to $90 million in the second full year after completion.

"We believe that our all-cash proposal is extremely compelling for Andrew shareholders and provides Andrew shareholders superior value over that contemplated by the existing merger agreement with ADC," said Frank Drendel, CommScope's Chairman and Chief Executive Officer. "Under our proposal, Andrew shareholders will receive a substantial cash premium for their shares without the significant uncertainties inherent in ADC's proposed stock-for-stock merger transaction. We believe that Andrew's Board of Directors and shareholders will find our all-cash proposal superior to the ADC transaction. For CommScope shareholders, we believe this transaction represents a unique opportunity to become even more competitive and profitable, with an even stronger and more diverse revenue stream. We look forward to Andrew's Board and management team carefully considering our all-cash proposal and moving quickly with them towards a definitive merger agreement.

"The combination of Andrew and CommScope is a logical step in the continued growth and development of CommScope," continued Mr. Drendel. "The combination will create a global leader in providing solutions for the 'last mile' of communications networks. The 'last mile' provides the final link between broadband and content-rich services and the end-user, including homes, business enterprises and wireless customers. Andrew is an excellent fit with our portfolio, and provides us with the opportunity to build upon CommScope's innovative carrier technologies and Andrew's strong global wireless channel and brand. The transaction will also expand our global footprint and our worldwide growth opportunities by combining CommScope's leading global channel in enterprise applications with Andrew's in-building wireless solutions."

The transaction would be financed through a combination of cash on hand and debt financing. CommScope has received commitment letters from Bank of America, N.A. and Wachovia Bank, N.A. (and their respective affiliates) for the financing of the transaction, which are subject to due diligence and other customary conditions. CommScope's offer, however, is not subject to a financing condition. Upon completion of the transaction, with the anticipated free cash flow generated by the combined company and divestitures of non-core businesses, CommScope intends to reduce the company's debt on a consistent basis.

Below is the text of the letter that was sent yesterday morning to Ralph Faison, Andrew's President and Chief Executive Officer:

August 7, 2006

Mr. Ralph E. Faison

President and Chief Executive Officer

Andrew Corporation

3 Westbrook Corporate Center

Suite 900

Westchester, Illinois 60154

Dear Ralph:

We are pleased to submit this proposal to combine the businesses of our two companies, subject to the terms and conditions discussed below. We believe that the combination of the businesses of Andrew Corporation ("Andrew") and CommScope, Inc. ("CommScope") is a compelling strategic fit that will build upon Andrew's and CommScope's highly complementary operating assets. This is an outstanding opportunity for both of our companies that offers significant value for Andrew's shareholders. We believe our proposal is superior, both financially and strategically, to the offer contemplated in your merger agreement with ADC Telecommunications, Inc. ("ADC").

We have followed the progress of the proposed merger between Andrew and ADC since its announcement on May 31, 2006. We note that since the announcement of the ADC-Andrew merger, ADC's share price has declined approximately 45%. Based on the exchange ratio in the ADC-Andrew merger agreement, and ADC's current market price of $12.22 per share, Andrew shareholders would receive only $6.97 per share of value under such merger agreement. We also note that while Andrew has reported results consistent with market expectations, ADC's recent pre-announcement of reduced guidance for the current quarter and fiscal year appears to have further eroded shareholder confidence in the proposed combination. We believe our proposal provides superior value to Andrew's shareholders in a market environment where the value of the proposed transaction with ADC has been subject to considerable uncertainty.

Our Board of Directors has unanimously authorized us to propose an alternative transaction in which CommScope would acquire all of Andrew's outstanding shares at a price of $9.50 per share in an all-cash merger. This proposal represents a premium of 36% over the current value of ADC's proposal, based on ADC's closing price on August 4, 2006 of $12.22 per share, and a 20% premium over Andrew's closing price on August 4, 2006 of $7.89 per share. Our proposal is not subject to any financing condition. Both Bank of America, N.A. and Wachovia Bank, N.A. (and their respective affiliates) have agreed to provide the financing necessary to consummate our proposed transaction, subject to due diligence and other customary conditions. In addition, we have reviewed the regulatory approvals that will be necessary to complete the transaction and will commit to obtaining these approvals as expeditiously as possible.

Our proposal is based on the publicly available information regarding Andrew, and is therefore subject to satisfactory completion of due diligence. However, as you are aware, we are familiar with most aspects of the Andrew business and expect our diligence review to be relatively short. We would expect to be able to complete our diligence review promptly after receiving access to the needed information. Our proposal is conditioned on negotiation of a mutually acceptable merger agreement. Beyond those changes needed to reflect an all-cash deal and any changes you may require, we expect the terms of our merger agreement would be similar to the merger agreement entered into between Andrew and ADC. Shortly after completion of the due diligence we expect to be able to enter into this negotiated agreement.

Taking into account the legal, financial, regulatory and other requirements, we expect that the proposed transaction could close in early 2007.

We believe that Andrew's Board of Directors should readily find that our proposal is a "Superior Proposal," as defined by your existing merger agreement, and that entering into a combination with CommScope would be in the best interests of Andrew's shareholders.

To the extent you are permitted to do so under your merger agreement with ADC, we and our advisors are prepared to meet with you and your advisors immediately to discuss our proposal and finalize an agreement as expeditiously as possible. We both have significant transaction experience and we believe that working together will create value for our stockholders.

We request a response to this letter by 5:00 p.m., Eastern Time, on Friday, August 11, 2006. Our proposal will expire at that time. We look forward to hearing from you. Please contact me at your earliest convenience.

Sincerely,

/s/ Frank M. Drendel

Frank M. Drendel

Chairman and Chief Executive Officer

|