|

Wall Street cool to Crown's strong revenue growth

March 1, 2006 - Although wireless tower operator Crown Castle International Corp. yesterday reported an 11% year-over-year increase in site rental revenue, which decreased the country's second largest tower owner's fourth quarter loss, the market discounted the good news and Crown Castle's shares dropped almost 5 percent in value, down $1.46 to $29.89.

Crown Castle said its net loss in the fourth quarter was $23.3 million, or 21 cents per share, compared to a loss of $87.7 million, or 44 cents a share a year earlier. Excluding special items, the company had been expected to lose $24.5 million, or 10 cents per share.

Total revenue was $178.6 million, up from $157.7 million a year earlier and ahead of the average forecast of $174.7 million.

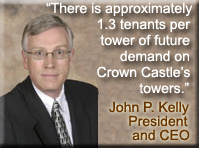

John P. Kelly, President and Chief Executive Officer of Crown Castle, said that "Our strong site rental revenue growth of 11.2% was driven by robust tenant additions on our towers as our customers continued to enhance their wireless networks. We remain excited about the outlook for growth in site rental revenue for 2006 as we are seeing activity from all of our major customers, as well as increasing activity from new wireless entrants."

He informed analysts this morning that in addition to the more traditional wireless providers, during the second half of 2005, Crown Castle saw increased activity from other wireless technology deployments from both the private industry and the public sector where State governments are enhancing their networks. Kelly also noted that they are not seeing any impact from decommissioning requirements

He envisions a prosperous industry expansion, explaining, "We continue to see significant growth ahead. We believe that based upon current wireless subscribers and minutes of use and ignoring any new wireless services, that there is approximately 1.3 tenants per tower of future demand on Crown Castle's towers. At approximately $18,000 per year per tenant, this demand would represent nearly $260,000,000, or 47% of additional annual US site rental revenue."

ATC's SpectraSite acquisition helps boost revenues

On Friday, American Tower Corp., the nation's largest tower owner posted a wider fourth-quarter loss from the effect of an accounting change. The company's quarterly loss totaled $87.3 million, or 21 cents per share, compared with a loss of $74 million, or 32 cents per share, a year earlier. Its loss from continuing operations was 13 cents per share, versus a loss of 30 cents per share.

The latest quarter's loss per share, which included an accounting change and other items, was affected by an increase in shares outstanding.

Revenue increased 67 percent to $307.6 million from $184.7 million, boosted significantly by the company's acquisition of SpectraSite Inc.

Analysts polled by Thomson Financial expected a loss of 3 cents per share on $300.5 million in revenue.

For the full year, the company posted a loss of $171.6 million, or 57 cents per share, compared with a loss of $247.6 million, or $1.10 per share. Its loss from continuing operations was 44 cents per share.

Revenue grew to $944.8 million from $706.7 million in the prior year.

For the first quarter, American Tower said it expects a loss from continuing operations of $3 million to $5 million, on revenue of $308 million to $313 million. The company forecast full-year results ranging from a loss of $25 million to a profit of $10 million from continuing operations, with revenue at $1.26 billion to $1.29 billion.

Analysts expect the company to post revenue of $305.3 million for the quarter and $1.26 billion for the year.

|