Crown Castle's T-Mobile tower buy could

easily be an industry game changer

September 28, 2012 - A public relations maxim is to never send a press release out on a Friday if it's good news, unless it precedes a major industry trade show. Crown

Castle International observed that principle today when it announced that it has entered into an agreement to acquire the rights to 7,180 T-Mobile USA towers in  advance of Monday's PCIA - The Wireless Infrastructure Association's show in Orlando, Fla. advance of Monday's PCIA - The Wireless Infrastructure Association's show in Orlando, Fla.

Crown will have the exclusive right to lease and operate the T-Mobile towers for an average term of approximately 28 years.

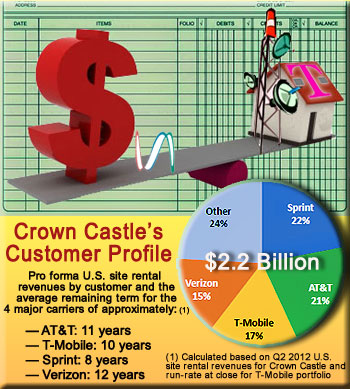

The $2.4 billion agreement, expected to close in the fourth quarter, rockets Crown to the enviable position of being the nation's largest provider of shared wireless infrastructure, a position they are likely to maintain for many years.

Their U.S. tower sites will eclipse the current leader, American Tower Corporation by 35%.

In addition, Crown will have the option to purchase the towers at the end of the respective lease terms for aggregate option payments of approximately $2.4 billion.

As with any major acquisition, the deal may not be in the best interest of some suppliers, contractors and second tier tower owners. Some analysts also believe Crown ponied up too much for the structures in order to top American Tower Corporation's offer, according to industry insiders.

"Favorable" price questioned

Evercore Partners analyst Jonathan Schildkraut, who was on Crown's analysts' conference call this morning, later said that Crown paid about $400 million more than he would have liked.

"As people start to pull apart the numbers, it doesn't look that great," Schildkraut said, but he added that Crown "needed to do it for growth."

That growth seems likely since T-Mobile's portfolio's high concentration of urban and suburban-centric sites are located where capacities are overwhelmed, said Jay A. Brown, Senior Vice President and Chief Financial Officer of Crown. That growth seems likely since T-Mobile's portfolio's high concentration of urban and suburban-centric sites are located where capacities are overwhelmed, said Jay A. Brown, Senior Vice President and Chief Financial Officer of Crown.

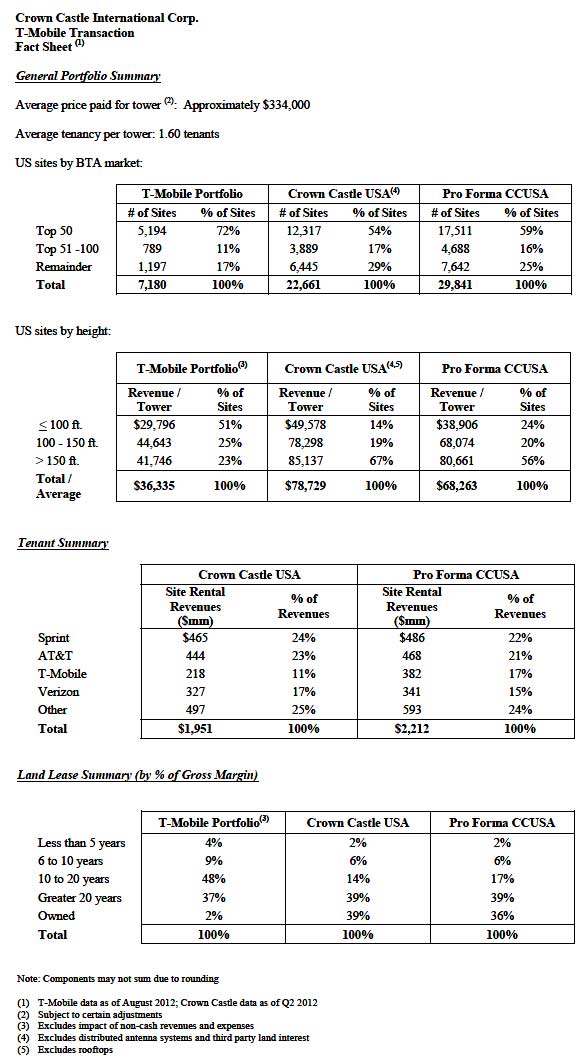

Approximately 72% and 83% of the T-Mobile sites are in the top 50 and top 100 markets, respectively.

Brown said that the transaction price of approximately $334,000 per tower compares favorably to publically announced tower deals dating back to 2007 at an average price of $493,000 per site.

The most recent comparison available is SBA Communications' purchase of TowerCo's 3,252 structures for $1.45 billion last June.

SBA's $446,000 per site cost was at a 33% premium over what Crown paid; however, TowerCo's revenues and tenant capabilities were higher.

Whereas T-Mobile's structures (see fact sheet below) have an average tenancy of 1.6 tenants, TowerCo's structures averaged 1.8 tenants. Also, TowerCo's towers have additional capacity for 2 more tenants versus Crown's inability to add any more than one without a considerable capital expense.

Purchase price multiple set at 18.8

Brown said during the analysts' call that Crown's purchase price multiple is 18.8. He also noted that approximately 10% of the leases are owned by other investors with 2% of them having been acquired by lease aggregators and the remaining 8% being owned by other tower companies.

The average annual income per T-Mobile tower is $36,335. Adding an additional tenant more than doubles the initial yield, according to Crown.

Global Tower Partners, the industry's largest privately owned U.S. tower consolidator, owned by Macquarie Infrastructure Partners, had been courted by TAP Advisors LLC  to submit a bid, but the company reportedly thought that the need for Crown and American Tower to maintain supremacy would drive the offered price too high. to submit a bid, but the company reportedly thought that the need for Crown and American Tower to maintain supremacy would drive the offered price too high.

“They got a very steep price at $2.4 billion,” said Kevin Smithen, an analyst with Macquarie Capital USA Inc.

Schildkraut said in a note to clients that it's possible that T-Mobile had sold rights to some of its shorter towers that are more expensive to upgrade with new equipment for LTE.

Monopoles are top towers

T-Mobile's tower database recognizes 8,930 towers in the U.S. and Puerto Rico, 1,750 more than Crown purchased.

It is possible that T-Mobile’s portfolio list includes sites that can’t be sold or assigned. In that case, it would be likely that Crown would agree to manage them.

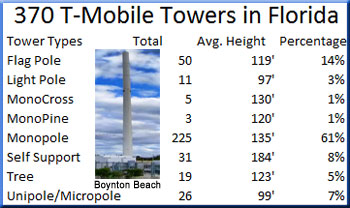

A review of 370 of their towers in Fla. identified that 61% of them were monopoles with an average height of 135'. Flagpoles, the second most popular structure with an average height of 119', accounted for 14% of T-Mobile's towers.

Crown said that 51% of T-Mobile's towers were less than 100' with 25% having a height between 100' and 150'. Towers higher than 150' comprised 23% of the portfolio. Crown said that 51% of T-Mobile's towers were less than 100' with 25% having a height between 100' and 150'. Towers higher than 150' comprised 23% of the portfolio.

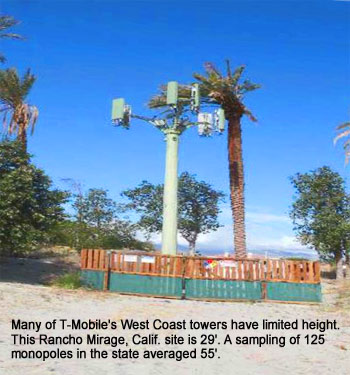

Approximately 31% of the Seattle-based carrier's towers are located on the West Coast where a sampling of 125 monopoles in Calif. averaged 55' in height.

T-Mobile reportedly has a considerable number of single tenant towers, but some of them will see their capacity increase as the carrier moves towards installing remote radio units (RRU) and hybrid cable, and removes their coaxial cable.

However, on many of their monopoles, where the coax is run on the interior of the structure, the wind loading isn't reduced and there is no substantial benefit. In addition, the RRUs at the top of the tower will increase flat plate loading.

It's excellent news for Crown, but not for all companies

A Northeast contractor who does a considerable amount of work retrofitting Crown towers saw the tower buy as an opportunity for additional revenue.

"From what I understand, not all of T-Mobile's towers can handle additional co-los and it's going to mean a lot more work when their lease-ups increase," he said.

But not all companies are excited about Crown's acquisition. But not all companies are excited about Crown's acquisition.

There will be a number of T-Mobile contractors who will lose business after the deal is completed. In addition, some manufacturers and suppliers will see reduced revenues.

"I saw it when American Tower bought SpectraSite," said a major manufacturer's sales manager. "It's troubling because you can lose a key account if you're not doing business with the acquiring company."

Second tier tower owners might also see their revenues affected by the sale.

One mid-size tower owner views the consolidation as disconcerting, stating, "We've always had challenges in trying to get site acquisition representatives to review the many assets that are available from smaller independents. They're oftentimes at a lower lease rate without heavy application fees, and they're on a better tower with the exact height the engineer wants."

He believes that even if an owner has the same master agreement of the carrier, many site acquisition representatives will tend to go with a major tower owner because they're used to dealing with them.

"This has to be a good move for Crown Castle, but I don't think it's good for the many hundreds of small tower owners out there who are underrepresented by PCIA and are unable to change some mindsets in the site acquisition community," he said.

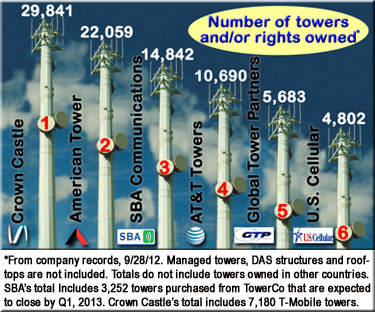

The six largest U.S. tower companies are Crown, American Tower Corporation, SBA Communications, AT&T Towers, Global Tower Partners and U.S. Cellular.

Moreland pleased with deal and additional revenues

"We are very pleased with our agreement with T-Mobile, which strengthens our position as the largest provider of shared wireless infrastructure in the U.S., which we  believe is the largest, fastest growing and most profitable wireless market in the world," stated Ben Moreland, Crown's President and Chief Executive Officer. believe is the largest, fastest growing and most profitable wireless market in the world," stated Ben Moreland, Crown's President and Chief Executive Officer.

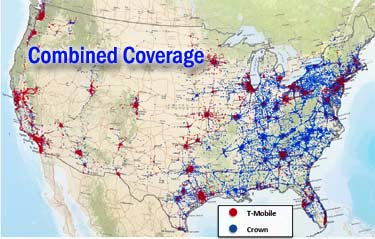

Crown had a weak footprint on the West Coast and the acquisition helps dramatically. Also, many of the T-Mobile towers in Calif. were acquired from PacBell, so they are older towers in hard to procure areas.

Crown is paying 9% of its enterprise value in return for a 33% expansion of its tower network.

The company estimates the T-Mobile towers will produce approximately $125 million to $130 million in adjusted funds from operations before financing costs in 2013.

T-Mobile has committed to maintain its communications facilities on the towers purchased by Crown for a minimum of 10 years with annual rent escalation provisions tied to the consumer price index.

Attractive lease terms provided to T-Mobile

An additional $164 million in initial annual rent will come from T-Mobile at an average per tower lease payment of approximately $1,905 per month, discounted by $584 from what Crown currently charges T-Mobile on Crown-owned sites.

T-Mobile's rent includes the rights, subject to certain limitations, to complete its current network modernization on these sites. T-Mobile's rent includes the rights, subject to certain limitations, to complete its current network modernization on these sites.

In July, Crown struck an agreement with T-Mobile to extend the remaining term on 7,300 leases they have with them to 10 years. Rent escalation amounts were not tied into the CPI.

The average monthly lease is approximately $2,489, according to Crown's stated annual revenue of $218 million from T-Mobile.

The agreement with Crown comes a little more than a week after T-Mobile USA named a new chief executive, John Legere.

Legere, in a statement, said he was pleased that the Crown tower agreement brings T-Mobile closer to realizing the "bold vision" outlined in the company's "Challenger strategy to solidify our competitiveness in the industry by investing in areas where we anticipate the strongest return for our customers."

In February, then-CEO Philipp Humm outlined the strategy, the primary focus of which is to make "amazing 4G services affordable," at a cost of $4 billion.

T-Mobile's nationwide network consists of approximately 51,000 cell sites.

Crown expects to fund the acquisition with cash on hand and debt financing. Deutsche Telekom, T-Mobile's parent, will use the proceeds from the transaction to retire corporate debt and strengthen its financial position.

Brown said that Crown did not have any committed financing for the transaction, but they did have the ability to securitize the assets if they were to finance them in that option.

Déjà vu? It's unlikely this deal will have problems

Tower companies had been shopping T-Mobile's towers when AT&T announced in March of 2011 that it was going to buy the carrier. Adding T-Mobile's structures to their impressive 10,000-plus sites would have propelled AT&T Towers to be the country's third largest consolidator.

The $39 billion deal, later abandoned by AT&T after regulators thwarted its ambitions to become the biggest U.S. wireless carrier, was strategically announced on a Sunday preceding the CTIA show, also being held in Orlando.

Crown shares fell 1.3 percent to $64.10, down 81 cents, at the close in New York today. Its shares hit a 52-week high to $66.11 per share two weeks ago. When Crown announced that it was buying Global Signal in 2006 for $5.8 Billion, its shares dropped almost 5%.

Headquartered in Houston, Tex. with its national corporate office in Canonsburg, Pa., Crown employs approximately 1,600 employees.

T-Mobile is being advised by TAP Advisors and Deutsche Bank Securities Inc. as financial advisors, as well as Jones Day and Lape Mansfield & Nakasian, LLC as legal advisors. Crown is being advised by Cravath, Swaine & Moore LLP as legal advisor.

Crown Castle International Corp. Portfolio Summary

|