By Ken Schmidt

Sprint and Mobilitie’s innovative plan to build mini-macros

Back in June of this year, the Wall Street Journal (WSJ) ran a story about Sprint’s use of “sidewalk utility poles” as a core element of their efforts to improve the Sprint network while reducing ongoing network operating expenditures. The article suggested that Sprint may have been delaying network capital expenditures due to difficulty in acquiring permits from municipalities for the new structures. Sprint has tapped into Mobilitie to build and deploy “mini-macro” cell towers. These mini-macros (or small cells) consist of antennas attached to existing utility poles or municipal infrastructure (such as street lights or traffic lights) or installed on new poles that Sprint intends to erect in public right of ways.

Sprint has engaged Mobilitie to develop their mini-macro network. While the details of this relationship are not public, as best as we can tell, Mobilitie is providing wireless backhaul services to Sprint using Sprint’s own 2.5GHz spectrum. We suspect that Sprint is providing the antennas and equipment while Mobilitie is funding the site acquisition, pole construction, and the wireless backhaul equipment in exchange for ongoing lease payments from Sprint to Mobilitie – a small cell and backhaul build to suit, if you will.

Mobilitie expects to build new poles as a utility

Central to this strategy is Sprint and Mobilitie’s joint supposition that they should be treated as a public utility. As a public utility, they suggest to municipalities that they have the right to add equipment to existing poles or build new poles when existing poles are either too expensive or too difficult to access. They represent to municipalities that as a utility, they are exempt from existing zoning and permitting regulations except those applicable to utilities.

The benefit of this is that in most municipalities, the regulations are significantly less onerous to get approval for a utility pole than they are to get approval for a cell tower. Furthermore, instead of paying traditional collocation rates to tower companies (rates which typically start at $18,000/year), pole attachments are typically regulated by the state utility commissions, about 2/3 of which have adopted FCC pole attachment rate schedules which provide for annual “lease” rates of $500 per pole or less. For new utility poles in the right of way, the fees are similar but are typically handled under franchise agreements with the local municipalities or counties. In either case, the rent paid for accessing the pole is substantially less than a traditional macrocell collocation.

Sprint reduces capex projections for 2016 while Mobilitie claims that Sprint is spending on small cells

While this all sounds great in theory, in practice it hasn’t gone so smoothly. Sprint announced in their 1st Quarter 2016 Earnings Call that they would be reducing their capital expenditures to $3 billion for all of 2016. Industry and public supposition at the time was that this was partially or wholly due to the lack of progress with acquiring zoning authorizations and/or building permits. In reply to questions by RCR Wireless, Mobilitie indicated in May 2016 that fewer than 2,000 small cells had been deployed.

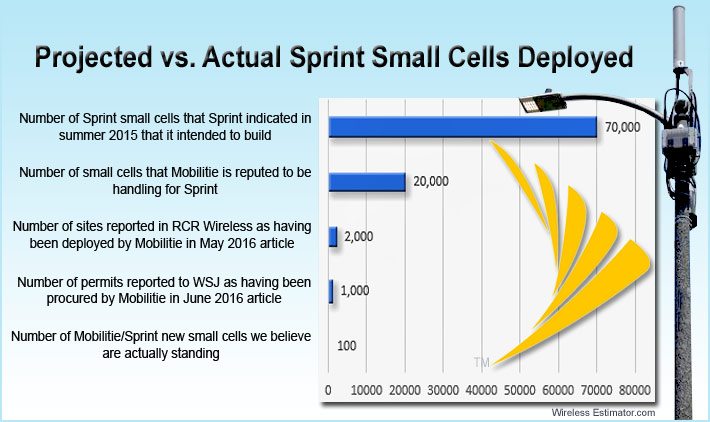

In response to questions by the WSJ in June of 2016, Mobilitie shared that they have over 1,000 permits approved and that they will start large scale installations once more permits are in hand. In the summer of 2015, Sprint indicated that they would be deploying over 70,000 small cells to “densify” their network. In an article in Fierce Wireless, Jennifer Fritzche of Wells Fargo commented that her checks with Mobilitie led her to believe that Sprint was farther ahead then was suggested in the WSJ article: “While we understand that Mobilitie is a vendor of Sprint, Mobilitie presented a picture in which Sprint IS spending, moving fast in its small cell deployment, and thinking of the network in a new and unique way.”

Actual number of deployed small cells appears to be much less

The actual number of small cells that have been deployed appears to be significantly less than Sprint and Mobilitie comments might lead one to believe (See above chart). It is our opinion that the number of actual, standing Mobilitie/Sprint small cells may be in the range of 100-200.

Mobilitie has submitted a substantial number of building permits and/or ROW access agreements across the US. Our off the cuff estimates would place this figure at around 2,000-4,000, although it actually could be higher. We anticipate that Mobilitie’s claim to have received 1,000 or more permits is also accurate. The problem is that they don’t appear to have started construction on that many sites. To confirm this, we sent out public records requests to a number of large cities and/or contacted them by phone. Here are the responses we have received to date. As we continue to receive responses to our public record requests, we will update this list.

-

New York City, NY

NYC’s Information Technology and Telecommunications office indicated that Mobilitie has 580 pole reservations on city poles through two franchises. The City has issued 128 Notices to Proceed to Mobilitie. No equipment has been installed on these poles.

- San Francisco, CA

No Mobilitie poles or pole attachments have been built in the City of San Francisco as of August 15th, 2016. Sprint may have existing small cells which were installed prior to their engagement with Mobilitie.

- Los Angeles, CA

Jonathan Kramer of Telecom Law Firm (located in Los Angeles) indicated that he estimates the number of actual standing Mobilitie structures at less than 20. He has submitted a public records request to the City of Los Angeles.

- Atlanta, GA

The City has issued fewer than 40 permits to Mobilitie and to their knowledge, only one is standing. (Disclosure: my company consults for the City of Atlanta on its cellular and small cell leases.)

- Seattle, WA

In response to a public records request, the City of Seattle indicated that it has online access to City Building Permit records. When searching for Mobilitie by name, we found no permits issued. However, that isn’t dispositive because permits are typically assigned to the person who submitted the application, and not the company. Accordingly, we scanned for any permits with the word “antenna” in the description. There were 129 recent permits, but none has a description to include the words “Mobilitie,” “pole top antennas,” or for new poles in the right of way.

-

- Mobilitie was fined $5,000 for constructing a small cell (inset) in Baltimore, Md. without a permit.

Baltimore, MD

While the City has issued a number of permits to Mobilitie, they indicated that they are aware of only one Mobilitie structure that is actually standing. Hopefully, it isn’t the subject of Wireless Estimator’s April article regarding a new small cell pole that was built by Mobilitie without permits.

- Tampa, FL

In May 2016, Mobilitie submitted permit requests to the City of Tampa for 5 or 6 sites. As of August 2016, none had been approved.

- Chicago, IL

A response to a public records request to the City of Chicago Department of Buildings “for a list of locations/addresses for which Mobilitie, LLC has submitted building permit applications within the City of Chicago within the last year” indicated that the Department has received no responsive document to the FOIA request. We have asked whether building permits are required for small cell attachments or new poles, but did not receive a response prior to this article’s publication.

It is worth noting that this type of search has limitations.

- As we noted on LinkedIn and also by RCR Wireless, Mobilitie may have not used its name when submitting the permit applications. By doing a internet search for Mobilitie’s address, we found a partial list of fictitious names that may have been registered by Mobilitie. Any permits that were issued or pulled by another entity (including under Sprint’s own name) would not have been found. Please note that we haven’t heard of a single case where Sprint pulled a permit or made a request to a municipality for a permit under Sprint’s name.

- Perhaps Mobilitie is focusing on other cities besides those that we contacted first. It seems unlikely, but it is possible.

- If the municipality does not require building permits for antenna installations on existing poles or construction of new poles in the right of way, a search for building permits would not detect new Mobilitie constructed poles or permits applied for or issued.

- To the extent that Mobilitie has built new poles outside of the subject city jurisdictions, this search would not detect them. Our requests were made solely to the City itself. In some metropolitan areas like Chicago or St. Louis, there are 50-100 separate municipalities that have their own zoning and planning departments. So it is possible that Mobilitie has constructed more mini-macros outside of the urban core cities. Presumably, the need for densification and additional capacity is greatest in the core city areas.

- Lastly, and importantly, we believe that Sprint is converting some Clearwire sites into mini-macro small cells. These sites would not be identified in our permit search. As such, the number of small cells that are on air could be significantly higher if converted and existing leased sites are included.

Difficulties that Mobilitie may be experiencing

Mobilitie has represented that they are unaware of any municipalities that have enacted moratoriums. We can’t contradict that. However, we are working with some municipalities that have issued a limited number of permits (or none at all) while they request further documentation from Sprint/Mobilitie permit applications, and while they draft new policies to address future requests for new poles and antennas. Some of these municipalities have indicated to us that they were “blindsided” by the number of applications they have received for small cells, and not just those from Mobilitie. Not only were these municipalities unprepared for the sheer volume of applications or requests (wait until 2017!), they believe they don’t have the staff to capably review the applications they have already received.

To further complicate matters, each state and each municipality is different. Mobilitie and Sprint each face a patchwork of regulations and municipality requirements through which they will need to navigate. Furthermore, with little or no revenue being offered to the municipalities, these small cell initiatives amount to an unfunded mandate. Municipalities have to decide whether to legally oppose Mobilitie and/or Sprint or acquiesce. They then have to decide what department(s) will handle the influx of applications, and how they are going to finance this additional burden for staff review. Our experience has shown that municipalities tend to make no decision at all rather than making the wrong one, especially if there is a cost and no revenue involved.

Atlanta, Ga. has issued fewer than 40 permits to Mobilitie and to their knowledge, only one, above, is standing.

Need for transparency from Sprint/Mobilitie

This begs the question: how transparent are Mobilitie and Sprint being about their progress with their next generation network plans? How many small cells are operational, and of those, how many are new small cells as opposed to converted decommissioned Clearwire or Nextel sites? So far, neither Sprint nor Mobilitie has provided guidance on the number of permit applications they have submitted across the US, nor have they provided any details regarding how many permits that they have submitted which haven’t been approved yet or that have been outright rejected by the municipality. Neither Sprint nor Mobilitie has provided any information stating how many applications or permits have been approved for the erection of taller new poles. Although we cannot confirm it, we surmise that of the permits they have received, the bulk are for pole attachments as opposed to new poles.

We believe that companies like Crown Castle have focused more on pole attachments because of the ease of permitting and the reduced probability of upsetting local residents situated near proposed new poles. For Mobilitie and Sprint, the need for taller poles is greater due to the wireless backhaul which requires a near or complete line of sight between dishes/antennas over trees and buildings. If Mobilitie and/or Sprint prove to be unsuccessful at getting a significantly high percentage of their proposed new poles erected, they will need to either use fiber to backhaul to and from the sites, or build significantly more small cells than originally projected.

Furthermore, the delays on deploying entire larger metropolitan areas could increase while “core” sites are acquired and permitted. Thus, Sprint could be waiting until Mobilitie procures a much greater number of small cell permits before they commence spending capex. We believe that while there are cities and areas where Mobilitie’s efforts are proving successful, there are also definitely those where they aren’t.

Sprint may not need the small cells yet

Fortunately for Sprint, we suspect that they still have plenty of capacity on their network, and their Network Vision efforts have proven to increase capacity, using carrier aggregation including 2.5GHz spectrum and software adjustable radios primarily. Sprint is terminating a number of Clearwire sites as nearby Sprint sites undergo 2.5GHz carrier upgrades. As mentioned previously, some of these Clearwire sites are being repurposed as mini-macros, which should further improve capacity issues as old WI-MAX sites are repurposed as 2.5GHz Sprint sites.

Furthermore, while their subscriber addition numbers are moving upwards, Sprint is still only seeing a small share of the number of new subscriber additions that T-Mobile is encountering. As a result, it is likely that Sprint doesn’t need the densification as immediately as the other “big 4” carriers. However, we question how long Sprint can continue to spend minimal capital expenditures on their network before their relative parity in urban and dense suburban areas is significantly lessened.

For market analysts and investors in Sprint (by way of disclosure, we hold no position in S stock), we believe that there should be more specific questions directed at Sprint regarding the actual number of small cells they believe to be sufficient to “densify” their network. Sprint needs to provide better guidance on the number of small cells actually operational at this time, and what the market can expect in terms of mini-macros that will actually be deployed in the remainder of 2016 and in 2017. Without such guidance, it is hard to see how Sprint’s mini-macro efforts will prove successful. And if these efforts aren’t successful, how will Sprint be?

About the author: Ken Schmidt is President of Steel in the Air, Inc. His company provides guidance to landowners nationwide regarding cell tower lease related issues including cell tower lease buyouts, lease renegotiations, and lease expirations and extensions.

About the author: Ken Schmidt is President of Steel in the Air, Inc. His company provides guidance to landowners nationwide regarding cell tower lease related issues including cell tower lease buyouts, lease renegotiations, and lease expirations and extensions.