|

Cingular flu infectious to all sectors of wireless industry, but some contractors are immune

June 12, 2007 - A wireless tower accessories manufacturing executive says that he's pleased that his firm is maintaining its 2006 levels of business this year. One of his  regional sales managers disagrees, saying that sales are down more than 10% in a number of their markets and margins have been severely cut on some products. regional sales managers disagrees, saying that sales are down more than 10% in a number of their markets and margins have been severely cut on some products.

Conversely, a northeast site development and construction firm is inundated with work and can't solicit enough qualified site acquisition and field employees to staff their ongoing projects. Major distributors are witnessing a drop in certain lines, but find their sales buoyed by Wi-Fi broadband equipment.

Yet out of necessity, a tower foundation contractor has moved almost entirely into the wind power industry where the margins are better and the work is plentiful.

Last month an equipment shelter manufacturer, whose primary market is in the telecommunications industry, was forced to lay off 80 employees. And as the orange Cingular jacks logo fades to at&t black, some small tower contracting businesses are joining its demise as the industry tries to weather a general slowdown that hasn't been seen since 2001.

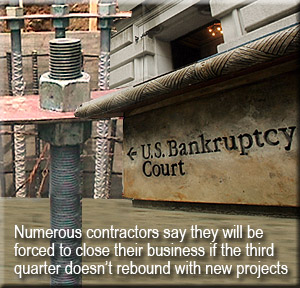

In a cyclical business where multi-million dollar projects can stop on a dime and businesses will fold as easily as an empty wallet, some company owners are concerned about 2007's second half outlook and are cautiously optimistic about reports that at&t's wireless unit is going to significantly ramp up capex spending.

Mergers crippling to many

The Crown Castle/Global Signal merger reduced business opportunities for some construction companies used to dealing with Global's centralized markets and not Crown's regional operations. Sprint and Nextel's carrier consolidation created similar business voids and less buildouts, but the AT&T/Cingular merger is being credited by many with spreading the 2007 financial flu.

With a greater portion of the industry's businesses sharing in Cingular's Universal Mobile Telecommunications System (UMTS) multi-billion-dollar project last year, the carrier's 2006 3Q and beyond slowdown had a disastrous effect upon all sectors of the market.

Over the past nine months, publicly traded equipment vendors have been blaming their missed quarters on the AT&T/BellSouth/Cingular merger. Installation contractors and service providers, the majority of them smaller private companies, agree that it has been a terrible period, some of them struggling with missed paydays.

"We're fortunate," explained a Midwest contractor with 16 employees, "that we have the funding to be able to pay our bills and provide our people with benefits, even though their hours have been cut considerably."

Other companies are less privileged, closing their doors, one after four successful years. "Sadly, most of what I have saved was spent paying bills and trying to hang on," said a small Southern line and antenna contractor.

"I don't know if I'm going to put my equipment on e-Bay and get next to nothing for it or keep it in storage and hope that business picks up again," he said.

NTPs as scarce as change orders

Millions of dollars of contracts are sitting on project managers' desks, but the NTPs are as infrequent as approved change orders.

Smaller contractors, a number of them working as independent 1099 employees, have been hit hard, being forced to take employment outside of the industry. One seasoned veteran said he has had to obtain part time work as a wrangler guide taking corporate groups on trail rides in a state park outside of Las Vegas.

The slowdown appears to be less in the Midwest, such as in Chicago where a 4G build is keeping some contractors busy, than in other regions of the country.

Numerous installation companies have been forced to let management and entire crews go after staffing for multi-million dollar projects that were put on hold by Cingular and other carriers.

One Midwest contracting executive said that the project delays allowed him to assess internal growth issues and allow the company to explore different disciplines and expand their capabilities. However, branching out into other service categories is cutting into business and margins of those already providing that service in an overly competitive marketplace.

Some construction companies are desperate, advertising on industry bulletin boards that they'll provide greatly reduced pricing to keep their employees working. Other firms are doing quite well, they say, and are frequently advertising to fill their staffing needs.

Companies are typically inundated with co-location installations during the third and fourth quarters, but estimators say they're not seeing the volume normally expected.

"We used to get hammered in those quarters, but it looks like it's not going to happen this year," explained a Southern project manager who said his company had 14 people in the field and they were down almost 40% in revenues over last year.

He said that a number of retrofitting projects were helping to keep the company, "healthy, but not necessarily very profitable."

Digital progress slows broadcast business

A tower erection and service contractor said that they were having a banner year. "Most of our work is outside of the cellular market, much of it involving government projects," he said. "I never wanted to get involved in cellular work and never regretted that decision I made almost twenty years ago."

However, other service areas are seeing a slowing of business. Broadcast tower work has always been a robust, but smaller segment of the industry due to the disciplines, equipment and knowledge requirements that are considerably more exacting than cellular construction.

With the digital TV buildout nearing completion, the fevered pitch of construction has slowed considerably. Last month the FCC extended the deadline for the 145 stations who have yet to finish construction of their digital facilities. The commission granted six-month extensions to 107 stations and gave until February 17, 2009 for 33 other stations.

The owner of a long-established broadcast erection and service business said recently, "I haven't seen it this slow in years. It used to be that the work just kept piling up on you. Now, I have to start knocking on doors again."

Location, location, competition

Cingular's slowdown - in many areas there is a complete halt to construction - has effected the pricing of many installation projects, cutting margins considerably as more businesses vie for the work of carriers and tower owners that are expanding their network and tower site locations.

A Cellular South manager said they "were getting better prices now than in the last ten years."

"We used to have three to four contractors on a job walk. Now we're getting ten or more," explained a Southern contractor who said oftentimes the winner is a company whose only concern is keeping their people working so that they don't lose them, or it's a contractor who left something out of their bid.

Some carriers, however, do not subscribe to the belief that they should capitalize on a downturn in the market. "I'm still keeping my same five to six dependable contractors that I've been doing business with for years, said a Sprint project manager," who implied that he is going to have to rely upon those firms when the industry heats up again.

Nevertheless, carrier management and procedures can change from market to market and pricing can fluctuate equally as much.

"We are very successful and profitable with much of the T-Mobile work that we do in our backyard, said an established Mid-Atlantic contractor, "but we were invited to bid on some projects in Florida and we couldn't win any of them."

No simple calculation for a co-location

Pricing across the country for a co-location project varies according to the carrier, the state, and the amount of material provided. Some management firms are also using pricing matrixes.

Additionally, it depends upon the contractual tier at which the company is hired. General contractors that used to employ up to a dozen or more crews throughout the country have scaled down their workforce and are subcontracting much of their co-locations and other wireless projects to contractors with less than six employees.

In a market that already has thin margins, each subcontracted level can see the project amount being lowered by approximately 10-to-20%.

Some colo kits include all mounting frames, transmission line, connectors and installation hardware, requiring the contractor to only provide grounding, telco and conductor runs. The only commonality in each area is that the installations are priced considerably lower than 2005 and 2006 levels.

Also, many of the sites are more labor intensive since compound space is at a premium, requiring longer ice bridge runs, and in some instances elevated platforms to accommodate additional equipment.

Capex cure on the horizon?

Industry observers say that Cingular is preparing to crank up its capital spending significantly for the second half of 2007 to approximately $3.6 billion. A return to business as usual from Cingular would be a welcome change for equipment vendors, and an equally welcome change for contractors whose earnings aren't reported publicly, but whose financial status and work in progress is oftentimes an open book in a niche industry.

|