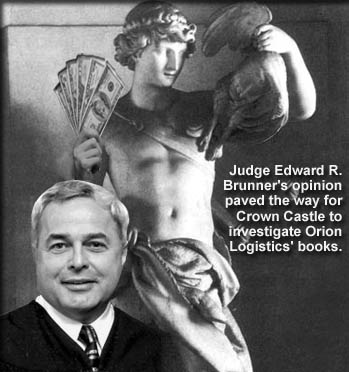

Court allows Crown Castle to examine related business's assets following judgment

December 14, 2010 - In a ruling last week the Wisconsin Court of Appeals held that Crown Castle USA, Inc. has the right to examine a third party's assets to determine if  money was transferred by a tower construction contractor to evade paying a judgment. money was transferred by a tower construction contractor to evade paying a judgment.

Crown Castle USA, Inc., and related companies obtained a judgment in Pennsylvania against Orion Construction Group, LLC, a Wisconsin company whose sole member is Douglas Larson.

The default judgment for $496,000 was based on Crown Castle's claim that Orion performed defective structural reinforcement work to cellular towers in Chicago.

On March 18, 2008 Crown sought to enforce the judgment in Wisconsin and a court commissioner gave Orion one month to provide Crown with all records pertaining to its assets.

Six months later, Orion provided Larson's personal tax returns from 2005, 2006 and 2007, and an accounting spreadsheet indicating a $210,831 account receivable from Crown.

A letter from Orion's attorney advised that there were no separate tax returns for Orion because it was a single-member LLC. The letter further stated that Orion had no assets, and no books, records or documents pertaining to its assets; no equipment or inventory; and no property.

A "Statement of Financial Condition" further indicated Orion had no outstanding loans; no financial records; no real or personal property, and none that had been transferred in the past five years; and it had less than $500 in a business checking account.

Crown then sought and obtained an order requiring financial disclosure from a different LLC owned by Larson, Orion Logistics, LLC. Orion Logistics appealed, but the Court of Appeals affirmed in an opinion by Judge Edward R. Brunner.

The court said that the circuit court properly exercised its discretion in ordering Orion Logistics to submit to a supplemental examination. Orion Construction reported a drastic drop off in sales for 2007, while Orion Logistics went from no apparent sales to more than $15 million in gross receipts in 2007.

In citing another opinion, Courtyard Condo. Ass’n., Inc., v. Draper, the court explained, “Property transfers between a judgment debtor and related business entities present the same risk of fraud as those between spouses. Examination of the alleged third-party recipient may be the only method available to a judgment creditor to ascertain whether a fraudulent transfer has occurred.”

Larson began Orion Construction Group LLC in 2000 and Orion Logistics, LLC in 2002.

His newest companies, Orion Builds, Inc. USA and Orion Builds, Inc. Canada, were formed in 2009.

-

|

ATC's Ghana joint venture could be

the forerunner of additional deals

December 8, 2010 - American Tower Corporation announced a deal this week to establish a joint venture with the MTN Group in Ghana. The cost, pegged at $218 million, is approximately half of what the Boston-based company paid last month to enter the South African market with a 1,400-tower-buy from mobile carrier Cell C Ltd.

However, this appears to be the first time that ATC is creating a major joint venture, and the move, if successful, could signal a partnership with MTN to develop additional holding companies in Asia and the Middle East - although both companies said they would not comment upon any deals that might be in consideration.

The joint venture, TowerCo Ghana, will be managed by American Tower.

It will be owned by a holding company of which a wholly-owned American Tower subsidiary will hold a 51 percent share, while a wholly-owned MTN Group subsidiary will hold the other 49 percent.

As part of the transaction, MTN Ghana will sell up to 1,876 of its existing sites to TowerCo Ghana for about $428.3 million.

MTN is a multinational telecommunications group operating in 21 countries in Africa, Asia and the Middle East. They currently have 134.5 million subscribers.

One area where ATC could assist with MTN's growth is in Iran, where MTN says they are not able to procure sites at a rapid enough pace in order to take full advantage of the market. Iran's subscribers total 6.7 million for MTN.

In Ghana, MTN's opex expenses are tied to the US dollar and any devaluation of the country's cedis affects their margin.

“Infrastructure sharing makes absolute sense for MTN,” Phuthuma Nhleko, the Johannesburg-based company’s chief executive officer, said in the statement. “The Ghanaian market has presented us with an opportunity to partner with a leading independent global tower operator.”

Capex funding has increased rapidly since the group's inception in 1994. Nhleko said last year that MTN intends to continue to pursue opportunities to unlock value from its infrastructure assets.

MTN had a very strong operational performance in Ghana last year and maintained a 56% market share against a fiercely competitive environment with five operators.

On Tuesday, ATC completed a registered public offering of $1 billion to, among other things, finance $200 million for the acquisition of towers from Cell C (Pty) Limited and up to $500 million for any proposed acquisitions in Latin America, including additional tower purchases in Colombia, Peru and Chile.

Country's engineers not pleased with deal

The Civil Engineers Association of Ghana says it's not pleased with the MTN Group Ltd and American Tower partnering. They believe having foreign companies own the structures is unduly undermining the ability for Ghanaian contractors to obtain work.

“We have six or seven telecoms companies in the country. What are they doing that is new? What they are doing that is new is how to lay and install fiber optics," President of the Association, Edward Amanor, said.

"Why don’t they spend some little money to train the Ghanaian contractors who are in the telecom sector so they can take over these things? If we cannot get any local company with that capacity, we can build that capacity. We can even put together all the local construction companies together and build them up. It would take about one month to six weeks.”

-

|

American Tower enters South Africa, leads stateside towercos in earnings

November 12, 2010 - American Tower Corp. agreed to acquire up to 1,400 towers from South African mobile carrier Cell C (Pty.) Ltd. for $430 million. The tower consolidator also reported its third- quarter earnings rose 15.6% quarter earnings rose 15.6%

Crown Castle International and SBA Communications had Q3 increases of 12.0% and 13.3%.

American Tower Chairman and Chief Executive Jim Taiclet said, "Our newly established presence in South Africa will provide us with a platform for our future growth in the region."

Under the deal, expected to close by early next year, American Tower also agreed to acquire an additional 1,800 towers that are planned or under construction. Cell C, South Africa's No. 3 mobile-phone operator, will be the anchor tenant on the purchased towers.

American Tower reported a third-quarter profit of $93.4 million, or 23 cents a share, up from $67.4 million, or 17 cents a share, a year earlier.

Analysts polled by Thomson Reuters most recently forecast earnings of 20 cents on revenue of $488 million.

To view the nation's largest tower owners with ten or more towers in the U.S., click here.

-

|

Popular tower software program RISATower acquired by Tower Numerics

November 1, 2010 - ERITower was the most widely used software tower design tool in the industry,  but five years ago when tower design pioneer Dan Horn passed away it was purchased by RISA Technologies and began a new life as RISATower. but five years ago when tower design pioneer Dan Horn passed away it was purchased by RISA Technologies and began a new life as RISATower.

Since 2005 Peter Chojnacki continued to improve RISATower's capabilities through correspondence and discussions with their customers, many of them recognized as the most prominent manufacturers and engineers in the industry.

The popular program has again been sold, and it will once more change its name, this time to tnxTower, but Chojnacki will continue to guide its success as the design software's new owner as President of Tower Numerics Inc.

"The program will evolve and improve in the coming years," Chojnacki said. "We intend to accelerate its development to service the growing expectations of our users for their design program."

"However, one of the cornerstones of our development will be the preservation of the stability of tnxTower and the design workflows currently in use. We will continue the partnership with RISA Technologies, which includes the interoperability with RISA-3D. Those capabilities have served our users very well in the past," Chojnacki said.

Chojnacki, a structural engineer with over 20 years of experience in the construction sector, says he is going to include new features for tnxTower and he will launch new software products and services for the tower engineering community.

During the past 10 years he has been a structural software developer, spending a great part of that time creating software tools for the tower industry. Chojnacki participates in the Telecommunications Industry Association ANSI/TIA-222 Standard Formulating Committee.

For additional information, contact Chojnacki or visit Tower Numerics Inc.

-

|

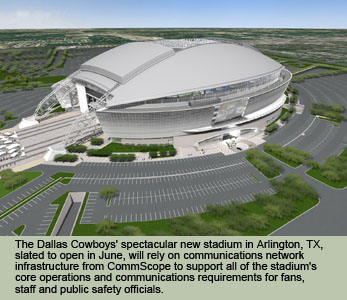

CommScope agrees to go private in

$3.9 billion takeover by Carlyle Group

Update: October 27, 2010 - CommScope Inc. has agreed to be bought out by asset manager Carlyle Group for $3.9 billion, two days after announcing it was in takeover talks.

Chairman and CEO Frank Drendel and Eddie Edwards, CommScope's president and chief operating officer, are staying on to lead the company along with other executives.

The company also reported its third-quarter net income rose 10 percent to $50.6 million, or 49 cents per share, from $45.8 million, or 45 cents per share, in the same period a year earlier.

Its adjusted earnings per share of 62 cents beat the average analyst estimate by ten cents.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

October 26, 2010 - On Friday traders swapped a mere 652,000 shares of CommScope stock. Following news yesterday that Carlyle, a private equity firm, would pay $31.50 per share for the company, a 36% premium over Friday’s closing price, 41.3 million shares traded and the stock surged to $30.16 at closing.

The tentative $3.9 billion deal appears to be favorable for CommScope's shareholders, but four law firms are considering class action lawsuits against the CommScope board, alleging that the company didn't entertain offers before entering discussions with Carlyle, and they might be selling the company for too low a price.

Two months ago the company traded below $19. On March 2, 2009 investors registered concern when CommScope hit $7.23, the lowest the stock had traded in over six years.

CommScope bought Andrew Corp. for $2.6 billion in 2008, following a 2006 failed attempt by ADC Telecommunications Inc. to buy Andrew for $2 billion.

The deal came nearly a year after Andrew rejected as inadequate an unsolicited $1.7 billion offer from CommScope.

ADC earlier this year was bought by Tyco Electronics Ltd. in a $1.25 billion deal.

Carlyle invests in a wide range of industries, with about eight percent of its holdings in consumer and retail companies. It closed on its $3.8 billion buyout of vitamin maker NBTY earlier this month.

If the transaction materializes, CommScope would become a private company and one of the company's production managers said it could be beneficial for "future growth opportunities that aren't always available when you're a public company."

CommScope's executives told their employees yesterday that as a publically traded company they were limited in the amount of detail they can provide about the Carlyle discussion.

"In the meantime, we are counting on each of you to remain focused on serving our customers and advancing our business objectives, just like you always have," they said.

CommScope is expected to benefit from 4G network buildouts, but the company has faced challenges recently.

In March, CommScope announced plans to lay off approximately 110 of its more than 500 employees at its connectivity solutions manufacturing facility in Omaha, Neb.

The layoffs reduced the facility's workforce to fewer than 400 people. Worldwide, CommScope has about 11,500 employees. The company is not providing an estimate on the financial impact of the layoffs, said corporate communications director Rick Aspan.

CommScope said it was also analyzing options for the facility, including potentially shutting it down and relocating production to lower-cost locations.

In the past two years, CommScope has reduced its global workforce and closed facilities in Australia, Belgium, Brazil, England, Italy and the U.S. to reduce costs.

The Hickory, N.C.-based company, in addition to coax cable, also sells cabinets for DSL and FTTN applications as well as radio frequency subsystem solutions for wireless networks.

-

|

Global Tower Partners purchases 450 tower

assets along railroad right of way

September 9, 2010 - Global Tower Partners has announced the closing of the wireless assets,  income and attachments built on Norfolk Southern property from CitySwitch, LLC . income and attachments built on Norfolk Southern property from CitySwitch, LLC .

The acquisition also includes CitySwitch's tower development and marketing agreements with the railroad. This agreement will give GTP access and master license rights to more than 450 towers and tower development rights along approximately 21,000 miles of NS right of way in the eastern and central U.S.

The additional CitySwitch towers raises GTP's structure count to approximately 4,150 owned towers in the U.S.

A number of CitySwitch employees were also retained by GTP as part of the transaction. Financial terms of the transaction were not disclosed.

"We are very excited to complete this transaction with CitySwitch and are confident that these sites as well as the development and marketing partnership with Norfolk Southern will be an exciting compliment to our existing assets in key Eastern U.S. markets" said Marc C. Ganzi, Chief Executive Officer, Global Tower Partners.

"These strategic locations will no doubt serve the needs of our customers as they continue to build out their 4th generation networks. Norfolk Southern has some very strategic locations in key urban markets that will allow us to best serve our carrier partners site needs" noted Alex Gellman, President and Chief Operating Officer, Global Tower Partners.

"CitySwitch is very excited to have concluded such a strategic and efficient transaction with GTP for many of the assets of the company. Additionally, the integration of the company's key managers into GTP management will provide an indispensable resource for the overall strategic mission related to Norfolk Southern and other railroad rights of way" said Stephen Raville, Chairman and Chief Executive Officer of CitySwitch.

"Norfolk Southern is pleased to be working with a partner with the track record of GTP, and looks forward to a long and mutually beneficial partnership," noted John Friedmann, NS Vice President Strategic Planning.

Norfolk Southern owns property and operates a 22-state rail network in the eastern half of the U.S.

GTP also picks up Texas site management firm

GTP also said it closed on the purchase of Highpointe Group, a rooftop management and consulting business that was the largest site management company in Texas.

Highpointe’s portfolio included 2,422 new managed and master leased rooftop sites, including some along the eastern seaboard.

"The addition of Highpointe to the GTP family solidifies our position as a leading developer and manager of wireless antenna facilities on structures and rooftops throughout the United States," said Ganzi.

Terms of the sale were not disclosed.

|

Peru puts American Tower close to 32,000 towers

August 9, 2010 - American Tower Corporation's announcement today that they have entered a new market in Peru has the international tower company approaching 32,000 company-owned towers,  according to filed documents. according to filed documents.

Although ATC's nearest competitor, Crown Castle International, has more towers in the U.S., 22,200 versus the Boston-based company's 20,200, Crown's total count including its Australian towers is 23,800.

ATC's Peruvian subsidiary, ATC Sitios del Peru S.R.L., said it has launched operations in Peru, where it recently entered into agreements to purchase up to 468 wireless communication tower sites from Telefónica del Peru S.A.A.

The Company has purchased 131 of these tower sites, on which Telefónica del Peru S.A.A. is the anchor tenant. They expect to close on the remaining sites by the end of 2010.

"Building on the momentum of our recent expansion into Chile, we are excited to announce today our launch of operations in Peru," said Jim Taiclet, Chairman, President and Chief Executive Officer. "Peru further extends our presence into yet another competitive Latin American wireless market where our existing customers currently operate. Meanwhile, our development teams will continue to evaluate future opportunities for growth and expansion within the region."

In addition to ATC's U.S. and Peru portfolio, the company owns 7,000 towers in India, 113 in Chile, 1,600 in Brazil and 2,800 in Mexico.

|

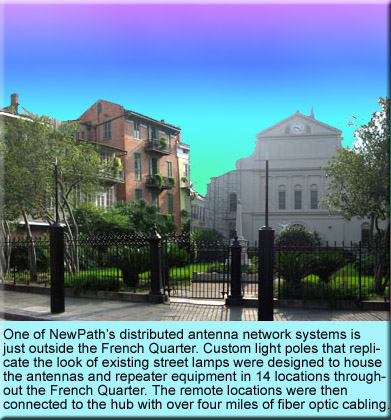

NewPath to be nucleus of Crown's DAS business

August 2, 2010 - Crown Castle International and NewPath Networks Inc. have been flirting with each other over the years, most recently at The DAS Forum during June when Crown Castle proudly  showed off its DAS facilities at The Resort at Pelican Hill in California. showed off its DAS facilities at The Resort at Pelican Hill in California.

NewPath's co-founder and CEO, Michael J. Kavanagh, was impressed. NewPath's owner, Charterhouse Group, Inc. was even more impressed when Crown Castle offered $115 million for the six-year-old company. They announced the DAS marriage last Wednesday.

The tower consolidator has known NewPath since its inception, said Crown's President and CEO, W. Benjamin Moreland.

"In fact, one of the two founders of NewPath is a former Crown employee. And so we've stayed close to them, been sort of admirers of what they have done as a competitor because we've been competing with them for several years," said Moreland.

He noted that the amount of business NewPath has secured from the big four wireless carriers "is obviously and certainly a real feather in their cap and credibility in our eyes in terms of how they've operated and conducted themselves."

Moreland said that Crown was well along the way in an integration plan.

"I think they'll roll right in and really become the real nucleus of our DAS team where we will, obviously, contribute both our existing networks and employee base that we have working there," Moreland said.

Pedro Miraz is Crown Castle's Director, DAS Development and Implementation .

Sweetwater Capital Partners was the primary investor in NewPath, committing $15 million in capital when the company was founded by Kavanagh and Shawn Cooprider.

To fuel its growth last April, Charterhouse, Meritage Funds, and Sweetwater raised another $47 million in private equity funding. Last August, Square 1 Bank provided the company with a $10 million line of credit.

Charterhouse wasn’t planning to sell NewPath, according to David Hoffman, a Charterhouse managing director.

This spring, Charterhouse again went out to raise capital for NewPath, but instead received multiple offers to purchase the firm.

“We decided to sell the business, which we had not expected,” he said, according to PEHUB's Luisa Betran.

NewPath began in 2004, and has since expanded their network footprint to include 20 states with 35 DAS networks in operation or under construction. Following the acquisition, expected to close next month, Crown Castle will have 44 DAS networks in operation or under construction.

|

AAT parades 750 new Macy's sites across America

July 23, 2010 - AAT Communications LLC, a subsidiary of SBA Communications Corporation, recently announced that it has inked an agreement with the department store chain R. H. Macy & Co to make available Macy's rooftops for its wireless clients throughout the nation. Co to make available Macy's rooftops for its wireless clients throughout the nation.

Almost 750 locations in high traffic areas are available.

SBA Communications of Boca Raton, FL purchased AAT in 2006 in a $1 billion deal.

Adding 1,855 towers to SBA's portfolio, the acquisition also provided SBA with a strong base of AAT's managed sites throughout the nation.

The Macy's deal complements the Woodbridge, New Jersey-based portfolio of managed locations.

According to AAT, a number of inquiries are already being processed following the announcement earlier this week.

For additional information, contact Michael Lee Foster, Director of National Sales or Michael Villa, Site Marketing Manager at 800-551-7483.

|

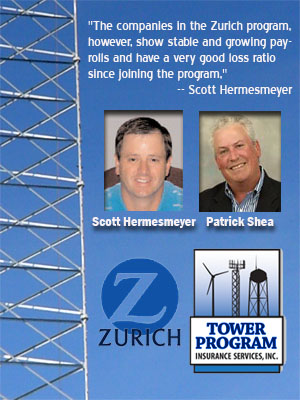

Tower program reaches insurance milestone

July 22, 2010 - Zurich Insurance Company, NA and Tower Program Insurance Services, Inc. announced today that they have reached an important milestone ahead of their planned growth projections. projections.

The insurance program, exclusively written for tower companies, wrote their 40th member company, making the program the largest of its kind in the country.

Annual premiums have reached $4.5 million, but more importantly TPIS officials say, losses have remained lower than expected since the program was founded in November of 2008.

Patrick Shea and Scott Hermesmeyer, founders of the program have over 14 years each in managing tower risks. The insurance executives note that significant change is occurring in the tower business.

Hermesmeyer and Shea say that companies have downsized as much as 80% since the mid 2000’s, and many have reduced their tower payroll and resorted to sub-contracting.

"The companies in the Zurich program, however, show stable and growing payrolls and have a very good loss ratio since joining the program," said Hermesmeyer.

Zurich is the largest writer of construction business in the US and a major sponsor of the National Association of Tower Erectors (NATE) annual conference and trade show.

The Zurich Tower Program is managed by Tower Program Insurance Service, Inc. and marketed exclusively to retail insurance agents nationwide.

|

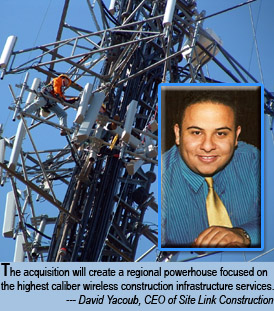

FMHC Corporation acquires MDM Construction

July 20, 2010 - FMHC Corporation, a turnkey wireless site development provider has announced the  acquisition of Schaumburg, Ill. based MDM Construction, Inc., a full service general contractor providing installation, maintenance, technical and construction services to the wireless industry. acquisition of Schaumburg, Ill. based MDM Construction, Inc., a full service general contractor providing installation, maintenance, technical and construction services to the wireless industry.

In addition to FMHC Corporation, the FMHC family of companies will now include FMHC Telecom Group, FMHC Global, FMHC Design and MDM Construction.

MDM Construction will continue to operate under the MDM name. Joe Marchese, current President of MDM Construction, will remain with the new company as Vice President of MDM Construction under FMHC, reporting to FMHC Corporation’s President, John Cankar.

“We continue to see rapid growth in the wireless industry, and consequently an increase in demand for cost effective and quality design and deployment services to accommodate that growth from our wireless network clients. By adding MDM Construction, FMHC can now offer a true full-turnkey solution to our customers in North America,” said John Cankar, President of FMHC Corporation.

“With MDM as a part of the FMHC portfolio we can now self-perform real estate, zoning, architecture, engineering, construction, installation, and maintenance services. With this self-performance ability we believe we can now offer one of the most cost-effective and highest quality wireless network solution in the industry,” he said.

Over the past 25 years FMHC Corporation has become a nationwide leader in turnkey telecommunications site development. They have performed site acquisition, construction management and project management for thousands of cell sites and all major wireless carriers across the United States.

With the addition of MDM Construction, FMHC Corporation’s service offerings will now include RF planning, design and optimization, site identification, real estate leasing, zoning and permitting services, architecture and engineering design, general construction, construction management, equipment installation and maintenance, technical services, project management, and outsourcing of personnel at more than 10 offices across the country.

|

ATC launches tower operations in Chile

July 13, 2010 - TC Sitios de Chile S.A., a subsidiary of American Tower Corporation, announced that it has launched operations in Chile, where it recently entered into agreements to purchase up to 287 communication tower sites from Telefonica Chile S.A.

A price for the deal was not provided.

The company purchased 113 of these tower sites, on which Telefonica Chile S.A. is the anchor tenant, at an initial closing on June 29, 2010, and expects to close on the remaining sites by the end of 2010, subject to customary closing conditions.

"Consistent with our strategy to expand within select Latin American countries, our launch of operations in Chile extends our presence into a vibrant wireless market where recent spectrum auctions are expected to drive investment in network expansion by existing wireless carriers as well as new entrants," said Jim Taiclet, Chairman, President and Chief Executive Officer.

"We have the people, systems and processes in place to support our operations in Chile as we work to establish our local market presence. In addition, we will further leverage our existing regional operations as we continue to pursue opportunities for future expansion and investment," Taiclet said.

|

Talley expands its operation to the East Coast

July 1, 2010 – Talley Inc. has announced the expansion of its business to include an East Coast warehouse and sales facility in the New York metropolitan area, effective July 6.

The new facility will increase Talley’s logistic footprint to seven locations.

“Talley has serviced business in the Northeast for several years without a facility in the market. With this new facility, we can now deliver the complete Talley experience to the Northeast,” said Mark Talley, President.

“At Talley, our philosophy is to provide customers with personalized, expert assistance so they can complete their projects in the shortest time, with the best possible products, and the lowest overall cost. This means having industry experts available in person to assist with everything from placing a simple order to helping customers plan their next project,” he added.

Talley is making the investment in inventory and people to support wireless carriers and contractors in the Northeast. Andrew and CommScope cable and accessories will be stocked in the new location along with all necessary site hardware including tower steel, components and consumables.

Talley’s newest facility is located at the intersection of Route 17 and Route 3 in the NJ Meadowlands, 10 minutes from Manhattan and one mile from the NJ Turnpike at 275 Veterans Blvd., Rutherford.

For more information, please e-mail: sales@talleycom.com.

Founded in 1983, Talley Inc. is one of the nation’s leading distributors of wireless communications infrastructure and mobile products. Talley's corporate office is in Los Angeles, with stocking and processing facilities in Dallas, Kansas City, Los Angeles, New Jersey, Phoenix, Sacramento and Seattle.

It is a privately held family owned company. For more information visit: www.talleycom.com

|

Lawsuit seeks $100 million in compensatory and punitive damages from American Tower

June 9, 2010 - Horse-Shoe Capital, a fund based out of the Republic of Mauritius, announced it has filed a $100 million breach-of-contract lawsuit against Boston-based American Tower Corporation. The requested amount includes approximately $69 million for punitive damages. requested amount includes approximately $69 million for punitive damages.

The complaint, which was filed in the Supreme Court of the State of New York on June 3, details American Tower's willful breach of the purchase agreement concerning the acquisition of XCEL Telecom, an Indian telecommunications infrastructure firm.

In March 2009, Horse-Shoe Capital sold XCEL Telecom and its more than 1,700 wireless communications towers in India to American Tower. The purchase agreement required a number of post-closing adjustments and created escrows to protect both parties, according to Horse-Shoe Capital.

These adjustments related to final accounting, due diligence and a potential tax liability that concerned American Tower.

Although the transaction closed more than a year ago, and all the conditions related to the post-closing adjustments have been met and the tax issues have been resolved, said Horse-Shoe Capital, American Tower has refused to release the escrows and has avoided paying the full price due under the acquisition agreement.

The Horse-Shoe Capital filing said at the closing, American Tower paid them $69,562,225, paid certain expenses in the amount of $5,208,224, deposited $7,545,642 into a holdback escrow and deposited $15,679,256 into a tax escrow.

XCEL, an Indian company run by former BPL Mobile chief executive Sandip Basu, was one of the late entrants in the Indian tower market, but acquired or built the 1,700 sites within the prior two years before the sale.

Horse-Shoe Capital is a subsidiary of Texas-based Q Investments, a private equity investor who funded XCEL Telecom. Q Investments invested approximately $50 million in XCEL.

Tower status, design could be an issue

American Tower did not respond to a request to identify if any of the escrow funds were not being released due to the possibility that some of the purchased towers may be shut down by government officials if they were not permitted correctly.

Throughout India, many thousands of towers were built without jurisdictional authority. Last month the Municipal Corporation of Delhi started turning off towers that were not properly permitted. There are 5,364 cell phone towers in MCD's jurisdiction. Of these, as many as 2,952 have been declared illegal.

Also, under new MCD guidelines the amount to be paid by a telecom operator to the civic agency for permitting a tower has been increased from the present Rs.1 lakh (U.S. $2,250) to Rs.5 lakh (U.S. $11,250).

If just 10% of XCEL's structures were found to be non-compliant and had to be removed or permitted following American Tower's due diligence, a pro-rata adjustments could reach $15 million or more.

Due diligence throughout the country by towercos have found that the foundations of a number of towers - and in some cases the buildings they are on - are incapable of supporting the structures. Also, some of the towers were severely overloaded.

India highlighted in ATC's growth

American Tower's performance in the past quarter was complemented by over a 25% core growth in revenues from their international markets.

India was particularly outstanding, said Thomas Bartlett, Executive Vice President and Chief Financial Officer, during a May conference call.

"For example, as of the first quarter, the average tenancy on our sites in India, nearly all of which have been acquired or constructed over the past 18 months, was approximately 1.5 tenants per tower. This rate illustrates this strong lease-up demand we are experiencing in India, which in fact are about two times our other served markets," Bartlett said.

Horse-Shoe Capital said the lawsuit is the culmination of a pattern of "bad faith behavior by American Tower, which has systematically evaded its post-closing financial obligations despite the fact that XCEL's assets are performing extremely well and all other requirements have been addressed."

Horse-Shoe Capital said it was disappointed that it had resort to litigation in an attempt to recover the escrow it is owed.

|

NATE webcast facilitates owner and operator involvement in tower safety

June 7, 2010 – The National Association of Tower Erectors, the unified voice for the tower erection, service and maintenance industry, recently hosted the first-of-its-kind webcast focused on how tower owners, operators and general contractors can directly improve tower site safety through the recognition of potential hazards on site. The event was presented to a live audience representing all facets of the tower industry. The event was sponsored by Zurich Financial Services Group. recognition of potential hazards on site. The event was presented to a live audience representing all facets of the tower industry. The event was sponsored by Zurich Financial Services Group.

The webcast was lead by Don Doty, former NATE Chairman and board member and co-founder of Doty-Moore Tower Services LLC, and David Sams, Director of Risk Management for SBA Network Services, Inc.

Doty and Sams discussed the importance of on-site managers recognizing hazards on tower sites and demonstrated NATE’s new educational resource, the Tower Site Hazard Recognition Guide. The Guide is designed to arm project managers, site superintendents and any other responsible personnel on a broadcast or communications tower site with the knowledge of best practices for tower site safety.

“Preventable accidents cost our industry dearly,” said Doty. "Not counting the enormous impact injuries and fatalities have on families, there are direct costs associated with an accident including stopping work, potential regulatory fines and possible litigation expenses. Accidents also have costs that are not felt for months and sometimes years after an accident. This can often be avoided by educating onsite personal to identify and correct potential hazards before an accident occurs.”

During the webcast, Doty and Sams highlighted the impact of accidents on a worksite, how it can cost a business and how these accidents can be prevented. The speakers also provided insight on how companies could face additional penalties with the new liability policies.

“Creating a culture of safety requires involvement from the entire industry”, said Patrick Howey, NATE Executive Director. “By hiring qualified contractors who observe best practices for safety and not compromising safety for timelines or budget constraints, together we can meet NATE’s goal to send every tower technician home safely tonight and every night.”

The Tower Site Hazard Recognition Guide online module is free to NATE members and non-members.

Visit www.natehome.com for additional information about the organization.

|

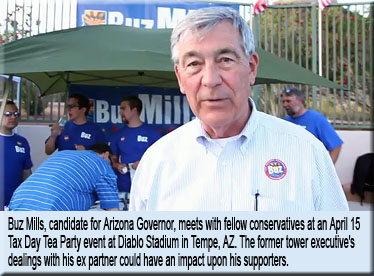

Former tower exec's campaign for Arizona Governor could be derailed by alleged fraud

April 29, 2010 - In seeking to get the nod in Arizona's Republican primary for governor, former tower consolidator Buz Mills has been championing his success in the business world stating that he "has created thousands of jobs and delivered results." created thousands of jobs and delivered results."

His campaign literature doesn't discuss how he made his millions, over $2 million of which he has already contributed to his campaign, but Tucson attorney and fellow gubernatorial candidate John Munger says some of it wasn't obtained fairly and this week demanded that Mills withdraw from the race.

Munger cited an eight-year-old court case that alleged Mills defrauded a business partner in a $105 million tower deal.

“At a time when there is already widespread distrust and anger toward government in general, your continued presence in the Governor’s race will only do further damage to the reputation of our state and the Republican Party,” Munger wrote in a letter to Mills.

A trial court in Florida determined that Mills owed a fiduciary responsibility to his business partner when he decided to sell the company they created in 1995 to construct cellular communications towers. Mills, who put in $900,000, had 90 percent of the stock and served as president, while John Mortellite had 10 percent of the stock for the $100,000 he contributed.

The company, which started in Mills’ garage, was ultimately purchased for $105 million by another company, American Tower. Court documents allege Mills bought out his former partner for $1.5 million — even extending Mortellite’s vacation to keep him out of the way during negotiations — without disclosing the real value of the company or telling him about the offer by American Tower.

After Mortellite sued, the judge found Mills was required to act in good faith. “Mills breached this duty and acted in bad faith,” toward his partner, the ruling found.

An appellate court sent the case back to the trial court — finding that Mortellite was entitled to a punitive damage award regardless of any compensatory damages — but it was ultimately settled out of court, with a confidentiality agreement barring the parties from talking about the details of the case.

It was after the sale of the company that Mills moved to Arizona and bought a firearms training facility.

Mills issued a statement rebuking Munger. “As a lawyer, John Munger should know the difference between accusations made in depositions and testimony, and a decision that was vacated by a judge,” the statement reads. “Since his flailing campaign needs attention, I guess this is his attempt at getting some.”

Mills and his spokeswoman, Camilla Strongin, were on the border shooting a commercial and were unavailable to expand upon the release.

According to court documents, Mills duped John Mortellite out of approximately nine million dollars by arranging the sale of OPM-USA, Inc. without telling Mortellite, then buying out Mortellite’s 10% share of the company for much less than it was worth. Mills and his wife, Sonja, owned 90% of the tower development company.

In 1997 Mills began talks with James Eisenstein of American Tower L.P. to sell OPM-USA, which he ultimately sold for $105 million. But he bought out Mortellite for just $1.5 million, according to court documents, without telling him about American Tower’s offer or disclosing OPM’s full value.

Court statements reveal that Mills even told Mortellite to extend a vacation for several weeks to keep him from finding out about the negotiations with American Tower.

When Mortellite returned from vacation, Mills fired him. Later, at an Aug. 1997 board meeting, Mortellite agreed to leave the company and take the buyout based on an incorrect assumption about the company’s value, according to court documents.

Mills didn’t tell Mortellite about American Tower’s offer, even when Mortellite’s attorney asked at the board meeting whether OPM was involved in any pending transactions.

Mortellite filed suit in Florida’s 12th Judicial Circuit, where a trial court judge ruled that Mills fraudulently induced Mortellite to sign away his shares of OPM.

“Mills, as the majority shareholder of OPM, did owe a fiduciary duty to Mortellite, the minority shareholder, which required Mills to act in good faith. Mills breached this duty and acted in bad faith toward Mortellite when he received the offer from American Tower and intentionally did not disclose the offer to Mortellite,” the trial court judge ruled. “Mills deceived Mortellite into thinking that there were no pending negotiations to purchase OPM stock and with the further intention that Mortellite would act to his detriment.”

By a letter dated August 19, 1997, American Tower offered to purchase OPM for $96 million. On August 21, 1997, Mills made a counteroffer of $105 million. At some point during that time, Mills informed Eisenstein, according to court documents, that he had a ten percent shareholder to buy out.

When Eisenstein asked Mills how he proposed to do that, Mills responded, "Don't worry. He has no idea what this is worth."

Camilla Strongin, Mills’ campaign manager, said Mills did not make the comment about Mortellite that was attributed to him in a deposition. She said the case was vacated after Mills and Mortellite reached a settlement, which included a confidentiality agreement.

“They clearly had a difference of opinion, which is not unusual between a majority and a minority stockholder on the value of the stock. And they sat down and resolved the differences via a settlement, and the case was vacated,” Strongin said.

A state appellate court ruled that Mills did not follow the terms of his 1995 purchase agreement with Mortellite and that Mills owed his old partner more than the $1.5 million he paid for the shares. The appeals judge remanded the case back to the trial court.

“We conclude Mr. Mortellite will ultimately be entitled to a punitive damage award,” appellate Judge Virginia Hernandez Covington wrote in a 2002 ruling.

After selling OPM, Mills, whose legal name is Owen P. Mills, moved to Arizona in 1999 and bought Gunsite, a tactical firearms training school in Paulden.

Munger said while Mills and his supporters may “try to dismiss these events as somehow normal” in the business world, “being in business is not a free pass to commit fraud.”

Other candidates in the GOP field for the Aug. 24 primary include Gov. Jan Brewer and State Treasurer Dean Martin. For the court's ruling, click here.

|

Canadian carrier's investors conference

unearths a hint of droll dromedary humor

April 16, 2010 - Canada's Shaw Communications has apologized after the company made jokes about a camel when describing Egyptian-backed rival, Globalive, during an investors conference. Globalive chairman and CEO Anthony Lacavera demanded an apology for the comments which  he described as a racial slur. he described as a racial slur.

A number of people polled said that they didn't view the jokes as a mean spirited jab, but observed them as a bit of levity in Shaw's presentation. They also said that even if it was a poke at dromedaries and their competition, they didn't view it as a racial slight.

The comments at issue were made during a conference call last week to discuss Shaw's financial results. During the call, there were jokes made about, "Is the wind blowing in here, followed by "Or is that a camel?" and "Oh, it's a camel."

Wind is the brand-name being used by Globalive, which is controversially backed by Egypt-based Orascom Telecom Holding. The government overturned a report that found the Canadian mobile network was majority controlled by the Egyptian company, in violation of local laws restricting foreign ownership of telecoms firms.

Shaw president Peter Bissonnette said he intended the remark to be "lighthearted" and "if anybody took offence to that comment, I just want to make sure that it's clear that I apologize."

He denied that he was making a reference to Orascom when he mentioned the camel. Instead, he said the camel was a metaphor for Wind's cellular coverage, which he thinks is comparable to a barren desert," which is not the foremost topography on most Canadians' minds.

"I think it was (made) in the jocularity of the moment - out in the desert with no coverage."

To retain his Tibetan subscribers, Bissonnette will probably check his humor at the door during the next call and will refrain from yakking it up with analysts since Globalive also owns Yak Communications.

U.S. tower companies' earnings call conferences are certainly humorless and their trying nature with carefully couched answers is seldom illuminating. Here are a few Q&As that we would love to see.

Operator:

We have a question from analyst Prentice Hall from J.P. Morgan.

Hall:

Great quarter, guys. Can you give us a little guidance about this one time charge of $962 million under Lodging and Missile Transportation?

Towerco CEO:

Goodness gracious, we didn't think you folks would even notice that.

We've changed our core growth model a little bit, Prentice, and although we anticipate that both our recurring free cash flow per share and our return on invested capital results will further benefit from lower cost debt financing, this one time charge is for predator drones that will be deployed by our multi-tasking NOC personnel.

We believe that by annihilating every one of our competitors' sites with more than one tenant we will see a marked improvement in client churn. That's noted in our 2010 guidance on slide six with the graphic of the monopole that was swiftly incinerated and didn't have to loiter for years before collapsing from base plate fatigue.

Hall:

Is there a reason you've opted to leave any structure standing?

Towerco CEO:

If there is only one tenant or less their fixed expenses are too high for them to be profitable and the multiples will be considerably lower when they come groveling at our feet to take it off their hands.

Operator:

Our next question comes from the line of Jonathan McCormick of Citigroup.

McCormick:

Looks like another great quarter, guys.

You're actively bidding against other towercos in India for existing sites to establish a presence, but how do you know that once you get them that they're legal and you won't have them sealed and be forced to take them down? News reports indicate almost 55% were erected illegally in Delhi and other cities. cities.

Towerco CFO:

Great question, Jon. As you're well aware, in looking at their book our analytical model contains one or more unknowns such as x, y, z, etc. So we have to have equality on both sides of the equation, so that a solution will be constituted. I hope that answers your question.

McCormick:

Sure does. Good. I won't read anything into those official government findings.

Towerco CEO:

Hi Jon. Let me add some color to that. We're outsourcing our due diligence for on site investigations in India to homeowners from the Hamptons and Palm Beach, and expect to have a better handle on it before we go into any deal.

If half of the structures are not viable assets we'll simply use our proprietary formula of cutting the rupees tendered in half or ask them to tether a cow to each mast as a good faith concession. It's quite doubtful that you're going to see a building official try to meddle with a 1,200-pound sacred bovine and risk ticking off big Ole Bessie and her neighbors.

Operator:

Our last question comes from Emily Litella of Lehman Brothers.

Litella:

This love fest of good quarter this and good quarter that sounds like a 900 sex call and it's making me nauseous. Let me get right to the point!

I myself, Emily Litella, have personally heard allegations that your corporation is using a front company to conceal millions of dollars in toxic assets and it could possibly cause your business to collapse due to your manipulation of finances.

Would you care to comment about this egregious trickery and how this will affect shareholder value, and if it will prevent you from increasing your dividend?

And another thing. Why don't you guys quit talking about Evita. That poor lady died before you were even born. But on every call I hear how you want to profit from her. Evita this, Evita that. Why don't you spend more time on talking about wireless backhaul instead of somebody who is buried in some backyard in Buenos Aires.

Towerco CLO:

Miss Litella, as an attorney I'm always captivated when given the opportunity during these calls to be challenged with a tripartite question that I can gingerly parse and parry into legal speak that obfuscates any semblance of a stable rejoinder to the queries, especially when, as I believe you said, it invovles something as tempting as trafficking in egregious trickery.

Unfortunately, in this instance I don't think it will be necessary since it appears that you are talking about the sordid practices used by the financial services firm you work for.

Oh, and also, Miss Litella, it's not Evita. It's EBITDA! Earnings before interest, taxes, depreciation and amortization. EBITDA, not Evita!

Litella:

Let's see. Yup, sorry, you're right. Oh, well - well that's very different. Never mind!

|

A Harbinger of good news:

Billions to be invested in hedge fund's 4G LTE

April 1, 2010 - A New York private equity firm plans to build a multibillion-dollar 4G wireless network that will cover most of the country by 2015, a welcomed addition to an already robust supplier  and contractor environment. and contractor environment.

The ambitious plan by Harbinger Capital Partners relies on deploying a Long Term Evolution network over spectrum owned by a few satellite companies — and would create an open wholesale wireless network available to retail companies, PC manufacturers or anyone who wants to offer mobile broadband.

On March 29, Harbinger, which manages funds totaling $28 billion, merged with SkyTerra for $262.5 million in cash.

Denver and Phoenix first

The planned network would launch before the third quarter of 2011 and cover 9 million people, with trials set initially for Denver and Phoenix.

The next milestone is that 100 million people have to be covered by the end of 2012, 145 million by the end of 2013 and at least 260 million people in the United States by the end of 2015.

Harbinger said in its statements to the FCC that all major markets will be installed by the end of the second quarter of 2013.

"The FCC's broadband policies have given us the confidence to make a series of investments that will bring new competition and innovation to all Americans," said Philip Falcone, chief executive officer of HCP in a press release.

The cost for the gargantuan 4G buildout will require 36,000 base stations along with tower sites, backhaul and other equipment associated with a terrestrial network. Harbinger did not disclose the identity of its co-investors in the network .

The project cost is expected to be in the billions of dollars, with some analysts estimating that it could be between $4 and $8 billion.

By comparison it is expected that Verizon’s LTE network will cost about $5 billion to deploy. Clearwire has also spent billions on its network, with analyst estimates ranging from $3 billion to about $6 billion.

The FCC approval of Harbinger’s buy of Skyterra set conditions that prohibit Harbinger and Skyterra from allowing AT&T and Verizon to use the spectrum without its approval, and that traffic from the nation’s two largest carriers cannot comprise more than 25 percent of the total network traffic.

Approximately 15% of HCP's assets are invested in Sprint Nextel.

Harbinger has access to 53 MHz of spectrum and the total spectrum in the MSS band where it has investments adds up to 90 MHz, A substantial quantity of the 500 MHz the FCC plans to free up as part of its National Broadband Plan.

While other attempts to create satellite/terrestrial networks have called for the use of large brick-sized handsets, the Harbinger proposal plans to have cellphone-sized user handsets and other consumer devices.

Cellular pioneer Craig McCaw had persuaded the FCC that no mobile satellite operator in the U.S. could survive unless it was allowed to use, free of charge, its satellite spectrum to deploy terrestrial towers to assure wireless connectivity in places satellites cannot reach.

The FCC agreed to permit mobile satellite operators to deploy a terrestrial network — called an Ancillary Terrestrial Component (ATC) — on the condition that they maintain a satellite service.

McCaw and his partners spent over $1 billion through mobile services startup ICO Global. ICO has gone through one bankruptcy and its North American affiliate, DBSD North America, is in the middle of another Chapter 11 bankruptcy reorganization.

A tower consolidator executive who monitors emerging technologies and FCC actions that might affect his company's revenues believes that Harbinger's plan will "complement our business and strengthen the need for our assets."

The Harbinger buildout's ambitious schedule will also provide additional business to an already healthy market being enjoyed by many contractors and suppliers.

Falcone made his fortune trading junk bonds in the ’80s. HCP was founded in 2001 and made another fortune betting against sub-prime mortgages.

Dubbed the "Midas of Misery" by BusinessWeek, Falcone made tens of millions of dollars on an earlier wager that Bear Stearns and other financial stocks would collapse.

Falcone runs his $6 billion hedge fund with a focus both on distressed and equity plays and often takes concentrated positions in companies.

He holds the No. 296 position on the 2009 Forbes list of the world's richest people. His paycheck from Harbinger last year totaled $825 million.

|

Sabre Site Solutions introduces its newest components and accessories catalog

March 15, 2010 - Sabre Site Solutions, the  components division of Sabre Industries, Inc., has released the 2010 edition of its Wireless Components and Site Accessories Catalog. This catalog offers both wireless components and pre-engineered towers. components division of Sabre Industries, Inc., has released the 2010 edition of its Wireless Components and Site Accessories Catalog. This catalog offers both wireless components and pre-engineered towers.

Designed to provide everything necessary to complete a wireless project, Sabre Site Solutions’ 2010 edition includes several new products such as Click and Go cable trays, Sabre’s innovative ULTRA boom, and a newly designed, expandable low profile platform.

The new catalog also features a full line of coax and grounding accessories, along with pre-engineered lightweight towers.

Committed to providing quick delivery and outstanding customer service, Sabre Site Solutions offers phone, fax or online ordering. The complete catalog is available online at.

To request a copy of Sabre Site Solutions’ new Wireless Components and Site Accessories Catalog, please call 866-428-6937 or send an email to: catalog@sabrecom.com.

|

Deese launches TelForce Group

February 13, 2010 - Industry veteran Ron Deese has announced the opening of Nashville, Tennessee-based TelForce Group, a provider of consulting services, talent and technology to the communications industry.

“Our services are embedded directly into our clients' business operations to improve efficiency and operability," said Deese. operability," said Deese.

Deese serves as founder, President and CEO of TelForce Group and has dedicated his business life to the productivity and enhancement of the communications industry for the past 30 years.

He has worked with Fortune 1000 companies producing over $200 million in project, staffing and consulting services sales over the past 15 years.

Deese first became involved with the communications industry working as an outside plant design wireline engineer with BellSouth in East Tennessee. Later in his career he did consulting engineering work for a number of companies, including Sprint, Verizon, and General Dynamics.

He later became involved in the staffing industry providing engineering and technical staffing services to the telecommunications industry. Deese moved into executive management working as vice president with companies such as Adecco, Alcoa Aluminum and KBR.

His diverse 30-year-career covers virtually all aspects of building start-up companies from marketing, business development, recruiting and selling a company.

Deese's current projects include business development, launching staffing divisions and consulting for some of the biggest and well-known brands in the communications industry.

For additional information visit TelForce's web site at www.telforcegroup.com or email Deese at: ron.deese@telforcegroup.com.

.

|

Berliner Communications Combines with UniTek USA to Become UniTek Global Services, Inc.

January 27, 2010 - Berliner Communications, Inc., a leading provider of installation, construction and site acquisition services to the wireless industry, today announced that it has combined with UniTek USA, LLC, a premier provider of engineering, construction management and installation fulfillment services to companies specializing in the broadband cable, wireline telecommunications and satellite television industries.

UniTek is a portfolio company of HM Capital Partners, a Dallas-based private equity firm. Under the terms of a merger agreement, HM Capital and its affiliates will ultimately hold approximately 80% of the common stock of Berliner.

Berliner intends to change its name to UniTek Global Services, Inc.

With a work force over 5,400 working throughout the United States and Canada, UniTek Global Services will have the scale and resources to compete in four distinct sectors of the permanently outsourced infrastructure services industry.

The pro-forma revenue for the combined UniTek Global Services entities on an unaudited basis for 2009 is approximately $360 million.

Rich Berliner, current Chairman and CEO of Berliner, will remain on the Board of UniTek Global Services and remain as CEO of BCI Communications, Inc. C. Scott Hisey, Founder and CEO of UniTek USA, will become CEO of the Company. Peter Giacalone, President of UniTek USA, has been appointed Chairman of the Company.

|

Through its investment in ExteNet Systems, SBA Communications shaves its DAS assets

January 25, 2010 - ExteNet Systems, Inc. has raised $128.4 million in equity funding in a deal that transfers SBA Communications  Corp.'s DAS assets to the Lisle, Ill. distributed antenna solution provider. Corp.'s DAS assets to the Lisle, Ill. distributed antenna solution provider.

The new round of equity financing includes the SBA assets, as well as contributions from SSP Offshore L.L.C., an affiliate of Soros Fund Management L.L.C., and all five of the company's existing institutional investors: Centennial Ventures; Columbia Capital; Sevin Rosen Funds; CenterPoint Ventures and Palomar Ventures.

SBA acquired its DAS assets with the purchase of Lightower in 2008. At that time Lightower had five distributed antenna system networks.

“The wireless industry is facing tremendous customer demand for new wireless services including expanded data, text, video, and voice applications. All of these demands are creating strains on the wireless service providers’ networks,” said ExteNet’s Chairman and Chief Executive Officer Ross Manire.

“This investment and the assets from SBA will allow us to significantly grow our business in a manner that supports wireless companies’ development of more robust and efficient networks,” Manire said.

“Since we first entered the DAS business in the fall of 2008, we have been seeking to materially increase our investment and capabilities in DAS,” commented Jeffrey A. Stoops, SBA’s President and CEO.

“Today we have accomplished that with our investment in ExteNet. We have had the pleasure of knowing and admiring Ross Manire and his team for years. ExteNet is a best in class DAS provider, with superior capabilities, technology, experience and project success. SBA will work closely with ExteNet to provide comprehensive customer solutions, and our goal is to provide increased investment to ExteNet over time as required,” Stoops said.

The assets provided to ExteNet include the physical networks as well as employees and existing contracts.

|

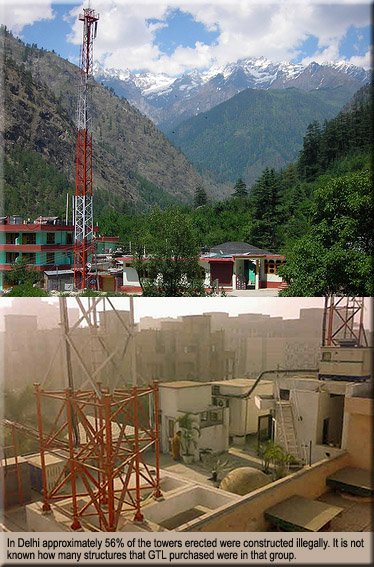

There's a possibility Crown and ATC lost a big tower deal, but came out the biggest winners

January 14, 2010 - In past years when Crown Castle International and American Tower Corp. made cattle car-size tower buys, they knew that their short due diligence window would prevent them from finding some weak steel sisters that were overstressed before they were erected. And in a couple of cases, it was discovered that the permitting process was less-than appropriate. cases, it was discovered that the permitting process was less-than appropriate.

However, lessons learned in the U.S. don't necessarily apply to business practices in India and there might be a number of administrators within the U.S.'s two largest tower owners that were privately relieved to find out that their company wasn't successful in buying the tower assets of Aircel Cellular.

GTL Infrastructure said today it was buying Aircel's towers for $1.8 billion, to become a key player in India's mobile tower market.

GTL, which currently has 14,500 towers, will add Aircel's 17,500 towers to its portfolio to become an industry leader with 32,000 towers.

Last September, Crown Castle and American Tower had been reported to be on Aircel's shortlist of suitors.

Of Aircel's 17,500 towers it is difficult to identify how many were not permitted, how many are overstressed, and how many structures might be taken down by authorities.

The Municipal Corporation of Delhi reported late last year that 56% of the city's towers were illegal.

"We are compiling a status report about such mobile towers and these would be demolished soon," said MCD commissioner KS Mehra .

Under a request under India's right to information request, an initial review indicated that only 2,015 of the 4,532 cellular towers in Delhi, with a population of over nine million, are legal.

India has a number of requirements that must be met before a structure can be erected, but many companies haven't observed them, Mehra said.

Applicants in Delhi must receive clearance from the Airport Authority of India, Delhi Urban Arts Commission, Chief Fire Officer, Archaeological Survey of India and the Delhi Metro Rail Corporation.

Structural safety certificates are required to be obtained from five institutions - Indian Institute of Technology (IIT), Central Building Research Institute (CBRI), Roorkee, Rail India Technical and Economic Services limited, (RITES), Delhi, National Council for Building Material, Faridabad and  IIT Roorkee. IIT Roorkee.

Hyderabad, with a population of over four million, is also concerned about illegal towers.

Although the Greater Hyderabad Municipal Corporation has not identified how many towers they believe have been illegally constructed, their major concern is structural integrity. They have identified that there were incidents of buildings developing cracks or collapsing due to the weight of the towers erected upon their rooftops. The GHMC has taken a number of them down.

There are nearly 2,800 cell towers in the GHMC area. Of them, 1,154 cell phone towers were erected on building rooftops, with 50 being ground-based; the remaining 1,791 were rooftop poles.

India is the world's fastest-growing market for mobile services.

The spree in tower consolidation began in 2007 when Bharti Airtel, Vodafone Essar and Idea Cellular collectively decided to spin off their towers into an independent firm — Indus Towers, which currently has over 100,000 towers.

Reliance Infratel comes next with over 50,000 towers. A Reliance Equities report, released in September, says the number of telecom towers in India in 2010-11 is estimated to grow to 337,375 from an estimated 282,074 in the country today.

Last month the Wall Street Journal reported that American Tower is in talks to acquire a controlling stake in India's Essar Telecom.

Essar Telecom is the tower arm of the Essar Group.

"The deal is likely to be valued at about $429.1 million," the person told Dow Jones Newswires, asking not to be named, adding that the deal is likely to be funded from ATC's internal cash flows.

Currently, ATC's combined India portfolio is at approximately 2,500 towers, while Essar Telecom has 4,500 towers, the person said.

|

Optasite founder Eisenstein joins VC firm

January 14, 2010 - Former Optasite Inc. founder, chairman and CEO Jim Eisenstein has joined Point Judith Capital as a venture adviser. Judith Capital as a venture adviser.

Point Judith's general partner Sean Marsh was previously on the board of Optasite.

Point Judith backs early-stage companies in the health-care technology, Internet, digital media, communications and software industries. The company is currently investing out of its second fund, worth $73 million.

Founded in 2000, Westborough-based wireless tower company Optasite Inc. was acquired in 2008 by SBA Communications Corp. of Boca Raton, Fla. The company had raised at least $330 million from investors including Citigroup Inc. and Columbia Capital.

Eisenstein co-founded American Tower in 1995 and previously held the position of Chief Operating Officer of the company. Before co-founding American Tower, Eisenstein was Chief Operating Officer of Amaturo Group, Ltd. from 1990 to 1995.

Amaturo Group owned and operated 11 radio stations in West Palm Beach, San Bernardino, Austin and Nashville, which were sold to American Radio Systems (an affiliate of American Tower).

|

Guy wire prices are coming under tension

January 9, 2010 - National Strand Products, Inc. of Houston, Tex., one of the nation's largest guy wire suppliers, is cautioning contractors to consider not offering long term pricing commitments to their clients.

Due to the escalating cost of zinc, scrap and high carbon steel rod used to manufacture

wire, National Strand said they are forced to increase their pricing on their galvanized steel strand products by $80 per ton, effective for all shipments made after February 1.

"The cost of raw materials used to produce galvanized steel strand remains unstable and more increases are possible in the near future," said sales manager Neal Krivjans.

"We understand that this time of year many of you are submitting bids for your 2010 projects and contracts, but we advise you to please take this volatility into account before entering into any long term price commitments with your customers."

|

Connecticut distribution facility allows Sabre to be able to better serve the industry

January 6, 2010 - Sabre Site Solutions, the components division of Sabre Industries, Inc. announced the opening of their new distribution facility in Hartford, Conn.

Located at 154 Knotter Drive in Chesire, this new facility offers will-call and shipments. Chesire, this new facility offers will-call and shipments.

“We are excited to open a new location in the Northeast,” said John Pleiss, Vice President and General Manager of Sabre Site Solutions.

“Our increasing footprint provides our customers with a great alternative, and the convenience of having a distribution center near them.”

Sabre Site Solutions’ products are available online at www.SabreSiteSolutions.com.

The latest edition of their Wireless Components and Site Accessories Catalog will be out early in 2010. The new edition features an expanded product line including everything from grounding lugs to mounts and pre-engineered towers.

|

CITCA announces the opening of its regional tower climber safety training facility near Dallas

December 17, 2009 - Steve Wilder, V/P and COO of CITCA, the Communication Industry Training and Certification Academy in Bradley, Ill. recently announced the opening a new regional  training facility near Dallas, Tex. training facility near Dallas, Tex.

The facility, built on the campus of Rio Steel and Tower in Alvarado, includes classroom training facilities as well as a specially designed training tower.

“For years, CITCA has enjoyed an incredible relationship with Rio Steel and Tower,” said Wilder.

“This new facility allows us to expand our training programs in the Dallas area, where we have always had a strong presence. Plus, both existing clients and new clients in the area will have access to more affordable training, with less travel demands and lower expenses for their employees. Now we have both instructors and a facility in the area, so the cost of training goes down,” Wilder added.

The facility includes a 60-foot self supporting tower, designed specifically for training.

“With some simple changes, it is almost an exact replica of the tower at our Illinois campus. It is built as a training prop, with student safety a top priority, and can be used for a variety of classes and subjects” he noted.

Wilder indicated that plans are on the table to cooperatively establish regional training sites with other clients across the nation as well.

“We take pride in the relationships we form with our clients, and those relationships are now setting the stage for additional regional training sites in other parts of the nation as well. CITCA has become known for the quality of our programs and our instructors. In this economy, companies are watching their training budgets closely, and looking for ways to do more with less. Regionalizing training and reducing the costs is part of our efforts to assist them in meeting their goals,” said Wilder.

Anyone wishing more information or class schedules can contact Wilder at 800-313-5159 or email him at swilder@citca4training.com .

|

Once for teens, social networks are becoming popular venues for the wireless industry

December 15, 2009 - The FCC does it, President Obama does it, the Chicago Tribune does, and even the members of the Edmonton Oilers do it. They tweet on Twitter, the two-year old social networking phenomena that has taken the world by storm. networking phenomena that has taken the world by storm.

Twitter first hit the headlines in late 2008 during the attacks on Mumbai, when eye-witnesses were reported to be sending 80 tweets every 5 seconds.

Emergency services and the media tuned into Twitter and CNN called it 'the day that social media appeared to come of age'.

It's also catching on as a great networking tool for a number of tower erectors and manufacturers. The latest manufacturer to dip its toe into the Twitter community is Structural Components of Boulder, Colo.

The provider of towers, reinforcement products and services, recently launched a completely redesigned web site that also incorporates social networks such as Facebook, Linkedin and Twitter.

"These new social features allow clients to become fans of our company on

Facebook, view live updates on Twitter and connect with Structural Components on

Linkedin. Clients are able to view product and project updates from anyone of these

social mediums and the company website," said company Vice President David Jessip.

Up to this point, the use of social networks for businesses has been too casual, according to Chris Brogan, President of New Marketing Labs. He believes that now is the time to use these tools to get the message to the right people.

He says: “It’s time to get over being a tourist. It’s time to put a claim down and do something with it and really tend it.”

|

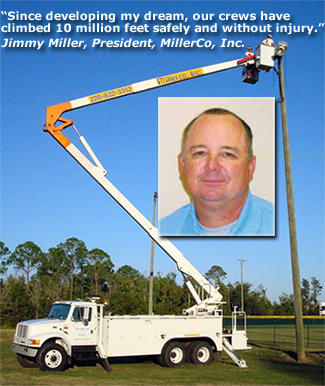

NATE board of directors is weighted

with expertise and Jims and Millers

December 2, 2009 - When the new board of directors of the National Association of Tower Erectors meets next February at its annual convention in Orlando, it will be top heavy with Jims and Millers. heavy with Jims and Millers.

There is Jim Coleman of Southern Broadcast Services, Inc., chairman of the organization, who was recently reelected to serve another two years as a director. Then there's seated director Jim Miller of EasTex Towers, not to be confused with Jimmy Miller of MillerCo, Inc., the board's newest director.

Dave Anthony, Shenandoah Tower Service, Ltd.; Pat Cipov, Cipov Enterprises, Inc.; and Ron Romano, Installation Services, Inc. were also also elected for a two-year term. They join Kevin Hayden, Kari Carlson and Jim Miller on the NATE Board of Directors for 2010.

Anthony previously served three terms on the Board from 2001 to 2007.

Miller - that's Jimmy - is president of MillerCo, Inc. of Gulfport, Miss. In 1997 Miller developed his telecommunications maintenance company from a small business with only four employees into a $7 million company with 60 employees.

His drive for success is only exceeded by his fervent belief that his company should "push the safety envelope to the next level".

"Our standards and policies meet or exceed industry standards. At MillerCo our policy on fall protection measures is strict and straightforward. Any employee 6-feet or higher above the ground shall be 100% bonded, at all times, with fall arrest protection," Miller said.

Miller is a Master Electrician in Alabama, Louisiana, Mississippi, and Texas. He was also a senior executive with 20 years of experience in the technology sector.

Coleman said that he welcomes Miller's wealth of knowledge about the industry and management, and looks forward to Miller's enthusiastic participation as a director of NATE.

|

For whom the Bell towers will earn a toll: ATC

November 19, 2009 - American Tower Corporation and Cincinnati Bell Inc. announced that American Tower has entered into a definitive agreement to acquire 196 of Cincinnati Bell’s wireless communications towers for $100 million. communications towers for $100 million.

The towers are located primarily in Ohio and Kentucky and currently average 2.1 tenants per tower. Cincinnati Bell will remain a tenant on all 196 towers pursuant to a long-term Master Lease Agreement.

“This transaction is a continuation of Cincinnati Bell’s strategy to improve liquidity and unlock shareholder value,” said Gary Wojtaszek, Chief Financial Officer of Cincinnati Bell. “We are pleased to expand our long-term relationship with a world-class operator such as American Tower, who is facilitating our ability to sell these non-core assets at an attractive valuation.”

“We are pleased that Cincinnati Bell has selected American Tower to own and operate this critical portion of its network infrastructure and we continue to actively pursue the acquisition of other strategic assets in the United States,” said Steven Marshall, President of American Tower’s US Tower Division. “We also look forward to broadening our partnership with Cincinnati Bell and supporting its ongoing network development and expansion in the future.”

The acquisition is expected to close on or about December 30, 2009, and the acquisition’s consideration is subject to certain closing adjustments. American Tower expects to use available cash on hand and cash equivalents to satisfy the consideration at closing.

Cincinnati Bell was advised in the transaction by Wells Fargo Securities.

|

TR-14.7 committee to welcome China's tower king and queen at Pittsburg meeting and queen at Pittsburg meeting

November 9, 2009 - In addition to a full schedule of committee work this Tuesday and Wednesday in Pittsburg, Pa., the TR14.7 Main Committee will be meeting with a delegation of engineers from China to discuss the design of towers in their country.

Speaking before the committee will be Professor Ma Renle of Tonji University, Professor He Minjuan, also of Tongji University; Xie Yshan, engineering director of Guang Don Telecommunication Design and Research Institute; Jing Jianzhong, engineering director of China Information Technology Designing Consulting Institute; Wang Fanglin; engineering director of Valmont China and a member of the Committee on Highrising Structure of China Association for Engineering Construction Standardization; and Qian Peilin, the marketing director of Valmont China.

Professor Ma and Professor He are married and many people in China refer to the celebrated professors as the “Tower King” and “Tower Queen" of the country.

The TR-14.7 group of volunteer professionals will also be addressing, anchor rod corrosion, full scale testing of baseplates, and they will discuss Revision G addendums versus Revision H.

A visit is also planned to tour Crown Castle International's National Operations Center in Canonsburg.

Chairman Brian Reese and Vice Chairman John Erichsen will be up for reelection at the meeting.

|

Tower painter benefits from World Series promo

October 30, 2009 - Sometimes tower companies find unexpected profit centers in non-traditional scopes of work. Such was the case for Precision Tower Services when the company was tasked with painting a 426-foot tall four-legged tower in Moorestown, NJ for Philadelphia station 11210 WPHT, the Philadelphia Phillies flagship radio station. WPHT, the Philadelphia Phillies flagship radio station.

In honor of the Phillies returning to the 2009 World Series, the station painted its radio transmission tower red and white and hung a giant banner with the Phillies “P” logo.

Previously painted in the required seven bands of aviation orange and white, Precision repainted the structure red at the top and bottom and white on three sections in between, according to station management.

The banner, at 200 feet on the 7-1/2-foot face, was hung by Precision in time for Game 1 of the World Series Wednesday. It might have helped since the Phillies ably trounced the Yankees 6-1.

However, last night, A.J. Burnett outdueled Pedro Martinez while Mark Teixeira and Hideki Matsui each homered for New York, as the Yankees pulled even in the World Series with a 3-1 victory over the Phillies in Game 2.

Whether the Phillies or Yankees take the best of seven games, an assured winner is Precision since the company gets paid to repaint the tower back to the required seven bands.

|

NATE's pre show planner available for viewing

October 28, 2009 - The National Association of Tower Erectors has announced that its pre show planner for its February 2010 conference is now available and can be viewed here. planner for its February 2010 conference is now available and can be viewed here.