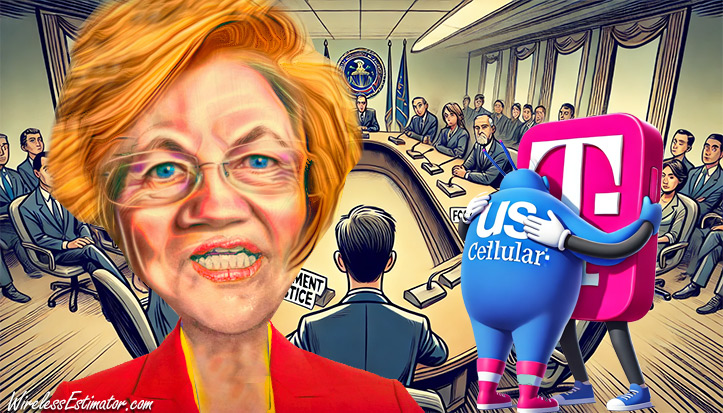

ANTI-ACQUISITION SENATORS—Led by Senator Elizabeth Warren (D-Mass.), six senators are petitioning the Department of Justice and the Federal Communications Commission to scrutinize T-Mobile’s planned acquisition of US Cellular. They believe it will reduce competition, increase pricing, and harm consumers and employees.

In a concerted effort to protect competition and consumers in the wireless market, a coalition of US Senators, including Elizabeth Warren (D-Mass.), Amy Klobuchar (D-Minn.), Chris Murphy (D-Conn.), Bernie Sanders (D-Vt.), Cory Booker (D-N.J.), and Richard Blumenthal (D-Conn.), has written a letter to Jonathan Kanter, Assistant Attorney General for the Antitrust Division of the Department of Justice (DOJ), and Jessica Rosenworcel, Chair of the Federal Communications Commission (FCC).

The Senators are urging these officials to closely scrutinize T-Mobile’s proposed $4.4 billion acquisition of US Cellular, citing concerns over reduced competition, higher prices, and other potential consumer and employee harm.

Since T-Mobile acquired Sprint in 2020, the national mobile wireless service market has consolidated significantly, leaving just three major carriers in control. This latest proposed acquisition by T-Mobile is seen as a continuation of a trend that could further deplete competition in the industry. The merger would bring T-Mobile an additional four million customers, potentially leading to a near-monopoly situation where a few players dominate the market, thus reducing consumer choices and increasing prices.

The Senators expressed strong concerns about the negative impact of the merger, emphasizing that past consolidations in the industry have resulted in increased prices and decreased quality of service. They pointed out that since the T-Mobile/Sprint merger, competition has reduced, leading to higher costs for consumers. A class action lawsuit filed in June 2022 claimed that the reduced competition caused by the merger led to billions of dollars in increased cell phone costs for AT&T and Verizon customers.

The Senators highlighted that US wireless customers already pay some of the highest prices in the world, a situation that has only worsened since the T-Mobile/Sprint merger. They noted that the anticipated benefits of such mergers often do not materialize, with companies instead prioritizing profit over service quality and affordability. They referenced an internal T-Mobile memo revealing plans to raise rates for customers on older plans, demonstrating the immediate consumer impact once pricing commitments from the Sprint merger expired.

Additionally, the merger has had a significant impact on employees. Despite promises of job creation, T-Mobile has conducted several rounds of layoffs, most notably firing 5,000 employees in the fall of 2023, shortly before announcing stock buybacks for shareholders. This pattern raises concerns about potential job losses if the UScellular acquisition is approved.

Antitrust laws prohibit mergers that substantially lessen competition, and the DOJ and FTC’s Merger Guidelines clarify that mergers consolidating a highly concentrated market may be impermissible. The Senators argue that the current high concentration in the wireless market, exacerbated by the T-Mobile/Sprint merger, would be further intensified by the proposed T-Mobile/UScellular deal, potentially violating antitrust laws.

The Senators emphasized that the DOJ should closely review T-Mobile’s compliance with the Final Judgement from the T-Mobile/Sprint merger. If T-Mobile is found to be in violation, or if the terms need to be strengthened to address transaction-related harms, appropriate actions, including potentially unwinding the 2020 merger, should be considered.

The FCC is tasked with reviewing telecommunications industry transactions to ensure they serve the public interest, convenience, and necessity. This involves assessing potential public interest harms such as fewer consumer choices, higher prices, job losses, and reduced network deployment and innovation investment. The Senators stressed that the FCC should not approve the transfer of US Cellular’s licenses to T-Mobile if the merger fails to affirmatively benefit the public.

They pointed out that T-Mobile’s previous promises of job creation were not met, urging the FCC to treat any future job growth claims with skepticism. The merger’s impact on competition for telecommunications industry workers and the consolidation of spectrum holdings, a critical input for mobile wireless carriers, should also be closely examined. The Senators argued that further concentration of spectrum holdings among the largest carriers would eliminate potential competition from smaller firms, contrary to the public interest.

The Senators concluded their letter by reiterating that T-Mobile’s merger with Sprint led to higher consumer costs, job losses, and less competition in the wireless industry. They urged the DOJ to scrutinize the proposed T-Mobile/UScellular deal and challenge it if it substantially lessens competition. They also called on the FCC to carefully review the merger and not permit the transfer of licenses if it fails to serve the public interest, convenience, and necessity.