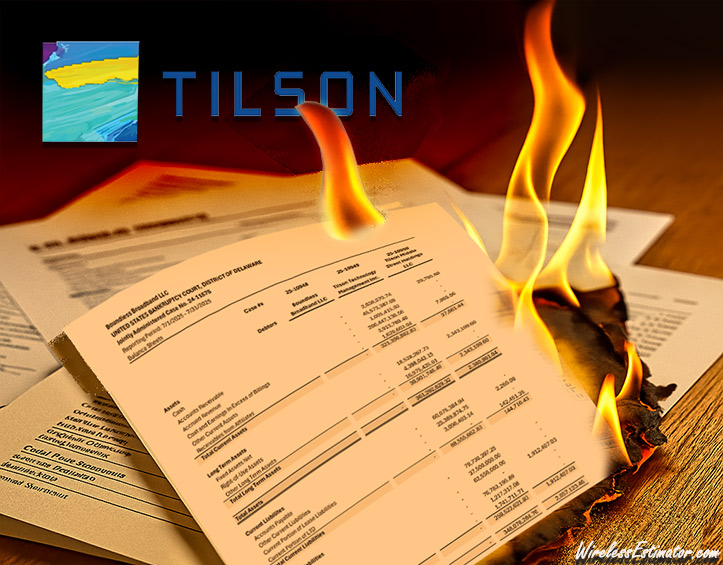

Wireless Estimator’s early presumption that Tilson would ultimately sell at a “fire sale” price following its bankruptcy has proven correct. Despite the company’s July balance sheet superficially showing more than $361 million in assets, Tilson announced in a press release Friday that it had selected an offer from ITG Communications, LLC for approximately $22 million as the highest and best bid at auction. The sale, the company said, was subject to court approval, with closing anticipated in mid-September.

Distressed balance sheet

Court filings from July 31, 2025, revealed the weakness behind Tilson’s headline asset figure. Of the $361 million in reported assets, $266 million represented “cost and earnings in excess of billings”—essentially unbilled work whose collectability was uncertain. Another $45 million was tied up in receivables, with at least $20 million directly tied to unpaid Gigapower invoices following the fiber joint venture’s abrupt termination of its agreement with Tilson. Against this backdrop, Tilson was carrying $348 million in liabilities, including a $62.5 million debtor-in-possession loan, a $79.7 million operating line of credit, and nearly $77 million in subordinated notes.

Given those conditions, the $22 million acquisition price aligns with what distressed buyers are willing to pay for Tilson’s workforce, contracts, and limited hard assets—not its inflated book value. What looked like a $361 million business on paper was, in reality, a heavily leveraged company with negative operating cash flow.

Stalking horse bid fizzles, ITG emerges by default

Tilson announced the $22 million sale to ITG Communications on a late Friday afternoon before a holiday weekend. Industry observers believed the timing appeared deliberate; had the news been entirely positive, the company might have waited for a broader audience to respond. By choosing that moment, Tilson seemed more focused on managing the message than maximizing attention.

Tilson’s restructuring team initially sought a stalking horse bidder to anchor the auction process and set a floor for competing offers. However, court records show that interest was tepid, with potential buyers missing deadlines and no qualified stalking horse bid materializing. It appears that, faced with the risk that the company might draw little or no interest, Tilson ultimately accepted ITG Communications’ $22 million proposal as the highest and best offer, a move that ensured a sale but underscored the limited appetite among other investors.

In its press release, Tilson framed ITG Communications’ offer as a step toward emerging from Chapter 11 “as a stronger, financially sound company with the resources and expertise needed to achieve long-term success.” However, that characterization is more public-relations spin than legal certainty. The court-approved transaction is structured as an asset sale, and there is no guarantee that ITG Communications will operate Tilson as a separate subsidiary. Instead, the company may choose to fully absorb Tilson’s contracts, workforce, and assets into its own nationwide platform, leaving the Tilson brand or corporate structure behind.

No más for MasTec and other key contractors

Although industry speculation suggested that larger competitors such as MasTec Communications Group might pursue Tilson, court filings show no evidence that the company or other major players submitted a qualified bid.

In the end, ITG Communications emerged as the successful bidder, with Clear Plan, LLC and Lumin8 Transportation Technologies, LLC named as the only backup bidders with lower offers than $22 million.

Tilson was bleeding cash

Tilson’s July operating report showed that, despite $9.4 million in revenue for the month, the company posted a $5 million net loss. Selling, general, and administrative expenses alone consumed nearly three-quarters of revenue. After factoring in debt service, Tilson’s cash position slipped to just $2.8 million at month’s end, leaving little room to maneuver.

ITG CEO Michael Brooks said in the press release that the acquisition would “significantly enhance ITG’s service offering and customer base,” particularly through Tilson’s wireless and consulting capabilities. He welcomed Tilson’s leadership team, noting they would accelerate future growth as part of ITG’s national platform.

$200 million lawsuit may not be an asset

Tilson has filed a $200 million lawsuit against AT&T’s Gigapower joint venture, alleging breach of contract, wrongful termination, and damages tied to the abrupt withdrawal of fiber construction work that left at least $20 million in unpaid invoices. Tilson’s restructuring advisors even modeled damages and explored litigation funding while negotiating the asset purchase agreement with ITG Communications; however, the bankruptcy filings do not clarify whether the lawsuit was included in the sale. Until the final APA and its schedules are filed, it remains unknown whether the claim was transferred to ITG or carved out for creditors.

A $200 million lawsuit has been filed against AT&T’s Gigapower joint venture by Tilson after Gigapower pulled Tilson’s contract. It is unknown if any of the proceeds that might be captured would be an asset for ITG Communications.

Even if creditors were to share in any lawsuit recovery, recoveries could be minimal.

The Gigapower dispute highlights a larger problem that industry leaders say begins with AT&T. AT&T’s matrix pricing model has forced contractors onto razor-thin margins, leaving them highly vulnerable when work is delayed or terminated abruptly. NATE: The Communications Infrastructure Contractors Association has been in direct discussions with AT&T to address these concerns, arguing that the carrier’s pricing framework—similar to other carriers, but reportedly lower—risks collapsing the very contractor base needed to build and maintain America’s wireless and broadband networks.

Across the wireless infrastructure sector, contractors are increasingly failing because they rely too heavily on one or two major carriers for the bulk of their work. Those carriers have imposed pricing models that slash compensation to unsustainable levels, leaving little room for error and no cushion for delays, disputes, or unpaid invoices.

Who Is ITG Communications?

With its headquarters in Hendersonville, TN, ITG Communications has 175 locations throughout the U.S. and employs approximately 8,200 people.

ITG Communications, LLC, based in Hendersonville, Tennessee, is a national provider of installation, fulfillment, construction, and project management services for the broadband and telecom industries. The company operates in 175+ U.S. locations with more than 8,200 employees, according to its website.

Backed by growth funding from Brookfield Oaktree Holdings, ITG Communications has expanded rapidly through acquisitions, including Broadband Technical Resources (2019), Infinite Communications (2024), and Spectra Broadband (2024), which collectively broadened its geographic reach and workforce.

ITG serves major cable and telecom operators. However, there is no public indication that it currently provides services to AT&T, Verizon, T-Mobile, or Dish Network for their mobility networks, although Broadband Technical Resources states that it offers ground and tower site preparation and integration, and is experienced in small cell and smart city deployment.