Across Chevak and the surrounding Alaska Kusilvak Census Area, the median owner-occupied home value is about $72,700. Under Alaska’s preliminary BEAD slate, Quintillion’s fiber cost is $113,578 per location—that’s 56% more than the average home is worth, putting the per-address subsidy well above local property values.

Alaska’s preliminary BEAD award slate landed last week with a six-figure outlier that dwarfs even the pricey builds called out elsewhere. When New Mexico’s $40,433-per-location fiber proposal drew scrutiny in August, it became a national reference point for “too high” costs. Alaska’s tentative award to Quintillion Subsea Ops. clocks in at $113,578 per location—about 181% higher than New Mexico’s benchmark.

Draft plan, big dollars, limited matches

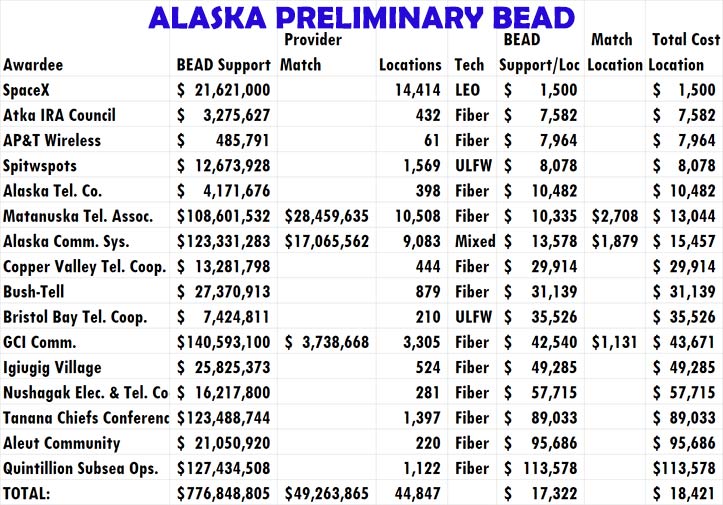

In its Draft Final Proposal now out for public comment, the Alaska Broadband Office (ABO) proposes to devote roughly $777 million of BEAD support to reach 45,000 eligible locations, using a mix of fiber (51%), LEO satellite (32%), and fixed wireless (13%), with about 4% of locations still missing a technology code in the working data.

Across all listed projects, the spreadsheet totals show $776.8 million in federal support, plus $49.3 million in provider matches for 44,900 locations—an average of $18,421 per address, with providers covering only 6% of the total project cost. The ABO notes that the figures are provisional and subject to NTIA approval.

Only a handful of awardees are putting meaningful skin in the game. Matanuska Telephone Association shows a match of about $28.46 million ($2,708 per location), Alaska Communications lists $17.07 million ($1,879/loc), and GCI adds $3.7 million ($1,131/loc). Several others list no match at all in the provided draft table.

SpaceX (Starlink) is listed at $1,500 per location for 14,414 locations—an order-of-magnitude reminder that technology-neutral options exist when terrain, climate, and construction windows make trenching and aerial fiber unfeasible.

Why Alaska looks different—and why scrutiny still matters

Valley Telephone Cooperative is slated for $40,433 per passing (300 locations), the highest line item in New Mexico’s final BEAD proposal.

Alaska’s average cost of roughly $18,421/loc is high by national standards, but not surprising given the conditions. Alaska’s geography (islands, permafrost, mountains), brutal winters, and a short build season undeniably inflate unit costs. Subsea segments and long middle-mile hauls are expensive. But the spread—from $1,500 to $113,578 per location—raises the same value-for-money questions that surfaced in New Mexico’s plan: when lower-cost, standards-compliant options are available for specific clusters, states need to justify six-figure fiber passes in a transparent, tech-neutral way.

Public comment: where to send input, and is it visible?

ABO says these results are preliminary and subject to NTIA approval. The 7-day public comment period is open now and closes at 5:00 p.m. AKDT on Wednesday, Oct. 1, 2025. Comments must be submitted by email to ced.abo.general@alaska.gov. As of the posting, there is no public-facing comment portal or live “view comments” page linked on ABO’s site—only the email address for submissions.

New Mexico’s $40,433/loc fiber line item drew a “tech-neutral sanity check” call. Alaska’s Quintillion Subsea proposal at $113,578/loc is 181% higher—and will likely become Exhibit A in the national debate over BEAD’s cost discipline.

NTIA’s BoB push: “cheaper, faster” plans under the microscope

NTIA chief Arielle Roth says the “Benefit of the Bargain” (BoB) overhaul is working—state BEAD plans submitted so far tally roughly $15 billion below their original allocations. Speaking at the SCTE TechExpo in Washington today, she framed BoB as a course correction that strips non-statutory add-ons, enforces technology neutrality, and tightens cost controls to drive down per-location prices and speed up builds.

Roth also noted that NTIA is pressuring some states to resubmit more affordable final proposals before approval. In the context of Alaska’s six-figure fiber outliers, that signals stricter scrutiny ahead: projects will be stress-tested for value and compared against lower-cost, standards-compliant alternatives (fixed wireless, LEO) wherever they can meet performance requirements at a fraction of the price.