The latest fiber deployment cost study documents rising construction and labor pressures across the industry, but stops short of addressing whether those higher costs are being offset through contractor compensation or recorded as benchmarks.

The Fiber Deployment Cost Annual Report 2025, released by the Fiber Broadband Association (FBA) in partnership with Cartesian, confirms what fiber contractors have been experiencing on the ground: deployment costs are rising nearly across the board, with labor, permitting, and make-ready work exerting sustained upward pressure on project economics.

According to the study, 92% of respondents reported higher fiber deployment costs in 2025, with underground construction averaging roughly $18 per foot and aerial construction averaging roughly $8 per foot. Labor remains the single largest cost component, accounting for roughly two-thirds to three-quarters of total construction costs, depending on build type. The report repeatedly emphasizes that fiber construction is inherently labor-intensive and increasingly constrained by workforce availability and wage pressure.

The study also highlights make-ready work and permitting delays as major cost wildcards. Respondents cited instances in which make-ready expenses approached—or exceeded—original construction budgets, forcing route redesigns, schedule extensions, or shifts from aerial to underground construction, all of which compound labor exposure and financial risk.

The FBA’s membership is weighted toward network operators/service providers and the vendor/supplier ecosystem, with operators alone representing roughly half of member companies. The association does not disclose how many of its members are prime contractors or subcontractors.

What the report doesn’t say: How contractors are being paid

While the report thoroughly measures rising costs and identifies their drivers, it is notably silent on how those higher costs are being absorbed contractually. The study does not address whether fiber contractors are being reimbursed at higher rates, whether labor cost escalations are being passed through, or whether master service agreements are being adjusted to reflect today’s inflationary environment.

That omission matters. Two senior executives at fiber-contracting firms told Wireless Estimator that, despite the cost trends documented in the report, their companies are not being adequately reimbursed for rising labor costs, particularly for skilled splicers and construction crews. Both said that while fiber owners acknowledge higher costs in principle, field-level compensation has not kept pace with wage inflation, extended schedules, or increased compliance requirements.

In effect, the report provides transparency on what costs are rising. Still, it offers no insight into who is funding those increases—a distinction contractors say is central to long-term workforce stability.

A familiar pattern for wireless infrastructure contractors

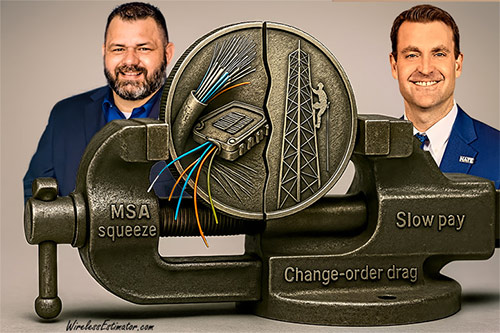

Contractors across the fiber-construction community argue that the conditions facing wireline builders increasingly mirror those long documented by wireless infrastructure crews—thin margins, take-it-or-leave-it MSAs, slow change-order approvals, and payment delays that can cascade into layoffs, safety compromises, and business failures. View coverage of their concerns.

For contractors in the wireless infrastructure sector, the fiber findings sound familiar. Macro tower construction, modification work, and other non-fiber wireless expansions have faced similar inflationary pressures over the past several years, including higher labor costs, insurance premiums, mobilization expenses, and regulatory burdens. Yet many wireless contractors report that carrier pricing has not adjusted sufficiently to offset those increases.

The three national wireless carriers have made limited concessions in the past year to ease contractor strain, including modest rate adjustments and targeted policy changes. However, contractors widely characterize those moves as incremental and largely symbolic, arguing that they have not meaningfully addressed the industry’s entrenched matrix pricing model, in which fixed rates fail to reflect real-world variability in labor, schedule risk, and site complexity.

Measuring the problem vs. solving it

The FBA/Cartesian report plays an important role by quantifying fiber deployment costs and reinforcing the labor-heavy nature of broadband construction. But from a contractor’s perspective, the absence of any discussion of reimbursement, rate escalation, or cost recovery mirrors a broader industry challenge across both fiber and wireless infrastructure.

In short, the report’s data underscores the pressure—higher costs nearly everywhere, labor-heavy work, and make-ready and permitting shocks—but it does not appear to answer the question contractors care about most: are those higher costs being funded, or measured?

As the Fiber Broadband Association continues to commission annual cost studies, contractors say a logical next step would be to examine whether rising labor and construction expenses are actually being offset through updated compensation, rate escalation, or other commercial mechanisms necessary to sustain the workforce delivering those networks.