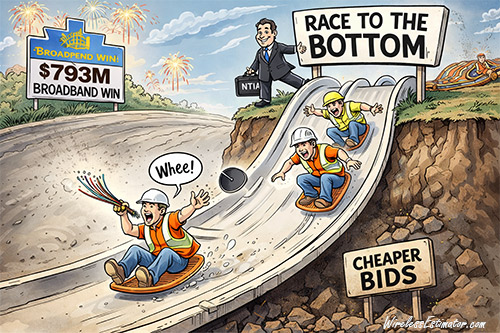

NTIA’s restructuring of the $42.5 billion BEAD program eliminated prevailing wage requirements and workforce training standards, forcing all 50 approved states—including Pennsylvania—to prioritize lowest-cost bids over skilled labor. For contractors, the policy shift mirrors the tower industry’s matrix pricing pressures that drove companies out of business and pushed employment to 20-year lows.

After five months in federal limbo, Pennsylvania finally received approval for its $793 million broadband deployment plan yesterday, but the Commonwealth’s hard-fought worker protections didn’t survive the journey.

The February 9 approval from the National Telecommunications and Information Administration (NTIA) chief, Arielle Roth, marks the end of a process that required Pennsylvania and dozens of other states to eliminate labor standards, workforce training requirements, and prevailing wage preferences from the $42.5 billion Broadband Equity, Access, and Deployment (BEAD) program.

For contractors and workers who will build these networks, BEAD now prioritizes the lowest bidder over skilled labor—a familiar dynamic for an industry that has watched similar pressures devastate the tower construction sector, and increase the amount of 1099 crews in violation of towercos and carriers’ MSA agreements.

Impact on Remaining States

Pennsylvania’s approval brings the total to 50 of 56 states and territories, leaving only six remaining. The pattern across approved states shows the restructuring’s impact: fiber percentages dropped nationwide (Pennsylvania’s fell seven points), with the 50 approved states collectively coming in $21 billion under original allocations by eliminating labor protections and shifting to cheaper technologies. For contractors, BEAD will create 50+ different operating environments—states with prevailing wage laws can still apply them, but can’t use them in bid evaluation, while states without such laws have no mechanism to ensure wage standards beyond self-certification—but all must prioritize lowest cost over workforce quality.

Pennsylvania’s approval brings the total to 50 of 56 states and territories, leaving only six remaining. The pattern across approved states shows the restructuring’s impact: fiber percentages dropped nationwide (Pennsylvania’s fell seven points), with the 50 approved states collectively coming in $21 billion under original allocations by eliminating labor protections and shifting to cheaper technologies. For contractors, BEAD will create 50+ different operating environments—states with prevailing wage laws can still apply them, but can’t use them in bid evaluation, while states without such laws have no mechanism to ensure wage standards beyond self-certification—but all must prioritize lowest cost over workforce quality.

The June Purge: What Workers Lost

On June 6, 2025, NTIA issued a restructuring notice that eliminated what Roth called “superfluous requirements.”

Among those requirements are virtually all of the labor protections the original program contained.

Gone was the entire “Fair Labor and Highly Skilled Workforce” section, which required states to prefer contractors with strong labor records. Eliminated was “Advancing Equitable Workforce Development and Job Quality Objectives.” The provisions that awarded higher scores to projects that commit to prevailing wage standards were scrapped.

The Biden administration’s NTIA had required detailed reporting from any BEAD project not subject to prevailing wage laws. Now, contractors need only certify they comply with federal labor laws—no verification, no enforcement mechanism.

What survived? A single criterion: lowest cost per location. States are explicitly prohibited from considering labor practices, workforce development, or stakeholder engagement in scoring.

Three Years Erased

Pennsylvania spent three years developing its BEAD strategy around fiber-first deployment with strong labor protections. By August 2025, the state had provisionally approved $793.4 million in grants.

Then came the June restructuring notice. NTIA invalidated all previously approved proposals and forced every state to restart. Pennsylvania submitted its revised proposal on September 4, 2025. NTIA is committed to a 90-day review. The approval came yesterday—more than five months later.

The Contractor Calculation

For contractors, the new BEAD rules create a troubling calculus: Underbid to win, or walk away.

It’s painfully familiar to the wireless tower construction industry. Matrix pricing has driven tower companies out of business and pushed industry employment to 20-year lows, as detailed by Wireless Estimator. Workers promised lucrative 5G careers instead found themselves competing for fewer jobs at lower wages with inadequate training.

Now the federal government is applying the same lowest-cost logic to a $42.5 billion infrastructure program.

Industry forecasts suggest BEAD could require 58,000 new workers by 2032. The Biden administration had allocated more than $350 million for workforce development. Under Roth’s restructuring, that funding was rescinded. Guidance on replacement funding hasn’t materialized.

Five years ago, thousands of individuals trained for tower technician roles that never materialized, with promised wages never paid. Matrix pricing crashed contractor margins, work dried up, and companies laid off experienced climbers. BEAD is setting up the same pattern.

The Technology Shift

Roth’s overhaul also eliminated BEAD’s fiber preference. The original notice of funding opportunity strongly favored end-to-end fiber optic networks as the gold standard.

Roth’s restructuring adopted “technology-neutral” rules. Satellite providers like SpaceX’s Starlink, fixed wireless providers, and operators using unlicensed spectrum—previously disqualified—can now compete on equal footing with fiber deployments.

Critics warn this undermines long-term effectiveness. While China and Europe invest heavily in fiber, the U.S. is “choosing the cheapest option.”

The $21 Billion Question

Roth touted Monday that states have left an estimated $21 billion in BEAD funds unused, achieving the same coverage for less money.

But those savings deserve scrutiny. Are states achieving the same outcomes, or settling for cheaper technologies that won’t meet future needs? If you eliminate training programs, remove wage requirements, and strip workforce development, of course, you save money—but at what cost?

Pennsylvania’s $793 million represents a reduction from its original $1.16 billion allocation. Whether that means efficiency or simply less robust infrastructure remains to be seen.

What States Can Do

States can still apply prevailing wage laws to BEAD projects—but cannot prefer projects that use them or require additional reporting. The BEAD FAQs make it clear that workforce requirements have been eliminated.

States with prevailing wage laws can apply them, but can’t use them to evaluate bids. States without strong labor laws have no mechanism to ensure fair wages beyond contractor self-certification.

Training organizations that planned workforce programs are in limbo. The restructuring rescinded approval for all non-deployment activities.

What Contractors Should Watch

Pennsylvania now moves to finalizing contracts and beginning construction—the first real test of how the restructuring plays out.

Contractors should monitor bid pricing to determine whether winning bids are sustainable or whether providers underbid and will struggle to deliver. The technology mix will show whether “neutrality” leads to diverse solutions or shifts dollars to satellite providers. And NTIA’s eventual guidance on the $21 billion in unused funds will determine if workforce development can be salvaged.

The Bottom Line

Pennsylvania got its $793 million. What Pennsylvania’s workers lost may take years to understand fully—and the tower industry’s cautionary tale suggests the outcome won’t be pretty.