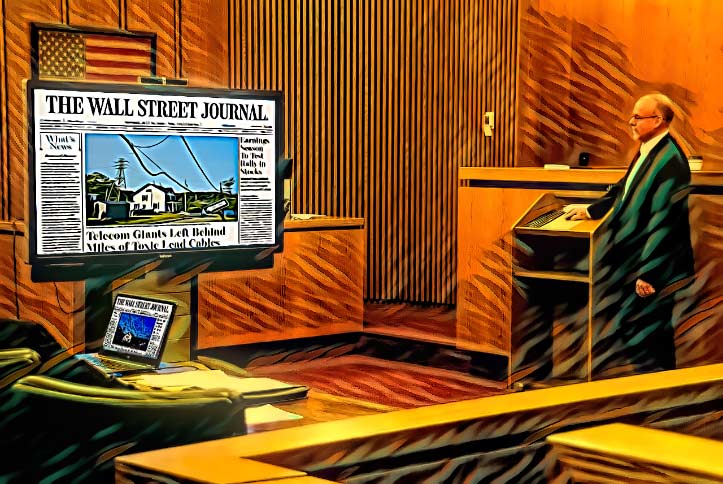

AN INTERESTING READ WITHOUT A SUBSCRIPTION – Whereas media outlets can only provide overviews and key points of The Wall Street Journal’s copyrighted reporting about AT&T and Verizon’s lead-shielded cables, a complaint filed Friday circumvents infringement concerns by using the articles as a basis for the stock’s decline. Beginning on page 13, the lawsuit provides an interesting summary of the publication’s investigatory allegations.

UPDATE – August 2, 2023 – On Tuesday, Verizon investors filed a similar lawsuit in Pennsylvania federal court to AT&T’s securities fraud lawsuit, stating the carrier lied about the health and safety risks associated with its network of lead-sheathed cables, leading to a decline in Verizon stock after The Wall Street Journal’s articles exposed the toxic cables that are still in place throughout the country.

A securities fraud class action lawsuit has been filed against AT&T in U.S. District Court for the District of New Jersey, alleging that the carrier misled investors about the environmental issues related to toxic lead cables for over three years.

Plaintiff and shareholder John Brazinsky states that AT&T’s top executives filed proxy statements, annual reports, and company reports highlighting its environmental, social, and governance commitments but failed to mention the toxic lead in its current or abandoned infrastructure.

The complaint said that an investigatory series of articles by The Wall Street Journal initially prompted AT&T’s stock to decline by 4.1% on July 14, closing at $14.50 per share. Further press coverage, including news that the Environmental Protection Agency could potentially mandate telecom companies to clean up the lead cables, drove the stock down another 6.7%, closing at $13.54 per share on July 17.

However, AT&T’s stock had been steadily declining since April 12 when it was $19.96, and appears to have temporarily weathered the lead cable concerns, closing yesterday at $14.45.

The lawsuit has provided an opportunity for 99% of U.S. adults who do not have a subscription to the publication to view the informative research by The Wall Street Journal provided in multiple articles.

In the complaint, available here, beginning on page 13, the plaintiff provides summaries and detailed content from the articles, such as the publication’s report that “for decades, AT&T, Verizon and other firms dating back to the old Bell System have known that the lead in their networks was a possible health risk to their workers and had the potential to leach into the nearby environment, according to documents and interviews with former employees. They knew their employees working with lead regularly had high amounts of the metal in their blood, studies from the 1970s and ’80s show.”

“Environmental records from an AT&T smelting unit in the 1980s show contamination in the soil. Government agencies have conducted inspections, prompted by worker complaints, that led to citations for violations involving lead exposure and other hazardous materials more than a dozen times over four decades, records show,” the complaint states.

Who should pay for remediation?

Cost estimates to remediate the lead-sheathed cable problem for the entire industry are between $4 and $20 billion.

In a commentary published on Friday for Brookings, authors former FCC Chairman Tom Wheeler and New Street Research analyst Blair Levin said that forcing shareholders of AT&T and other companies to pay for remediation will be “time-consuming and has limited potential for success.”

They said the notion of taxpayers paying for the remediation may also seem unlikely but it is the most likely path to at least accelerate the remediation of those locations “where the lead presents a clear immediate or near-term danger.”

According to the authors, a recent court filing by AT&T estimated that approximately 10% of its two million miles of copper wires are sheathed in lead. The company said about two-thirds of its lead-covered cables are “either buried or in conduit” followed by aerial cable, and a “very small portion” running underwater.

Analysts estimate that about 25% of those 200,000 miles of cable are aerial, 63% is buried in conduit, seven percent are buried directly without the protection of conduit, and the remaining five percent is under water.