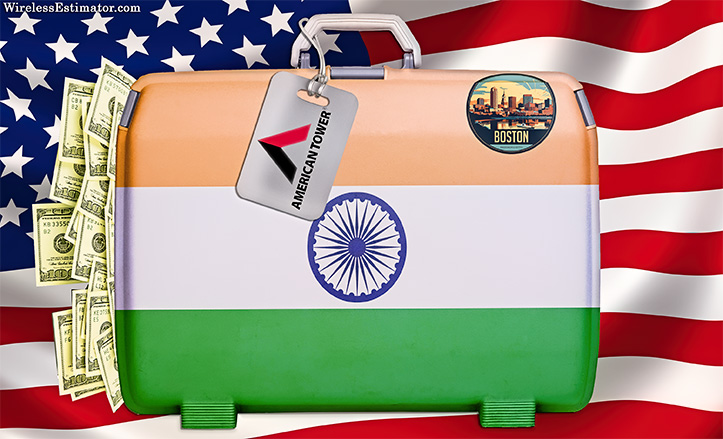

After a 16-year run in India, American Tower Corporation (“American Tower”) is exiting the country in a deal with Data Infrastructure Trust (“DIT”), an Infrastructure Investment Trust sponsored by an affiliate of Brookfield Asset Management (“Brookfield”), under which DIT will acquire 100% of the equity interests in American Tower’s operations in India.

The deal would potentially represent up to approximately $2.5 billion at today’s exchange rates and is expected to close in the second half of 2024.

Taiclet’s numerous success stories were sullied by entering India

In 2006, then American Tower CEO James Taiclet announced that the company was seeking but had yet to conclude any agreements in India with a specific carrier.

Taiclet had been pitching his board of directors on India since 2006 when he said the country is a vibrant market with low penetration and scores high on overall political and economic stability.

The following year, American Tower opened its first office outside of the Americas in New Delhi and acquired XCEL, an Indian company that had 1,700 tower sites. American Tower then made multiple acquisitions throughout the years, reaching approximately 78,300 sites today.

Although Taiclet’s acquisitions, over the years, put ATC as one the largest and most successful REIT’s in the world, his bet on India failed after rapid consolidation in telecom along with Vodafone Idea (Vi), a key carrier, withholding payments.

Warning signs surfaced in 2018 when Tata Teleservices settled with ATC for $320 million following its early exit from 30,000 tower leases.

This week’s move marks the completion of American Tower’s previously announced strategic review of its operations in India. On February 23, 2022, in a filing to the US Securities and Exchange Commission (SEC), American Tower said it was exploring strategic alternatives, including selling an equity stake in its India operation to one or more private investors.

Its largest India customer, Vi, had said in early 2023 that it wouldn’t provide all of the payments it owes American Tower.

In the filing, ATC said Vi represented roughly 3.2% of its total revenue ($10.71 billion) for the year ended December 31, 2022.

ATC had already taken a $411.6 million impairment charge due to Vi’s partial payments and warned of more such potential charges in the future amid continuing payment concerns at its largest customer in India.

The Indian government has occasionally introduced policies related to tower installation fees, environmental regulations, and taxation that have impacted the tower industry, policies that have led to disputes and negotiations between tower companies and regulatory authorities.

Over the years, there have been changes in spectrum policies, licensing, and regulatory frameworks, which have affected tower companies like ATC India.

Security concerns, including theft and vandalism at tower sites, have been reported in certain regions of India. These issues can lead to operational disruptions and increased security costs for tower companies. At many American Tower sites, it was necessary to provide full-time security to ensure that materials and fuel for generators were not stolen.

Recently, thieves stole all cell site materials, including the tower.

In the Data Infrastructure Trust deal, total cash proceeds include an enterprise value on the ATC India operations of approximately $2.0 billion, plus a ticking fee that accrues from October 1, 2023, to the date of closing. Proceeds associated with the enterprise value assume the repayment of existing intercompany debt and the repayment, or assumption, of the existing India term loan by DIT.

Furthermore, and considered within the total potential cash proceeds above, American Tower will retain the full economic benefit associated with Vodafone Idea’s optionally converted debentures (OCDs). It will be entitled to receive future payments related to existing ATC India receivables. Proceeds from the transaction are expected to be used to repay American Tower’s existing indebtedness.

On a down day for all indices on Wall Street today, yesterday evening’s announcement had no impact on American Tower’s stock.