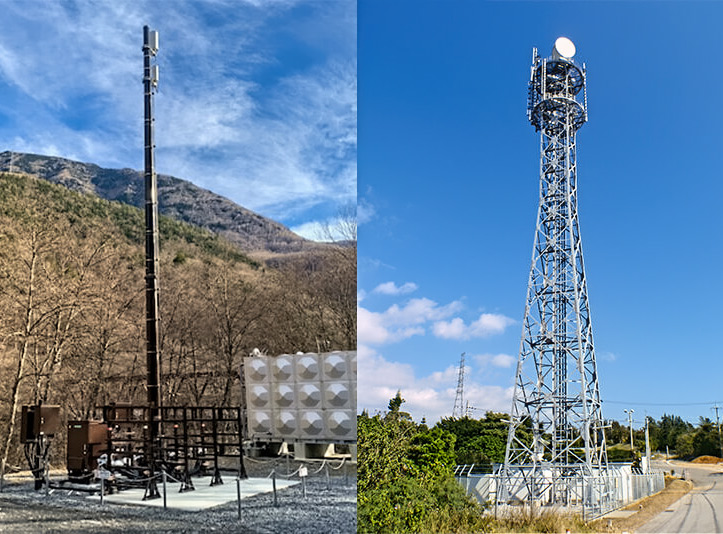

JTower’s portfolio of towers range from this recently constructed 50-foot monopole to this self-supporting tower that was acquired in an acquisition.

In a landmark deal, DigitalBridge Group, Inc. has announced its acquisition of Japan-based JTower Corporation. The acquisition, executed through a tender offer, is a significant step in DigitalBridge’s strategy to expand its global footprint and enhance its presence in the rapidly evolving Japanese telecommunications market.

JTower employs in-house construction crews that provide services to Japan’s mobile network operators.

DigitalBridge, through its subsidiary DB Pyramid Holdings, will acquire JTower’s common stock and stock acquisition rights, effectively taking the company private. The deal, valued at approximately $631 million, includes an offer at $24.46 per share, a 152 percent premium.

Bloomberg said it was a “hefty” premium, A year ago, the stock was trading at $46.28, and during the past 12 months, the Tokyo Stock Exchange, represented by the Nikkei 225 index, has experienced a substantial rise of approximately 29%. JTower shares fell to $9.23 on Tuesday.

JTower’s board of directors has recommended that shareholders tender their shares in the offer.

JTower’s founder and president, Atsushi Tanaka, along with significant shareholders Nippon Telegraph and Telephone Corp. (NTT) and its mobile unit NTT Docomo, have agreed to tender their combined 26% stake, signaling support for the acquisition.

TowerXchange estimates that Japan has approximately 221,000 towers. According to JTower’s website, they own 7,700 of those structures. Whereas mobile network operators mostly own Japan’s towers, JTower is the nation-state’s largest shared infrastructure tower company.

Founded in 2012, JTower pioneered infrastructure sharing in Japan, a concept gaining increasing importance as the telecommunications industry faces growing challenges. The need for efficient network development, maintenance, and operation is becoming more critical, especially as the industry moves beyond 5G and prepares to deploy 6G technologies.

The acquisition will enable JTower to secure the necessary capital to invest in its indoor and outdoor infrastructure-sharing businesses. This will ensure that the company can respond flexibly to future capital needs and make the long-term investments required for sustained growth.

In a press release, JTower highlighted the deal’s advantages: “We expect that we will be able to raise funds for growth in an agile and stable manner from DigitalBridge. As a result, we will be able to respond flexibly to future additional funding needs and make upfront investments from a long-term perspective, thereby appropriately being able to seize growth opportunities in the infrastructure sharing market and further increase the speed of business growth.”

Despite the change in ownership, JTower has assured that it will maintain its business alliances with existing partners, including NTT, NTT Docomo, and KDDI Corporation. These partnerships have been instrumental in JTower’s success to date, and their continuation is expected to ensure a smooth transition under DigitalBridge’s ownership.

Tanaka, who will continue to lead JTower as its president, expressed confidence in the company’s future under DigitalBridge’s stewardship. “By joining forces with DigitalBridge, we are not only strengthening our financial foundation but also gaining a partner with the expertise and resources to help us achieve our long-term vision for infrastructure sharing in Japan,” Tanaka said.