It’s alleged by a Chapter 7 bankruptcy trustee that James Goodman, at left, James Frinzi and other companies and individuals were involved in fraudulent activities that siphoned off tens of millions of dollars.

FedEx sues Goodman for $81 million in what trustee says was a minority business product laundering scam

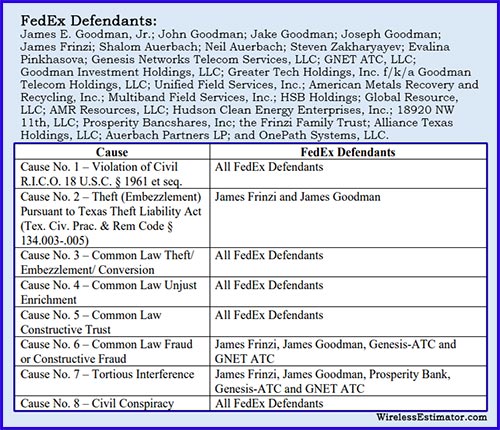

A FedEx subsidiary, FedEx Supply Chain Logistics & Electronics, Inc. (FSCLE), is suing executives and directors of Goodman Networks as well as Goodman-associated companies, a Texas bank, and business associates for a multi-faceted scheme to defraud FSCLE of more than $80 million. The complaint also alleges a sweeping RICO claim.

However, Goodman Networks, Inc. Chapter 7 bankruptcy trustee for the Northern District of Texas, Scott M. Seidel, has filed an adversary proceeding for a preliminary injunction to stay the lawsuit, claiming that FedEx isn’t entitled to receive $81,158,452 that they claim was due them from a Goodman Networks bank account because it is a bankruptcy estate asset and FedEx, one of the petitioning creditors initiating the bankruptcy, is an unsecured creditor.

Seidel has lodged multiple complaints against individuals and Goodman Networks-affiliated companies alleging that they siphoned off tens of millions of dollars. Fraudulent transfers are when a debtor’s assets are moved in order to deter, hinder, or defraud a creditor or to unfairly place such property out of the reach of a creditor.

FedEx and the lawsuit’s 26 defendants have agreed to and were provided the court’s permission to answer the complaint 21 days after the bankruptcy court entered a final order resolving the preliminary injunction motion after a trial set to begin February 28, 2024, in Dallas.

In the FSLE 153-page lawsuit, FedEx said it had a master services agreement (MSA) with Genesis-ATC/Goodman Networks to service specific logistics. Primarily, Goodman would receive the FSLE pre-purchased materials, many millions of dollars per month, and resell the inventory to AT&T or an end-purchaser. The sales amount would flow back to FSCLE for a nearly identical amount, with Goodman keeping only .02% of the sale and invoicing for pallet moves.

The funds would go into Goodman Networks bank account No. 4352 with Prosperity Bank in Texas to easily manage invoices, service orders, payments, and transfers, coupled with automation by a Microsoft Dynamics 365 software database. The automated process began in late 2020.

But in November 2021, according to the lawsuit, Goodman Networks CEO James Frinzi, James Goodman, who controlled Goodman Networks and multiple other entities, as well as other associates, decided to stop transferring funds to FSCLE but still invoiced under the MSA.

The result swelled the 4352 account with Prosperity Bank to have a tens of millions of dollars balance.

That same month FSCLE asked Goodman Networks why transfers back to FSCLE were interrupted and demanded payment.

The complaint alleges that Frinzi and others directed Goodman Networks/GNET ATC employees to hide their true motivations and tell FSCLE that the company would soon be migrating off the Microsoft platform and needed to transition to a new platform. FSCLE cooperated and expected the transition to be completed by February 15, 2022. At that point, they discovered that the tens of millions of dollars due them had been stolen.

Unbeknownst to FSCLE, by October 2021, AT&T had terminated its business with Genesis-ATC, Goodman Networks, and related Goodman companies.

On November 23, 2021, Frinzi authored a memo in which he stated, “Goodman Networks Incorporated (the ‘Company’) no longer has any remaining revenue source. At this point in time, a Shareholder’s Meeting will be requested to dissolve the Company. Further information on this topic will be sent out at a later date.” This memo was not sent to FSCLE, and the substance of it was affirmatively hidden from FSCLE, the complaint states.

FedEx says defendant Prosperity Bank played a central role in the scheme to defraud the company since it conspired with Frinzi and James Goodman to falsify and or accept falsified corporate documents for Goodman Networks, which in turn allowed Frinzi and others to access funds in the 4352 Account and transfer those funds to entities and persons other than FSCLE “with actual or constructive knowledge that Goodman Networks had ceased to exist and/or was defunct.”

FedEx claims that Prosperity Bank took those actions because it wanted to continue to do business with the Goodmans, Frinzi, and others in the businesses and enterprises the stolen FSCLE money was directed to and because some of the FSCLE stolen money was used to pay off loans that one or more Goodmans or Goodman controlled companies owed to Prosperity Bank.

In August and September 2021, Goodman Networks began requesting Prosperity Bank to change the names of the people who could control its bank accounts, including the FSCLE 4352 account, and to have Frinzi the signatory on the account.

The bank’s representative, Bater Bates, requested a corporate resolution from the Goodman Networks Board. They were provided, but the lawsuit alleges that the documents were fraudulent and “no such resolutions or any reference of them appear in the Goodman Networks corporate documents until January 2022.”

After Frinzi gained control of the 4352 account, he and others were accused in the complaint of laundering the money. In addition, in early February of 2023, FSCLE claims that the bank aided and abetted the fraudulent money laundering transfers by raising the daily transfer limit on the 4352 account to $17.5 million.

Prosperity Bank, in an email, told Frinizi that the account change came from the “top of the house.”

Some of the stolen funds were used to pay off loans that one or more Goodmans or Goodman-controlled companies owed to Prosperity Bank, the complaint alleges

Bankruptcy trustee says its claw back duty trumps FedEx’s attempt to jump ahead of the creditor’s line

To retain assets for distribution to creditors in Goodman Networks, Inc.’s Chapter 7 bankruptcy petition filed by unpaid bondholders in September 2022, trustee Seidel’s motion for a preliminary injunction attempts to tear apart FedEx’s claims.

In a late November filing, the trustee said FedEx has sued “two of the debtor’s subsidiaries and virtually every party that the trustee has sued or is preparing to sue in respect to the same transactions.”

Seidel said that the FedEx lawsuit could take all financial recoveries for itself, and many defendants no longer have comfort with an estate settlement as they “now prepare to spend massive amounts of money to answer FedEx’s complaint.”

Seidel said that FedEx’s claim that the Prosperity Bank 4352 account was some “automated” account is incorrect since no payment was ever made to that account from that account but was paid through another Goodman Networks account at Prosperity Bank.

He is asking the court to consider that the FedEx MSA makes no reference that any funds held by Goodman in the 4352 account are owned by FedEx and FedEx is just another claimant in the bankruptcy, and the account was not a trust, escrow, or blocked account, or an account with respect to which FedEx held any property interest.

The trustee is attempting to claw back this 7-bedroom, 6-bath home in Horseshow Bay, TX that was allegedly acquired by James Frinzi using “sham document”.

He also notes that various defendants used some of the funds from the 4352 account “to obtain or acquire property for themselves, which property the trustee is seeking to recover, such as 7 bedroom, 6 bath, 4,750 sq.ft. lake townhouse and separate lakefront lot Northwest of Austin, purchased by Frinzi’s family trust in Horseshow Bay, TX. It is alleged that Frinzi had made a $4.4 million transfer and attempted to hide it through sham documents.

In an August 5, 2023 Bankruptcy Court complaint, Seidel also alleged that Frinzi, along with James Goodman and others, including an attorney and his wife, stripped the estate of $13.5 million and other valuable assets in a convoluted transaction that occurred in March 2022, while Goodman Networks, owed tens of millions of dollars to secured and unsecured creditors.

Specifically, through the Goodman entities, James Goodman owned many of Goodman Network’s worthless preferred shares from a previous Goodman entity after it emerged from Chapter 11 bankruptcy in 2017. Looking to monetize the shares, James Goodman, Steven Zakharyayev and Frinzi concocted a plan to have the shares transferred to 18920 NW 11th, LLC, controlled by Zakharyayev and Evelina Pinkhasova. the lawsuit stated.

After the Hollywood, FL corporation purchased the shares, not with its money at risk, using Goodman Network’s money, it made a fraudulent redemption demand on shares it did not own.

James Goodman and the Goodman entities then pocketed $10 million for worthless shares, and 18920 held onto cash of approximately $3.5 million, according to the complaint.

In answering the complaint, James Goodman denied the allegations, or he lacked sufficient knowledge to admit to or deny them. He said the shares were not worthless. Frinzi also denies all of the allegations.

Additionally, the bankruptcy trustee went after James Goodman, Frinzi, and other companies and individuals, alleging that they were involved in the fraudulent transfer by Goodman Networks of $30 million of the company’s bonds, which James Goodman knew could not and would not be repaid.

The complaint charged that James Goodman sought a mechanism to cash out the company’s bonds in secret. Goodman Networks, aided by Frinzi, entered into an agreement with Neil and Judith Auerbach whereby Neal Auerbach, through his entities, would purchase the bonds with the Debtor’s funds—not his own funds—and would keep $5.9 million for himself with no benefit whatsoever to Goodman Networks.

Seidel also believes the FedEx lawsuit will require hundreds of thousands of dollars in legal bills, if not more, by the “funds that would be better saved to improve recoveries to the estate instead of spend responding in another forum to the exact same allegations raised by the trustee.”

FedEx’s AT&T/Goodman agreement is seen as a minority business product laundering scheme

In their lawsuit, FedEx described their business relationship with Goodman as: “Under the Master Services Agreement, FSCLE would pre-purchase inventory of mobile device accessories from AT&T or its suppliers, Genesis-ATC/Goodman Networks would receive the pre-purchased inventory and provide contract labor and logistics services. Genesis-ATC/Goodman Networks would resale the inventory to AT&T or an endpurchaser on behalf of FSCLE, send FSCLE the original pre-purchase amount less .02% as compensation for the services provided.”

In their lawsuit, FedEx described their business relationship with Goodman as: “Under the Master Services Agreement, FSCLE would pre-purchase inventory of mobile device accessories from AT&T or its suppliers, Genesis-ATC/Goodman Networks would receive the pre-purchased inventory and provide contract labor and logistics services. Genesis-ATC/Goodman Networks would resale the inventory to AT&T or an endpurchaser on behalf of FSCLE, send FSCLE the original pre-purchase amount less .02% as compensation for the services provided.”

Seidel, however, questioned the nature of the relationship between Goodman and FedEx.

“It appears that it was FedEx laundering products through Goodman Networks to take advantage of the Debtors’ minority-owned business status,” Seidel said.

Goodman Networks qualified as a minority-owned business since members of the Goodman family are Hispanic.

He noted that FedEx failed “to describe in any material detail what services the Debtor allegedly provides for its 0.2% cut of apparently tens or hundreds of millions of dollars.”

Nonetheless, his investigation found that FedEx would purchase mobility accessories such as earphones and Bluetooth devices from third parties based on AT&T forecasts and demands. These products would arrive at FedEx’s location in Fort Worth, where they were electronically sold to a Goodman Networks-controlled company without any physical transfer. Goodman Networks would then electronically sell the products back to FedEx without any physical transfer.

“In this manner, FedEx would be able to state that it procured the goods from a minority-owned business,” a Seidel submission said.