Verizon said Frontier’s fiber network will enhance its position as the provider of choice in more markets

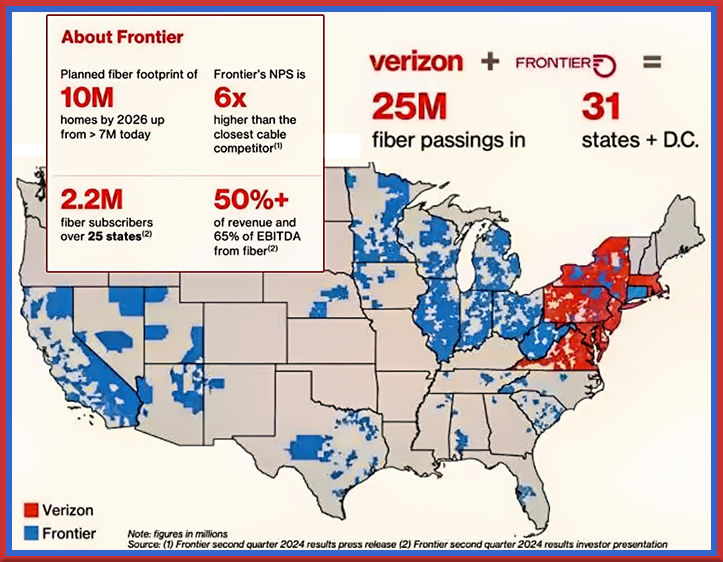

Verizon Communications Inc. announced its agreement to acquire Frontier Communications Parent, Inc. in an all-cash transaction valued at $20 billion this morning. This strategic acquisition will significantly expand Verizon’s fiber network, extending its reach to 25 million premises across 31 states and Washington, D.C.

The deal will also bolster Verizon’s premium broadband and mobility services, enhancing its ability to serve current and new customers nationwide.

The acquisition will integrate Frontier’s cutting-edge fiber network, which has 2.2 million fiber subscribers, into Verizon’s extensive portfolio of fiber and wireless assets, including its renowned Fios service. The transaction is expected to be accretive to revenue and Adjusted EBITDA growth upon closing, with Verizon forecasting at least $500 million in annual cost synergies.

Hans Vestberg, Verizon Chairman and CEO, emphasized the significance of the acquisition: “Verizon offers unmatched connectivity, and this strategic fit will enable us to deliver premium offerings to millions more customers. Frontier’s fiber network will enhance our position as the provider of choice in more markets.”

Nick Jeffery, President and CEO of Frontier, stated, “This acquisition is a recognition of our efforts to build a best-in-class fiber network. It also signals a bright future for fiber, providing significant value to Frontier’s shareholders and expanding connectivity for more Americans.”

The transaction has been unanimously approved by the Boards of both companies and is expected to close within 18 months, subject to regulatory approvals and other customary conditions. Verizon reaffirmed its full-year 2024 financial guidance and highlighted its continued focus on maintaining a strong balance sheet and capital allocation strategy.

Key Highlights of the Deal:

- Expands Verizon’s fiber network to 25 million premises in 31 states and Washington, D.C.

- Expected to generate $500 million in annual cost synergies within three years.

- Transaction valued at $20 billion, expected to be accretive to revenue and EBITDA growth.

- Extends Verizon’s premium broadband and mobility services to more markets across the U.S.