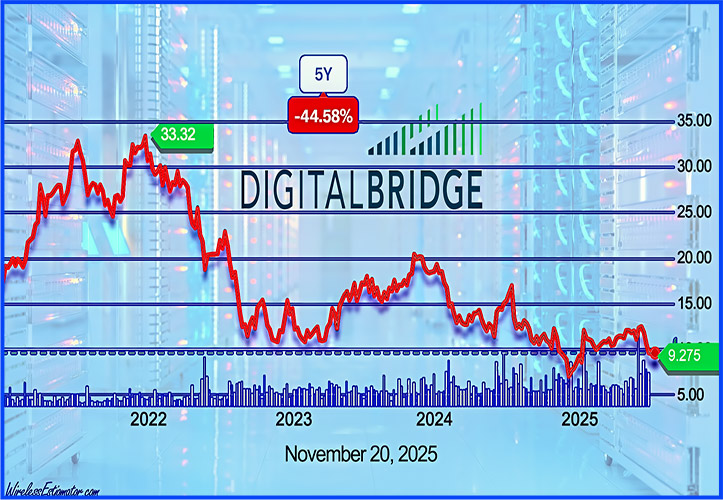

Despite DigitalBridge’s announcement of $11.7 billion in new capital for its DBP III fund and strong enthusiasm from institutional investors, the company’s stock has not mirrored that confidence. Over the past five years, shares of DigitalBridge Group, Inc. (NYSE: DBRG) have lost 45% of their value, a disconnect underscoring that Wall Street’s reception of the firm’s multi-billion-dollar fundraising momentum has yet to translate into sustained gains in the public markets.

DigitalBridge Group, Inc. announced a major financial milestone with the closing of its third value-added digital infrastructure fund, DigitalBridge Partners III, securing more than $7.2 billion in commitments. When combined with $4.5 billion in limited-partner co-investment commitments that accompany DBP III’s early portfolio, the firm now has amassed $11.7 billion dedicated to scaling the next generation of digital infrastructure. It is among the largest capital-formation events in the company’s history and reflects the accelerating demand for hyperscale data centers, fiber networks, and AI-ready infrastructure.

The strong interest in DBP III underscores confidence in DigitalBridge’s long-term strategy and its consistent ability to execute across economic cycles. More than 65% of the fund’s commitments came from existing investors in the DigitalBridge Partners series, with additional participation from new limited partners across the Asia-Pacific region, Europe, and North America. That depth of recurring investment is typically viewed in private markets as a signal of both performance and trust—indicating that institutional LPs continue to view DigitalBridge as a reliable operator in a rapidly evolving digital ecosystem.

Chief Executive Officer Marc Ganzi said the fund represents DigitalBridge’s next stage of growth as the company positions itself at the forefront of global AI-driven infrastructure demand. He noted that DBP III gives the firm the scale and flexibility needed to advance high-conviction opportunities in hyperscale data centers and the power and connectivity assets that support them. Ganzi emphasized the company’s three decades of digital-infrastructure focus, stating that DigitalBridge remains committed to investing where its operational expertise can create measurable value.

DigitalBridge has already begun deploying capital, and the early DBP III portfolio highlights where the company believes the market is heading. Its investments in Vantage Data Centers North America, Yondr Group, Orange Barrel Media, FiberNow, and JTOWER position the fund across several high-growth verticals, including large-scale data center platforms, fiber deployment, urban digital-media networks, and edge and shared-infrastructure solutions. These early placements reflect DigitalBridge’s belief that AI, cloud scaling, and data-intensive workloads will require massive expansions of compute power, bandwidth, and real-time connectivity worldwide.

Kevin Smithen, DigitalBridge’s Chief Commercial and Strategy Officer, said DBP III was specifically structured to pursue the most compelling opportunities emerging across these sectors. According to Smithen, the fund is focused on proprietary sourcing and operator-driven value creation—two hallmarks of DigitalBridge’s investment approach that the company believes give it an edge in identifying growth platforms ahead of broader market recognition.

External industry reports align with that outlook. Global demand for hyperscale data centers has surged as AI adoption accelerates, with analysts projecting multi-trillion-dollar infrastructure needs over the next decade. Companies like Vantage Data Centers, already a major presence in the hyperscale market, are expanding aggressively to meet surging compute requirements from cloud hyperscalers and AI-focused enterprises. Meanwhile, fiber and edge network operators continue building out dense, low-latency network corridors essential for AI inference, cloud distribution, and bandwidth-intensive applications.

DigitalBridge’s dual emphasis on data centers and connectivity places it squarely at the heart of this shift. The firm announced earlier this year that it manages approximately $108 billion in digital infrastructure assets across towers, data centers, fiber, small cells, and edge infrastructure. With the closing of DBP III, the company now holds significantly increased dry powder at a moment when operators globally are racing to support generative AI, machine-learning workloads, and the surge in data being created and consumed by both consumer and enterprise platforms.

The closing of DBP III—alongside its co-investment capital—marks a defining moment for DigitalBridge as it positions itself to accelerate the deployment of AI-enabling infrastructure. As investor demand remains high and digital transformation intensifies, DigitalBridge’s newest fund arrives at a time when global connectivity needs are expanding faster than at any point in the past decade.