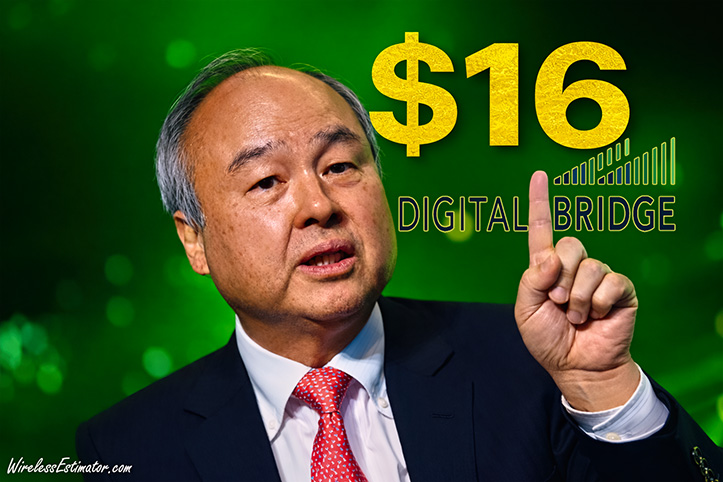

SoftBank founder Masayoshi Son, who informed President Trump recently that he plans to invest as much as $100 billion in the United States, is beginning to put capital behind that pledge, with SoftBank’s proposed $16-per-share bid for Boca Raton, FL-based DigitalBridge, representing roughly a $2.9 billion equity outlay, marking one of the first major investments tied to that commitment in U.S. digital infrastructure. At noontime, DBRG was at $15.27, where it has remained for most of the day.

SoftBank Group’s agreement to acquire DigitalBridge Group, Inc., announced today, has quickly drawn attention across the digital infrastructure investment community, not only because of the transaction’s strategic importance but also because of how the $16-per-share price will be paid and whether that valuation fully captures the company’s long-term potential.

How the $16 Per Share Will Be Paid

According to the companies’ press releases and initial regulatory disclosures, the transaction is structured as an all-cash acquisition of DigitalBridge’s outstanding common stock. At closing, each share of DigitalBridge common stock will be converted into the right to receive $16.00 in cash.

This means the $16 per share will be paid directly to DigitalBridge shareholders, not transferred onto SoftBank’s balance sheet or retained within the company. Once the transaction closes, shareholders will no longer hold equity in DigitalBridge, and the company will be taken private under the leadership of its current CEO, Marc Ganzi.

For most investors holding shares through brokerage accounts, the process is expected to be automatic, with cash proceeds credited once the shares are cancelled.

Understanding the $4 Billion Valuation

The acquisition has been widely described as valuing DigitalBridge at approximately $4 billion, a figure that has created some confusion among investors. That number reflects enterprise value, not the amount being paid to common shareholders.

Enterprise value includes not only the equity value represented by the $16-per-share offer, but also net debt and other financial obligations on the company’s balance sheet. When those factors are considered, the equity value implied by the cash offer is materially lower than the headline enterprise valuation, underscoring the importance of distinguishing between the two figures when assessing the deal.

Timing and Approval Process

The transaction is expected to close in the second half of 2026, subject to regulatory approvals, shareholder approval, and other customary closing conditions. Until that time, DigitalBridge remains a publicly traded company, and its board continues to owe fiduciary duties to shareholders.

Additional details are expected to be disclosed in forthcoming SEC filings, including a proxy statement that will outline the board’s rationale for approving the deal, the financial analyses supporting the $16-per-share price, and the mechanics of the shareholder vote.

Scrutiny Over Whether $16 Is Adequate

While DigitalBridge’s board has approved the transaction, the valuation is already attracting scrutiny. Several shareholder-focused law firms and investor advocates have indicated they are reviewing whether the $16-per-share offer adequately reflects DigitalBridge’s value, particularly given the company’s exposure to data centers, towers, fiber, and other digital infrastructure assets that are increasingly tied to artificial intelligence and long-term connectivity demand.

Such scrutiny is common in take-private transactions, especially where shareholders are being cashed out ahead of what some believe could be significant future growth. Whether that review results in litigation, demands for additional disclosures, or other challenges remains uncertain, but it highlights the broader debate over whether the current offer fully accounts for DigitalBridge’s strategic positioning.

What to Watch Going Forward

As the deal progresses, investors will be watching closely for additional disclosures that shed light on how the $16 valuation was determined and whether alternative paths were considered. Regulatory reviews and the shareholder approval process will further test the transaction’s assumptions.

Because DigitalBridge remains a public company and the SoftBank transaction has not yet closed, another bidder could legally make a competing offer, although any such proposal would face practical constraints. Most merger agreements include no-shop provisions that limit a company’s ability to solicit alternatives, but boards are still obligated to evaluate unsolicited proposals that could be deemed superior. If a higher or more certain offer were to emerge, DigitalBridge’s board would be required to consider it under its fiduciary duties, even if doing so triggered a termination fee payable to SoftBank. As a result, while the announced deal creates hurdles for rival bidders, it does not prevent a competing offer if another party believes DigitalBridge is worth materially more than the current $16-per-share price.