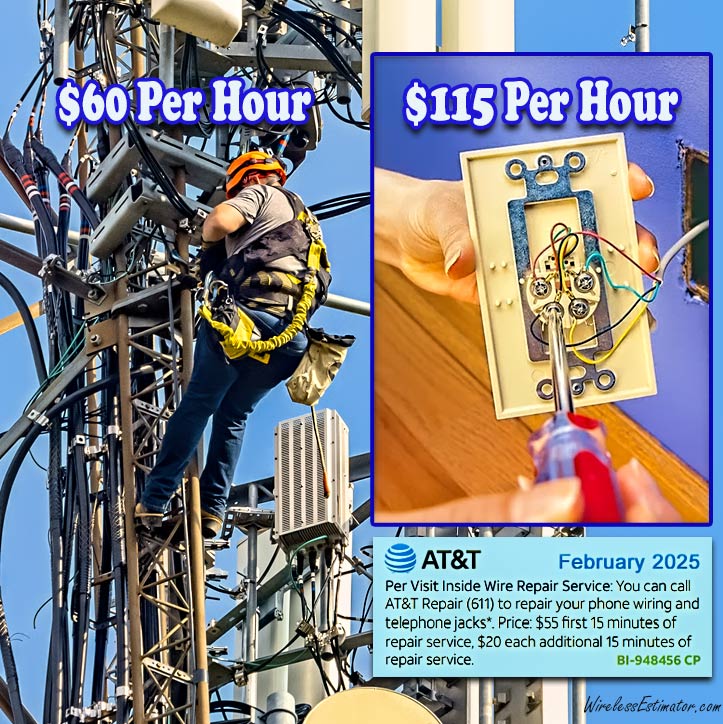

MAN‑HOUR DISPARITY — Tower technicians, whose work at extreme heights demands specialized training and safety measures, are capped at just $60 an hour—barely covering expenses—while AT&T bills $115 for the first hour of low‑voltage service requiring only basic tools like screwdrivers and wire strippers.

In recent weeks, three mid-sized wireless infrastructure contractors have informed Wireless Estimator of their decision to exit the industry, citing an inability to turn a profit over the past two years. These closures underscore a growing crisis within the sector, where contractors are facing mounting financial pressures due to declining or non-existent profit margins and rising operational costs. Another contractor stated that he had to close an office, resulting in the layoff of long-term employees, including one with nearly two decades of service.

Multiple contractors have reviewed carrier installation contracts and, based on the man-hours invested and the matrix pricing stipulated, found that the effective man-hour rate hovers around $60.00. This rate barely covers employee wages, benefits, equipment, vehicles, insurance, and other operating expenses.

One contractor, who had been in business for eight years, described the current pricing model as a “no-win” situation. He lamented, “If I had bailed out two years ago, instead of thinking that things would change, I could have walked away with a clean slate.” He further shared the personal toll, stating, “My life’s savings have been decimated.”

Operational burdens and delayed payments

Beyond low pricing, contractors are increasingly burdened with additional responsibilities without corresponding compensation. They are required to warehouse carrier materials at no cost and pay annual fees to companies like Avetta, which manage the carrier’s supply chain compliance. Payment terms have also extended to between 60 and 90 days or more, creating cash flow challenges.

Contractors are grappling with significant increases in variable costs, including fuel, hotel expenses, auto insurance, and other expenditures.

These inflationary pressures are not adequately reflected in matrix-based pricing models, which often fail to account for shifting costs such as mobilization, training, seasonal impacts, and weather-related delays.

As more contractors exit the industry, there is growing concern about the long-term sustainability of the wireless infrastructure sector. The current pricing models and operational demands may lead to a shortage of experienced contractors, which could impact the rollout and maintenance of wireless networks.

Comparison with other skilled trades

To put the carriers’ $60 an hour effective rate into perspective, here’s what other service professionals in North America typically charge:

Plumbing: Plumbers typically charge an average of $110 per hour for standard repairs, with emergency services often commanding even higher rates, sometimes up to $350 per hour.

Auto Repair: Independent auto shops bill between $95 and $125 per hour, while dealership service centers commonly charge $125 to $175 per hour for labor.

HVAC Service: Labor costs for HVAC maintenance range from $90 to $150 per hour, with an average of around $110 per hour for routine service calls.

AT&T: If you require wire repair inside your home to maintain your AT&T service, their published rate is $115 for the first hour.

By contrast, wireless infrastructure contractors are effectively limited to about $60 an hour—barely half of what other skilled trades demand—despite facing greater training, equipment, and liability requirements. This disparity underscores the unsustainable nature of current matrix‑based pricing in telecom buildouts, according to contractors.