Mark Ramsey of PACTEL (Protecting America’s Contractors in Telecom and Empowering Livelihoods) appreciated that Todd Schlekeway, President & CEO of NATE reached out to support what he’s building, noting their candid conversation about the industry revealed how similar their stories are—towers versus trenches, but the challenges, pressures, and risks are nearly identical.

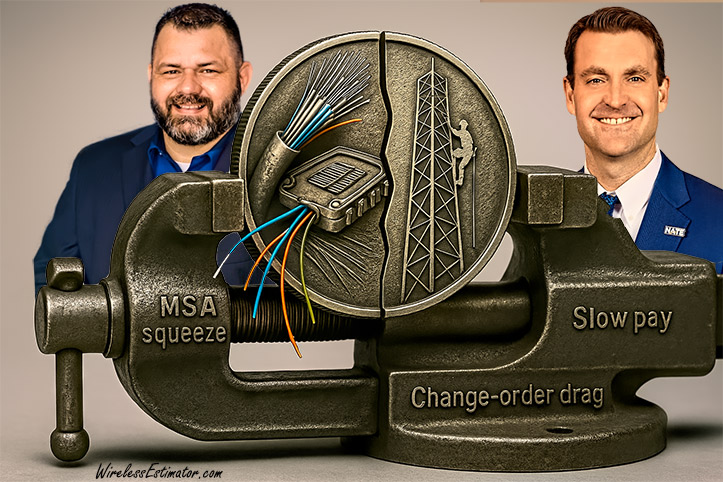

A new petition circulating in the fiber-construction community by PACTEL argues that conditions facing wireline fiber companies mirror the pressures long documented by wireless contractors—thin margins, take-it-or-leave-it MSAs, slow change-order approvals, and payment delays that cascade into layoffs, safety compromises, and business failures.

Parallels to NATE’s campaign

It’s a message that tracks closely with the themes NATE: The Communications Infrastructure Contractors Association has elevated for years, and it’s being carried now by industry advocate Mark Ramsey, whose recent article on LinkedIn makes the case that wireline and wireless contractors are living the same problem set—and should be fighting it together.

Ramsey’s thesis: the wireless squeeze repeats in fiber

In the article that provides an interesting conversation he had with NATE President & CEO Todd Schlekeway and NATE Board Member Mike Young, telecom consultant Ramsey laid out a simple but urgent thesis: the business model squeezing wireless field services is being replicated across fiber builds, especially on BEAD-adjacent projects and large private deployments. He pointed to familiar pain points—matrix pricing divorced from real input costs, unilateral change-order rules that push risk downstream, and net-60/90/120 pay cycles that effectively conscript contractors into financing projects. The result, he said, is predictable: strong firms pull back from bidding, weaker firms cut corners, and the industry loses the skilled workforce it needs just as demand peaks.

Ramsey formed PACTEL (Protecting America’s Contractors in Telecom & Empowering Livelihoods) and is sponsoring the petition.

Giving NATE its due

Ramsey is quick to credit NATE’s role in surfacing the problem on the wireless side. Whereas NATE can mobilize a broad membership, produce research, and take structured proposals to agencies and carriers, Ramsey is, by his own description, a voice trying to aggregate the wireline experience into a coherent push.

“NATE has horsepower,” he said—meaning an organized coalition, documented evidence, and formal pathways for reform—“and fiber needs that same horsepower if we’re going to stop the race to the bottom.”

What the petition seeks

His petition asks contractors to add their names to a campaign for practical fixes: rate realism tied to documented inputs, rapid and documented change-order approvals, prompt-pay protections with interest on late payments, and enforceable safety provisions that can’t be waived in the name of schedule.

The calls echo what NATE members have advanced in the wireless arena: standardizing scopes and deliverables, creating transparent escalation paths when site conditions don’t match drawings, and banning practices that shift design and utility-coordination risk onto the smallest firms.

Stakes for workforce and delivery

Ramsey argues that these are not “asks” so much as prerequisites for keeping trained crews in the field. “We can’t scale fiber if contractors can’t keep the lights on,” he said, noting that work stoppages, bankruptcies, and serial re-staffing cycles ultimately delay the very builds policymakers want accelerated.

Early reaction from the field

Reaction to the petition has been brisk with 46 signers already on board. On LinkedIn, contractors described living with “perpetual under-water” bid sheets and warned that chronic slow-pay forces them to choose between payroll and vendors. Several readers emphasized that safety isn’t a line item you toggle off to hit a date; if margins don’t support certified climbers, trench safety, or proper traffic control, “the calendar will win and the people will lose,” one wrote.

One commenter said: “There is more and more talk or labor getting organized in these two areas. And where contractor/owners were resistant to this idea in the past, they are openly talking about it as a means of regulating compensation in order to keep their companies alive today.”

Calls for unity—and exit from bad MSAs

Others urged unifying wireline and wireless voices: “Different toolbelts, same squeeze.” A number of commenters said they’ve already exited low-rate MSAs and now chase fewer, saner customers; they support the petition not out of theory but as a last attempt to fix a model they’ve given up trying to survive.

Strategy: end fragmentation, define fixes

Ramsey’s larger point is strategic: fragmentation benefits buyers. When contractors are isolated—by region, by technology, by company size—they negotiate alone and accept terms they would never accept collectively. By contrast, he sees NATE’s momentum as proof that disciplined, professional advocacy can reset a market. The task for fiber, he says, is to translate scattered frustration into specific remedies. He cites four immediate ones: (1) transparent, auditable unit pricing indexed to input-cost movements; (2) a 48-hour clock on change-order determinations with interim authorizations for safety-critical work; (3) prompt-pay standards with automatic interest and fee recovery; and (4) safety clauses that cannot be superseded by schedule pressure or liquidated-damages threats.

Owners’ constraints—and aligning incentives

To be sure, network owners and prime integrators will say they face their own constraints—finite subsidies, shareholder expectations, and the real risk of over-paying for uneven performance. Ramsey doesn’t dismiss any of that. Instead, he argues that durable outcomes come from aligning incentives. When contractors are paid on time for verified deliverables, when re-work isn’t forced off the books, and when designs are frozen before crews roll, total-program cost goes down. Cutting corners, by contrast, is the expensive choice: accidents, warranty claims, and churned vendors erase any savings gleaned from below-cost bids.

Participation as proof and data

Where this goes next depends on participation. Ramsey’s petition is as much a data-gathering device as a sign-up sheet; he’s asking firms to contribute anonymized examples—aged receivables, rejected change orders, and rate cards compared to wage and material inflation—that can ground the case for reform. He wants carriers, ISPs, and public agencies to see the same spreadsheet NATE has shown the wireless side: if you don’t fund the work at sustainable levels and pay for it promptly, you won’t have a workforce to build with.

BEAD context: the diversification push

As BEAD dollars began flowing toward fiber, wireless contractors—already strained by unsustainable pricing—were urged at conferences to diversify and chase the “next wave” of profits in fiber builds. But as the concerns highlighted by Ramsey make clear, the move hasn’t been the easy or profitable adjunct many expected.

A mid-sized contractor told Wireless Estimator their company had been encouraged “multiple times” to get into fiber. “Our stance has been consistent: we’ll do it if there’s committed volume. Otherwise, we risk loading up on equipment and overhead only to end up where we are with wireless,” she said, adding that recent feedback from the fiber side “validates that concern, because carriers and turfers are managing the work the same way that got us into this problem.”