According to a Telecommunications Industry Association (TIA) report, within the next two decades, it is predicted that every person, industry, and service provider will be using 5G systems. The paper, an update on TIA’s previous 2015 5G Operator Survey, provides valuable insight into the network operators’ view of the 5G revolution and presents important findings about usage in the near future. It is available to download here.

According to the report’s author, Dr. Phil Marshall, Chief Research Officer, Tolaga Research, as the mobile industry faces tremendous market disruption, there is a great deal at stake for 5G. His report compiles the findings from an online survey of communication network operators that investigates their current and future 5G strategies. The survey was conducted in the winter of 2016 by the Telecommunications Industry Association with support from InterDigital and Tolaga Research.

NOTABLE FINDINGS FROM THE SURVEY INCLUDE:

- Thirty-two percent of respondents have already commenced technology trials, and a further 26 percent plan to trial 5G over the next 24 months, despite the standardization process still continuing.

- More than two-thirds of survey respondents envision conducting trials of radio technologies rather than core network technologies first.

- Almost a third of respondents plan to launch pre-standard 5G products.

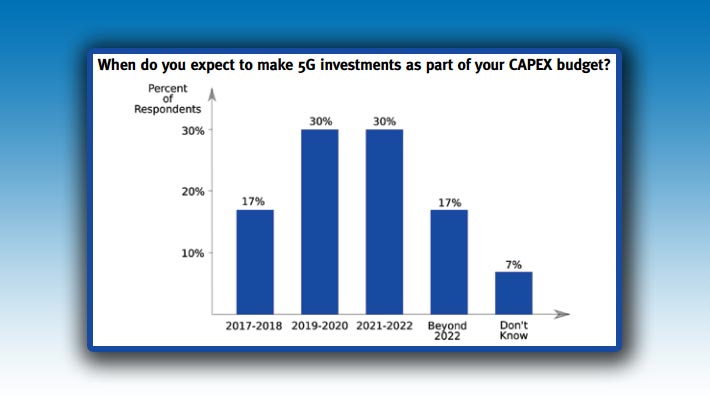

- Nearly half of respondents expect to have made 5G investments as part of their CAPEX budgets by the end of 2020.

- By the end of 2020, 33 percent of respondents expect their companies will be offering commercial 5G services.

- A lack of partner diversity is likely to challenge 5G network densification efforts.

Operators have diverse data offload strategies in unlicensed spectrum. - Fiber back-haul is preferred, but watch out for millimeter wave.

- Operators are uncertain about how 5G will prove to be transformative.

- Security concerns for 5G vary dramatically among use cases.

- Optimism for network slicing prevails.

- Operators have high expectations for 5G-enabled autonomous vehicles.

- There is optimism for telemedicine in remote regions and emerging markets.

- Industrial IoT is expected to fuel unprecedented connection densities and connection latency demands