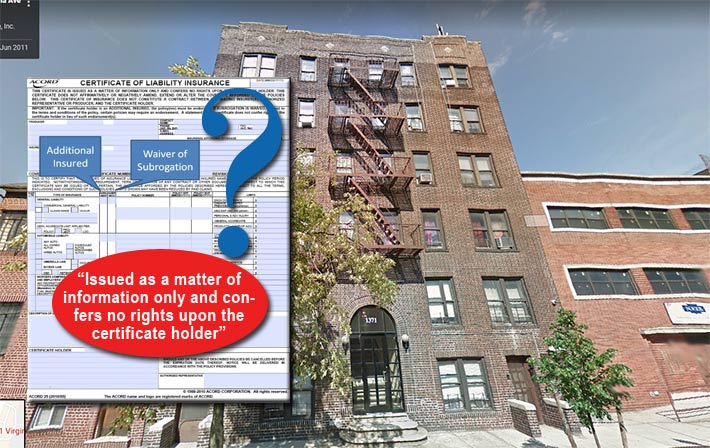

The Washington state Supreme Court’s anticipated decision on the validity of an additional insured form will shape how carriers and other clients view the Accord form that might not provide binding coverage. T-Mobile was denied coverage from their contractor’s insurance carrier – even though they were listed as an additional insured – when a cell site installation on this Bronx, N.Y. building went awry.

In a Nov. 9, 2018 filing, the Ninth Circuit has asked Washington state’s Supreme Court to consider whether an insurer must cover a carrier’s costs in a lawsuit alleging its subcontractor’s rooftop antenna installation caused damage to an apartment building in the Bronx, N.Y., stating that Washington state law is uncertain on a critical issue in the case.

The Ninth Circuit panel is specifically asking the high court: “Under Washington law, is an insurer bound by representations made by its authorized agent in a certificate of insurance with respect to a party’s status as an additional insured under a policy issued by the insurer, when the certificate includes language disclaiming its authority and ability to expand coverage?”

The case concerns an insurance dispute between T-Mobile USA Inc. and Selective Insurance Company of America (SICA).

After T-Mobile was sued over damage to a building located at 1371 Virginia Ave. caused by a rooftop cell site, a disagreement arose over whether T-Mobile was entitled to coverage as an additional insured under a SICA insurance policy taken out by the contractor, Innovative Engineering, Inc.

In 2012, SICA’s authorized agent and insurance broker, the Van Dyk Goup, Inc. (VDG) issued a certificate of insurance (COI) to T-Mobile. The COI said that T-Mobile USA, as the certificate holder, “is included as an additional insured” under the policy.

But it also stated, in capitalized and bolded text, that the COI “is issued as a matter of information only and confers no rights upon the certificate holder,” “does not affirmatively or negatively amend, extend or alter the coverage afforded by” the policy, and “does not constitute a contract between the issuing insurer(s), authorized representative or producer, and the certificate holder.”

The COI further warns that “[i]f the certificate holder is an ADDITIONAL INSURED, the policy(ies) must be endorsed” and that “[a] statement on this certificate does not confer rights to the certificate holder in lieu of such endorsement(s).”

According to the filing, in 2005, T-Mobile’s predecessor, Omnipoint Communications, Inc., had leased space on the Bronx building to construct a cell site, and contracted with Innovative to perform services in connection with this work.

Omnipoint assigned this lease to T-Mobile NE in 2009, when T-Mobile NE acquired Omnipoint.

In early 2013, the building owner notified T-Mobile and Innovative of alleged property damage that resulted from Innovative’s earlier work on the rooftop cell tower. Innovative submitted the claim directly to SICA.

SICA stated that they would not be defending T-Mobile in the lawsuit because “T-Mobile does not appear in the Selective Policy named as an insured” and “[i]t does not qualify as an additional insured.”

T-Mobile then brought suit against SICA for breach of contract, declaratory judgment, common law insurance bad faith, common law attorney’s fees, and violation of consumer fraud statutes.

In bringing the question before the Supreme Court, the Ninth Circuit said there are two competing principles under Washington insurance law that are at loggerheads.

The first is that under Washington law, “an insurance company is bound by all acts, contracts, or representations of its agent, whether general or special, which are within the scope of [the agent’s] real or apparent authority.”

The second, they said, is that under Washington law, “the purpose of issuing a [COI] is to inform the recipient thereof that insurance has been obtained.”

“Accordingly, under Washington law, a COI is not the functional equivalent of an insurance policy, and it therefore cannot be used to amend, extend, or alter the coverage provisions of an insurance policy,” the panel wrote in its request to decide whether T-Mobile should be covered for the building’s damages by SICA.

COI’s are oftentimes misunderstood, misleading and on occasion, forged, as well as misrepresented by some agents, according to Wireless Estimator sources.

Depending upon an agency agreement, naming a third party like T-Mobile as an insured under a policy could be an unauthorized endorsement since the agent doe not have the actual authority to confer additional insured status.

At a NATE Wireless Industry Network presentation on Oct. 29, 2018, John McGarvey – Partner-Telecommunications Division, McGriff Insurance Services, discussed the myths behind COIs and how oftentimes companies find out they don’t have specific coverage until an incident occurs.

Comments? Send them to info@wirelessestimator.com .