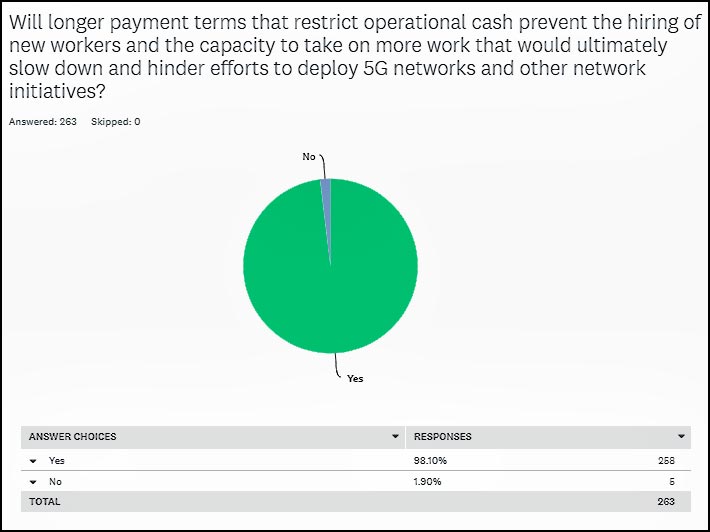

Although wireless contractors are in high demand, their low – sometimes nonexistent – profit margins could trigger a major shakeout in the industry as contractors struggle to remain afloat

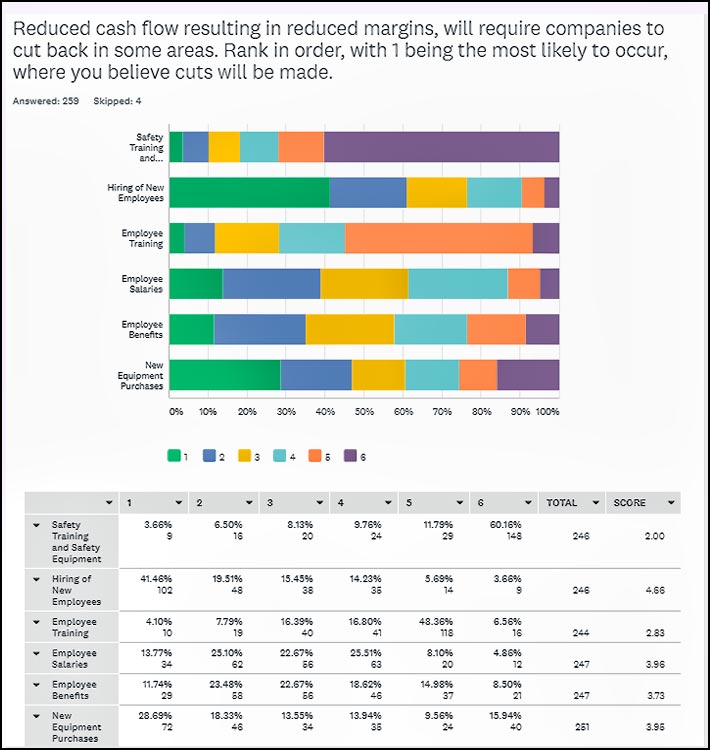

In their drive to lower capex as they roll out 5G, carriers have created a troubling national Achille’s heel – a contractor base that has many companies swimming in debt with serious cash flow problems, according to results of an extensive nationwide survey taken by Wireless Estimator.

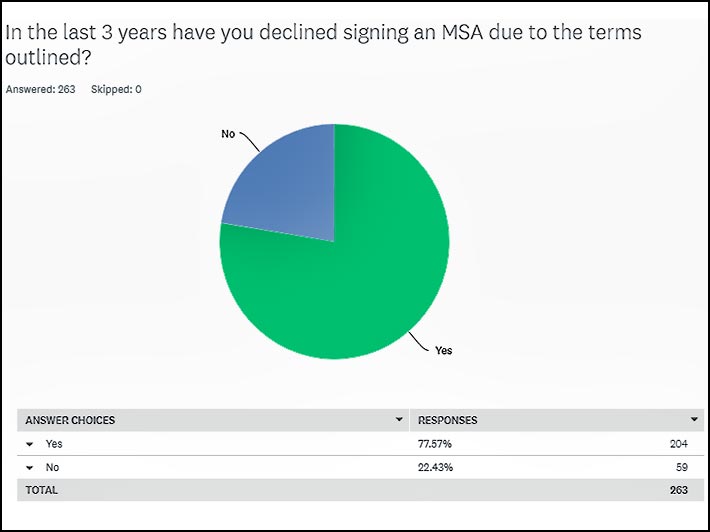

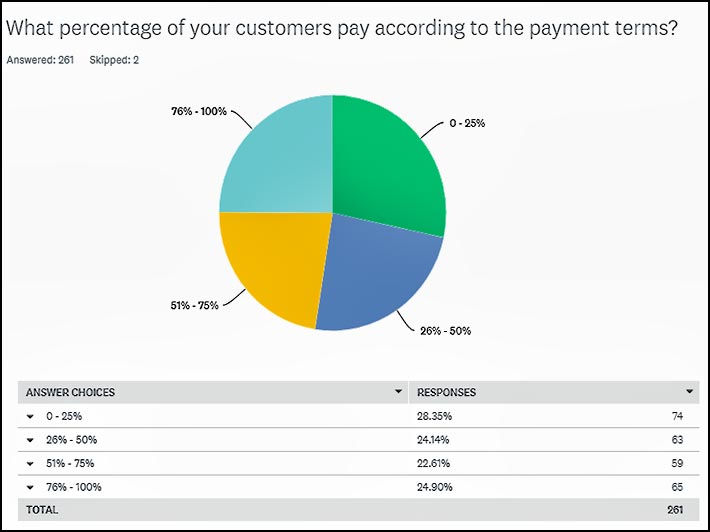

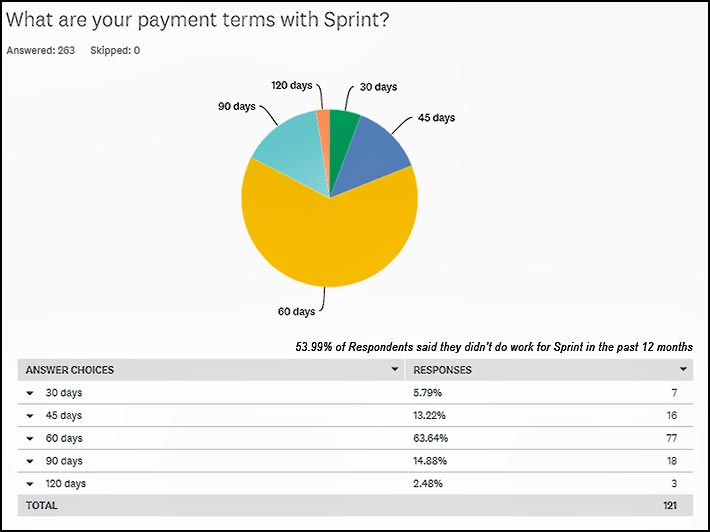

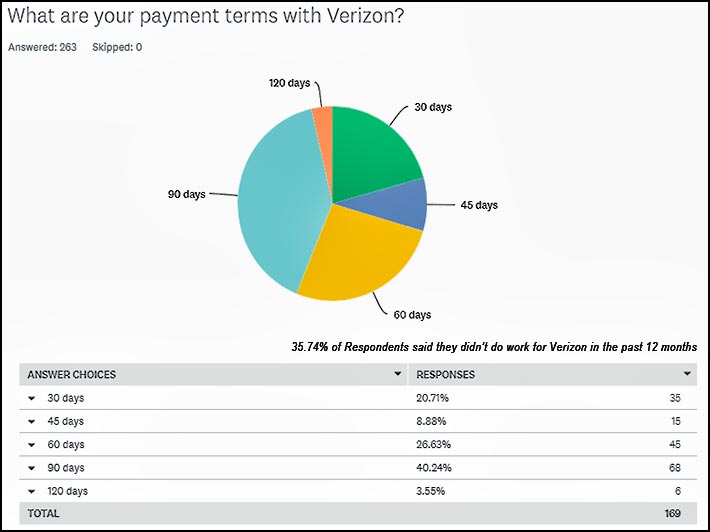

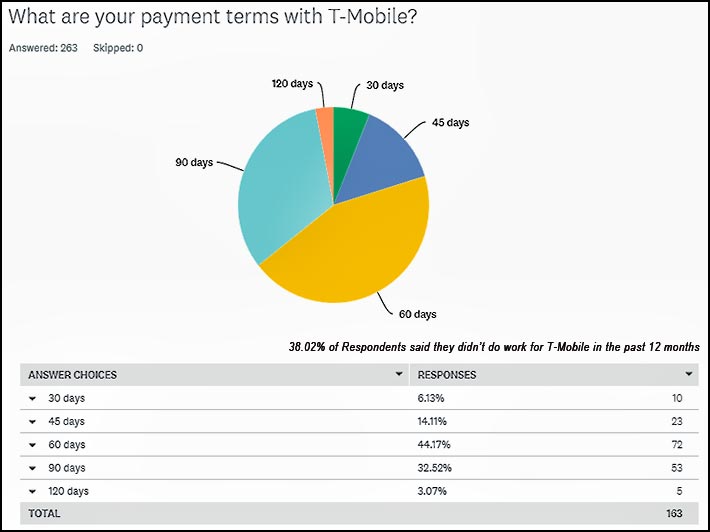

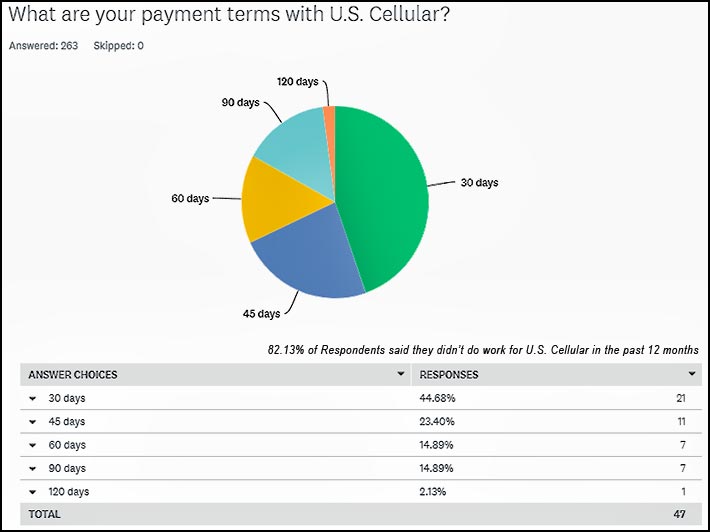

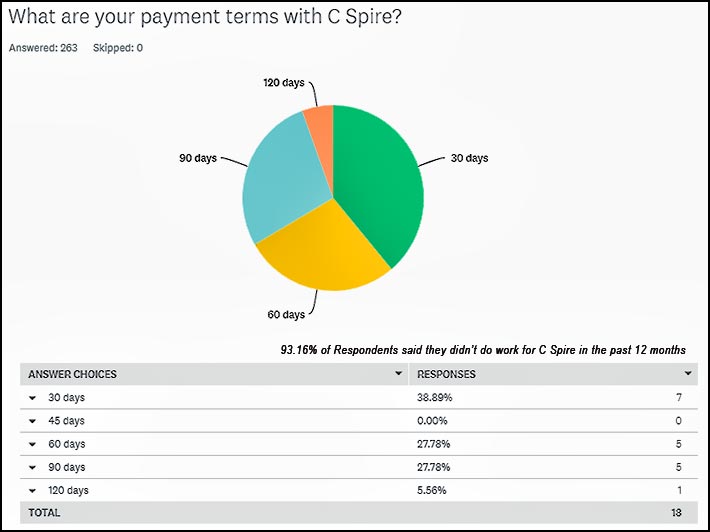

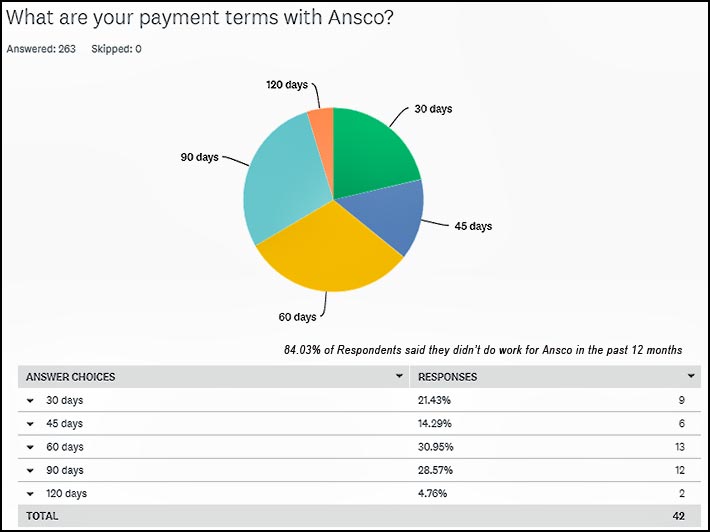

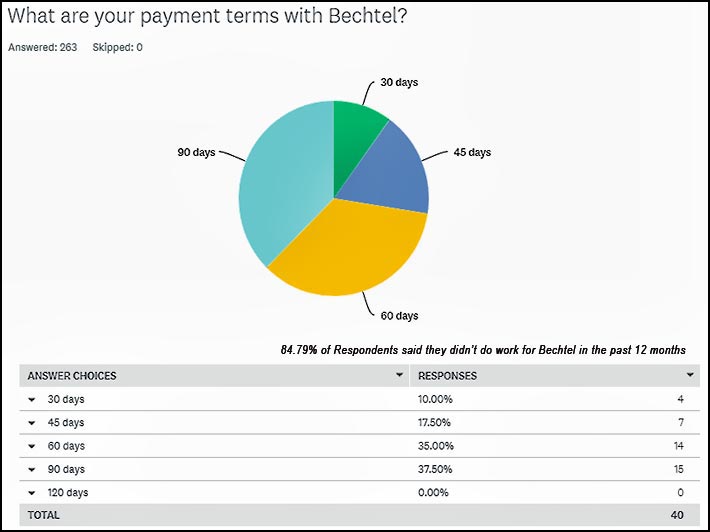

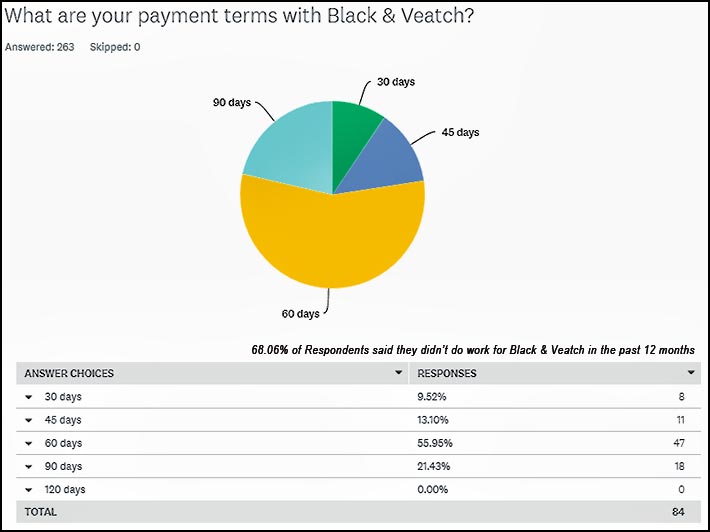

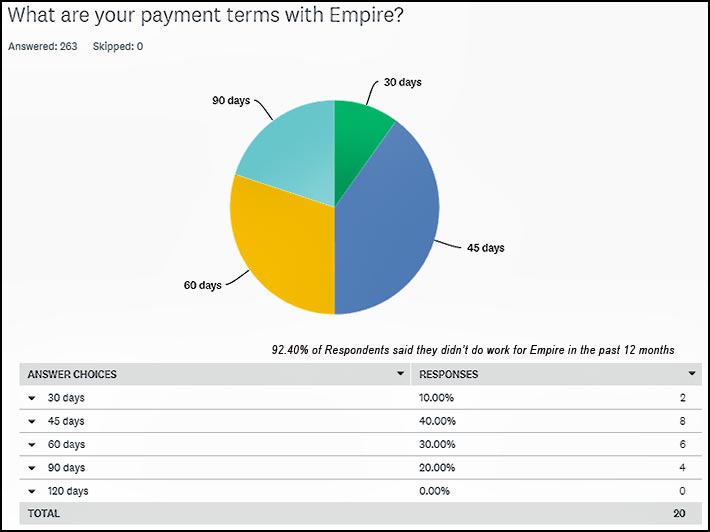

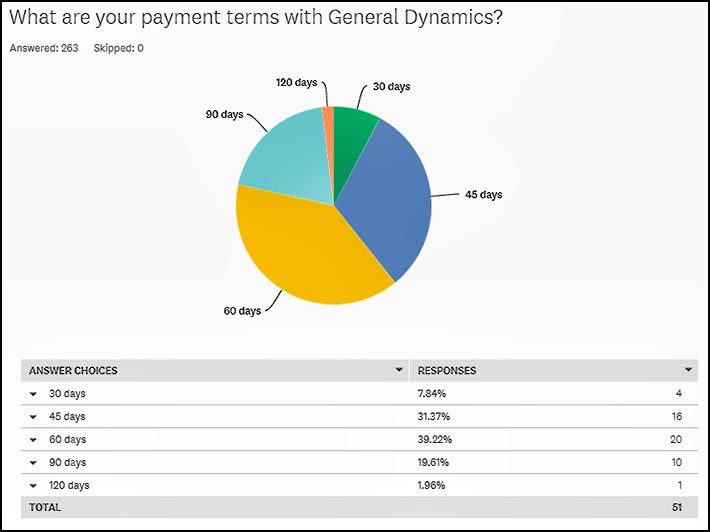

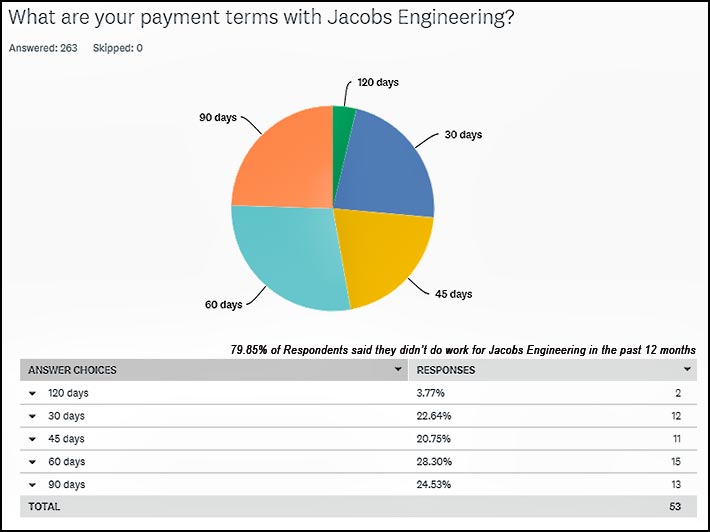

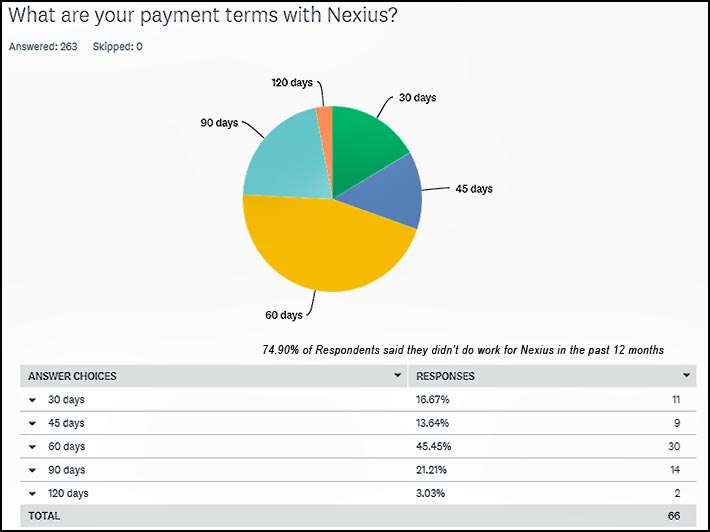

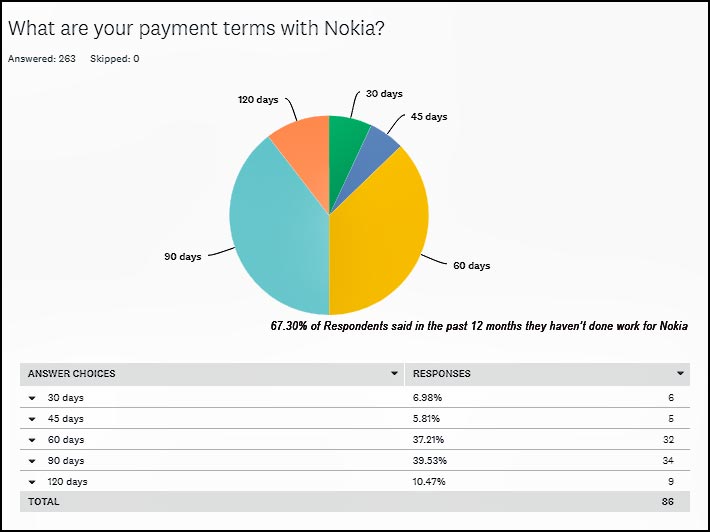

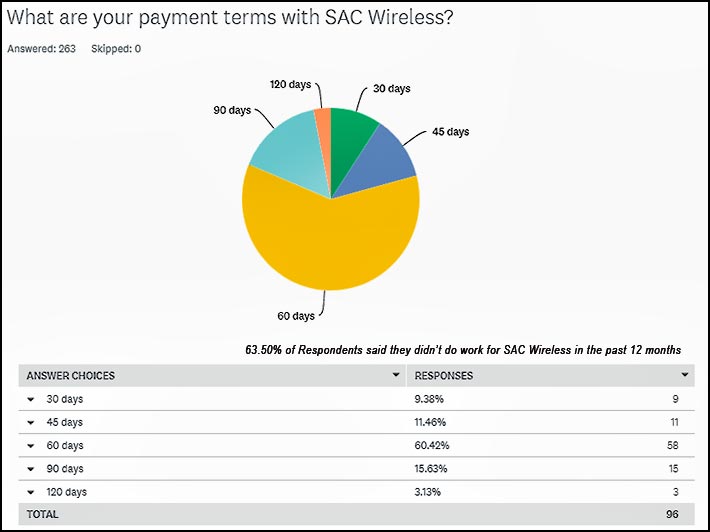

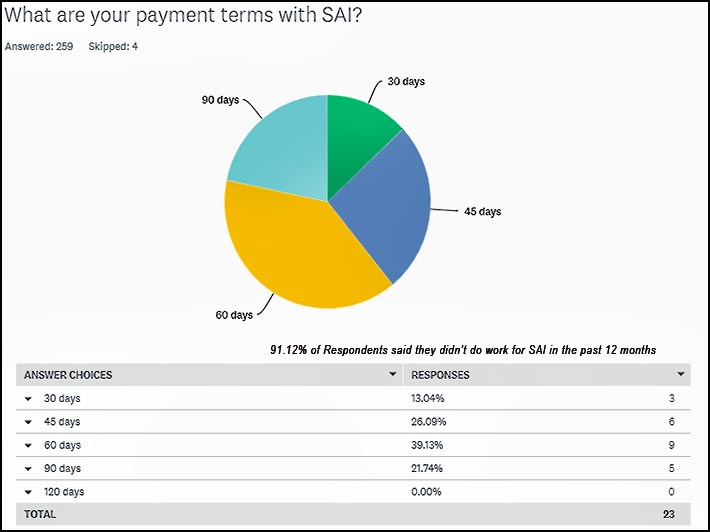

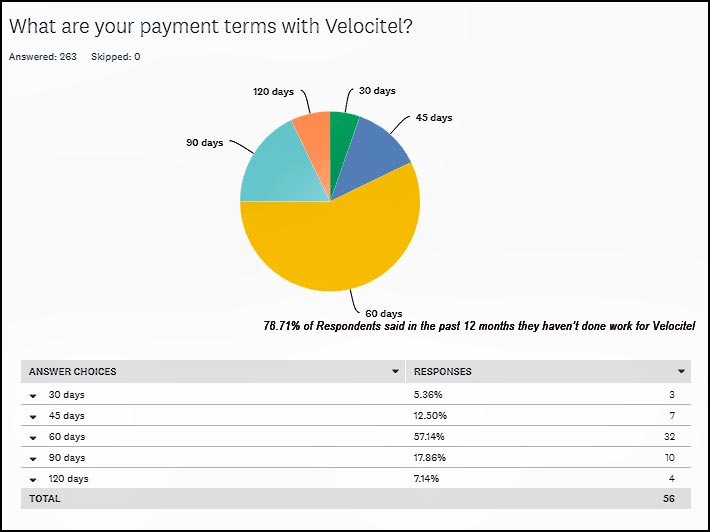

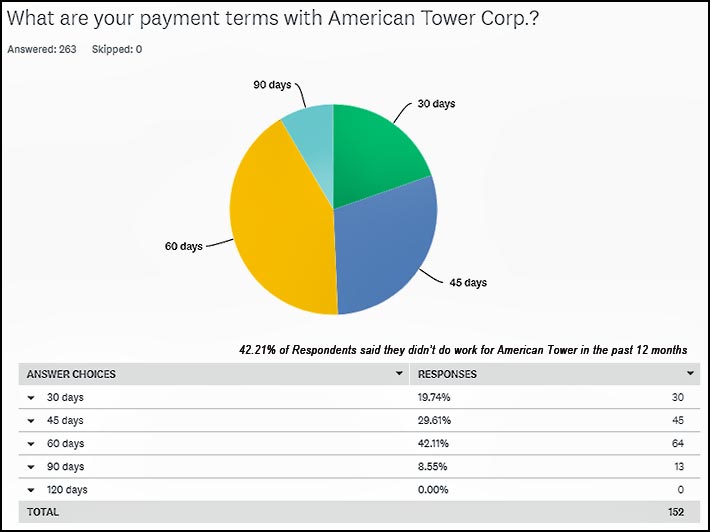

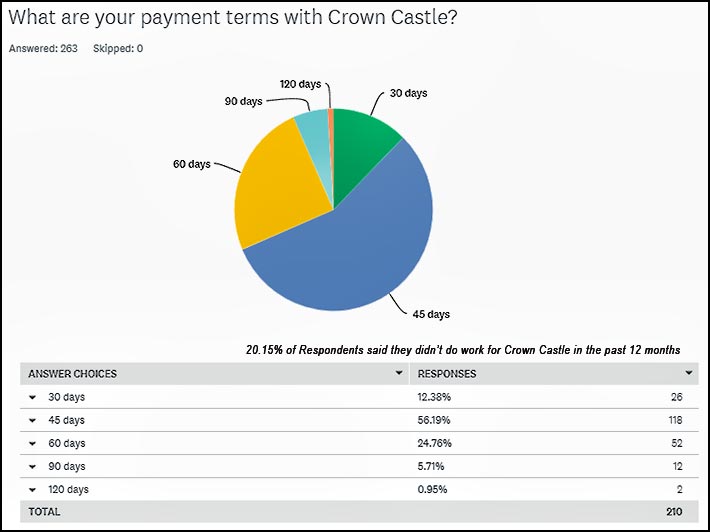

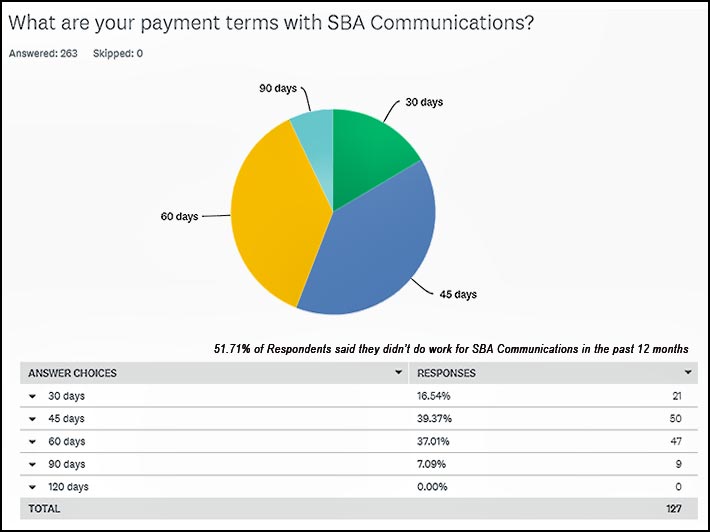

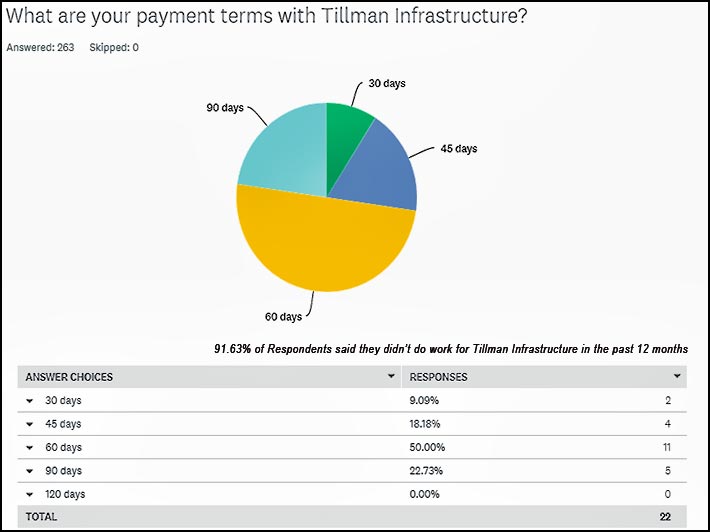

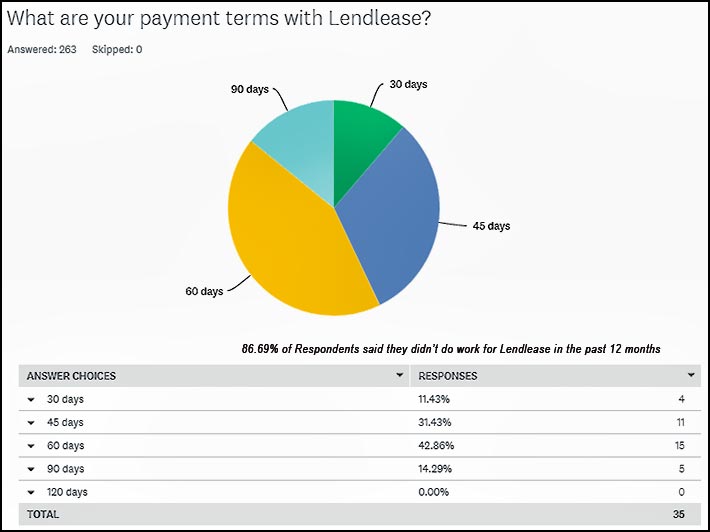

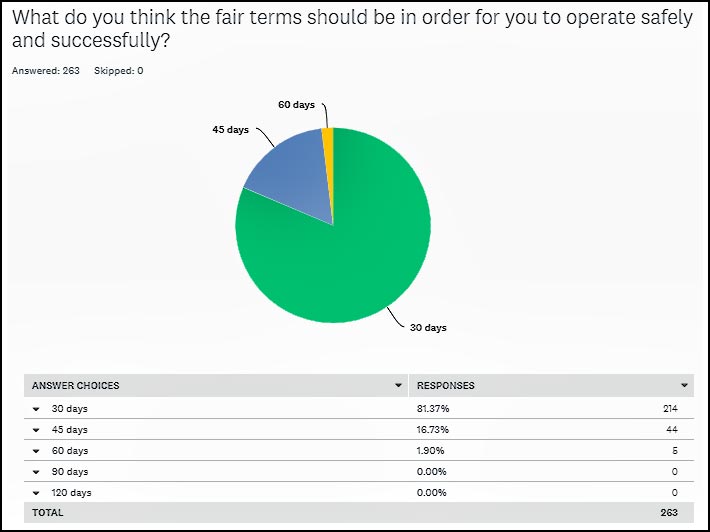

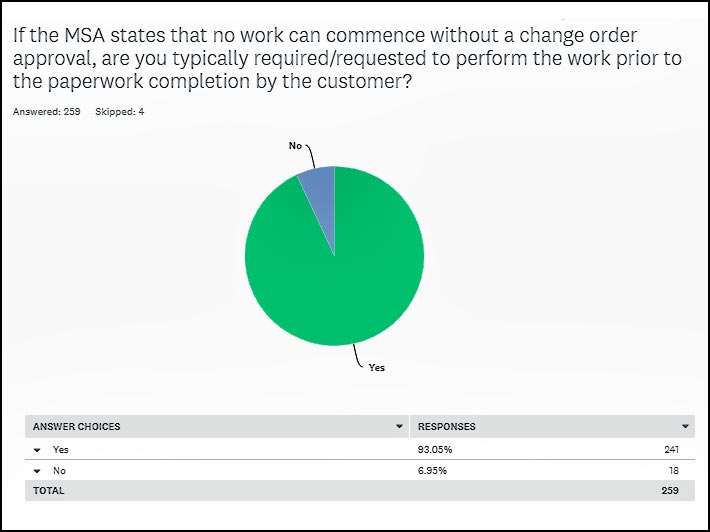

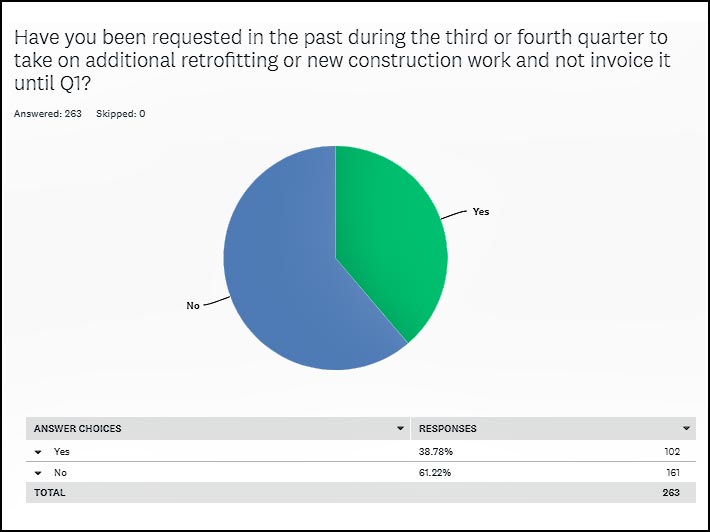

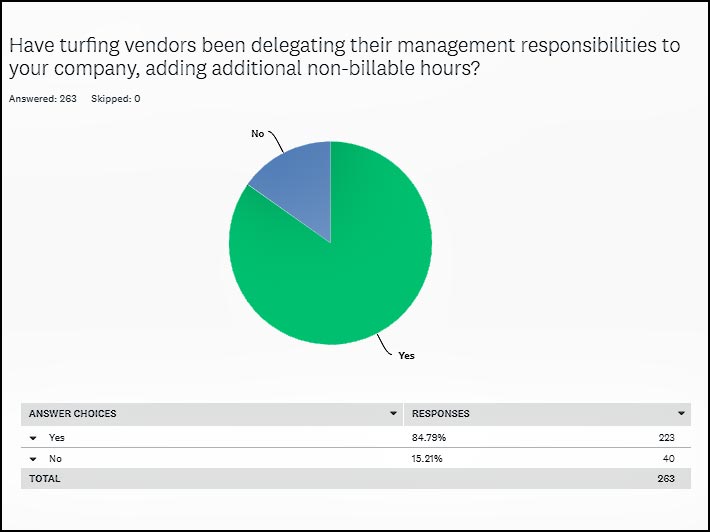

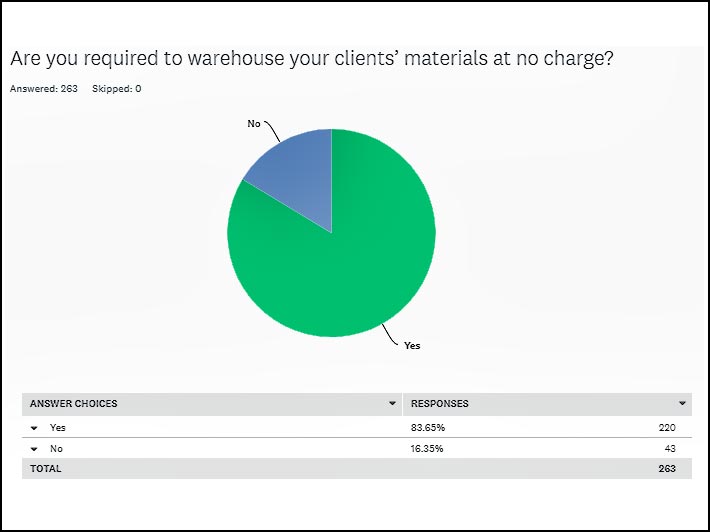

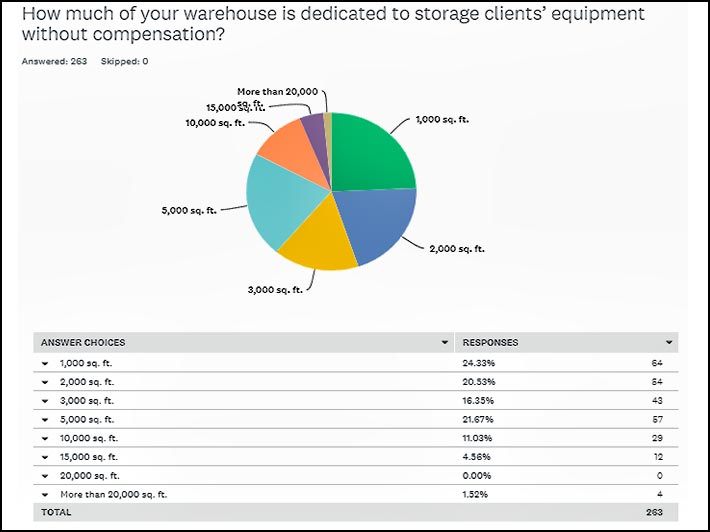

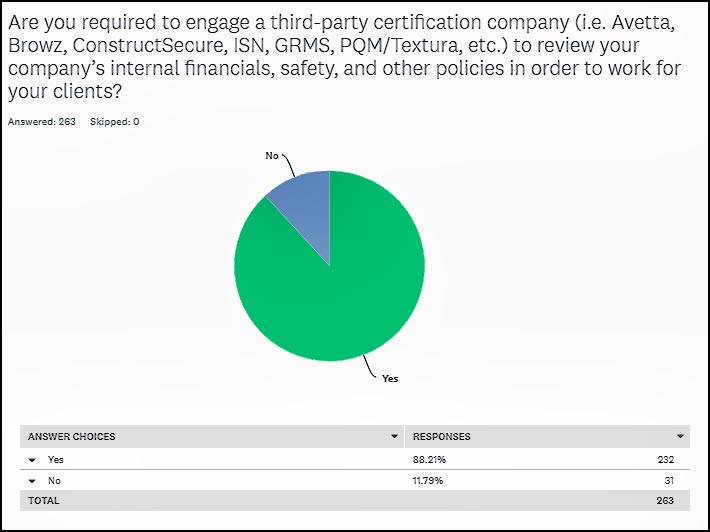

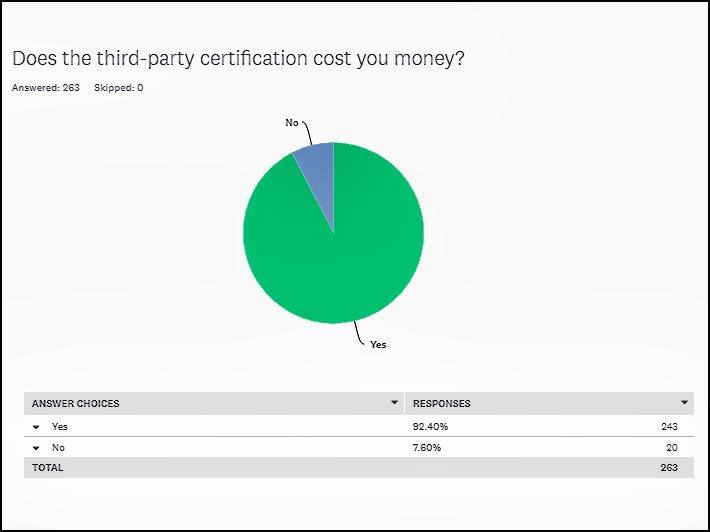

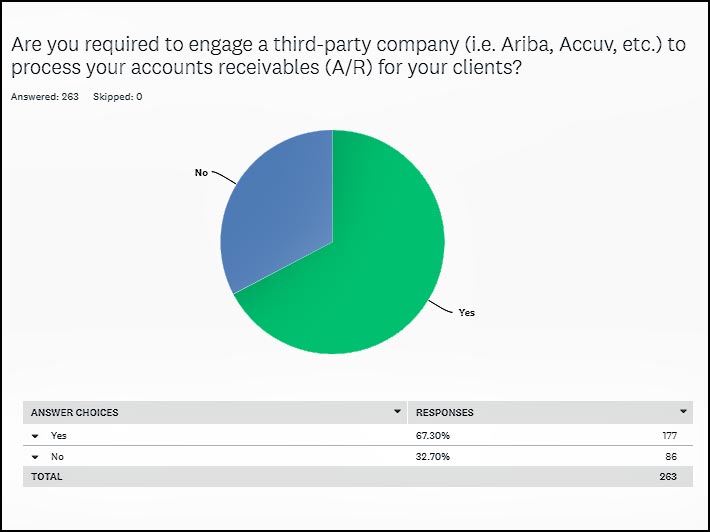

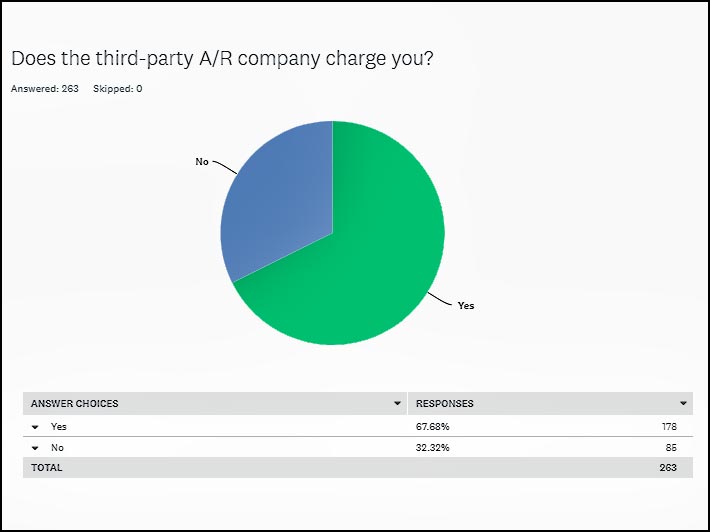

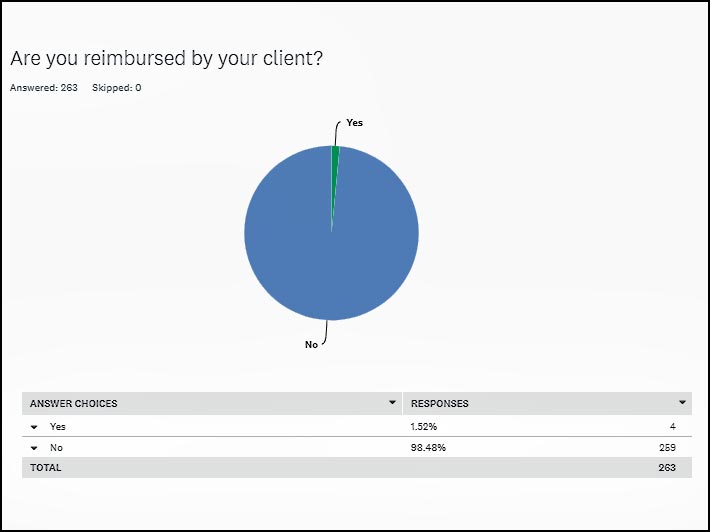

The wireless contractor survey that was completed last quarter by 263 vetted companies, clearly indicates that many owners are concerned about their ability to take on additional work as their margins keep getting squeezed, as carriers continue to pass on additional responsibilities and their inherent costs while extending payment terms to 90 days or more.

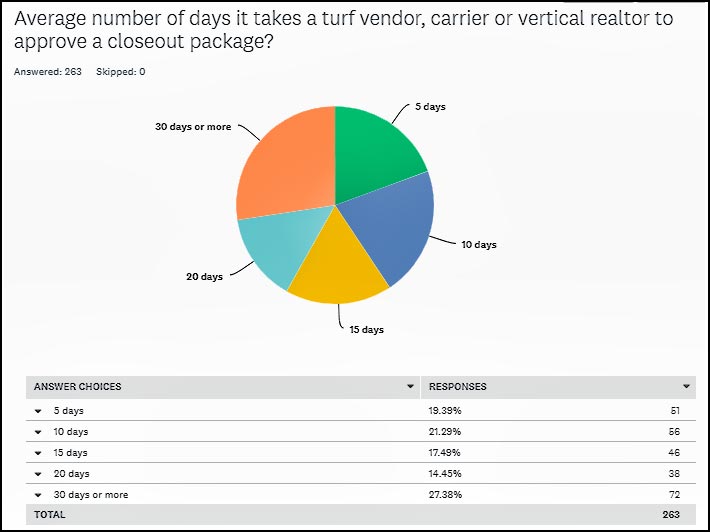

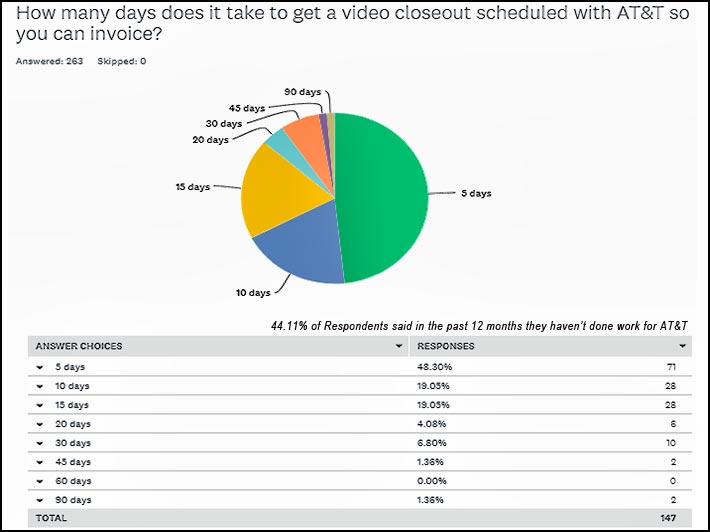

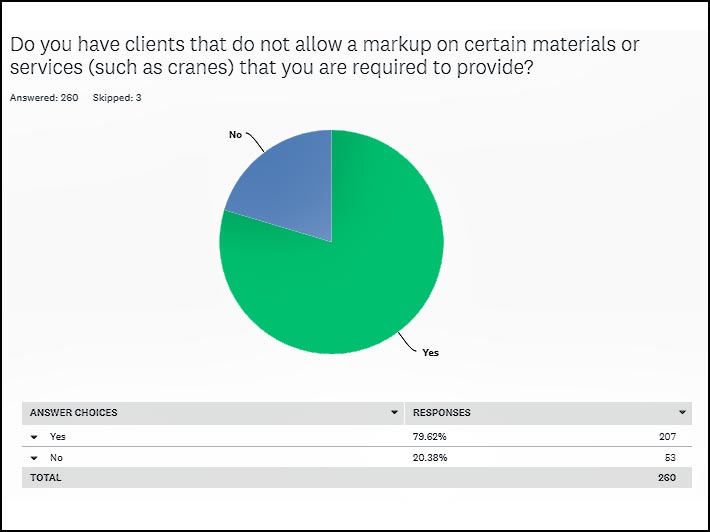

Those unsustainable terms, in a mostly labor-centric industry where contractors can’t markup cranes and other expenses, are compounded by the fact, according to the survey, that closeout document problems and other client-generated delays can add another 30 to 45 days or more to the time before payment is received in order for contractors have the ability to take on any additional work.

Respondents addressed over 70 questions with the results provided in the below graphs.

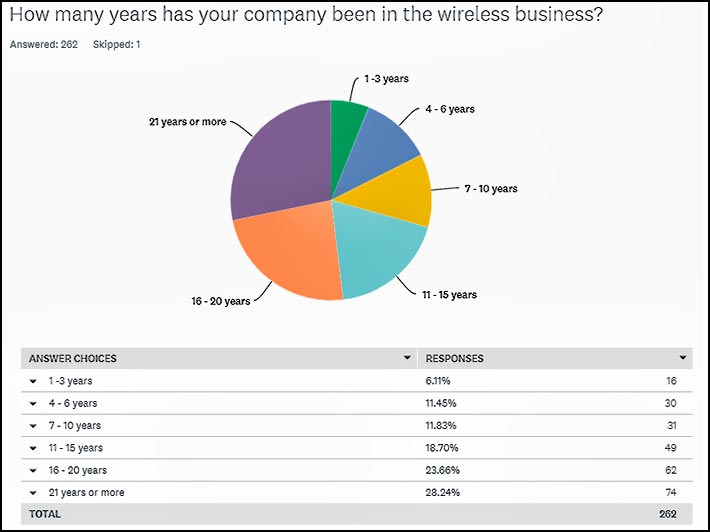

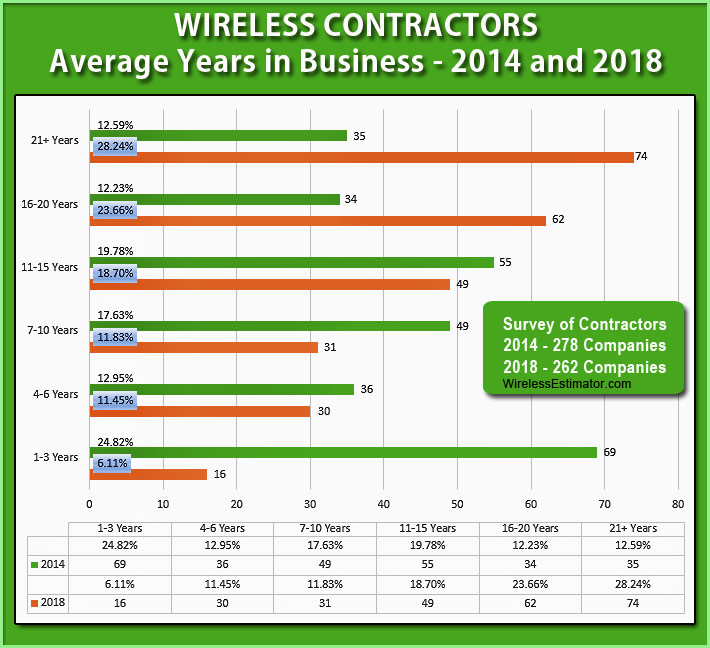

One question, regarding the number of years contractors have been in business, identified that startup contractors have dropped dramatically compared to a survey in 2014. It’s most likely, according to respondents’ answers, that there are too many barriers to entry, and investors are shying away from funding contractors.

Other key findings were:

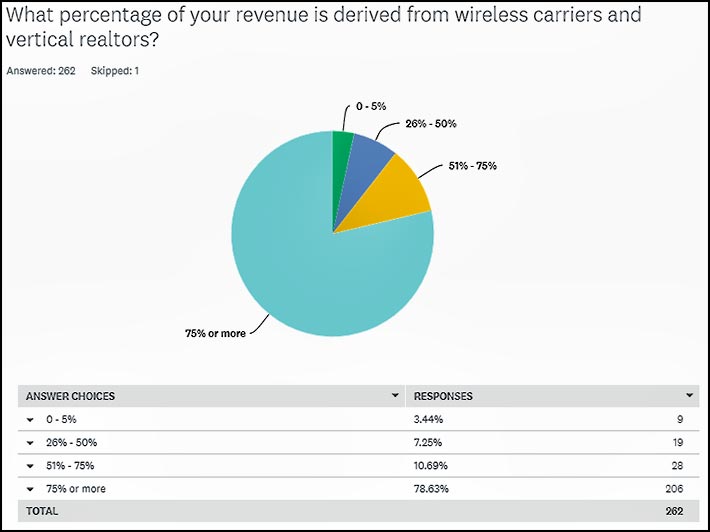

- 79% of contractor revenue is derived from carriers and vertical realtors

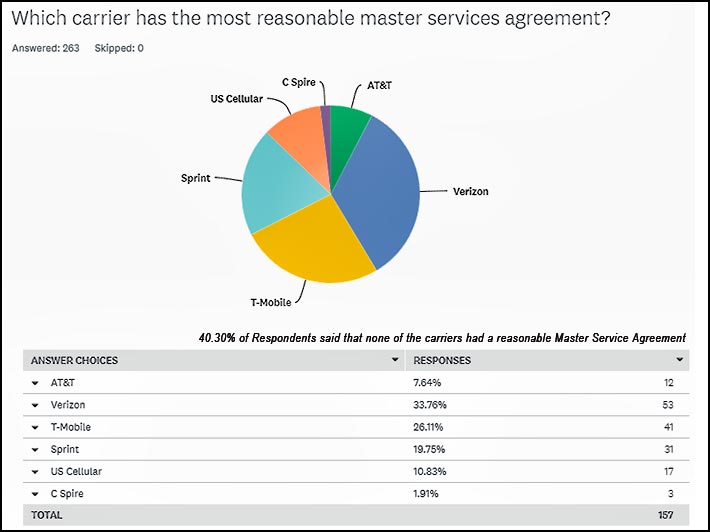

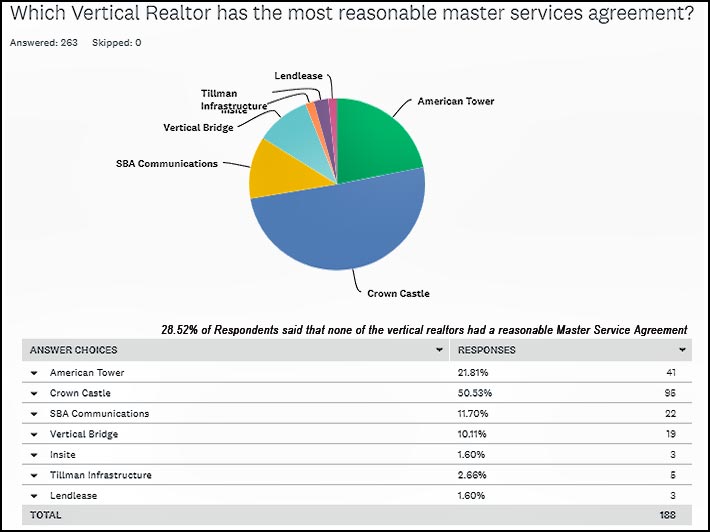

- Vertical realtors’ payment terms were far better than carriers’ terms with Crown Castle being viewed as the best towerco

- MasTec was identified as having the best MSA of all turfing vendors

- 89% of respondents said at times their clients purposely found something in their closeout package to delay payments

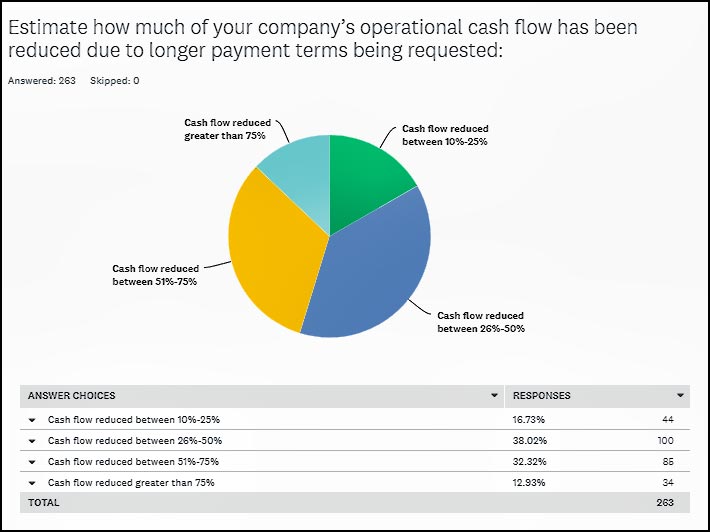

- Extended payment terms have seriously impacted operational cash flow

- It takes 30 days to get a change order, according to 21% of respondents

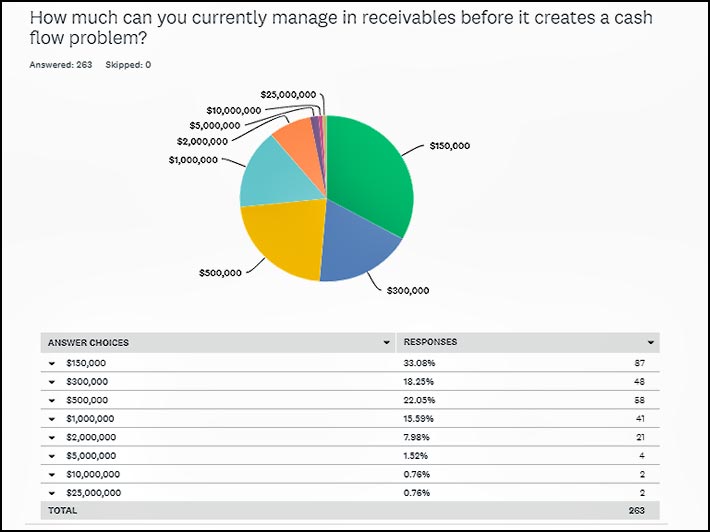

- One-third of all companies can only handle $150,000 in receivables before it creates a cash flow problem – indicating a truly cash strapped industry

- 80% of all companies are not allowed to markup certain items like cranes

- Contractors believe that carriers are unaware of their higher than average truck roll expenses

The devil is in the digital dialogue

Hundreds of valued contractor comments paint an unattractive picture of the financial state of the industry, and question its ability to continue as a vibrant profession if carriers continue to require contractors to fund their build-out, in addition to having to accept ever-declining price points.

The survey’s questions were developed by wireless industry associations’ members with field employees ranging from 8 to 135. The 263 companies responding represented an accurate cross-section of industry contractors estimated to be approximately 1,800.