Latest market forecast predicts the industry will have deployed 35.7 million radio units by 2026 with impact of 5G, adoption of new network architectures, and rise of network sharing and neutral host accelerating deployments as the pandemic eases

The Small Cell Forum (SCF) has released its latest market forecast report identifying a large growth curve.

The report, available here, confirms the continuing growth of the small cell market, with 5G driving new deployments, particularly in industrial and enterprise settings. This is forecast to be accelerated by increasing access to new spectrum and open architectures, both of which will facilitate new deployers and business models. The emergence of simple, scalable, and repeatable deployment processes supports a rapid increase in small cell deployment, especially enterprise small cells, by MNOs, new deployers such as Private Network Operators (PNO), Neutral Hosts and Augmented TowerCos.

Key highlights:

- There are a rising number of industrial applications that require full 5G capabilities such as high availability, and these will accelerate adoption of 5G small cells, with a CAGR of 77% in 2019-2026.

- Access to a wider variety of spectrum, with more flexible licensing, will be the most important enabler of enterprise small cell roll-out in the early 2020s. Deployments in shared spectrum will overtake those in licensed bands in 2025.

- As small cells need to address increasingly diverse requirements from different industries and use cases, flexible, cloud-based architectures will become essential. Two-thirds of deployers expect to adopt small cell vRAN by 2025.

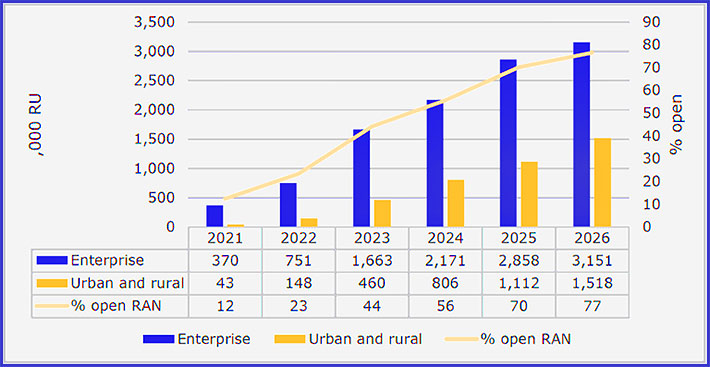

- One driver of vRAN expansion will be open small cell architectures. These will account for 77% of new deployments in 2026. There will be strong support for SCF’s Split 6 in the enterprise and industrial environments, where it will be adopted by 58% of deployers by 2024.

- The trend for rising diversity of small cell deployers and business models will intensify as enterprise demand grows, and by 2026, over three-quarters of enterprise small cells will be deployed and operated by private network operators or neutral hosts.

The forecast shows clearly the impact of rising 5G adoption, often enabled by availability of new spectrum. Some of this spectrum is the result of auctions that are now gathering pace after Covid-related delays in 2020; but some is a result of more flexible licensing regimes, including spectrum sharing, that will facilitate enterprise, rural and urban deployments by non-MNO providers, and increase the overall pace of build-out.

The Forum’s forecasts, now in their fifth year, are based on responses from MNOs and other small cell deployers. The research is based on operator surveys, modelling and forecasts, completed in the first quarter of 2021. A total of 84 operators and 33 other small cell deployers took part and were surveyed or modelled on their deployments to date, roll-out plans to 2026, expected choices of architecture, vendor strategy and spectrum, their most important drivers and barriers, and their business models and use cases.

Prabhakar Chitrapu, Chair, Small Cell Forum, says: “While the turbulence of the last 18 months has had an effect on deployments, this forecast continues to show not just the crucial role small cells will play in facilitating a 5G future, but also how important new breeds of network deployers will be to delivering it. SCF champions a diverse mix of service providers, operators and vendors, and we are committed to aligning technical requirements and driving global standards, technologies and legislation which can make deployments faster and more affordable.”

Caroline Gabriel, SCF Content Director, says: “Our research has shown that increasing diversity of the services small cell networks will support, the environments they are deployed in, and the organizations that build and manage them, will help to accelerate deployment throughout the 2020s, and especially as we move away from the pandemic. It also has a profound impact on the whole supply chain, as the requirements for design and performance of small cells also become diversified to support these different business cases.”