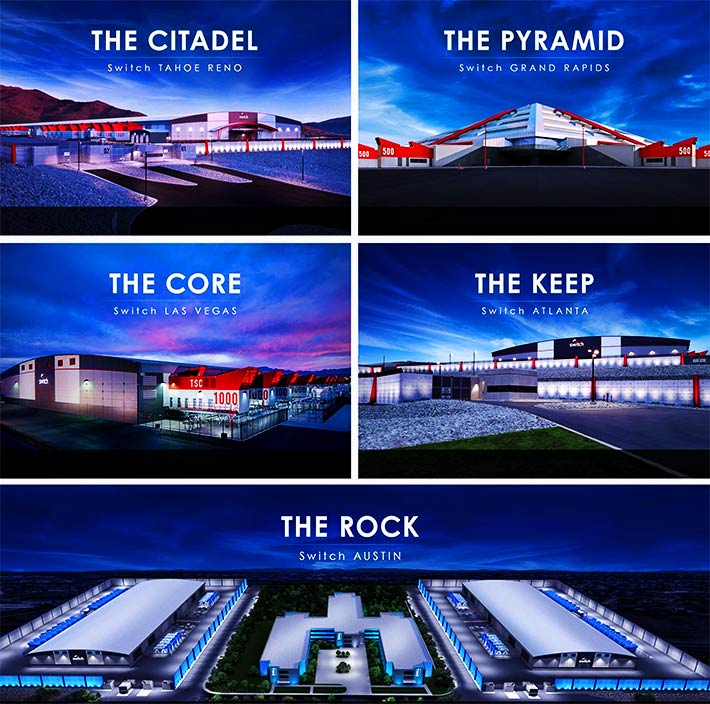

The Switch PRIMES are intentionally located in the most cost-effective area of each North American zone based on low or no taxes, lowest cost of power, lowest cost of connectivity, lowest costs of living and lowest risk from a natural disaster, according to Switch’s website.

DigitalBridge Group Inc. and IFM Investors have announced they have agreed to buy data center operator Switch Inc. for $11 billion, including debt, marking the latest deal in the digital asset sector.

Last November, American Tower announced the acquisition of CoreSite for $10.1 billion, in which the company paid $170 per share for 25 data centers, 21 cloud on ramps and 32,000 interconnections in eight major U.S. markets.

DigitalBridge, and an affiliate of global infrastructure investor IFM Investors (“IFM”) will acquire all outstanding common shares of Switch for $34.25 per share.

“Today’s announcement is an important step towards our long-term vision for the growth and evolution of our company. Through this partnership we will be ideally positioned to continue to meet strong customer demand for Switch’s environmentally sustainable Tier 5 data center infrastructure,” said Switch Founder and CEO, Rob Roy.

“Following our expansion into a Fifth Prime campus last year, and with our plan to construct more than 11 million additional square feet of capacity through 2030, Switch’s strategic position has never been stronger. The combination of our advanced data center infrastructure, significant expansion capacity in our land bank, and a new partnership with experienced digital infrastructure investors lays a strong foundation for Switch’s continued industry leading growth.”

“This transaction provides significant and immediate value to our stockholders, and is a reflection of Switch’s industry leading performance and differentiated technology,” said Thomas Morton, President of Switch. “Through this transaction, we will remain at the forefront of growth and innovation within the data center industry. Following a robust evaluation of market dynamics and strategic review process by the company and its Board of Directors, we strongly believe that this is the optimal path forward for Switch and our shareholders.”

Marc Ganzi, Chief Executive Officer of DigitalBridge, said, “At DigitalBridge, we are building the world’s leading global digital infrastructure investment platform, and this transaction allows us to partner with one of the industry’s fastest growing and highest quality data center portfolios. Rob and his team share our vision for the future of communications infrastructure, making us the ideal partner to scale their business both domestically and internationally to meet the exponentially rising demand from large enterprise customers looking for mission critical digital infrastructure. We are also pleased to partner with IFM Investors, one of the world’s leading institutional infrastructure investors, to execute this compelling transaction.”

“We have a proven track record of accelerating companies’ time-to-scale by leveraging our deep domain expertise and access to capital,” said Jon Mauck, Senior Managing Director of DigitalBridge Investment Management. “We look forward to supporting Switch’s continued growth with the creative solutions and operational expertise necessary to scale these leading assets going forward. This fast-growing and renewables-powered business is a highly complementary fit within our expanding IM business and broader strategic priorities.”

Kyle Mangini, Global Head of Infrastructure at IFM, said, “IFM is excited to partner with DigitalBridge and Switch on this transaction. We consider Switch to be an excellent digital infrastructure business with strong potential. The company is a recognized industry leader with an impressive approach to ESG. Today’s announcement reflects IFM’s strategy of investing in high quality infrastructure to protect and grow the long-term retirement savings of working people.”