DigitalBridge Group’s stock tanked today after it unveiled an excellent Q3 earnings report yesterday. This afternoon, the company announced that an Abu Dhabi Investment Authority subsidiary will acquire a 40% stake in Landmark Dividend.

When American Tower Corporation (ATC)) released its Q3 earnings report on October 26, 2023, analysts were pleased with the company, beating its earnings per share of $1.26 by 11.51%. The company also had a surprise increase in revenue of 2.10% at $2.82 billion.

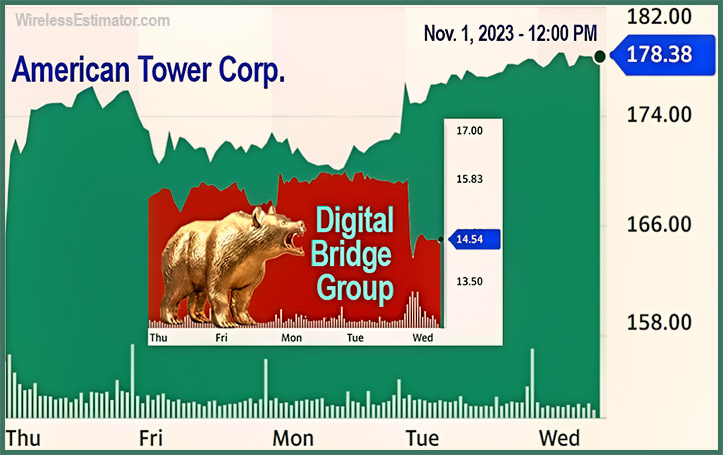

Although ATC cautioned that its 2024 expectations might be slightly lower since annual 5G investments by U.S. carriers won’t return to their 2022 peaks, and noted that it intends to pause dividend growth in 2024 amid the uncertain interest rate environment to pay down debt, the market took that at as a positive, and the stock has seen a steady rise since Friday, trading today at noon at $178.38.

So when DigitalBridge Group yesterday reported that it had a profit of $1.39 per share, with earnings, adjusted for one-time gains and costs coming to 20 cents per share, with the results beating Wall Street’s estimates of 11 cents per share, investors expected a sharp rise in the stock today since the company’s Q3 report also reflected a stable growth-oriented future.

Nonetheless, DBRG cratered this morning from yesterday’s close of $15.85 to $14.12, an almost 11% freefall. At noon, it was trading at $14.54.

During Q3. DigitalBridge completed the $2.2 billion recapitalization of DataBank on September 14, resulting in $50 million in incremental gross proceeds and bringing net monetized value to DBRG to $471 million while generating a 32% IRR for DBRG shareholders. The final closing resulted in the consolidation of DataBank from DBRG’s financial statements, the company said.

DigitalBridge announces a United Arab Emirates firm’s minority acquisition of Landmark Dividend

This afternoon, DigitalBridge announced that a wholly owned subsidiary of the Abu Dhabi Investment Authority (“ADIA”) will acquire a 40% stake in Landmark Dividend LLC (“Landmark”), a leading acquirer and developer of real estate and infrastructure focused on the wireless communication, digital infrastructure, outdoor advertising, and renewable power industries. The investment includes a significant commitment from ADIA and DigitalBridge-sponsored vehicles to support the continued expansion of Landmark’s growth platform.

The press release is available here.