WHILE THE NATION’S WIRELESS CONTRACTORS AND SUPPLIERS were being informed by Nexius Solutions, Inc. and its associate companies earlier this year that it was in a cash crunch and they would have to get in line for payment, the company gave preference to its supplier, Novelus, making 44 payments totaling over $4.5 million, according to documents reviewed by Wireless Estimator. The payments lined the pocket of Nabil Taleb, Nexius’s chairman, the co-founder of the Beirut, Lebanon company that provides network help desk services to contractors and carriers. The payments were made during the 90 days before Nexius filed bankruptcy on June 2, 2023, and could be clawed back by the bankruptcy court trustee if it is found that they were preferential payments.

In 2001, brothers Nabil and Ned Taleb co-founded Nexius in a two-bedroom Virginia apartment. They continued to bootstrap their first year’s revenues of $1 million to a multi-corporation self-performing wireless industry enterprise that boosted revenues to $1 billion in 2022.

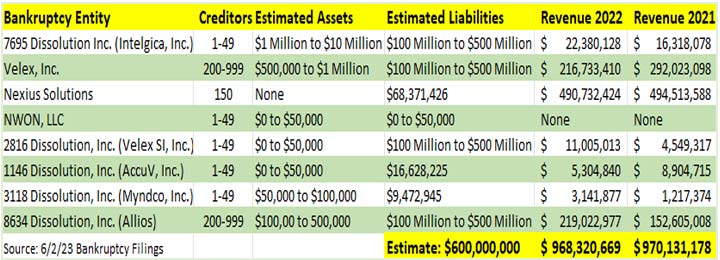

But cash is king, and they ran out of it last year and sought Chapter 7 bankruptcy protection three weeks ago, owing approximately $600 million or more to their creditors, burning suppliers and contractors who were led down a dead-end path of promises of payment.

It is the largest Chapter 7 bankruptcy ever recorded in the wireless infrastructure industry.

Over a thousand companies are due money, with the largest unsecured creditor identified as CommScope Technologies LLC, which is owed $21 million. In March, it was presumed that CommScope’s $21.9 million increase of “doubtful” accounts receivables in their Q4 2022 SEC filing represented what Nexius owed them.

At that time, it was estimated that Nexius owed creditors $95 million or more.

Can the court claw back over $4.5 million provided to Nexius chairman’s privately held company?

Three months prior to the June 2, 2023 bankruptcy filings, multiple contractors informed Wireless Estimator that if they couldn’t collect in full their past-due invoices, they were going to have to lay off employees and possibly shutter their business – at a time when Nexius’s Chairman, Nabil Taleb, appears to have been benefitting from his co-ownership of Novelus, a supplier of help-desk and network services in Lebanon.

Nexius had been using Novelus, an unaffiliated company in the bankruptcies, but wholly or partially owned by Nexius Chairman Nabil Taleb, for its help desk contractor node issues. MSN, who took over Velex’s site builds, has switched to its wholly-owned subsidiary, QuadGen, for contractor and node support issues.

According to payments reviewed by Wireless Estimator that were made by the seven bankrupt companies (Nexius Solutions, Velex, Inc., Velex SI, Inc., Allios, AccuV, Inc., Myndco, Inc., and Intelgica, Inc.) in their filings 90 days before their bankruptcy, 44 payments were made to Novelus totaling more than $4.5 million.

The bankruptcy court trustee could claw back the payments if it is found that they were preferential payments, especially considering that engineering companies such as Atlas Wireless and Telecommunication, Inc., owed $786,873.00, hadn’t been paid for many months of prior work.

Nexius states in its filing that they still owe Novelus $695,733.

Audela’s $365K in payments also raises a concern about undue enrichment

This Montreal, Canada, artificial intelligence software company was paid $365,469 just before the June 2, 2023 bankruptcy fillings. Nexius Chairman Nabil Taleb’s brother co-founded it.

Just months before their bankruptcy filing, AccuV, Inc, Intelgica, Inc.. and Allios made 19 payments for $365,469 to Audela, identified as a supplier. According to the company’s website, the Canadian firm, based in Montreal with an office in Richmond, WA, is an artificial intelligence company providing products and services solutions to communication service providers.

The company’s ownership is unknown, but it lists its partners as ACCUV, Nexius, B-Yond, and Intelgica. Three of the partners have filed for bankruptcy. B-Yond was co-founded by Nabil’s brother Neb, the company’s CEO.

Some creditors say they weren’t informed of the bankruptcies

After the seven companies (NWON, the corporate holding company, owning 100% of the equity interest of all of the debtors, also filed, but had less than $50,000 in assets and liabilities) filed a Chapter 7 petition for bankruptcy, the court was required to send via U.S. mail notification to their creditors.

It was news that there had been a filing by a supplier’s executive two weeks ago after Wireless Estimator contacted him for a statement as to what impact it would have on his business. His company is owned over $140,000.

Calls to two other suppliers and three contractors said they had checked office correspondence and received nothing regarding the bankruptcy. A supplier said that they had finally received notification on Friday of a meeting of creditors set for July 11, 2023.

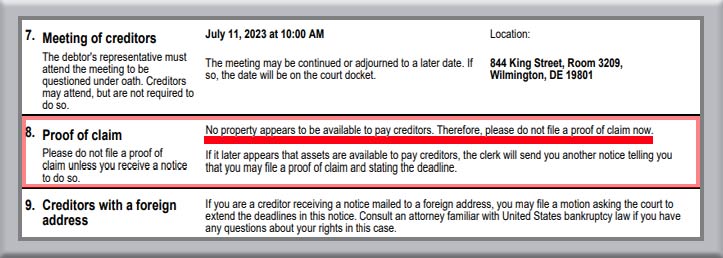

Delaware bankruptcy court filing says to hold off on your claim

If they received notification as a creditor from the Delaware Court, they would have been informed that it was unlikely that they could recover any past due balances since the filings state, “No property appears to be available to pay creditors. Therefore, please do not file a proof of claim now.”

The filing also stated that if it later appears that assets are available to pay creditors, the clerk will send creditors another notice telling them that they may file a claim with a specific deadline.

Who are the creditors, and how much are they owed?

Except for Nexius, the associated corporations provided a list of creditors without any amounts due, such as this filing from Velex, the construction arm of the Nexius group.

Most suppliers can be found on the Allios creditors list. Wireless Estimator has compiled a list of Nexius’s creditors, below, that were identified in their filing, representing $68.3 million, approximately 11% of all of the debtors’ estimated liabilities.

The bankrupt corporations’ creditors lists may include companies or individuals that are not owed any money since it’s stated: “In addition, certain of the entities included in the List of Creditors may not hold outstanding claims as of the date hereof, and thus may not be creditors of the Debtors for purposes of these chapter 7 cases, but are included herein for notice purposes out of an abundance of caution.”

If the trustee finds cash or assets, it’s possible that suppliers and contractors will not receive a percentage since, with a few exceptions, the bankruptcy code significantly limits a debtor’s ability to discharge taxes in bankruptcy, and tax payments are prioritized.

According to the filings, hundreds of taxing authorities are identified as creditors. Nexius says it cannot determine the amount of those tax claims with certainty.

Some Nexius entities have notes receivable outstanding from other co-debtors, such as Nexius’s liabilities showing that it owes Allios over $23 million. However, Nexius acknowledges that all assets have either been foreclosed upon or sold, and the balance of those cash management transfers is deemed uncollectible.

Where is MasTec in the mix, and are they paying creditors?

With the blessing of Nexius’s largest customer, AT&T, on January 20, 2023, MasTec Network Solutions South LLC (MNS) acquired all accounts receivable of the entities and work performed before January 20, 2023. They did not acquire any liabilities. MNS purchased all inventory owned by the debtors.

MasTec does not have to file the amount they paid for the assets with the SEC if it did not create a material change in their business. MasTec’s revenues in 2023 are projected to be $13 billion.

On March 7, 2023, MNS notified creditors that they had acquired the entities’ assets but not their liabilities, emphasizing that they had no obligation to satisfy any claims of vendors, suppliers, and contractors.

However, they then provided a form to vendors, requesting that they complete the document with invoices and detailed backup for their claims against Nexius and submit it to vendor management by March 20, stating that it would take several weeks to assess the claims.

Multiple contractors said they had been contacted and were offered approximately 30% of the value of their claims. Some said they then received a 50% settlement offer when they turned the first offer down.

They now have to wrestle with either accepting that payout or risk not being paid anything.

If they had a prior mechanic’s lien on the site, their chances of negotiating a larger settlement are higher. However, the majority of contractors were strung along with the belief that payment was right around the corner, and they passed the 90-day window (periods vary greatly depending on the state and can be anywhere from two months to one year) from the last time they furnished labor or materials to the project to file a lien.

An unveiled MasTec and AT&T agreement would help contractors

If a clouded MasTec/Nexius and AT&T agreement were made public, contractors and their subcontractors would have a more solid footing regarding their options and legal standing to be paid.

Although two individuals knowledgeable of the negotiations said that AT&T had an agreement with MasTec that MasTec had to pay contractors in full for projects that were not CIO100 construction complete, it was based upon comments made during top-level meetings that can’t be verified.

Possibly supporting those comments, in NWON’s bankruptcy filing, it is stated: “All accounts receivable and work performed before January 20, 2023, were acquired by MNS South, LLC under the Purchase Agreement.”

It also identified: “Certain creditor claims may have been purchased by MNS South, LLC but have not been released against the Debtor.”

Suppliers told to Fuggedaboutit

Three suppliers informed Wireless Estimator that they had sent in the vendor application for processing but did not get a response from MNS.

One creditor said they had frequently followed up on the status of their application and had been recently informed that MasTec had determined they “cannot purchase” their claim.

TESSCO Technologies had filed a breach of contract lawsuit against Allios in Circuit Court for Baltimore County, MD, on November 18, 2022, and received a garnishment against PNC Bank for $2,374,612.50. A court order to release the garnished funds was made on April 19, 2023, and the lawsuit has been closed.

Allios also paid TESSCO $273,864.12 on April 21, 2023.

Another distributor, Golden Gate Communications of Santa Barbara, CA, had filed a lawsuit against Allios for $1,252,580 for 403 outstanding invoices. However, the company was granted by the U.S. District Court, Eastern District of Texas, an order to dismiss the lawsuit without prejudice on April 25, 2023, when Golden Gate realized that even if it continued with expensive litigation costs and won, there were no assets to attach. Each party was responsible for their attorneys’ fees.

Although multiple lawsuits have been filed against the Nexius entities, new complaints are not permitted since the court declares an automatic stay that stops creditors from filing lawsuits when a Chapter 7 bankruptcy is filed.

MasTec’s critical asset buy is Velex’s employees

In mid-2022, as Allios’s ever-expanding growth ate Nexius’s cash, it was imperative that Nexius’s construction group, Velex, continued to build out AT&T’s sites to remain afloat until additional capital could be raised or an acquisition could be completed.

MasTec said that Velex tower techs would have competitive salaries and benefits. (Photo Courtesy: Velex)

In addition to not paying its suppliers and contractors, Nexius was not paying its credit card companies, and banks canceled employees’ cards around June of 2022.

Taleb used his personal credit line to continue operations but was reimbursed by the entities $442,860.49. However, his salary was only $3,956 per month.

Velex’s management had been active in industry organizations and had an excellent safety program and best-in-class equipment. To Nexius’s credit, it still maintained its safety program while many employees in its entities were being laid off.

At its peak, Velex had about 1,200 employees, and approximately 700 at the time of the takeover.

Approximately 70% of their field technicians were NWSA TTT certified.

Velex also had the largest enrollment in the Telecommunications Industry Registered Apprenticeship Program.

When MasTec held a video conference call with Velex employees announcing the acquisition of the assets, MSN President Rick Suarez discussed wages, compensation, and benefits provided by the Fortune 500 company. “I think you’re going to find that it’s going to be very competitive, and most likely, nothing changes there either,” said Suarez.

What has changed, state some employees, is the position’s profile and the salary, often as much as 25% lower.

Approximately two-thirds of Velex employees are expected to be onboarded with MasTec.

Editor’s Note:

This article is not intended to provide guidance or legal advice. If you plan to take legal action as a creditor, you are advised to consult a competent attorney whose discipline is in representing bankruptcy creditors. If you have any additional information regarding the bankruptcies or any other industry matter, please contact, in confidence, craiglekutis@wirelessestimator.com .