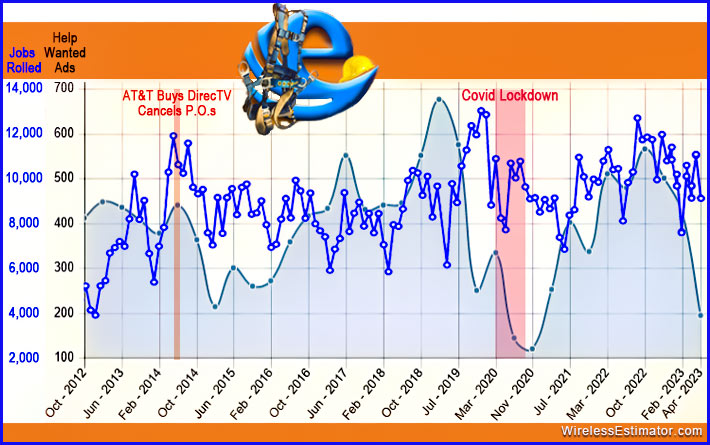

Monthly totals of help wanted ads placed on the industry’s largest job board show that April submissions fell to almost pandemic levels. In addition, jobs rolled using Wireless Estimator’s Emergency Services Locator also dropped during the same period, indicating an apparent industry downturn.

Last week at WIA’s View From the Top panel session at Connectivity Expo 2023, the top towerco executives hinted that they are aware of a dip in carrier capex and a turn towards fiber, possibly cutting into site builds. Still, they championed the industry and said 5G would be a constant and maybe a ten-year driver, although it would be “more moderate.”

As the heads of their public company, you wouldn’t expect anything less than a positive spin on what could be a future temporary slowdown cycle that also occurred following the initial 4G burst of network builds.

However, for many of the industry’s contractors, the future is now, and they’re struggling.

Fourteen contractors interviewed by Wireless Estimator this week said that they are already seeing a slowdown in work, and many of them are reassessing how they’ll manage their company in the next few weeks to maintain any semblance of profitability.

Six of them said they were seriously affected by Nexius closing its doors in March and would be considering laying off employees.

One northeast company recently terminated the employment of almost two-dozen employees, and a long-established southwest contractor said closing its doors might be his only option. “We took a big hit with Nexius, and it’s been difficult to recover,” said the company’s owner yesterday.

Another contractor said that their workload has slowed, and he would have to let one or two tower technicians go. “This happened during the first weeks of Covid, and I was forced to let some people go. Doing it again frustrates me, but I can deal with it. The concern is where will these people find employment?” he said.

Judging the industry’s health by the comments of 14 contractors could be considered significant but anecdotal since there are 1,500 or more aerial contractors.

However, a review of help wanted and construction project statistics for almost 12 years shows a slowdown.

As shown on the above graphic using the monthly totals of help wanted ads placed on the industry’s largest job board, April submissions fell to almost pandemic levels. In addition, jobs rolled also dropped during the same period, indicating an obvious industry downturn.

If you would like to let Wireless Estimator know about your company’s concerns, please contact Editor Craig Lekutis, in confidence, at craiglekutis@wirelessestimator.com