Scripted corporate earnings calls have a commonality: they are bland. However, Viavi Solutions Inc.’s President and CEO, Oleg Khaykin, left analysts and investors perked up after hearing his straightforward commentary about carrier CapEx spending for 2024 and 2025. As the country’s largest testing and monitoring equipment manufacturer for wireless networks and other industries, Viavi keeps a daily pulse on global infrastructure builds.

In a refreshing twist from the typical earnings call script, Viavi Solutions Inc.’s President and CEO, Oleg Khaykin, left analysts and investors buzzing with straightforward commentary during Thursday’s Q3 FY24 earnings discussion.

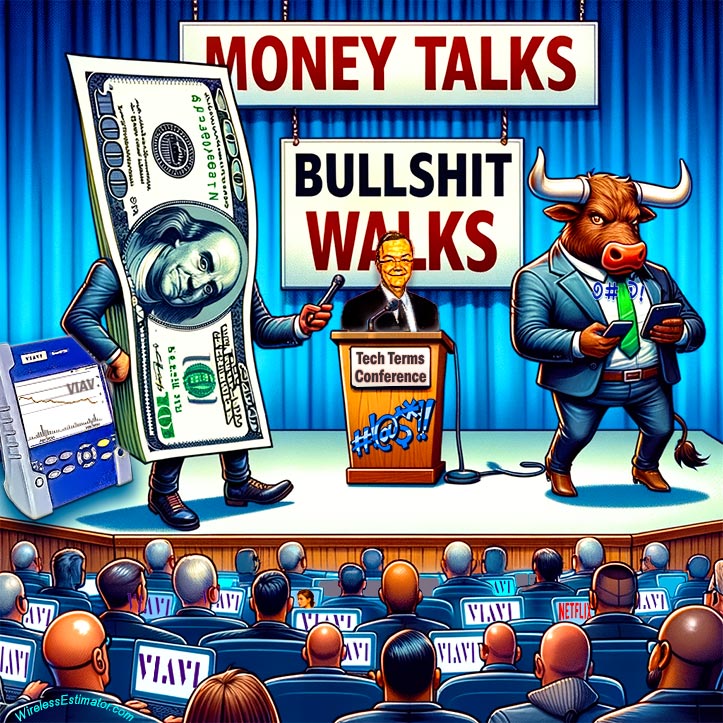

Departing from the usually reserved tone of such calls, Khaykin’s blunt assertion, “Money talks and bullshit walks,” underscored his frustration with the prevailing cautious spending behaviors among Tier 1 service providers and enterprise customers.

The conference call with CFO Ilan Daskal provided insights into the company’s financial health and future outlook amid a challenging market environment. Viavi reported a slight decline in year-over-year revenue, with third-quarter figures reaching $246 million, marginally above their forecasted range.

However, Khaykin’s candid explanation during the Q&A session with analysts captured the most attention.

Addressing service providers’ ongoing conservative capital expenditure strategies, Khaykin expressed skepticism about optimistic spending forecasts for 2025, suggesting that a real uptick would require a more aggressive market stance from competitors.

His frank language and direct approach clarified the underlying tensions in telecom spending, starkly contrasting the more measured tones typically found in corporate earnings calls.

There needs to be a shootout: Khaykin

Viavi CEO Oleg Khaykin believes that if one carrier became more competitive, in order for others to prevent them from muscling in, the carriers would have to increase their CapEx and build programs instead of using their cash to pay down debt. He’s calling for a shootout to prevent what he sees as a Mexican standoff.

Khaykin said the industry needs a “shootout,” and one carrier needs to compete for a higher market share. Analysts and reporters have frequently agreed upon this measure, and it could assist in reversing the industry’s downturn. Still, it’s the first time an executive entrenched in wireless infrastructure has publicly broached it.

“If your competitors are not trying to muscle in on your market, and it’s a fairly steady-state equilibrium market, every quarter that everybody stays disciplined, you’re generating a massive amount of cash. You’re not spending CapEx, you’re really economizing on OpEx, and you continue to collect your subscriptions.”

“I mean, that is like the best possible scenario you can have, right, to generate cash, and you take the cash and take down your debt. The moment somebody — the moment the first person tries to grab share and tries to get ahead, that’s when all the bets are off, and then it’s off to the races,“ explained Khaykin.

A question drives Viavi chief to unpack the “B“ word

An analyst asked Khaykin if his team has heard about Tier 1 U.S. service providers, stating that 2024 is not a year of network expansion or growth capital but that they are “sort of“ planning for 2025.

“I believe it when I see it. Money talks and bullshit walks, to use a very technical term here. I mean, they all can say whatever it is. I mean, look, we’ve seen the cable players. We’re going to do a major upgrade expansion,” Khaykin replied.

“And they just kind of looked around and they just see the interest rates are not getting longer. And they’re all taking a very prudent view to just kind of kick the can down the road. And look, from what I see here is, I mean, unless somebody starts getting hungry and tries to grab market share and get ahead of their competition. Right now, it’s a — I wouldn’t call it a collusion, but it’s kind of everybody — I would call like probably more of a Mexican standoff. Everybody is standing with their guns loaded, looking at each other.”

Khaykin said that if nobody pulls the trigger, things will go according to plan. He noted that if carriers do decide to start expanding and upgrading their network, they are going to duplicate demand because not only will they need to replace the installed base for network maintenance, but every time they start building out and expanding, they’ll need to buy new tools for that as well.

“So to the extent you believe ’25 will be an expansion of the beginning — expansion of the network as well as the upgrade of the network, it actually would put even greater pressure to upgrade and replace the installed base of equipment in the field.“

Khaykin’s comments may resonate with stakeholders looking for clear signals in an industry often clouded by cautious optimism and strategic hedging.