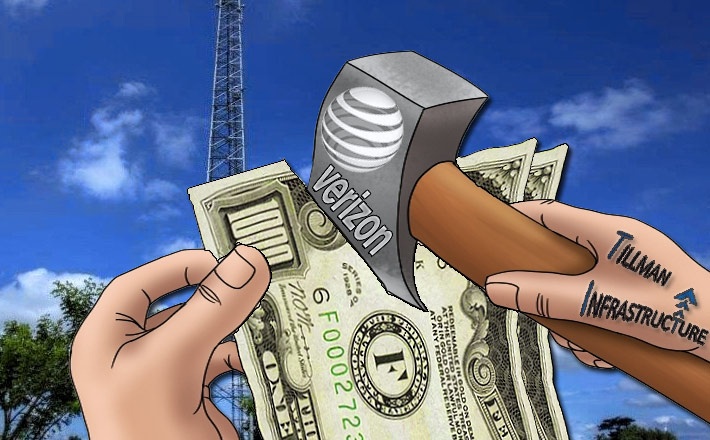

Last year, Tillman struck a deal with AT&T and Verizon to cut their lease rates by offering better terms than the big three towercos

Build-to-suit developer Tillman Infrastructure, currently building sites in over 36 states across the U.S., will receive up to $1 billion in additional funding from La Caisse de dépôt et placement du Québec (CDPQ) and global investment manager AMP Capital, with an initial investment of $500 million.

Tillman’s biggest clients are AT&T and Verizon. Both carriers last year announced a joint agreement to build hundreds of cell towers, with the potential for significantly more new site locations in the future.

Tillman, which describes itself as “a disruptive US Telecom tower builder and operator,” is owned by Tillman Global Holdings, which owns Apollo Towers based in Myanmar and has a portfolio of close to 2,000 towers.

According to a press statement, the first Tillman tranche will help finance the construction of new telecommunications towers to satisfy demand for coverage in additional locations, provide new service opportunities for carriers, and increase the overall communications infrastructure in the U.S. Under this agreement.

Founded in 2016, Tillman began construction on its first sites in late 2017 and is actively building in over three dozen states across the U.S.

Marc Cormier, Executive Vice-President, Fixed Income at CDPQ, said: “With Tillman’s strong leadership and seasoned experts, along with our partner AMP Capital, we look forward to contributing to Tillman’s great potential. It has a competitive product that delivers coast-to-coast speed and efficiency. The company will only continue to benefit from a growing demand for data that will drive mobile infrastructure spending and development for years to come.”

AMP Capital Infrastructure Debt Partner Patrick Trears said: “With the investment in Tillman, we are pleased to add another terrific asset to the portfolio for our investors around the world. We see strong value in the North American telecommunications infrastructure market and expect it will be a driver of future growth for our platform.”

“The proliferation of data globally will see an increasing demand for telecommunication infrastructure and Tillman is well-positioned to capitalise on the growth opportunity. The transaction marks the second investment in telecommunications infrastructure in the region since the close of AMP Capital’s Infrastructure Debt Fund III last year and highlights the strength of our partnerships with leading institutional investors like CDPQ.”

Tillman Infrastructure Chief Financial Officer Suruchi Ahuja said: “We are excited to have found great partners in CDPQ and AMP Capital to fuel the next stage of our aggressive growth plans. We are committed to continue to be the carrier friendly and carrier preferred infrastructure provider, and a true partner to our customers as they focus on expanding their coverage and capacity across the nation.”