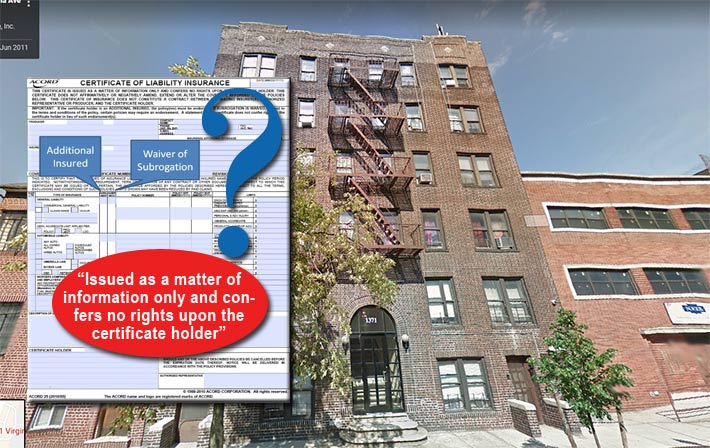

The Washington State Supreme Court’s decision on the validity of an additional insured form will shape how carriers and other clients view the standard Accord form. Although T-Mobile was named as an additional insured, they were denied coverage from their contractor’s insurer when an antenna installation allegedly damaged this apartment building’s roof in the Bronx, NY.

Selective Insurance Company of America (SICA) must cover T-Mobile’s costs in a lawsuit alleging the carrier’s antenna installation contractor damaged a building in the Bronx, NY, a split State of Washington Supreme Court said Thursday, settling a critical issue at the center of a Ninth Circuit coverage dispute that may shape how the standard Accord insurance form is viewed from a legal perspective.

Last November, the Ninth Circuit panel asked the state’s high court: “Under Washington law, is an insurer bound by representations made by its authorized agent in a certificate of insurance with respect to a party’s status as an additional insured under a policy issued by the insurer, when the certificate includes language disclaiming its authority and ability to expand coverage?”

In its decision, the State Supreme Court said, “We answer the Ninth Circuit’s certified question this way: an insurance company’s agent who makes an authoritative representation binds the insurance company, even when that specific representation is transmitted via a certificate of insurance and accompanied by general disclaimers.”

After T-Mobile was sued over damage to a building located at 1371 Virginia Ave. caused by a rooftop cell site, a disagreement arose over whether T-Mobile was entitled to coverage as an additional insured under a SICA insurance policy taken out by the contractor, Innovative Engineering, Inc.

In 2012, SICA’s authorized agent and insurance broker, the Van Dyk Goup, Inc. (VDG) issued a certificate of insurance (COI) to T-Mobile. The COI said that T-Mobile USA, as the certificate holder, “is included as an additional insured” under the policy.

But it also stated, in capitalized and bolded text, that the COI “is issued as a matter of information only and confers no rights upon the certificate holder,” “does not affirmatively or negatively amend, extend or alter the coverage afforded by” the policy, and “does not constitute a contract between the issuing insurer(s), authorized representative or producer, and the certificate holder.”

The COI further warned that “[i]f the certificate holder is an ADDITIONAL INSURED, the policy(ies) must be endorsed” and that “[a] statement on this certificate does not confer rights to the certificate holder in lieu of such endorsement(s).”

The Supreme Court ruling noted that the agent explained that it began issuing the T-Mobile Additional Insured certificates of insurance because the contractor informed them that its agreements with T-Mobile required that T-Mobile be named as an additional insured under the contractor’s insurance policies and that T-Mobile qualified as an additional insured per the standard terms of SICA’s policies for that reason. SICA never objected to the agent’s issuance of the certificates.

Given those facts, the Ninth Circuit held that the agent acted with apparent authority in issuing the certificate at issue, which “clearly lists T-Mobile USA as an additional insured under the policy.”

But when T-Mobile requested that SICA represent them, they were informed of the COI’s disclaimers that were in bold text and they would not be covered.

The Supreme Court disagreed, viewing the bolded text and agreed with T-Mobile that it was basically ‘boiler plate’.

Supreme Court Justices Barbara Madsen and Susan Owens dissented, stating: “Certificates of insurance cannot supplant a policy that does not award coverage. Certificates are tools of the insurance trade. They are informational documents only.”

“Certificates do not confer insurance coverage—which is found in the insurance policy itself—nor do they create a contractual relationship between an insurer and an additional insured.”

The decision is available here. The Wireless Estimator November Ninth Circuit filing article can be viewed here.