DigitalBridge Group. Inc. today announced that funds affiliated with DigitalBridge Investment Management, the Company’s investment management platform, have reached a definitive agreement to acquire a controlling stake in Vertical Bridge Holdings, LLC (Vertical Bridge), the largest private owner and operator of wireless communications infrastructure in the United States.

As the operator of the largest independent tower platform in the U.S., Vertical Bridge is positioned to continue scaling rapidly, capitalizing on tower market growth opportunities driven by the strong tailwinds from enhanced data consumption and development of next-generation digital services that underpin investment in 5G networks and digital infrastructure to support IoT applications.

Since its founding in 2014, Vertical Bridge has expanded its portfolio to include over 308,000 owned or master-leased sites, including over 8,000 towers across the U.S.

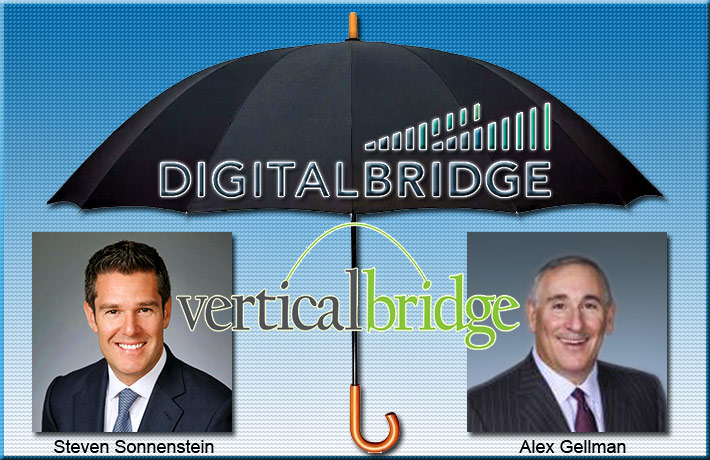

“Vertical Bridge is the leading independent tower platform in the U.S., led by the preeminent tower management team in the industry,” said Steven Sonnenstein, Senior Managing Director of DigitalBridge Investment Management.

“Significant acceleration in 5G infrastructure spending in the U.S has created a tremendous long-term growth opportunity for telecommunications infrastructure and demonstrated that investments to support the next generation of mobility continue to be a powerful thematic. By consolidating Vertical Bridge’s ownership via our fund management business, we will not only extend our long-standing relationship, but we will be even better positioned to support the Vertical Bridge team as they build on their market leadership and capitalize on exciting growth opportunities,” said Sonnenstein.

“We have experienced significant, industry-leading growth at Vertical Bridge since our inception, scaling our platform to meet the evolving needs of our customers,” said Alex Gellman, Chief Executive Officer of Vertical Bridge.

“This financial commitment not only positions Vertical Bridge to meet the rising demand for infrastructure solutions in light of new technologies, but also accelerates the substantial organic and inorganic growth opportunities available to us in this dynamic market. We look forward to continuing to work with the DigitalBridge team as we expand our asset portfolio to become a stronger and more agile partner serving the U.S. wireless and broadcast markets,” said Gellman