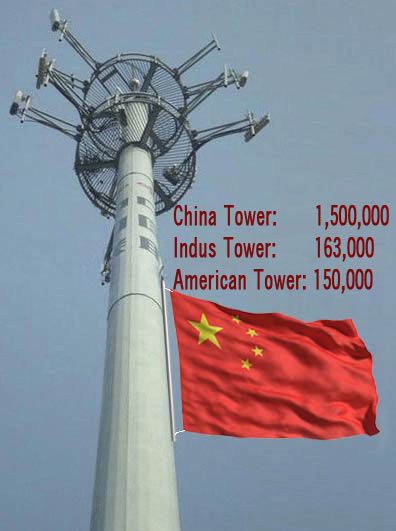

India’s Bharti Infratel Ltd has agreed to merge with Indus Towers, in a deal that creates the world’s second largest telecom tower company, a title that American Tower formerly held.

The new company with more than 163,000 towers has an estimated equity value of $14.6 billion

The new company with more than 163,000 towers has an estimated equity value of $14.6 billion

Indus Towers’s tower total lags considerably behind the world’s largest tower owner, China Tower which reportedly has a staggering 1.5 million towers.

Bharti Airtel already owns a 42% stake in Indus Towers, with Vodafone Group owning another 42%, Idea Group owning 11.15% and Providence Equity Partners owning the remaining 4.85%.

Post-merger, Vodafone will be issued 783.1 million new shares in the combined company, while Idea Group will be given the option of selling its shares in the company or taking shares based on the merger ratio, and Providence will be given the option of selling most of its holdings.

Presuming Idea and Providence take up the option of selling their shares for cash, Airtel’s shareholding in the combined company will be diluted to 37.2% and Vodafone’s shareholding would be diluted to 29.4%.

Vodafone and Idea had previously stated they would look at selling their stakes in Indus and other tower assets they separately own to help cut debt for the merged telecoms carrier.

The deal also comes a day after Bharti Airtel reported its smallest quarterly profit in 15 years, hit by the price war triggered by rival Reliance Jio Infocomm which has been a disruptive force in the Indian telecommunications market.