ALTHOUGH ALL MAJOR TOWERCOS BUY LEASES held by their competitors, Vertical Bridge claims that Everest Infrastructure Partners is using proprietary confidential trade secret-protected pricing terms to do so. That information was provided to Everest by the landowner, Vertical Bridge alleges, who was aware that they were under a confidentiality agreement with Vertical Bridge to not disclose any terms.

Vertical Bridge REIT, LLC has filed a lawsuit against competitor Everest Infrastructure Partners (EIP), alleging that it ran an unfair “multi-million dollar scheme to unlawfully improve its market share” at Vertical Bridge’s expense through trade secret misappropriation, interfering with existing contractual relations and false advertising.

Vertical Bridge, the tower arm of Digital Bridge, requests that EIP provide an accounting of all sums earned from its unlawful actions, and having the court enjoin them from interfering with existing and prospective contractual relationships with tower site landlords. They’re also seeking punitive damages and lost profits and want EIP to give up any profits they made due to their illegal and wrongful conduct.

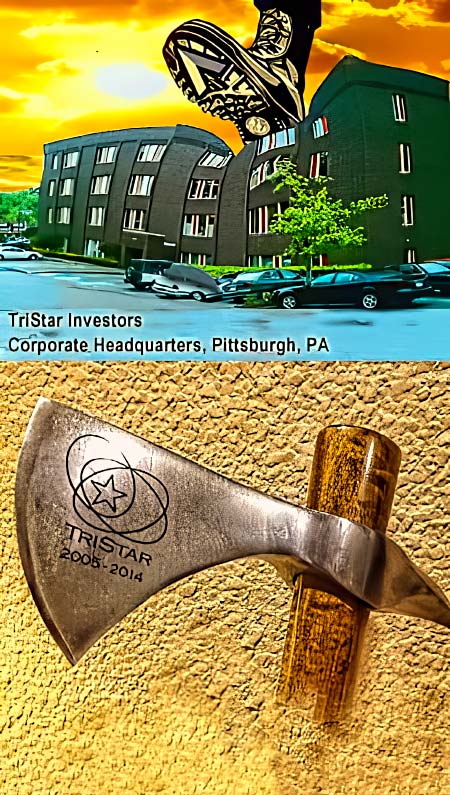

Vertical Bridge said that several of EIP’s current principals owned TriStar Investors, an aggregator that was sued by American Tower for similar allegations. TriStar countersued, and the two towercos buried the hatchet in an undisclosed agreement. TriStar possibly agreed to the settlement when attorneys’ fees started reaching the high six figures. EIP might be able to weather attorneys’ fees since it announced yesterday that it had closed on $500 million in new capital commitments.

Vertical Bridge also alleges EIP has undermined its first right of refusal in purchasing the land underneath its towers.

In the complaint, Vertical Bridge states that EIP’s illegal business design isn’t new.

They stated that several of EIP’s current principals, including its CEO and general counsel, previously owned and operated a company called TriStar Investors, Inc. In 2012, American Tower (ATC) sued TriStar and its principals in Texas for unlawful business practices, including misappropriation of trade secrets.

Vertical Bridge said TriStar ceased operations shortly after the conclusion of the litigation.

But some time later, certain principals of TriStar created Everest to continue the scheme under a new name.

According to an extensive review of the lawsuit by Wireless Estimator, TriStar alleged that ATC made false statements to landlords. It was also found during discovery that ATC claimed that SBA Communications had made a $2.4 million investment for 9% of TriStar’s stock, and Crown Castle subsequently bought 14% of it for $13 million and were funding TriStar, which ATC said falsely represented itself as “a small feisty competitor to the big tower companies.”

In last week’s lawsuit, Vertical Bridge said most of their contracts include confidential trade secret-protected pricing terms and price structure information, including rental payments and periodic payment increases.

They state they use a confidential formula to set the pricing terms on an individual site basis and incorporate provisions that prohibit landlords from disclosing the terms of their contracts to third parties.

They claim that EIP solicits their ground leases with less than ten remaining years, knowing that the information they get from the landlord includes protected trade secrets.

As part of EIP’s solicitation efforts, Vertical Bridge says the company makes deceptive promises to landlords that they will receive a percentage of the revenue that Everest will receive.

“The promise is illusory because Everest knows full well that even if it supplants Vertical Bridge,

“Everest will have no tenant revenue to share,” Vertical Bridge claims.

“In certain instances, Everest’s illusory promise includes an offer to buy a small portion of the landlords’ land to host its own tenants to provide revenue share to the landlords. In making that offer, Everest does not inform the landlords that, as a matter of industry practice, tenants are highly unlikely to sublease space on Everest’s sites if Vertical Bridge’s towers are already operating nearby, and as a result, Everest would have no revenue to share with the landlords.”

Vertical Bridge said that EIP fails to inform landlords that most of the financial benefit promised is contingent on Vertical Bridge keeping the towers in place after the current contracts expire, which EIP is aware that Vertical Bridge would not and does not do.

Vertical Bridge said that EIP has acquired multiple contracts containing confidential information and ignored the trade secret protections it had in place by using that information to structure highly competitive offers specifically tailored to the landlord that would “damage Vertical Bridge’s reputation with landlords and tenants.”

The Boca Raton-based towerco says that those offers are competitively unfair.

“… unlike Vertical Bridge and almost all other telecommunications infrastructure companies, Everest’s operations include an extreme form of a business practice known as ‘tower land aggregation’ or simply ‘tower aggregation.’ Legitimate tower aggregators offer landowners lump-sum payments that are a fraction of the expected total rental revenue, based on the tower aggregator’s estimation of market rent and utilizing a market-determined multiple. In exchange, the tower aggregator assumes the landowner’s interest in their lease agreements with the telecommunications infrastructure company and receives the monthly rent payments that the company would have made to the landowner. In so doing, the tower aggregator receives a steady stream of income, and the landowner exchanges that stream for a one-time up-front payment.”

“Tower aggregators are typically not themselves telecommunications infrastructure companies in that they do not own or manage or operate towers or have relationships with telecommunications tenants. Everest, by contrast, is a telecommunications infrastructure company that deploys a form of tower aggregation made possible only by unlawful misappropriation of trade secrets in order to tortiously interfere with existing VB Contracts (as well as the contracts of other telecommunications infrastructure companies) to increase its market share,” Vertical Bridge said in its lawsuit.

EIP and Vertical Bridge will not comment on an ongoing lawsuit.