Infrastructure company Black & Veatch announced this morning that it has sold its wireless telecommunications infrastructure business, a subsidiary of Overland Contracting, to Ansco & Associates, a wholly owned subsidiary of telecom engineering and construction services company Dycom Industries.

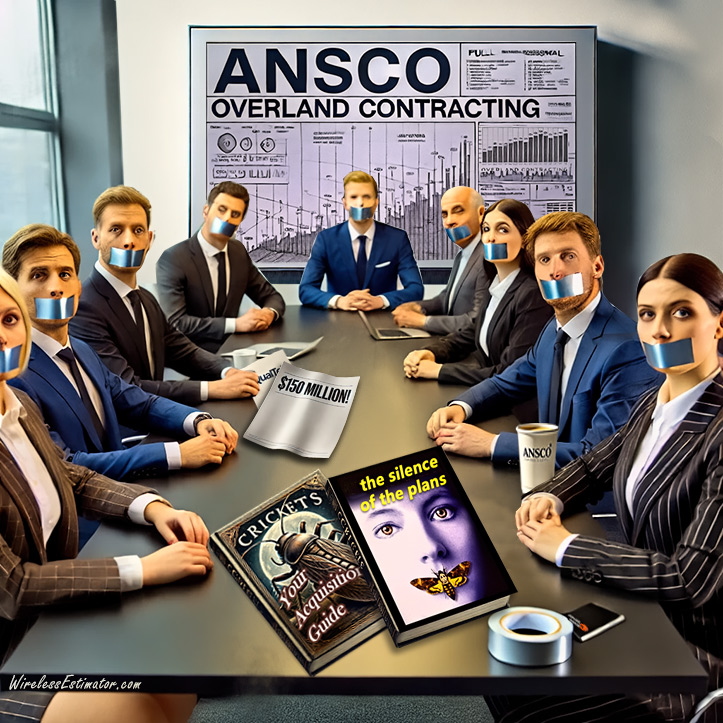

Dycom also put out a brief one-paragraph release announcing the acquisition, alerting media to the news that was already well-known by Overland’s contractors, who were aware of the deal in mid-July and could not obtain any information from Overland’s management team who Ansco reportedly onboarded in early August.

For the past weeks, neither Overland, Black & Veatch nor Ansco has responded to requests from Wireless Estimator regarding contractor concerns regarding past-due invoicing and planned projects that were put on hold.

As of this afternoon, two Overland Contractors said they still have not received any correspondence regarding the sale or the future direction of their workforce.

According to Dycom’s Q2 report, the company paid $150 million in cash for Black & Veatch’s employee-owned wireless infrastructure business. This business provides wireless construction services primarily in the states of New York, New Jersey, Missouri, Kansas, Colorado, Utah, Wyoming, Idaho, and Montana.

For fiscal 2026, the acquired business is expected to contribute $250 million to $275 million of contract revenues.

Dycom said in a release that the acquisition “strategically strengthens Dycom’s customer base and expands the geographic scope to more broadly address growth opportunities in wireless network modernization, including Open RAN transformation initiatives and deployment services.”

Dycom expects the Overland unit to contribute between $250 million to $275 million in contract revenues during its fiscal year 2026 and to add $1 billion to its backlog.

In a presentation of Dycom’s most recent quarterly results, released today, Dycom noted that the B&V business is “currently focused on site acquisition for next year’s construction program” and, therefore, would have “modest revenues” in the next two quarters.

Black & Veatch said that while it is selling its public carrier wireless business, it will continue to provide wireline and fiber connectivity, private wireless telecom networks, and grid modernization solutions that require wireless technology.

According to company data, Dycom’s top five customers during its fiscal second quarter for 2025 included AT&T, which accounts for 17.5% of contract revenues, or $210.2 million, an increase of $35.9 million over the 2023 period; Lumen, contributing 13.6% of contract revenues, or $163.7 million; Comcast, with 8.8% of contract revenues, or $105.6 million; and Verizon, at 7.1% of contract revenues, or $85.3 million, a decrease of $19.6 million from 2023.

Dycom also stated that it had previously acquired another telecom infrastructure construction business for $20.8 million, which extended its geographic footprint to Alaska. However, they did not identify the company that could generate income from the state’s $1 billion in BEAD money.

Last August, Dycom acquired Bigham Cable Construction, Inc., for approximately $130 million.

Dycom currently has 15,900 employees. It has been estimated that the addition of the Overland Contracting employees will add close to 300 new hires, many of them who reportedly had to sign a non-disclosure agreement before being onboarded, according to one individual knowledgeable of the acquisition. Ansco has approximately 1,500 employees.