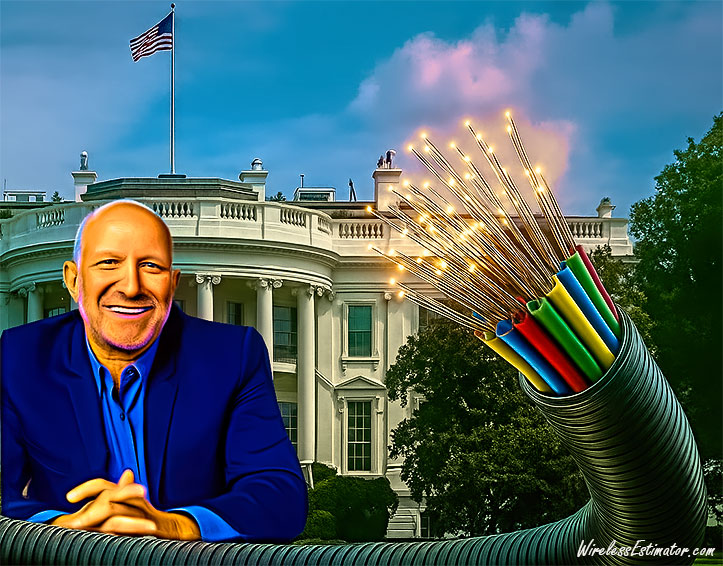

THREE MONTHS after Commerce Secretary Howard Lutnick pledged to revamp the $42.45 billion BEAD program, the new guidance unveiled Friday eliminates what Lutnick described as “burdensome regulations” imposed by the Biden administration. While it formally removes fiber’s preferred status, the technology is still likely to remain the top choice for most states.

The National Telecommunications and Information Administration’s (NTIA) June 6, 2025, BEAD Restructuring Policy Notice reframes the Broadband Equity, Access, and Deployment (BEAD) Program with a stated goal of “technology neutrality.” But a close read reveals that while the language has changed, the outcome is likely to remain fiber-centric.

The notice formally eliminates the Biden-era “fiber preference” and other regulatory requirements like climate benchmarks, workforce mandates, and middle-class affordability rules. However, the newly adopted scoring rubrics, subgrantee selection mechanisms, and performance benchmarks heavily favor fiber-based deployments in practice, especially for priority broadband projects.

A revised definition, but the same champion

Under the new rules, any technology can theoretically qualify as a priority broadband project. To do so, it must:

- Provide service of at least 100/20 Mbps

- Have latency at or below 100ms

- Scale to meet evolving needs (including 5G and other advanced services), and

- Be installable within 10 business days without delays attributable to network extension

The NTIA makes it clear that any project meeting these benchmarks, regardless of the technology used, is eligible. However, the burden of proof falls on applicants using wireless or satellite technologies to demonstrate compliance. Fiber providers, by contrast, often meet these criteria by default.

All states are now required to reopen subgrantee selection via a new “Benefit of the Bargain” round. Preliminary awardees must be rescored or requalified, and all past fiber-favoring biases are to be removed. Yet, states may give additional weight to previously selected applicants, most of whom are fiber providers.

Even with this reset, fiber proponents cite its advantages:

- Fiber providers typically passed the earlier NOFO’s qualification process

- They have well-developed engineering and financial plans

- They avoid the technical scrutiny now required of ULFW and LEO providers.

The Policy Notice allows unlicensed fixed wireless (ULFW) and low Earth orbit (LEO) satellites to compete, but they face heavy burdens.

ULFW must: Prove mitigation of spectrum interference; demonstrate the capacity to deliver simultaneous 100/20 Mbps to all BSLs; submit design documentation to satisfy new technical criteria.

LEO providers must: Reserve and guarantee capacity for 10 years; provide subscriber equipment at no cost; accept clawback, performance timelines, and extended letter of credit conditions.

The NTIA will not take a federal interest in LEO networks, but will monitor their performance as rigorously as it does for terrestrial networks.

States still hold the steering wheel

The policy notice gives states latitude to shape outcomes through scoring. The primary criterion is minimal BEAD cost per location. The secondary criteria are deployment speed, network performance, and previous selection status.

Fiber often leads in all three, particularly in suburban, urban, and rural areas with tower access.

States must also remove served areas from eligibility lists, particularly if ULFW providers demonstrate viable existing service. Still, NTIA warns that unsupported claims will result in the area staying BEAD-eligible.

While the NTIA has stripped away explicit fiber favoritism, the rules still create a steep climb for alternative technologies. Fiber remains the path of least resistance to BEAD funding.

Eligible entities may no longer be allowed to exclude a technology outright; however, the technical, operational, and economic hurdles built into the Policy Notice strongly suggest that for most areas, especially those with density, existing infrastructure, or anchor institutions, fiber will prevail.

The new policy has sparked significant concern across the broadband community. Critics argue that the abrupt policy shift forces states to reset their subgrantee selection processes, erasing extensive planning and procurement efforts. Many fear that the new scoring rubric, which prioritizes cost minimization over long-term performance, may result in a wave of awards going to lower-cost technologies like fixed wireless and satellite, even in areas where fiber was previously deemed the most suitable solution.

Broadband equity advocates have warned that this approach could exacerbate the digital divide by funding infrastructure that lacks the scalability, reliability, and capacity of fiber networks. Concerns have also been raised that prioritizing short-term cost savings over durable infrastructure undermines the program’s original intent to make long-term, future-proof investments, particularly in light of global competitors aggressively pursuing fiber deployments.

Blair Levin, a policy advisor at New Street Research, shared with investors that this realignment prioritizes cost-effective solutions, such as satellites and fixed wireless, over traditional fiber buildouts, positioning these alternative providers as likely top beneficiaries under the revised rules. States must now restart their applications within 90 days, potentially delaying broadband deployment by several months but opening the door for these technologies to compete more effectively.

At the same time, Senate Democrats have expressed concern that the new rules represent a rollback from the BEAD program’s original goals. They argue that prioritizing short-term cost savings over lasting, high-capacity infrastructure undermines the long-term viability of rural broadband access

The policy changes echo parts of the Trump-era approach, which critics say was too favorable toward satellite megaprojects, risking a departure from the durable investments that fiber networks offer.