A searing and thoroughly sourced white paper from an anonymous industry insider warns that the nation’s tower and wireless infrastructure sectors are on the verge of collapse, hollowed out by unchecked consolidation, one-sided contracting practices, and the commoditization of a skilled workforce – a strategy that is fast becoming a tragedy for the men and women that build and maintain the nation’s wireless infrastructure.

Wireless Estimator has chosen to publish the white paper in full due to its compelling accuracy, depth, and relevance to current industry challenges. The author, whose identity is being withheld, works with the nation’s largest mobile carriers and would likely face professional retribution if their name were attached to the document. Their anonymity, however, does not diminish the credibility of their insights — it underscores the stakes.

From Boom to Breakdown

The white paper begins with a historical account of the industry’s rise, from the early cellular days of the 1980s to the explosive growth that followed the Telecommunications Act of 1996. As the mobile landscape shifted from 2G to 3G and beyond, tower service contractors expanded to meet the demands of America’s insatiable wireless growth. Equipment upgrades, densification, and the launch of 4G fueled unprecedented revenue and job creation. Trade schools flourished, safety standards improved, and the Communications Infrastructure Contractors Association (NATE) became a force for professionalism and progress.

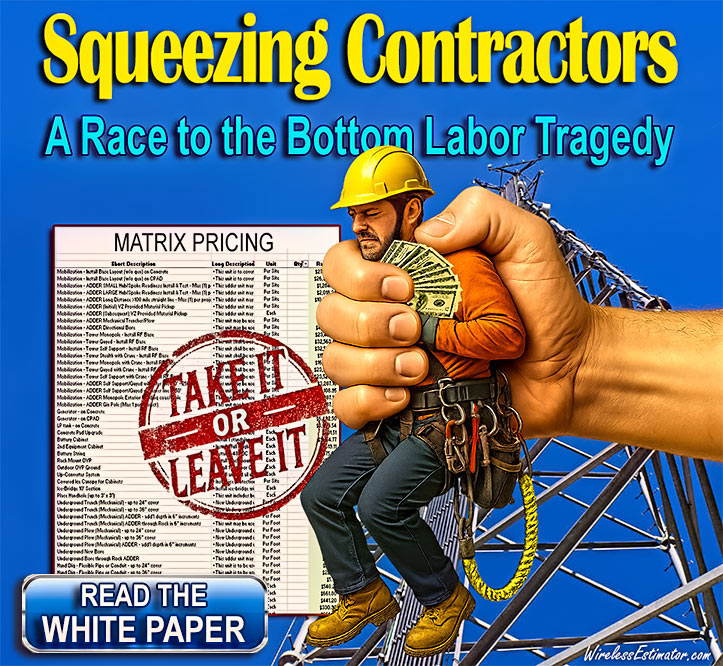

But that initial growth masked a slow descent. As mergers shrank the number of major carriers and investment dollars flooded the space, competition shifted from quality to scale. Equity-backed rollups and large general contractors began chasing revenue at the expense of margin, dragging down per-hour pricing. Then came matrix pricing — spreadsheets dictated by Mobile Network Operators (MNOs) that locked contractors into take-it-or-leave-it rates, regardless of market conditions or actual costs.

As costs soared due to inflation and outsourcing, those fixed rates remained unchanged. MNOs offloaded safety, warehousing, and procurement tasks to third parties — but contractors were forced to foot the bill. When contractors objected, they were told someone else would take the work. Eventually, many did: unqualified 1099 crews with falsified certifications and rock-bottom bids flooded the market, further destabilizing safety and wages.

The paper cites the 2023–24 recession as a breaking point. MNOs simultaneously paused capex, canceled purchase orders, and laid off workers — leaving contractors with idle inventory and no work. Even as 5G’s hype fizzled, prices stayed flat. The final insult? Some of the nation’s most critical infrastructure is now being built and maintained by unvetted, sometimes undocumented workers, while qualified contractors are pushed out.

A letter to the editor published by Wireless Estimator in late 2024 identifying The death of Tower Contracting From an Insider, sparked a broad reckoning. NATE issued a warning. And a petition to FCC Commissioner Brendan Carr followed. For the first time in years, contractors nationwide are uniting in their call for reform.

With a new FCC Chairman and a White House that claims to prioritize Main Street over Wall Street, the author sees a window of opportunity for change — but only if carriers are willing to return to the table. The message is clear: restore fair pricing, uphold safety standards, and stop shifting risk to those who can least afford it.

“We ask to make us your partners once again in utilizing the precious natural resource of wireless spectrum… There is enough for all in America. There is no need to be selfish,” the author concludes.

It’s a must-read for carriers, contractors, regulators, and all Americans who rely upon the nation’s telecom networks.