|

From the landowner's perspective...

"Why is there all of this interest in my cell tower lease all of a sudden?" lease all of a sudden?"

By Ken Schmidt

June 2, 2008 - In the last few years, landowners with cell tower leases or rooftop cell site leases are being bombarded by inquiries from the lessees and from third parties alike. To the uninformed landowner, the bombardment appears to suggest that there is increased value in the underlying lease agreement. If not, why would all of these third party companies be contacting the landowners?

The inquiries take the following shapes:

Cell Tower Lease Renegotiations - Direct: A tower company or cellular carrier directly contacts the landowner in an attempt to negotiate a reduction in the lease rate. There is often either an implicit or direct threat that failure to negotiate will cause termination of the underlying lease agreement. Cell Tower Lease Renegotiations - Direct: A tower company or cellular carrier directly contacts the landowner in an attempt to negotiate a reduction in the lease rate. There is often either an implicit or direct threat that failure to negotiate will cause termination of the underlying lease agreement.

Cell Tower Lease Renegotiation - Indirect: The tower company or cellular carrier retains the services of a third party optimization company that will attempt to negotiate a reduction on behalf of the carrier for a percentage of the savings going forward. These companies can collect upwards of 30% of the savings. The optimization firms typically use high pressure sales techniques from salesmen who have little to no experience in wireless. Cell Tower Lease Renegotiation - Indirect: The tower company or cellular carrier retains the services of a third party optimization company that will attempt to negotiate a reduction on behalf of the carrier for a percentage of the savings going forward. These companies can collect upwards of 30% of the savings. The optimization firms typically use high pressure sales techniques from salesmen who have little to no experience in wireless.

Cell Tower Lease Buyouts - Direct: The large tower companies attempt to purchase the remainder interest in the ground lease from the landowner. Typically, these transactions are structured as a purchase of a perpetual easement in exchange for a lump sum of 10 years or more worth of the current rent amount. Cell Tower Lease Buyouts - Direct: The large tower companies attempt to purchase the remainder interest in the ground lease from the landowner. Typically, these transactions are structured as a purchase of a perpetual easement in exchange for a lump sum of 10 years or more worth of the current rent amount.

Cell Tower Lease Buyouts - Indirect for the cash flow: There are a number of companies that were created solely to target the acquisition of the ground leases and rooftop leases. The companies purchase the leases via a fixed term easement or an assignment of lease and a successor lease that kicks in for a defined number of years at expiration of the original lease. Cell Tower Lease Buyouts - Indirect for the cash flow: There are a number of companies that were created solely to target the acquisition of the ground leases and rooftop leases. The companies purchase the leases via a fixed term easement or an assignment of lease and a successor lease that kicks in for a defined number of years at expiration of the original lease.

Cell Tower Lease Buyouts - Indirect for takeover of the tower: There are a few companies and individuals who are aggressively contacting landowners with towers who have multiple tenants. These companies are buying the ground rights under the tower under a perpetual easement with the purpose of taking over the ownership rights in the tower directly at the expiration of the ground lease. These companies target towers in difficult zoning areas where replacement or relocation would be impossible. Then at the expiration, they will negotiate a reduced lease rate with the current tenants in an attempt to get the wireless carriers to "encourage" the tower company to silently release the tower. The tower companies call them "vultures". Cell Tower Lease Buyouts - Indirect for takeover of the tower: There are a few companies and individuals who are aggressively contacting landowners with towers who have multiple tenants. These companies are buying the ground rights under the tower under a perpetual easement with the purpose of taking over the ownership rights in the tower directly at the expiration of the ground lease. These companies target towers in difficult zoning areas where replacement or relocation would be impossible. Then at the expiration, they will negotiate a reduced lease rate with the current tenants in an attempt to get the wireless carriers to "encourage" the tower company to silently release the tower. The tower companies call them "vultures".

Landowners find inquiries baffling

To the landowners, these inquiries can be bewildering. On one hand, they are being told that they need to sell or renegotiate their cell tower lease or face termination. On the other hand, they are being solicited with offers for 10 years or more of rent for the remainder rights to the lease. One ear hears there is a threat to the future of this income; the other hears that it must be safe for at least 10 years. As you might expect, the truth is somewhere in between. remainder rights to the lease. One ear hears there is a threat to the future of this income; the other hears that it must be safe for at least 10 years. As you might expect, the truth is somewhere in between.

There are a number of reasons why landowners are being solicited so heavily.

First, the tower companies and wireless carriers are trying legitimately to extend their cell tower ground leases and rooftop cell site leases. This is a necessity for any industry that has relied primarily on leases rather than the acquisition of property for their core network assets.

If you have read any of the earnings calls for the public tower companies or read their annual or quarterly reports, you will see frequent reference to the percentage of underlying ground leases for their towers that are at risk of expiration. You will also see frequent discussion of how "successful" their lease buyout programs have been.

In essence, the market is questioning how future revenue (partially the basis for the stock price) can be attributed to towers where the ground lease is not secure.

The tower companies need to document that these assets that sit on leased property are secure for a long period of time. In their quarterly and annual statements, there are charts showing what percentage of their ground leases are set to expire in 1-3 years, 4-7 years, etc. What these charts don't show is what percentage of the company's revenue is subject to expiration within 1-3 years, 4-7 years, etc.

If it is assumed that mature leases are more likely to have short remaining lease terms, and we assume that mature towers have greater per tower revenue, should the question not be how much revenue is subject to risk if ground leases are not renewed?

We surmise the answer is that the tower companies would prefer reporting percentages of leases rather than percentage of revenue. This is not to say that the tower companies aren't targeting high revenue leases with the buyout offers aggressively. This occurs at some public tower companies more aggressively than others.

Secondly, the tower companies and cellular carriers are now finding themselves burdened down by the poor management of site acquisition contracts in the past. History is replete with examples of poor site acquisition where the objective was to build out a new market as quickly as possible regardless of how high lease operating expenses were. These examples are still occurring even as new markets are being launched today.

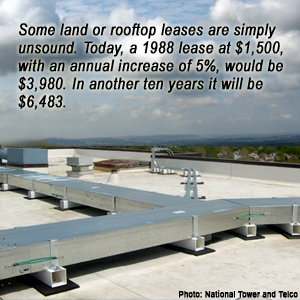

Rather than focus on lease costs, the target was always speed to market. Many older ground leases or rooftop leases have 5% or higher escalators, which over time significantly increases the cost of operating the site. These land leases or rooftop leases are simply untenable now due to the escalated cost of the lease.

In these cases, the leases should be either renegotiated or terminated provided that an alternative site(s) can be found. As an aside, our company is seeing increased use of capitalized leases for new leases where the landowner is given a lump sum up front for a 25 year lease. These lump sums are far less than what the carrier or the tower company would have paid during the course of the lease.

Third, the third party buyout companies are actively attempting to purchase leases. With three main lease buyout companies and numerous smaller entities actively trying to grow their portfolio, competition for lease buyouts has reached a feverish high. These companies are using high pressure sales techniques because they have to if they want to compete for the landowner's attention.

These techniques can often include trying to scare the landowner into selling. Alternatively, the buyout companies attempt to mislead the landowner by suggesting that a wireless carrier is interested in leasing their property when in fact there is none. We suspect that all of the three main lease buyout companies have no intentions of holding on to these leases; they are simply "churning and burning" to acquire as many leases as possible to resell at higher values to equity firms and investment banks who will then securitize them and resell to less intelligent buyers.

This creates motivation to buy more and more leases and a "gold rush" effect.

Fourth, some leases just aren't needed anymore or aren't profitable. Truth be told, in most cases landowners are poorly informed. This can work for and against the tower companies and wireless carriers. In some cases, there are legitimate reasons why a ground lease is too expensive. Steel in the Air regularly consults with landowners who have completely unrealistic expectations of what their lease is worth. They value their lease by finding out what other landowners get but fail to assess why those landowners are in better positions than they are.

Many towers that were built 5, 10 or 20 years ago are still single tenant towers, but the leases have escalated to a point where the ground lease is significantly higher than average. In some cases, it would be cheaper over the long run to terminate the existing lease and rebuild the tower at another location nearby where the landowner is more reasonable.

Fifth, in other cases where the tower company or wireless carrier asks for a reduction in their lease, they are simply trying to improve their bottom line even if the tower is highly profitable. As mentioned previously, here once again the landowners are typically poorly informed. The tower company, wireless carrier, and in particular, the lease optimization firms often rely upon misleading information or in some cases, completely false statements of "doom and gloom" about the prospects of the wireless industry.

Sixth, the merger of some of the large wireless carriers has in fact created redundancy in the carrier's combined networks, making some network sites unnecessary. Unfortunately, the carriers and lease optimization companies have seized upon this opportunity to create fear in the landowner's minds and make them question their resolve. Some landowners who failed to negotiate have lost leases. Others who agreed to reductions never had any risk at all. Once again, the landowner's ignorance is targeted.

Lastly, there are a number of opportunists out in the market who are identifying particularly valuable tower assets and endeavoring to take over the land rights underneath them. At a minimum, they will be able to negotiate favorable lease rates going forward. Alternatively, they will attempt to own the tower.

Opportunists flourish

Some of the opportunists have taken to making the landowners a "partner" in the future income of the tower if the opportunists are successful in taking over ownership rights of the tower. Others are simply taking the upside from uninformed landowners who do not realize that their lease can be renegotiated for a higher premium.

Amidst all of these inquiries, the landowner is left to determine the value of their lease alone and they typically do a fairly poor job at it. They typically research the internet for anything they can find on cell tower leases. They find numerous stories about leases on public property. Then they contact their attorney or CPA who more often than not knows little about cell tower leases.

They contact their neighbors with towers whose lease is typically not representative of value. Meanwhile they are being repetitively contacted by the lease buyout firms, the tower company, the wireless carrier, the optimization firms, and the opportunists who badger them to make a decision by a certain drop dead date. (Hint: these drop dead dates are almost never real).

Of course, the landowner can be and often is a benefactor in these transactions. Lump sum purchase prices for cell site leases are higher than in the past. Some landowners have been able to negotiate a new lease rate starting now even though their lease does not end for another 10 years. Some landowners have sold their lease and put the money to better use.

Others desperately needed the money from a buyout and had no other place to turn. Steel in the Air, Inc. believes that similar to the housing market, that there may be "irrational exuberance" in the lease buyout market currently that is supporting pricing that is not tied to realistic expectations of the wireless industry. If this is correct, perhaps we could be nearing a peak in pricing.

Whatever the scenario is, one thing is clear. Landowners should expect to be inundated with more and more offers as time goes by.

About the author: Ken Schmidt is President of Steel in the Air, Inc. His company provides guidance to landowners nationwide regarding cell tower lease related issues including cell tower lease buyouts, lease renegotiations, and lease expirations and extensions.

|