|

Some observers say it's not too early to push to talk about the impact of a Nextel spin-off

May 6, 2008 - In a move that will have a significant impact on the tower siting community, Sprint appears to be assessing spin-off options that would slice the company into a number of parts, according to a report in The Wall Street Journal.

The industry's number three carrier is seeking to sell its Nextel operation, its Achilles heel that has crippled the company's earnings. Last year they posted a $29.6 billion loss from writing down the value of the Nextel unit, which lost subscribers after complaints about customer service and poor call quality.

The potential move would help to remove the neglected iDEN two-way radio network off Sprint's hands now that the 2005 merger has been widely seen as a failure.

Unconfirmed reports indicate that Sprint is also looking to sell its long distance/fiber optic holdings.

The Journal reported that Deutsche Telekom AG, which owns T-Mobile's U.S. unit, might seek to buy Sprint. Deutsche Telekom and Sprint declined to comment. Shedding Nextel, acquired for about $35 billion, may help make the company a more attractive acquisition target, the Journal said.

Siting community might suffer

Some industry observers say that it is too early to speculate whether a T-Mobile/Sprint and/or Nextel partnership would benefit the wireless community. Numerous tower erectors and line and antenna installation company owners disagree, and believe that history will repeat itself and their businesses will suffer when integration issues arise and previously planned projects are put on hold or cancelled.

Citing the 2005 Sprint and Nextel mismatched marriage that derailed many millions of dollars of co-location and raw land builds, the continued consolidation of carriers, they say, might further depress pricing in an industry that is concerned by eroding margins.

"Even the re-branding of Cingular and the new AT&T pulled the plug on a number of our projects," stated a large Midwest contractor, who said he scrambled for almost two months to keep crews from remaining idle, oftentimes having to bid jobs at cost in order to maintain his workforce.

A regional manager for one of the nation's vertical realtors believes that a Nextel spin-off might be beneficial for the industry, depending upon which company acquires it. However, he was adamant that an acquisition of Sprint and Nextel by Deutsche Telekom would be "disastrous" for infrastructure providers.

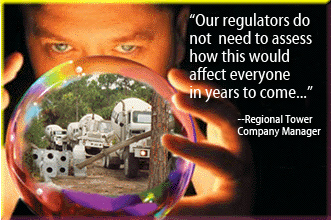

"Our regulators do not need to assess how this would affect everyone in years to come, all they have to look at is what the Bell System did to stifle competition in the telecommunications industry until the early '80s when they were forced to divest."

"T-Mobile could argue that there will still be three major wireless carriers to ensure competition. That's too much spectrum for too few companies, and could easily open up opportunities for pricing pressures for consumers and service providers as well," he said.

Cyren Call believes consortium is the right ticket

Sprint is also contemplating other possible buyers, such as private-equity firms, The Journal said, adding that the company may also choose to spin off Nextel into a separate company.

A number of analysts believe that Nextel's network could be a good fit for emergency response and public safety groups interested in operating the service. It would also open up a number of new opportunities for wireless suppliers and contractors.

Cyren Call, a company founded in early 2006 and based in McLean, Va., is reportedly working to put together a group of investors to buy Nextel, although Cyren Call wouldn't be one of the buyers. Cyren Call is headed by Nextel co-founder Morgan O'Brien. The company advises the Public Safety Spectrum Trust Corp. and is trying to help public safety organizations build a nationwide wireless network.

If Sprint's splinter strategy is successful, the carrier will be able to carry on as a pure wireless telco holding less debt and presumably more cash. But don't expect a Nextel deal to be a cash cow for the beleaguered company. Sprint may only get $5 to $8 billion for Nextel, according to Cowen & Co.'s Tom Watts. Two other Wall Street analysts peg Nextel's value between $8 and $10 billion.

Technology problems would still remain

On the technology front, a new consortium of investors put together by Cyren Call would appear to be a better suitor. The main problem Deutsche Telekom has to overcome is that T-Mobile USA and its European counterpart, T-Mobile, use a different wireless standard than Sprint Nextel. T-Mobile is GSM-based, whereas Sprint uses CDMA and Nextel uses iDEN.

Putting Nextel's and T-Mobile's technological differences aside, U.S. regulators would be sure to look closely at a merger that involves the nation's No. 3 and No. 4 wireless operators. Such a deal would leave the U.S. with just three national wireless carriers, an environment that would not be beneficial to the tower siting community.

Additionally, it's likely that U.S. regulators wouldn't like the deal because it would allow a foreign company - Deutsche Telekom - the opportunity to control the largest wireless communications network in the country, something security experts would caution against allowing.

Earlier last year, T-Mobile USA Inc. said that it was interested in selling up to 5,500 of its towers. Although they narrowed their four major tower companies and a few venture capital groups down to two bidders, the sale opportunity was cancelled because the initial pricing offered was insufficient, according to one of the finalists, who also stated, "It failed because the timing just wasn't right."

When Sprint purchased Nextel, the company added an additional 17 million subscribers to the Sprint/Nextel family, but by the end of 2007, almost 4 million subscribers divorced themselves from the underperforming wireless carrier.

The majority of the losses came from the Nextel side of the business. It lost 2.8 million customers just in 2007.

Qwest pulls the plug on Sprint and the FCC rules against them

Adding to Sprint's tough times, Qwest Communications announced earlier this week that it is ditching the company as the provider of its cellular service and switching its mobile-phone customers over to Verizon Wireless' network. The move will cost Sprint another 860,000 customers.

In addition, Sprint lost a federal appeals court case last week that gives the Federal Communications Commission the go-ahead to force Sprint to meet a June 26 deadline to vacate airwaves it uses that are close to public safety networks.

The company is involved in a massive project to eliminate interference between the Nextel network and radios used by police and firefighters. Sprint leaders say they are hopeful a compromise can yet be worked out, but also have said that the possible FCC actions could cripple the Nextel network.

Sprint had previously said that if it were not successful in the court action, its total rebanding costs could be more than $3.4 billion, including $1.1 billion it has already spent. If it won the decision, it had estimated the cost at $2.7 billion to $3.4 billion.

The carrier is still requesting that the FCC provide it with waivers to remain on the channels because more than 500 public safety agencies aren't ready yet to make the transition. Sprint's agreement requires them to provide spectrum to those agencies within 60 days of when they are ready to make the switch.

Mixed messages from analysts

Exploring the pitfalls of a Nextel sale, Goldman Sachs analysts, in a research report, said:

"A deeper dive highlights the complexity:

(1) credit markets are effectively still closed, and uncertainty around cash flow projections at Nextel further limits funding capabilities;

(2) legal risks are extremely high - involving FCC challenges around the Nextel spectrum swap, as well as probably bondholder and shareholder litigation;

(3) untangling the Sprint Nextel integration process would be a huge challenge, with Sprint executives recently highlighting the difficulty."

Other analysts are raising their ratings on Sprint and believe that the company would benefit from divesting itself from its Nextel albatross and would see its stock rise as a result.

During 2005, many analysts were issuing glowing reports about the Sprint Nextel merger announcement, advising their clients that the combined company would be the undisputed leader to beat in the wireless industry.

|