|

Project pricing, employee compensation and safety could be affected

LTE workforce shortfall could result in increased

pricing, injuries and fatalities

July 19, 2012 - There's no need to speculate whether the current shift from 3G to Long Term Evolution (LTE)-based networks will strain the available installation workforce; it already has,  and some industry executives believe that in the next six months it could rival the manpower shortages seen in the late 1990s after the FCC auctioned off the first PCS licenses. and some industry executives believe that in the next six months it could rival the manpower shortages seen in the late 1990s after the FCC auctioned off the first PCS licenses.

The National Association of Tower Erectors' Executive Director, Todd Schlekeway, said that in polling a number of the trade group's members last week he found a robust backlog of work.

"Those contacted indicated that their schedules are booked for the remainder of 2012 and most anticipate 2013 to be even busier with LTE work," Schlekeway said.

Although wireless technology has changed since the PCS build-out, two constants might remain from a lack of resources, according to industry leaders interviewed by Wireless Estimator: increased project pricing and a greater number of injuries and possibly deaths due to an unskilled workforce.

However, whereas almost all of 1990s' salaries saw hockey stick rises due to respectable margins coupled with the scarcity of talent, today's workers will not benefit as much from a high demand from a limited talent pool since the greater portion of new hires will be for entry level positions.

Tower techs appear to be in great demand

Even though finding local talent to fill any telecom position has become challenging, according to Niki Davidson, AllStates Technical Services’ Telecom Division Regional Director, "Tower climber positions are the most difficult to fill due to the fact that there just are not that many of them in the country."

A review of jobs posted during a 31-day sampling of 432 help wanted advertisements showed that almost two thirds of resources required were tower crew-level positions, and many of those for tower technicians.

Davidson said the skill sets for 4G/LTE are very similar to those required for 3G work, however, "the biggest difference is the introduction of fiber and stricter adherences to proper cabling tolerances, requiring field level equipment installers and construction technicians to have a deeper understanding of fiber installations and general telephony skills."

She said that her staffing company is seeing a greater demand for technicians that can not only do antenna installations, but also have the experience and ability to perform Ethernet installations, testing and equipment turn up.

Acknowledged as the U.S.'s largest cell site installation contractor, WesTower Communications is on a drive to increase the number of its self-performing crews to meet industry demand, according to V.P. of Resource Management, Daniel Adickes.

"Based upon my current knowledge of the crew needs versus the existing industry resources, I believe the industry will be challenged to aggressively increase industry resources to meet the needs in the second half of the year," said Adickes.

How many available crews are there?

Although everyone agrees that there is a manpower shortage, carriers, turfing contractors, general contractors and tower contractors - both large and small - share another common thread: they have no idea of how many crews or employees are available for LTE and other communications infrastructure projects.

Although 10,000 workers has been a bellwether number used by many industry analysts, that count is probably well south of the actual number of available field personnel capable of performing LTE and other upgrade projects, according to research by Wireless Estimator.

During 2005, Wireless Estimator commissioned an extensive three-month survey that identified that there were approximately 8,700 employees nationwide that climbed communications supporting structures for their employer. In 2009 it was revised to approximately 10,500.

Today, that number could be upwards of 15,000 to 20,000 or more, but it's only an estimate without any actual data to support it.

Staffing solutions help to complicate the count

Bigger hasn't always been better for a few major companies over the years during lean times and they've downsized and aligned themselves with a network of smaller companies. They're also relying upon staffing companies to fill employee shortfalls.

But the trend today is to increase company crews to self perform the considerable amount of work that is currently available.

Although AllState's telecom field staff has grown by almost 40% from last year, it's challenging to identify what portion of their growth is from downsizing versus additional industry needs.

But Davidson says there is clearly industry growth. "We expect this trend to continue until at least the end of 2014," she said.

Adding to the industry's difficulty in trying to recognize an accurate crew count is an inherent need by company officials to inflate their available resources to capture larger project awards.

A turfing company senior manager, requesting anonymity, said he was concerned about a company's ability to self-perform the work and asked for some type of payroll information to verify their approximately 40 field personnel.

"He told me that he was not going to release any confidential information that could be misused. I then asked him to give me a list of his company crew vehicles. I think it was something ridiculously low, like four or five," he said.

Whereas larger employers used to emblazon their web site and promotional literature with their employee count, resources are now couched in terms such as: "One of the nation's largest...".

Even though WesTower is recognized as having the largest workforce, they do not release their employee count. Through talking with some of their field personnel and others familiar with the operation, a guesstimate would be 600 workers in the U.S.

Also obscuring an accurate total are the numerous companies that are comprised of a few employees.

New companies competing to capture LTE work

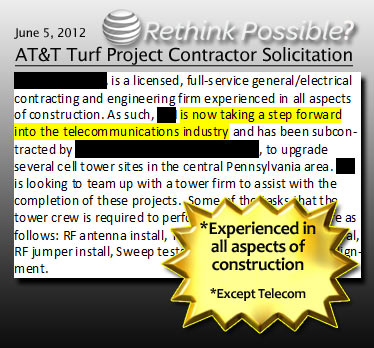

Every month, new companies, some already established as contractors, decide they want a slice of the LTE pie and start a telecom division.

In some cases, previous relationships with turfing or general contractors in other construction disciplines opened those doors. In some cases, previous relationships with turfing or general contractors in other construction disciplines opened those doors.

In June, a New Jersey general/electrical contractor received a contract from a turfing vendor to upgrade a number of cell sites to LTE in the Pennsylvania area.

In the company's email to tower service companies soliciting them to build out the project, the firm readily admitted that this is their first telecom venture.

"What were they [the turfer] possibly thinking," questioned a long-established Northeast wireless general contractor.

"They're [the contractor] new, have no idea what the problems are and will not make the money they think they can. All of their screw-ups will be blamed on the contractor that is doing the work for them," he said.

ComTrain's president, Zane Windham, has seen a marked increase in companies entering the industry.

"The companies most interested in attending our tower construction and technology classes this year were clients gathering information and tower construction knowledge so that they can convert their conventional construction company into a tower construction and maintenance provider," Windham said.

ComTrain's tower safety training program has also witnessed considerable growth in the first half of 2012 of approximately 20%, according Windham.

LTE: Long Term Employment, but not necessarily higher pay

The shortage of workers has required some companies to maintain or provide additional benefits to employees to ensure their continued employment, but four company HR directors contacted by Wireless Estimator echoed AllState's Business Development Manager Robert Pirtel's comments.

"There may not be enough people to do the work, but there is not enough money in the work to hire people at higher pay rates. So companies are hiring less skilled people, green hands, and putting them to work for less than average pay," Pirtle said.

But there appears to be a small crack widening in the seemingly fixed worker salaries.

A sign-on bonus of between $500 and $1,500 is beginning to appear in a few help wanted ads and referral fees are also being paid.

And the previously unthinkable "paid relocation" expenses are starting to be given a little more thought by companies seeking experienced talent.

"It's only natural that salaries will rise when companies want to lure away talent from their competitor," said a Northwest project manager who handles hiring for his 15-employee service company. "Entry level workers can be hired in most markets, but you need foremen and supervisors to direct them."

"Promises of long term [employment] are typically promises broken and workers know that. When a major project ends or this LTE window closes, you're going to be let go no matter how good the intentions of the company are if you're the last one hired," he said.

"Few companies are capitalized to keep you on board until the next NTP [Notice to Proceed] is issued."

Along with a decrease in safety, pricing could see an increase

You would have a better chance of winning a dart tournament with a water balloon, than getting contractors, without collusion, to collectively raise prices; but supply and demand does work and carriers are starting to see the warning indicators.

Hardest hit will be the AT&T turfing contractors who are locked into driver pricing.

A needed compromise with contractors started earlier this year when turfing firms began to dramatically improve their payment conditions from the onerous paid-when-paid or 90-day terms to a more equitable agreement.

Nsoro Mastec's recent newsletter heralded that they have an improved payment arrangement, and requested that contractors should contact their vendor management organization if there are any issues.

"Regarding supply and demand and their affect on pricing, I think this goes without saying. The price of resources will go up which will put a burden on those with fixed price contracts. Margins will mostly be impacted in order to compete for those resources," said an industry executive heavily entrenched in providing LTE build-out management for AT&T.

"There will be new contractors popping up and a push to increase staff which will result in an underlying concern for safety and quality which must be maintained," he cautioned.

Schlekeway agrees, stating, "As 4G access networks and backhaul network deployments continue for the foreseeable future, NATE believes this should only heighten the industry’s priorities to achieve a higher degree of safety and quality."

Even if project pricing does increase, it won't provide assurances that workers will be any safer as contractors become stretched too thin to meet ambitious scheduling and hire whatever resources are available, oftentimes managing them sight unseen.

Almost daily, postings on social networking sites help to fulfill staffing needs, but are plainly in violation of accepted and regulated subcontracting practices.

On the Friday before July 4, a Tulsa, Okla. company was requesting the services of a four-man crew to perform line and antenna work in Bakersfield, Calif. that was to begin on July 3.

The company, whose Okla. LLC status is inactive, would have been hard pressed to perform the due diligence necessary to get their customer to approve the contractor - if that process was ever observed.

Small companies, sometimes serving solely as brokers, will illegally cobble together 1099 workers to complete a project.

The Okla. company did not respond to a request for additional information.

"Yes it does happen," a former construction manager for a turfing contractor explained to Wireless Estimator. "Yea, we would tell everyone how we only hire safe, quality crews, and mostly we did. But I have to admit, there were times I pulled up on one of my sites and saw a sub doing the work and not the company that was supposed to be doing it, and I ignored it."

"They throw a lot of sites at you and put a lot of pressure on you to meet your schedule," he said.

Tiger team providers might have an advantage

It's generally conceded that the ambitious LTE drive for deployment will not run as smoothly as expected and there will be a need for additional tiger teams - typically two-man contingents that correct poor quality installations.

"The people who are really going to be busy are the tiger teams as they charge extra to fix all of the mistakes made by new startups," said a Florida contractor whose current backlog of work can't be managed by his limited crews. "Trying to even get subcontractor crews has become the most difficult I've seen it in years, he said."

He also believes that unqualified people will be promoted.

"In order to add more crews to the workforce you're going to see climbers advanced too quickly to a foreman. When that happens you'll be assured of seeing quality, performance and safety going downhill."

Finding qualified workers proves to be a daunting task

Bruce Budagher, COO of Data Cell Systems, said that finding apprentice or experienced employees to apply for openings in his five offices is difficult enough, "but the more complicated problems begin with screenings."

"Over 50% of them do not meet our minimum hiring requirements," he said, "and of the ones that we will hire, some of them present issues that require us to let them go after a short period of time."

The lack of a driver's license leads the list for making an employee ineligible for hire, according to 14 mid-sized contractors contacted by Wireless Estimator, with an inability to pass a drug test as a close second.

An unqualified average by respondents puts substance abuse at 24% in wireless construction, but there is little competent data available to identify what the national average is for general construction.

The last notable study was performed in 2007 by the Substance Abuse and Mental Health Administration which put drug use in construction at 15%.

One reason new tower technicians may not last too long is because they can't adapt to being a road warrior.

"They'll find that, although they thought it wouldn't be a problem, being on the road for lengthy periods can be difficult for a new hire and you'll lose them in the first three to five months," said an executive of a large Midwest-based national contractor.

"We've been successful in using the services of a staffing company," he said, explaining that the personnel provided are experienced and they'll then hire them as a full time employee after a number of months if they prove that their performance is acceptable.

"I can assure you, whether they're trained or not, we treat them as a new employee when they come on board and they are required to meet all of our training and safety requirements no matter how competent they might be."

Although it might be more expensive in the beginning, in the long term it's less work for his HR department and less costly, he said, "because you're cutting down on the number of employees that wash out in the first few months."

|