Site acq specialist avoids jail time after hiding $221,150 from funds linked to $4 million fraud

October 29, 2013 – A former Velocitel, Inc. site acquisition specialist was sentenced to three years’ probation for not reporting to the IRS an additional $221,150 he was paid for moonlighting for a company that received money fraudulently in a conspiracy with a Velocitel manager.

U.S. District Judge Mae D’Agostino carried out the sentence last Tuesday for Christopher Bevans, 39, who pleaded guilty June 13, 2013, and could have received the statutory maximum of three years in prison.

He could have also received a $250,000 fine for filing false income tax returns, but was only ordered to perform 200 hours of community service for not reporting the money that mostly likely was obtained through fraud by his past bosses.

Former bosses could get 23 years in prison and a $500,000 fine

His former employer, David Olek, 57, President of Oltek, Inc., who was also a former Velocitel site development and construction director, along with Craig Matuszak, 49, who ran Velocitel’s day to day operations at their Syracuse, N.Y. office, will be sentenced January 14, 2014 for mail fraud of almost $4 million and tax evasion.

As a result of their pleading guilty to fraud, Matuzak and Olek are facing a term of imprisonment of up to 20 years, a term of supervised release of up to three years, and a fine of up to $250,000.

They also face up to three years’ incarceration, a term of supervised release of up to one year, and a fine of up to $250,000 for tax evasion.

Olek and Matuszak were scheduled to be sentenced along with Bevans on October 22, 2013, but their sentencing hearing was adjourned to next January due to an issue regarding a forfeiture from Olek and also allowing Olek the opportunity to provide additional grand jury testimony, if needed.

He’s paid $162,550 for extra hours in 2008, but gambles it away

According to court documents, Bevans did not report the $59,600 he earned in 2007 and $162,550 he made in 2008 while employed by Oltek, Inc., a subcontractor of his full-time employer.

Bevans said that the payments were for services he performed on nights and weekends although there is no court documentation as to what he did for the money.

In 2007, Bevans reported to the IRS only the $57,029 he earned as a site acquisition consultant for Velocitel and received a tax refund of $3,878, court papers said.

In 2008, he reported only the $62,000 he got from Velocitel and received a tax refund of $1,879.

Bevans did not pay $75,725 in taxes on the unreported income, but has recently paid that amount to the IRS, court papers said.

Although his payments were extraordinary for part time work, averaging in 2008 over $156 per hour if he was working 20 additional hours on the side each week for Olek’s company, Bevans' payments were legal, his attorney wrote in a sentencing memorandum, citing that there were no government charges against him.

He also stated that Bevans has a gambling problem and that played a major part in his decision to not report his full income.

"His gambling losses prevented him from paying all his taxes," the defense lawyer wrote. "He mistakenly believed that he could recoup the tax owed through gambling," lawyer Michael Vavonese wrote.

The fraud by Olek and Matusak happened between 2006 and 2009 after Velocitel was hired by AT&T to upgrade, build and decommission cell phone towers in New York state and Michigan.

In July of 2012, Olek waived his right to be charged by a grand jury and entered his plea of guilty of defrauding Velocitel and a tax evasion charge.

Olek tried to swindle the IRS out of an additional $1 million in taxes

Matusak pleaded guilty in August of 2012 and was scheduled to be sentenced three months later, but the sentencing was deferred.

In filing his tax return, Olek and his wife claimed that they made $70,826 in 2008, owing a tax of $3,266, but he pleaded guilty to tax evasion, stating that he knew that his income was $1,724,320 and he was responsible for an income tax of $573,907.

In addition, Olek did not include payments he received from Capital Solutions, RJ Schickler, Patriot Towers and Armor Tower from 2006 through 2008 for services he provided.

The revenues he did not report on his personal tax return were: 2006, $525,650; 2007, $707,065; and 2008, $1,653,494. The tax due the IRS for those years is approximately $943,680.

Matuszak agreed to pay restitution to Velocitel in an amount to be determined by the court and $439,019 to the IRS as well as agreeing to the forfeiture of his home and two vehicles, possibly because they were funded through the fraudulent monies obtained.

However, according to Olek’s attorney, Samuel Ianacone, and agreed to by Assistant U.S. Attorney Tamara Thomson, Olek’s only forfeiture asset is a loan in the amount of $259,070 he made to David Spencer.

Matuszak and his wife filed for bankruptcy earlier this year listing assets at $871,673 and liabilities of $1,182,085.

How the fraud was orchestrated

According to a court transcript, Olek and Matsuzak defrauded Velocitel by submitting purchase orders and corresponding invoices for services not provided.

About April 2006, Velocitel received paperwork from Capital Solutions to be an approved vendor. What the California-based company did not know was that Matuszak had an accomplice, still unnamed in available court documents, set up the company which illegally obtained money that was distributed to him and Olek for three years.

In 2006, the Capital Solutions accomplice, the company’s sole proprietor, delivered materials 12 times to AT&T cell sites in the Syracuse market.

Following those deliveries he did not provide any more services or materials on behalf of Capital Solutions for Velocitel.

At the direction of Olek and Matuszak, Capital Solutions received purchase orders and submitted invoices for work that the contractor did not execute such as retainer fees for 136 different sites, SA savings incentives at 55 different sites, 249 site surveys that were performed by salaried Velocitel employees and Velocitel subcontractors, and the delivery of 26 cable ladder racks along with freight charges.

Using the their fraudulent scheme over the course of three years, Velocitel paid Capital Solutions a total of $3,901,885, most of it in 2008 when the con company was paid $1,896,929.

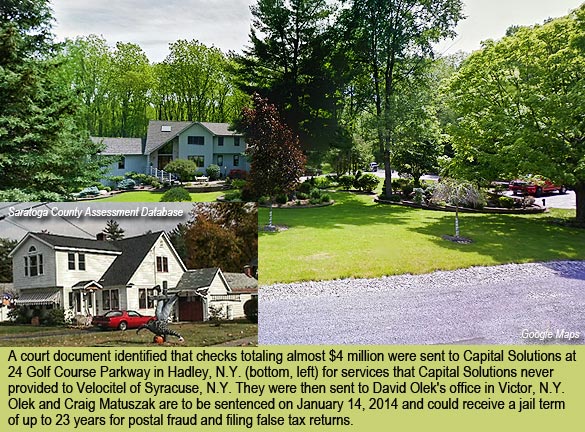

A court document identifies that all checks were sent to Capital Solutions at 24 Golf Course Parkway in Hadley, N.Y.

According to representatives of the Sarasota Country Real Property Tax Service Agency, and the Hadley assessor, the property has been owned by Derrick Frinton and Lisa Chandler since January 1990. A message for information regarding Capital Solutions was left by Wireless Estimator at a number reported to be a landline at that address, but was not returned.

Olek and Matuszak directed the payments from Capital Solutions to go to Olek’s company, Oltek.

Olek then deposited them into two separate accounts he had, one of which Matuszak had authority to make withdrawals.

Prior to his employment at Velocitel, Olek, was a zoning manager representing AT&T for Divine Tower International. After Velocitel’s employment he managed his company which was a contractor for AT&T until he was charged by the U.S. Attorney’s office.

It is not known how much money AT&T lost due to Olek and Matuszak’s fraudulent billing to Velocitel or how much Velocitel compensated AT&T for their actions.

Both AT&T and Velocitel did not respond to requests for information from Wireless Estimator.

Bevans, Matuszak and Olek’s prosecution resulted from investigations conducted by the Internal Revenue Service-Criminal Investigations and the Federal Bureau of Investigation, Syracuse, N.Y. The cases were prosecuted by Thomson.

AT&T was also victimized by site developer Clovis Prince, owner of Prince & Associates. He was sentenced in March of 2012 to 30 years in prison for bank and bankruptcy fraud.

|