Service Information

Tower Leasing and Resources

Every telecommunications tower site is unique in its construction cost, strategic location, return on investment requirement, tenant load capacity, proximity to competition, subscriber concentration and landowner lease fees. Add to those distinctive requirements zoning, FCC, NEPA and other preconstruction costs.

Similarly, the foundation for rental pricing is structured upon these requirements as well as the number of antennas, transmission lines, platforms, heights and all other wind load additions to the structure. It's challenging to identify an industry average for rentals, but the table below provides examples of monthly rates in some markets.

From $400 a month for a paging company on a rural Tennessee site to $3,900 or more for a New England prime highway corridor for a PCS carrier, rates are based upon the location of the tower and the location and size of the antennas and lines as well as the ground space required. Included occasionally will be a touch of mathematical acrobatics based upon exclusivity coupled with availability. From $400 a month for a paging company on a rural Tennessee site to $3,900 or more for a New England prime highway corridor for a PCS carrier, rates are based upon the location of the tower and the location and size of the antennas and lines as well as the ground space required. Included occasionally will be a touch of mathematical acrobatics based upon exclusivity coupled with availability.

The following table provides estimated monthly rates in some markets for PCS carriers. However, with voice/data convergence and increased minutes of use (MOU), calls per hour are less frequently used for leasing analyses.

| Type of Corridor: |

Calls Per Hour: |

Lease Per Month: |

| Secondary Highway |

600 or less |

$1,300 to $1,500 |

| Primary Highway |

600 - 1,200 |

$1,500 to $2,000 |

| Expressway/Freeway |

1,200 - 1,600 |

$2,000to $2,200 |

| Prime Locations |

1,600 + |

$2,200 + |

Prior to being approved on some of the major tower companies' structures you might be charged an application fee. Also, a structural analysis fee may be added. Stringent safety and insurance standards are being enforced by owners if the tenant is using their contractor to provide the installation for antennas and lines and other equipment.

The ideal convergence in a site management company is to be able to provide excellent customer service to both communications system operators and site owners, while maximizing the revenue opportunities for both clients.

Co-location process varies by owner, but procedures are similar

Driven by customer satisfaction, tower companies have developed sublease and construction approval procedures to assist their potential tenants to co-locate upon their sites.

Although zoning, building and jurisdictional roadblocks can delay a project, owner/tenant miscommunications often result in unexpected and costly delays. Prior to conducting business with a tower owner, it’s important for the applicant to fully understand the approval and construction procedures so that the co-location process can be processed as quickly as possible. For additional information on sublease and implementation phases that you'll encounter, click here.

We recommend that you contact our listed Tower Leasing and Resource companies to obtain additional information about their services, capabilities, experience and available locations.

How did the industry establish $1,400 to $1,600 lease rates?

You can subscribe to economist Adam Smith's supply and demand environment as the evolution for today's rental rates or you might consider the following: following:

During the late '80s and early '90s, almost all cellular carriers and lottery license winners constructed their own towers and sites at prices considerably higher than a quarter million dollars. Increased loading design was kept at a minimum.

Return on investment was a voice in the wind and those who whispered it were labeled as wireless heretics by the WSPs and tower consolidators and ceremoniously thermowelded to the stake.

Competing carriers saw an opportunity to share their resources and allow for colocations.

Sixty-plus cents per minute and speed to market mantras made strange bedfellows. However, there was no benefit derived from charging an inflated rental fee since the debits and credits would be a wash. Conversely, they couldn't accept a token consideration due to potential accounting practice problems that might surface.

An unknown uncelebrated accountant threw the monthly fee of $1,500 against the cellular ceiling and like lint on a day glow velvet monopole picture it stuck. When the major tower owners and other accumulators entered the market the carriers negotiated this monthly level. And with unlicensed spectrum opportunities, 3G proudly peeking over the horizon, and inflated stock prices that matched analysts' egos, who cared? Lease ups were anticipated to soar. tower owners and other accumulators entered the market the carriers negotiated this monthly level. And with unlicensed spectrum opportunities, 3G proudly peeking over the horizon, and inflated stock prices that matched analysts' egos, who cared? Lease ups were anticipated to soar.

Highly sought corridors and other prime locations did fetch handsome monthly increases. These poster child structures were waltzed in front of Wall Street while their anorexic bare steel sisters were strategically stealthed in juggled portfolios begging for Dramamine.

Rental pricing has stabilized, but carriers are under daily marching orders to renegotiate and reduce their lease rates if they can. Some major tower companies have been able to weather the carriers' requests by increasing revenues after reorganization and divestments of non-core businesses. of non-core businesses.

In South and Central America and other continents, monthly lease fees can range in excess of US $1,500 since an existing pricing structure had not been established by the carriers and tower companies were able to negotiate higher rates.

Carrier master lease agreements typically have a five to seven year initial term with three to five year renewal terms. There are some 10 and 25-year leases.

Carriers would like tower owners to renegotiate their lease in a technology space that changes every three years.

Crown Castle International Corp., the nation's second largest tower consolidator, said in March of 2006 that their average annual tenant income was $18,000, representing a monthly lease rate of $1,500.

Providing the landlord with increased rent for additional antenna colocators is often referred to as "revenue sharing" and is used in negotiations to obtain prized locations. It is important for the landlord to look for language in the lease which would restrict or inhibit their use of the land near and around the tower.

Taxes are usually paid by the tenant as well as structural modifications to the tower required for a colocation. Ensure that you get protection against an increase in taxes due to the tower changing your zoning or tax classification or as in some cases increasing your land value. Lease price escalators range between 3% and 5%. To ensure an adequate return on on investment, tower consolidators typically look to pay 9 to 10 times earnings or less for an existing structure.

Location, location, population are key determiners of rent

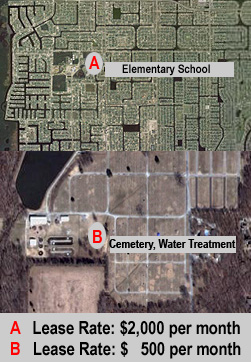

In January 2008, the Lee County Florida School Board approved a lease agreement with Sunshine Towers Inc. to install a cell-phone tower on campus at Gulf Elementary School in Cape Coral. The agreement will bring the district $2,000 a month with an option to renew every five years for the next 30 years.

At the same time the Florida board members were voting upon the cell site, Carterville, Illinois aldermen said they were moving forward in negotiations for approving an at&t cell phone tower to go up near Hillcrest Cemetery. Their lease will be considerably less: $500 a month.

The sizeable difference in lease payments has little to do with the carrier's or tower owner's negotiating skills. It is based upon the location, the number of tenants that will co-locate on the site and the population that will be served, industry site acquisition professionals say.

Population is a key element in determining the number of potential customers that will be served by the cell tower location. The Cape Coral (Population: 151,000) site is in a densely populated residential area with soccer moms wanting to have excellent coverage near two school campuses.

The rural Carterville (Population: 5,200) site is outside of town. The few workers at the town's water treatment plant will clearly enjoy better coverage. The at&t tower will also help to fill in the dead zones surrounding Carterville's two adjoining cemeteries.

Negotiating a lease rate is difficult

Unless you have access to thousands of points of comparable data and understand why a carrier would choose one tower site above another, it is difficult to negotiate effectively. If you need assistance with determining what you should be charging for a cell phone tower lease or a tower tenant lease or modification, you might consider contacting Steel in the Air, Inc. They have co-sponsored this page and have assisted over 2,200 landowner and tower owner clients. They maintain one of the largest private cell tower lease rate databases in the country.

|