The Federal Communications Commission’s (FCC) auction to buy spectrum from television stations, repack the spectrum, and then sell it to wireless providers, kicked off yesterday with broadcasters having to make a commitment as to whether and how they would participate.

But a 39-month post auction deadline is seen as too compressed by the National Association of Broadcasters (NAB). And the National Association of Tower Erectors believes that worker safety is not being fully considered in the FCC’s ambitious deadline.

To assist readers in getting a better understanding of the magnitude of the ‘repacking’ program, Wireless Estimator has provided the following primer:

Q: What prompted the FCC auction?

A: In 2010, the Federal Communications Commission National Broadband Plan indicated a need for a reallocation of spectrum, stating that the nation needs to free up 500 MHz of spectrum for commercial use in 10 years to serve America’s insatiable appetite for everything wireless. In 2012, Congress authorized an auction to free up 120 MHz from broadcast TV stations.

Q: When did the auction begin?

A: The auction process kicked off on March 29, 2016 when the broadcast incentive auction required 1,800 eligible broadcasters to submit a binding agreement to take part. They had until 6 p.m. to make their initial commitment to give up the 6 MHz they’ve been allocated, share their 6 MHz block with another broadcaster, or move to a different 6 MHz block, or simply do nothing.

Q: How many stations are expected to participate?

A: Estimates are between 600 and 1,200 stations. The names of the TV broadcasters participating in the auction will not be revealed during the auction. However, stations are still free to say whether they are participating, although most are choosing not to. As part of the bidding process, the FCC is prohibiting stations from discussing their bidding strategies.

Q: Are there two auctions

A: Yes, there are two separate, but interdependent auctions, according to the FCC – a reverse auction, which will determine the price at which broadcasters will voluntarily relinquish their spectrum usage rights; and a forward auction, which will determine the price mobile broadband providers are willing to pay for flexible use wireless licenses.

The reverse auction is like a construction project. The lowest bid, if it meets the FCC’s needs in a market will most likely be the successful bidder. But it is expected that broadcasters aren’t going to give away their valuable property for a song and have already established their exit price.

Broadcasters will be offered progressively lower payments through a series of bidding rounds that will end when the FCC reaches targets for the amount of spectrum to be cleared in each market. Since the low-band 600 MHz spectrum can travel further and penetrate buildings easier than high-band alternatives, it’s a sought after asset.

Q: ‘Repacking’ is used in a lot of articles. What does it mean?

A: The essential element for joining the reverse and the forward auctions is the ‘repacking’ process which requires reorganizing and assigning channels to the remaining broadcast television stations in order to create contiguous blocks of cleared spectrum suitable for broadband providers.

The vast majority of stations that remain on the air after the auction will be assigned channels in the TV band; in a few markets where the post-auction TV band is not large enough to accommodate every station, stations may be assigned a channel in the wireless band. The FCC will have to move services on hundreds of channels to avoid interference, and use the airwaves efficiently. Some stations will be repacked even if they don’t participate in the auction.

Q: How much money could a station anticipate on getting?

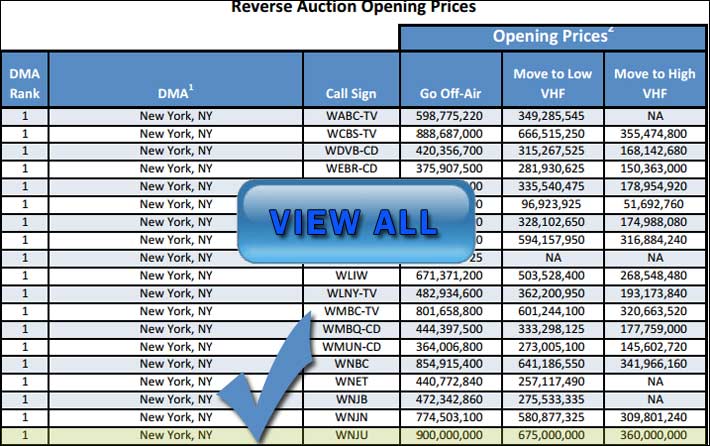

A: Telemundo’s WNJU New York has the highest opening bid price at $900 million, with WCBS coming in second at $889 million, if the broadcasters went off the air, but KTTM of Sioux Falls, SD, would only receive $14,703 and most likely considerably less as it moves through bidding rounds. The complete list of prices for going off the air, moving to a low or high VHF are available here.

Q: How much money is anticipated to be raised in the auction?

A: Initial estimates of money that will be raised through the auction run from $20 billion to $60 billion, but the high end seems unrealistic, according to AT&T Mobility CEO Glenn Lurie and

other wireless executives and analysts. But spectrum is beachfront property as seen in the FCC’s record-breaking $41 billion it received in net bids in last year’s AWS-swath of airwaves auction, and this auction could possibly reach the top estimates.

Q: How many broadcasters will cash out?

A: A couple of estimates indicate that approximately 500 broadcasters will cash out, but many of them will still broadcast their programming by sharing spectrum with another station. With today’s digital compression technology, stations can broadcast in HD in about half of their allowable 6MHz. Smaller stations, not affiliated with a network, could receive many times that value in an FCC payment that was multiple times its value as a TV broadcaster. The mostly likely stations will be broadcasters with primarily syndicate reruns and religious programming.

Q: What companies will be participating in the forward auction?

A: According to a list released by the FCC on March 18, 2016, a total of 104 companies, 69 of them complete and 35 incomplete, have applied for the forward auction. These companies include major carriers Verizon Communications, AT&T, and T-Mobile US, and a few rural telecom operators from North Dakota to New Mexico. Pay-TV providers Comcast Corp. and Dish Network Corp. were on the list.

Social Capital Rama Spectrum Holdings LLC, which is connected to Chamath Palihapitiya, a venture capitalist and former Facebook Inc. executive is also an applicant along with Sinclair Broadcast Group Inc., the biggest owner of TV stations in the U.S., and Puerto Rico Telephone Company Inc., which is owned by telecom billionaire Carlos Slim’s America Movil SAB.

Heavy hitters Sprint Corp., Google and Charter Communications are sitting out the auction.

Q: When will the auction end?

A: Although it is expected that that the auction will take several months to complete, it does not have a set end date and will conclude when the forward auction proceeds meet the threshold established by the FCC are sufficient to cover the prices awarded to TV stations in the reverse auction, a $1.75 billion relocation fund for eligible TV stations moving to a new channel, and other administrative costs related to designing and conducting the auction.

Q: What are the deadlines for stations to transition?

A: After the repacking process is finalized, the FCC will reauthorize and relicense the facilities of the remaining broadcast television stations that receive new channel assignments in the repacking, or because they have won their auction bid to move to a different frequency band or to channel share.

Reassigned stations will have three months to file construction permit applications for any minor changes to their facilities necessary to operate on their new channels.

Following the three-month application filing deadline, stations will have up to 36 months to transition to their new channels. Licensees that successfully bid to relinquish their licenses will have three months from their receipt of auction proceeds to cease operations on their pre-auction channels; licensees that successfully bid to relinquish their license and enter channel-sharing agreements will have six months from receipt of auction proceeds.

The Commission will assign stations construction deadlines within the 36-month transition period based on the unique circumstances of each station’s move. Stations may request extensions of time to construct their new facilities, but no station will be allowed to continue operating on their pre-auction channel more than 39 months after the repacking process becomes effective.

Q: Is a 39-month completion window possible?

A: Although a 39-month post auction completion deadline appears to be cast in concrete, FCC Chairman Tom Wheeler hinted at being a little conciliatory to reviewing it during a March 15, 2016 House Appropriations Committee panel where he said it would “irresponsible” to not deal with the ambitious deadline if additional stations over his anticipated 1,000 move.

However, following Wheeler’s statement that the National Association of Broadcasters (NAB) said the project could be done in 30 months, NAB spokesperson Dennis Wharton fired back with a press statement, stating: “It’s disappointing and disingenuous for Chairman Wheeler to suggest that NAB’s repacking advocacy supports the FCC’s arbitrary 39-month deadline. As he well knows, when the FCC initially pushed to repack the country in 18 months, NAB responded in 2013 that it would take at least 30 months to repack the then-expected 400 or so broadcasters. A year and a half later, the FCC first revealed that it might repack as many as 1,300 TV stations. Given the FCC’s decision not to minimize the scope of repacking, the transition will likely require significantly more time.”

However, following Wheeler’s statement that the National Association of Broadcasters (NAB) said the project could be done in 30 months, NAB spokesperson Dennis Wharton fired back with a press statement, stating: “It’s disappointing and disingenuous for Chairman Wheeler to suggest that NAB’s repacking advocacy supports the FCC’s arbitrary 39-month deadline. As he well knows, when the FCC initially pushed to repack the country in 18 months, NAB responded in 2013 that it would take at least 30 months to repack the then-expected 400 or so broadcasters. A year and a half later, the FCC first revealed that it might repack as many as 1,300 TV stations. Given the FCC’s decision not to minimize the scope of repacking, the transition will likely require significantly more time.”

During the House Committee session, Wheeler said that he was taken back when he found out how many tall tower erection companies there were, which is why the FCC might take a regional approach to repacking.

He didn’t illustrate how that would assist the limited workforce in completing the projects in a little over three years.

Nevertheless, Wheeler has known about the shortage of crews for many years.

In correspondence to the FCC in 2014, the National Association of Tower Erectors (NATE) said, “…the FCC and its intervention are likely to promote a scenario in which under-trained and unqualified individuals and contractors will seek to reap the rewards of over a billion dollars of channel relocation dollars. This will undoubtedly lead to an increase in accidents and fatalities similar to what occurred in 2006 as more and more contractors rushed to take advantage of TV stations’ need for tower-related services leading up to the 2009 analog sunset.”

Scott Bergmann, VP of regulatory affairs for CTIA says the industry opposes any effort to stretch out the repack. “The success of the auction assumes carriers will bid substantial sums, and that cannot happen absent certainty that they will receive timely access to the spectrum purchased,” calling the deadline “fair and achievable,” but CTIA has neither studied the tall tower workforce, nor has contacted key companies who will be taxed with meeting the onerous deadline.

Steve Berry, CEO, Competitive Carriers Association, is in lockstep with Bergmann, and is championing the need for carriers to recoup their money as soon as possible.

During his keynote address at NATE UNITE 2016 in New Orleans in February, Berry said the FCC has “established reasonable alternatives” for circumstances to address safety concerns during the 39-month window, but he didn’t present those substitutes.

Although T-Mobile said there were adequate crews, DTC said that many of the ones they identified were incapable of working on tall towers.

Q: How many tower crews are available to do the work?

A: There are questionable counts of how many crews are capable of observing the exacting disciplines required for working on tall towers, employing the right rigging equipment and working for companies that are capable of obtaining the high insurance coverages required by many tower owners.

The NAB commissioned a study last year by Digital Tech Consulting (DTC) that identified that there were only 13 tower construction companies in the country that were capable of working on tall towers, and another three might be available in the near future.

In a study undertaken by CCA, the trade group said that there are 41 crews.

However, some industry observers still think that those crews will not be able to complete the work that needs to be done.

“In a perfect construction world, it might be possible, but there are so many unknowns – from engineering and weather to materials – that could add weeks just to one project,” said a tall tower erector at the NATE UNITE 2016 conference in New Orleans in February.

“I’ve already been contacted by broadcasters and tower companies to commit to more work than I can handle. It’s been really slow since the digital days and it looks like we’ll benefit from the shortage with a decent payday,” he said.

An extensive T-Mobile study filed with the FCC earlier this year said that Broadcast Tower Technologies and Hammett & Edison concluded that the 39-month time frame could be met.

However, DTC fired back earlier this month with a response that stated that some of the 41 crews identified in the study were incapable of doing the work.

“T-Mobile overstates the availability of critical resources, including tower crews with the equipment and experience qualifying them to perform broadcast antenna installation and removal work. T-Mobile claims to have identified 41 qualified tower crews capable of performing this work. In fact, based on our interviews with the additional companies T-Mobile identified, some of these companies have not performed broadcast work in more than a decade, some lack necessary specialized rigging equipment, and some specialize in radio, microwave and cellular antenna installations. Many broadcasters have never heard of some of these additional companies, and will not trust them to perform hazardous work on their critical facilities,” DTC said.

At a NATE UNITE 2016 panel discussion, Bob Paige, Senior Vice President, Mergers and Acquisition at Vertical Bridge said his firm was currently capturing as many tall tower resources as possible, “…because we believe there is going to be a resource shortage when it comes to tall tower crews.”

Although Vertical Bridge is the largest private owner of tall towers in the U.S., the majority of them are FM and AM towers.