NATE is concerned that the race to 5G could be easily derailed by ‘take it or leave it’ matrix pricing. It’s urging its members to decline unprofitable matrix-based projects and work with the Association to document why current pricing levels are unsustainable.

In 1999 when The Matrix opened in theatres, carriers and towercos began utilizing matrix pricing to project CapEx budgets for macro sites, while still allowing acceptable margins and opportunities for contractors to continue to be successful.

Fast forward 22 years. The Matrix Resurrections sequel will hit the big screens this December and it is expected to be hugely profitable, unlike contractors who now find ‘take it or leave it’ matrix pricing is forcing them to exit the industry or cut corners on safety and quality to remain sustainable.

NATE: The Communications Infrastructure Contractors Association, representing the majority of the nation’s contractors, is taking their members’ profitability plight to carriers, tower owners, and turfing contractors in the form of an animated educational video released this morning that is balanced with the hard truth and a fair point of view.

NATE: The Communications Infrastructure Contractors Association, representing the majority of the nation’s contractors, is taking their members’ profitability plight to carriers, tower owners, and turfing contractors in the form of an animated educational video released this morning that is balanced with the hard truth and a fair point of view.

It illustrates the negative impact on safety and quality that current pricing pressures are imposing upon contractor firms by top wireless carrier, turf vendor, and tower owner customers.

As a result, NATE said in a statement, some of these small businesses have had to close their doors at a time when there is already a shortage of qualified contractors required to ensure that America wins the race to 5G.

For many, the hard-hitting video wasn’t an October surprise

The video is a bold move for the trade group, but not unexpected after NATE President & CEO Todd Schlekeway surprised attendees during a keynote address at the South Wireless Summit in June when he exposed the pricing pressures.

When NATE President & CEO Todd Schlekeway gave a keynote address in June he warned that wireless contracting in the U.S. could become untenable. “Despite the dynamic industry we’re in, we can’t paint rose-colored eyeglasses over everything,” he said.

In his presentation, he posed a rhetorical question, “Is wireless contracting becoming untenable in the United States?” His answer: “Unfortunately, yes.”

Although it is not known whether carriers and towercos reached out to NATE to discuss the issues that were fully outlined in Schlekeway’s presentation, the Association came out swinging again with an impactful video that capsules its members’ concerns.

Schlekeway said, “This video is designed to educate our member contractors’ top customers of the concerns that should be addressed if we want to remain a vibrant industry capable of keeping America connected.”

Schlekeway said that NATE will be sharing the video with stakeholders from government agencies and Congress to demonstrate the challenges contractor small businesses are dealing with in the wireless industry that compromises the nation’s ability to develop the workforce, deploy 5G and close the digital divide.

The key proposition is “We aren’t budging anymore!”

The video calls upon contractors to refuse to take unprofitable ‘take it or leave it’ matrix pricing and ends with an emphatic, “We aren’t budging anymore!”

Although it’s unlikely that contractors will join together today and refuse to take marginal or unprofitable matrix-based projects, the video puts their customers on notice that it could very well happen soon.

NATE said it is offering an alternative.

NATE said it is offering an alternative.

“The Association remains ready and willing to engage in the constructive dialogue necessary between the wireless carrier, turf vendor and vertical realtor executives and their teams to address the problems that affect the entire wireless industry ecosystem,” said Schlekeway.

NATE said the whiteboard video’s key points are not anecdotal but are “truly representative of the concerns of every one of our more than 500 contractor members in the United States.”

Dozens of those contractors have also registered their concerns with Wireless Estimator and have provided documentation of untenable pricing models and the instability of the industry.

Their reluctance to go on the record is understandable since it could result in a collective blacklist by approximately a dozen major companies that feed the industry’s primary project pipeline.

A wireless contractor established over 30 years ago, with over 85 personnel currently in the field, condensed industry concerns this afternoon after viewing the video, stating in an email:

” This was long overdue and necessary. Wireless contracting has gotten increasingly more complex with each generational change. It’s not just turning nuts and bolts anymore. The skills and training of our workers are a magnitude greater than in the days of 1G, 2G, and 3G. And yet at the same time unit pricing offered by the customers has gone steadily lower. All the while demands for the time of completion have gotten shorter and structured around very small maintenance windows. In the early days of wireless contracting, there was money to be made by the large, medium, and small contractors. Now no one is making money. If something doesn’t change the customers will find soon enough there will be shortages of contractors and workers. And the blame rests with them because they knew this was coming.”

The message needs to be viewed by those at the top

Some contractor owners believe that the severity of the problem might not be reaching the right C-level executives.

Last Wednesday, Crown Castle CEO Jay Brown said during Connect (X)’s The View From the Top panel discussion, “If you want to start your own service business…there is lots of opportunities and I think it’s going to continue, and I think it’s a great opportunity for us to engage new talent and up the game.”

One industry observer disagreed. In an email to Wireless Estimator they said, “Jay is completely off base. His team under him must not be briefing him adequately enough on the pricing, workforce, supply chain, onboarding, and other challenges that Crown’s contractor and vendor pool are dealing with.”

A medium-sized contractor said in an email regarding the session’s decades-old positive outlook, “I think our industry has been in such a rah, rah cheerleader mode for so long that they don’t know any other way, but there are problems below the glamorous surface.”

Dish Network boosts matrix pricing a little and seeks a partnership

On July 29, Wireless Estimator published an article regarding Dish Networks’ ambitious build that requires contractors to ‘accept or reject’ unprofitable blue plate special colo pricing.

Dish Network is now asking for contractor feedback and has added additional project dollars to offset price increases for materials

A month later, Dish informed its vendors that after receiving feedback from them on the materials contractors are providing that their commitment was to create a long-lasting relationship, “…and in a spirit of partnership they will offer an additional $1,500 per site to offset these cost increases.”

They also clarified contractor confusion over RAD center adders above 150’ AGL, according to a document reviewed by Wireless Estimator.

“As always, we welcome your constructive feedback as we continue to look for ways to make your experience with Dish positive and profitable,” said Richard M Leitao, Vice President of National Development – Wireless Operations.

That positive approach could be a polished public relations pitch or a sincere effort from a company that values the importance of dependable, quality-providing, and safe contractors.

A contractor who is working directly for Dish Network said last week his company is almost done with a few jobs but he wouldn’t be able to assess project profitability at this time.

Multiple contractors have informed Wireless Estimator that they were not going to accept a major towerco’s discounted pricing that appeared to be at least 20% lower than working directly for the nation’s newest carrier.

AT&T doesn’t seek feedback. It wants 3% back

New builds and colos for many of the major carriers and turfing contractors are based upon matrix pricing that is lowered every year as increased services are extracted from the contractor such as maintaining free warehousing and being held responsible for any equipment that doesn’t match the bill of materials.

And if a contractor is registered on Ariba’s Spend Management site, they get the privilege of being invited to bid a job for T-Mobile or Verizon. However, Ariba is in the invoice discounting market and takes up to 3% of the invoice amount for using its software. In addition, vendors have registered their concerns regarding late payments.

There are many contractors who have successfully carved out an industry niche by providing maintenance services, but that segment is also becoming increasingly difficult for service companies to earn a sustainable margin.

Late last month, AT&T informed their service contractor vendors that to “simplify things,” they would like them to extend their agreement for another two years so that they could reap a 3% reduction, according to a document reviewed by Wireless Estimator.

If the contractor didn’t agree with the extension terms, AT&T said it intended to go through another round of reverse auction/re-bidding process later this year, on top of one they held last year that reportedly benefited them with 20% to 25% in price reductions.

It’s evident that AT&T did not receive the memo that inflation and wages are cutting into profitability as well higher fuel prices. And as NATE identifies in its video, price concessions cannot be absorbed through proficiency since contractors are already working as productive as they can without compromising quality and safety.

Verizon’s high crows and mileage misdemeanors

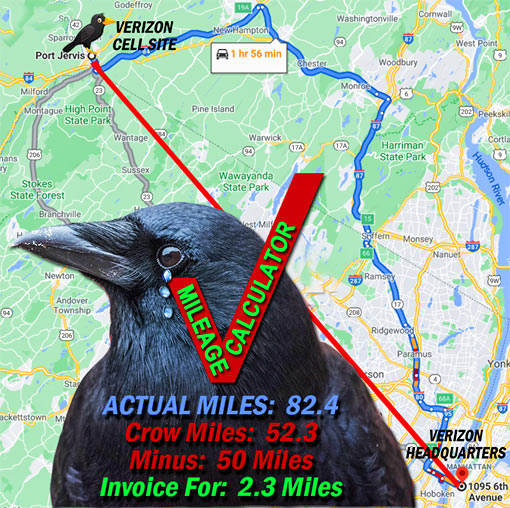

Until teleporting is a viable 5G-powered app, service companies will continue to be taken advantage of when using Verizon’s avian mileage reimbursement plan that uses skewed crew matrix pricing.

It is another example of how contractors are being squeezed on a daily basis.

It is another example of how contractors are being squeezed on a daily basis.

Instead of the carrier paying for actual mileage when a crew is required to travel an extended distance, the payment is for an ‘as the crow flies’ mileage calculation from the closest dispatch location to the cell site.

Therefore, according to a Verizon document reviewed by Wireless Estimator, if the cell site is located 165 miles away in a straight-line path, then the chargeable distance is only 115 miles because Verizon insists that the first 50 miles are the contractor’s burden.

A crow can fly from point a to b without impediment, crews can’t. As shown in the graphic above, an 82-mile trip from Verizon’s Manhattan headquarters to a Port Jervis cell site should take approximately two hours. That is if the Lincoln Tunnel isn’t backed up for 45 minutes and traffic isn’t bumper to bumper at Routes 4 and 17 for another half hour.

According to Verizon’s payment calculator, the trip with a three-man crew would allow for a 2.3 miles adder at $5.78 a mile, an embarrassing $18.50 for tolls, gas, a minimum of six man-hours, and vehicle expenses that should be invoiced for at least $600 for a contractor to remain sustainable.

Verizon acknowledges that actual drive routes are never a straight line. “However, that is how the unit is applied in order to mitigate misuse of this unit,” a Verizon sourcing assistant wrote in an email.

Adequate worker compensation is key to contractor survival

In 1999 when matrix pricing was in its infancy, contractors were still providing some materials and their markups allowed them to be profitable, especially when they had to offset unforeseen, uncompensated for project additions and delays that cut into their revenues.

Today, Tier 1 clients are offering rock-bottom, take it or leave it pricing and providing all of the materials, preventing any opportunity for employees to be adequately compensated.

CTIA, WIA, and other trade groups frequently extoll the experience and true grit of tower technicians. Nonetheless, they will never address – even though they are fully aware of the problem – the fragility of wireless contracting and employee compensation due to pricing pressures since it would conflict with the business model of their largest members.

FCC Commissioner Brendan Carr is frequently seen climbing towers to learn about macro infrastructures as he’s assisted by industry professionals in identifying the exacting and important skillsets of tower technicians.

Carr has been an ardent supporter of community college wireless installation training programs, NATE, and the National Wireless Safety Alliance.

However, it is unknown whether he is aware that the highly skilled technician climbing beside him might only be making the same amount of money that a barista in his comfy signature hi-tops makes as he gingerly hands out macchiatos while his eyes turn to caress a tip container.

The FCC is going to be doling out billions of broadband dollars when the infrastructure bill is passed, and contractors and their employees need to be compensated fairly. NATE’S video is clearly the conduit for that message.

Numerous contractors have informed Wireless Estimator that they have to hire inexperienced employees at $16 dollars an hour, making it almost impossible to recruit new talent. It’s not that they want to take advantage of their workers, conversely, they say, it’s their customers that take advantage of them.

If carriers and towercos want to survive they’ll have to keep the union at bay

The SBA designates a small business as having an employee count of 1,500 or less which would put approximately 98% or more of service and installation contractors in that category.

Carriers and vertical realtors have been the beneficiaries of an industry that is comprised of primarily non-union contractors, most of them at a threshold of under 40 employees, with an estimated 30% of the contractors having 15 or fewer employees dedicated to their success.

Carriers and vertical realtors have been the beneficiaries of an industry that is comprised of primarily non-union contractors, most of them at a threshold of under 40 employees, with an estimated 30% of the contractors having 15 or fewer employees dedicated to their success.

Today, agreements have tipped from allegiance and partnership to strictly pricing compliance.

The Communications Workers of America (CWA) has had its sights upon some of the larger wireless contractors during the past two years as prime candidates for collective bargaining, especially now since the infrastructure bill is championing one of its prime benefits as providing high-paying union jobs.

And CWA-represented workers are generally paid more.

A Verizon field technician with some seniority will make approximately $89,000 or more a year, according to the CWA, plus they’ll have considerably more benefits than those presently accorded non-union workers.

The tried-and-true method of keeping a union at bay is to provide salary and benefit increases, and address other concerns.

The conundrum is after projects are completed under current matrix pricing, companies can barely pay salaries, not increase them.

If the CWA took over collective bargaining control of wireless construction, most small businesses would have to close when subcontracting came to a sudden stop and America reluctantly pulled out of the race to 5G.

Paying contractors’ employees what they deserve is a lot cheaper option, a position that NATE is advocating.

CWA says the nation’s contractors are ‘low-road’ and in danger

The CWA is accusing carriers of using ‘low-road’ contractors that are stealing work from more capable union workers. What the union fails to acknowledge is that non-union workers built America’s wireless infrastructure, providing union workers with opportunities to become field technicians.

In May, the CWA began marshaling its membership to attack non-union 5G contracting.

It launched its ‘5G Technician Brigade,’ to train union members in 28 states how to engage their local governments to advocate for transparency in their local permitting processes.

They are focused upon exposing that “Verizon Wireless is using low-road, out-of-state, non-union subcontractors to build their 5G network, and local governments issue permits, but many of them don’t keep track of who the work is subcontracted to – meaning they don’t know who’s actually in the street doing the work.”

“This lack of labor standards and transparency has resulted in dangerous and costly outcomes for workers, taxpayers, and communities,” the CWA said.

Is there a workforce shortage or a scarcity of companies willing to accept unprofitable projects?

In January, NATE, WIA, CCA, and seven other industry groups sent a letter to President Joe Biden warning the country faced a shortfall of skilled labor to kickstart 5G rollouts, pressing for legislation to fund new educational and apprenticeship programs.

“The stakes are high,” they wrote. “Without a properly trained 5G workforce, China can use centralized authority to quickly focus labor resources to beat us to the finish line.”

“The stakes are high,” they wrote. “Without a properly trained 5G workforce, China can use centralized authority to quickly focus labor resources to beat us to the finish line.”

“We cannot build advanced networks to serve tomorrow’s needs without a properly skilled and diverse workforce today,” they said.

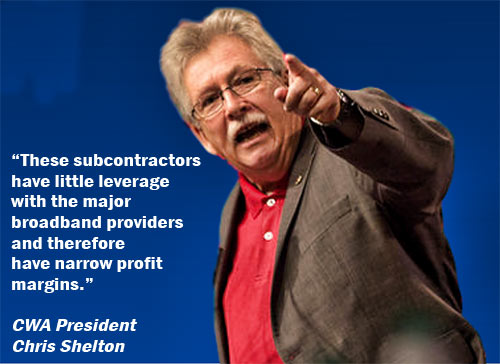

In April, the CWA highlighted what they believe the reasons are for the lack of skilled workers in a letter that was sent to U.S. Representatives and Senators by CWA President Chris Shelton.

“A major problem facing the telecommunications industry is a fissured workforce — outsourcing functions that were once managed internally — across hundreds of small subcontractors. These subcontractors have little leverage with the major broadband providers and therefore have narrow profit margins,” Shelton said.

“This dynamic creates a race to the bottom for workers’ wages driven by the major broadband providers, which benefit by cutting skilled union technician jobs and outsourcing their work to lowest bid contractors.”

Shelton said that legislators should oppose legislation that accepts the broadband industry’s unsupported claims of workforce shortages “and undermines workers across the broadband industry.”

NATE’s underlying message in its video is that contractors already employ tower technicians that are highly trained and capable of building out America’s networks, but they’ll be unable to add to their workforce if they’re unable to pay them.

Multiple contractors informed Wireless Estimator that they could hire and train additional skilled workers, but the cost of outfitting a new crew and paying them a respectable wage is impossible at today’s project pricing levels.

NATE said industry stakeholders are encouraged to share the video with their colleagues and contacts and post it on their respective social media platforms utilizing the hashtag #WirelessContractingSolutions.