|

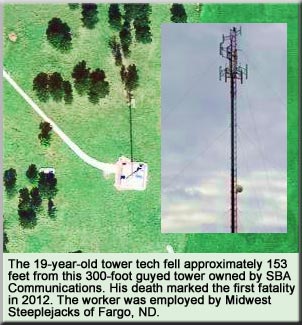

First 2012 tower fatality claims life of 19-year-old

Update: June 28, 2012 - Services have been announced for Jeremy Jo  Froemke, 19, of Lisbon, N.D., who died Tuesday after falling from a cell tower in Minn. The funeral will be July 2, 10:30 a.m. at Anselm Lutheran Church, rural Lisbon. Burial will be in the Anselm Lutheran Cemetery. Visitation is Sunday, from 4 to 7 p.m. with a prayer service at 7 p.m. at Armstrong Funeral Home, Lisbon. Froemke, 19, of Lisbon, N.D., who died Tuesday after falling from a cell tower in Minn. The funeral will be July 2, 10:30 a.m. at Anselm Lutheran Church, rural Lisbon. Burial will be in the Anselm Lutheran Cemetery. Visitation is Sunday, from 4 to 7 p.m. with a prayer service at 7 p.m. at Armstrong Funeral Home, Lisbon.

Beltrami County Sherriff Phil Hodapp said that Froemke was equipped with a safety harness. An earlier report attributed to a dispatcher said that the tower technician wasn't wearing one.

_______________

June 27, 2012 - A 19-year-old man working on a cell phone tower fell and was killed Tuesday evening directly south of Solway Elementary School in Solway, Minn. June 27, 2012 - A 19-year-old man working on a cell phone tower fell and was killed Tuesday evening directly south of Solway Elementary School in Solway, Minn.

An emergency call came in to a Beltrami County Sheriff’s dispatcher at 5:50 p.m. Tuesday. Emergency crews were called to a tower at 134 Loman Ave.

According to a Beltrami County Sheriff's official, a Midwest Steeplejacks Inc. employee fell 153 feet from the cell tower and was killed on impact.

The man, who will remain unidentified until all family members are notified, is from North Dakota.

The tower tech who made the emergency call, also a Midwest Steeplejacks employee, called from 160 feet up the tower. Authorities said the man was in shock and was unable to comment on what happened.

A dispatcher said the person who fell was not wearing a harness. However, initial reports are oftentimes skewed based upon an emergency responder's lack of knowledge about the industry or the equipment could have been removed to perform CPR.

Shortly after 6 p.m., the crews called to airlift the man to the hospital were called off because the man had died.

The 300-foot guyed tower he was working on is owned by SBA Communications. The customer Midwest Steeplejacks was working for is not known at this time.

Owned by Rory Kiland, Midwest Steeplejacks was founded in 1997. In addition to a considerable amount of cellular experience, the company has performed many years of tall tower and broadcast work.

The fatality was the first death within the industry this year. See: Fatalities.

|

Sources: Don't give TowerCo the 10-count

June 27, 2012 - After employees were told to start polishing their resumes after TowerCo sold its entire portfolio to SBA Communications, the media started  referreeing the 10-count to CEO Richard Byrne's company he co-founded in 2004 along with his COO, Scot Lloyd. referreeing the 10-count to CEO Richard Byrne's company he co-founded in 2004 along with his COO, Scot Lloyd.

However, following yesterday's article, a number of industry insiders contacted Wireless Estimator and said that Byrne may not be planning on retiring to a secluded island off of Bimini any time soon, but may reemerge with an even larger TowerCo buoyed by T-Mobile's 8,900 towers.

"It makes sense that TowerCo would go in that direction," said one investment banker. "Their backers more than doubled their investment in less than four years. Byrne has a proven track record and you would expect them or other PE firms to know that he could do it again."

One source familiar with ongoing negotiations informed Wireless Estimator that TAP Advisors had contacted TowerCo and the Cary, N.C.-based consolidator had been taking a serious look at the T-Mobile towers.

TAP, a boutique investment bank, was hired to look for potential suitors for the T-Mobile deal and they're intimate with TowerCo's operations. Prior to joining TAP as a Vice President, Aye Thiha was involved in TowerCo’s acquisition of Sprint Nextel’s tower portfolio which was sold to SBA yesterday.

In addition, TAP's senior advisor, Ronald LeMay, served as the first employee and CEO of Sprint PCS and guided it from start-up to $10 billion in revenue.

Another investment banker believes that Byrne and his management team will continue to look for acquisitions. "It wouldn't surprise me if they stay in - everyone does," he said.

Analysts peg T-Mobile's tower assets at approximately $3 billion, but some industry insiders believe it could be considerably lower.

Soros Strategic Partners, Tailwind Capital, Vulcan Capital and Altpoint Capital Partners are TowerCo's equity partners.

|

SBA buys TowerCo's portfolio for $1.45 billion

and sidesteps a T-Mobile bid

June 26, 2012 - SBA Communications Corp. is buying 3,252 towers from TowerCo in a cash-and-stock agreement valued at about $1.45 billion. The deal essentially pulls away TowerCo's entire portfolio and thwarts SBA's ability to bid upon T-Mobile's tower  assets. assets.

The towers are located in 47 states and Puerto Rico. SBA says the towers will be in great demand for future cell-splitting needs of U.S. wireless carriers.

In an SBA conference call this morning, Jeffrey Stoops, SBA's President and Chief Executive Officer, said that TowerCo's CEO, Richard Byrne, initiated the deal in early May.

"Let's really give this a college try and see if we can get this done," Stoops told Byrne, who he worked with to ink a 430 tower buy from TowerCo for $193.5 million in 2008. At that time the towers had a tenancy rate of 1.5.

Today's buy, according to Stoops, averages 1.8 tenants with additional tenant capabilities of 2 per tower.

Stoops is pleased, but Byrne's investors might have fared better

"This is definitely the deal we wanted to do at the price we wanted to pay," Stoops said.

The price that TowerCo wanted to pay when they bought the towers was considerably less.

TowerCo's portfolio was obtained when the company purchased Sprint Nextel's 3,300 towers for $670 million in cash in 2008. Byrne had been previously employed as the national director of business development at Nextel.

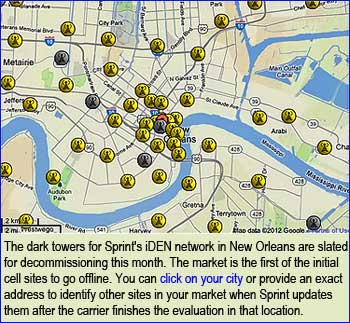

A number of TowerCo's structures have Nextel as a single tenant, and Stoops said that they might have to be decommissioned when Nextel removes its iDEN network.

However, Stoops said, he anticipates that continuing lease agreements with Nextel should offset the cost to remove the towers which is expected to cost between $15,000 to $25,000 per site to drop the tower and rehabilitate the compound.

While Sprint's iDEN leases expire between 2015 and 2018, Stoops said there would be no decommissioning until 2015.

After the deal, Sprint's contribution to SBA's revenue will increase to 27 percent from 23 percent, he said.

Stoops said he believes that TowerCo's assets, primarily urban and suburban, will be attractive to two underrepresented carriers. "These are clean towers for AT&T and Verizon to get on," he said.

Macquarie Capital analyst Kevin Smithen suggested in a report today that the changes at Sprint may have influenced TowerCo's strategy.

"We believe that TowerCo's financial sponsors, including Soros, opted for a strategic sale instead of an IPO given the long-term overhang of the iDEN decommissioning and were able to achieve a robust exit multiple," Smithen wrote.

A run at T-Mobile's towers is off the table

The cattle car buy has put SBA out of the running in the underheated race to purchase T-Mobile's 8,900 towers that are currently being shopped by Crown Castle International and American Tower Corp. as well as some private equity firms. T-Mobile represents approximately 18% of SBA's leasing revenue.

Stoops said that SBA would not be looking at acquiring T-Mobile's towers or any other major acquisitions this year and favored international buys for future expansion to benefit stockholders.

"As a practical matter, as you look around what is available in the U.S., we might find more opportunities outside the U.S.," he said.

In February, SBA bought Mobilitie LLC's 2,300 tower sites in the U.S. and Central America and other assets in a cash and stock deal valued at $1.09 billion.

Sale will see an end to "must be seen at" parties

TowerCo has a staff of approximate 70 people. Byrne said that employees have been offered the opportunity to remain with the company until the deal closes.

TowerCo's marketing budget was one of the largest in the industry and the tower consolidator was known for media advertising and its convention galas, the most recent, a packed crowd last month at Pat O'Brien's in the French Quarter during the CTIA show.

Although TowerCo was dwarfed by competitors eight times its size, the company held a corporate presence that made their events the place to be seen at if you were a mover and shaker.

Byrne is on the PCIA - The Wireless Infrastructure Association's board of directors, a position he has held since 2009.

JPMorgan Chase & Co. provided $900 million in financing and acted as financial adviser for SBA, while Greenberg Traurig LLP provided legal council. Wells Fargo & Co. acted as financial adviser to TowerCo, and Paul, Weiss, Rifkind, Wharton & Garrison LLP was its legal adviser.

|

It's a go to just say no to some existing tower

obstruction lighting requirements

June 25, 2012 - If a tower owner wants to flash or omit steady-burning red lights from several obstruction lighting configurations, they'll be able to do so after they electronically file for a  waiver. waiver.

Using the Federal Aviation Administration's "Deviation from Red Obstruction Light Standards" request, which should be available in early July, according to an FAA official contacted by Wireless Estimator, tower owners can take advantage of three new lighting configurations available for review here.

Studies by numerous avian groups have determined that abandoning the use of steady-burning obstruction lights in favor of flashing lights will help to reduce migratory bird fatalities.

The FAA's Airport Technology Research and Development Team released a study last month that stated that they agreed, and their researchers went further in their proposals adopted by the FAA to assist in lowering the mortality rate of birds killed after flying into communications towers.

FAA Style A, a standard for red obstruction lighting, has been changed, allowing owners of towers 351 feet and taller to turn off or remove their smaller steady-burning side lights.

Towers from 151 to 350' feet will still require midpoint side lights (L-810) that must flash at the same rate as the top beacon (L-864). Towers from 151 to 350' feet will still require midpoint side lights (L-810) that must flash at the same rate as the top beacon (L-864).

Towers using medium intensity dual lighting from 351 to 700 feet, Style E, will also be allowed to abandon side lights, but from 151 to 350 feet, midpoint flashing side lights will be required.

From 501 to 2,200 feet on dual high intensity lighting, Style F, sidelights will not be required, saving tower owners the requirement of installing and maintaining up to six additional levels of L-810 lighting.

A number of broadcasters are anxious to reconfigure their lighting systems to reduce power consumption.

The researchers determined that the proposed lighting configuration on the WPBN tower in Harrrietta, Mich. they studied should be flashed as close to 30 flashes per minute as possible to provide the optimal presentation  to pilots. to pilots.

When flashed more slowly, the FAA's test pilots said there was too much time between flashes, making the tower dark, which could potentially be a safety issue for pilots approaching the tower.

When the lights flashed more quickly, the L-864 fixtures were unable to achieve full intensity for long, which reduced the exposure time for pilots to see the lights.

Numerous circular routes were flown around the tower while the WPBN technicians turned the L-810s on and off again.

The researchers found that the tower was still visible from 20 miles away. In addition, the 30 fpm kept the lights on long enough so the location of the tower was never lost. The omission of the L-810s did not create any unusual presentation or adversely affect the overall appearance of the lighting configuration.

The purpose of the L-810 side lights, when used in conjunction with the L-864 lighting configuration, is to provide a point of reference for the pilot when the brighter flashes of the L-864 could not be seen.

The FAA said that technologies for flasher units and for the lights themselves now allow tower owners to select a specific flash rate or flash pattern to achieve an instant and accurate result.

However they acknowledged that older mechanical flasher units are not as accurate and cannot be set to an exact flash rate.

In order for the tower owner to remove the side markers a new L-864 lighting system that can meet the 30 fpm requirement must be installed.

The FAA is revising Advisory Circular 70/7460-1K, Obstruction Marking and Lighting to incorporate the new lighting styles.

|

Billions and bragging rights are on the line

with T-Mobile tower bids

June 22, 2012 - T-Mobile USA Inc. received a second round of bids for its cell towers, attracting offers from companies such as American Tower Corporation and Crown Castle International, according to a report in Bloomberg.com.

T-Mobile, which owns approximately 8,900 towers in the U.S., has also received bids from private equity firms, said the unnamed Bloomberg source. T-Mobile, which owns approximately 8,900 towers in the U.S., has also received bids from private equity firms, said the unnamed Bloomberg source.

The deal would help the carrier's self funding strategy for additional wireless spectrum and network enhancements. It also makes sense since AT&T gave T-Mobile a seven-year UMTS roaming agreement that will allow T-Mobile to expand its coverage an additional 50 million POPs.

If American Tower or Crown Castle were successful in their bid, the deal will be accompanied with bragging rights as to who will be the largest tower owner for years to come, possibly forever with approximately 31,000 towers.

According to Crown Castle's marketing materials and financial reports, the company owns approximately 22,250 towers in the U.S.; American Tower's database shows 22,050. See: Top Tower Companies .

The towers were being shopped last year, but there were no further negotiations after AT&T announced that it had agreed to buy T-Mobile USA from Deutsche Telekom for $39 billion.

The deal that would create the largest wireless carrier in the nation fell through.

The highest concentration of T-Mobile's towers are located in Calif.

. |

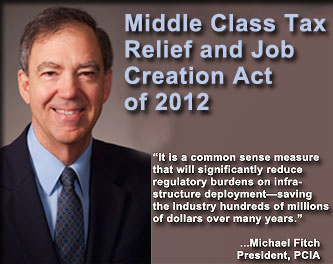

Michael Fitch honored by NYSWA as PCIA

searches for his replacement

June 21, 2012 - Michael Fitch, president and Chief Executive Officer of PCIA – The Wireless Infrastructure Association, was honored with the Wireless Warrior award by the New York State Wireless Association at their 2012 Annual Trade Show &  Conference this past week in Niagara Falls, NY. Conference this past week in Niagara Falls, NY. Fitch announced in April that he was resigning his position and returning to Los Angeles where his family resides and engage in telecommunications consulting work. Fitch has been the President and CEO of PCIA since 2005.

He said he will continue in his position while the search for a new President & CEO is conducted. He will work with the Board of Directors and his successor to ensure a smooth transition.

A spokesperson for PCIA said yesterday that it was not known whether a new President &CEO would be selected before the trade group's annual show, Oct. 1 through 4, in Orlando, Fla.

Fitch was recognized by the NYSWA for his preeminent role in the wireless industry and his significant contributions to furthering the industry.

“We thought it fitting to begin the tradition of formally recognizing those who have not only made an impact on NYSWA’s mission, but have made a significant impact on the wireless industry,” said NYSWA vice president Chris Fisher. “Mike Fitch has stood out for his tireless effort to implement wireless in every way - every day, and is a shining example of dedication and commitment to our cause.”

“PCIA has enjoyed great success under Mike’s stewardship,” stated Marc Ganzi, Chairman of the PCIA Board of Directors and CEO of Global Tower Partners.

“We have greatly advanced the wireless infrastructure advocacy agenda at the local, state and federal levels, making it easier for millions of Americans to enjoy ubiquitous use of their wireless communications devices. It has been an honor and a privilege to work with Mike. He leaves the association strong, prosperous and positioned for continued success, meeting the challenges to advance this industry he cared passionately about as our leader,” Ganzi said following Fitch's announcement that he was leaving.

Major accomplishments during Fitch’s tenure include: the historic passage of federal collocation by right legislation this year; state legislation streamlining wireless siting in New Jersey, Georgia, North Carolina and California; creation of The DAS (distributed antenna systems) Forum; expansion of State Wireless Associations; and significant growth of PCIA membership and the association’s annual Wireless Infrastructure Show.

“It has been an honor and a pleasure to serve as President & CEO of PCIA,” Fitch stated. “PCIA’s members play a crucial role ensuring that coverage and capacity are available to meet the exploding demand for wireless services. We have worked successfully for greater recognition of the importance of wireless infrastructure and more pragmatic approaches in policy making.”

|

Puerto Rico code change adds to mainland

tower contractors' backlogs

June 16, 2012 - In February 2011, the U.S. territory of Puerto Rico adopted the 2011 Puerto Rico Building Code, which references nine 2009 International Code Council  model codes, and many legacy towers are in the process of being retrofitted to meet new co-location design requirements. model codes, and many legacy towers are in the process of being retrofitted to meet new co-location design requirements.

There is no consensus of how many structures need to be rehabilitated, but there is a considerable demand for experienced island crews.

Last week an Edmond, OK construction company was advertising that it needed five to seven crews for modification work in Puerto Rico, and the companies "Must be willing to deploy quickly," their ad said.

Other stateside contractors are also trying to fill the growing demand by tower owners who have a considerable presence in Puerto Rico and are requiring structural upgrades.

Towers exceeding capacity range from a low of 15 percent, according to a tower manufacturer's engineer, to close to 80 percent, based upon what a Puerto Rico ISP representative said he has heard from a number of co-location personnel.

On Tuesday, the transmission lines on an SBA Communications tower off of PR-22 near Manati caught fire as welders were reportedly retrofitting the 190-foot self supporter.

Major Puerto Rico tower owners include AT&T Mobility, Crown Castle International, Global Tower Partners, Puerto Rico Telephone Company, SBA Communications, Inc., T-Mobile and TowerCo.

Noticeably absent is American Tower Corporation. The second largest tower owner in the U.S. doesn't own one tower in Puerto Rico. Its sole presence is managing a shopping mall rooftop near San Juan.

|

Answers at a glance available for ANSI/TIA-222-G  standard's questions standard's questions

June 14, 2012 - The TIA TR14.7 Steering Committee is now providing a publically accessible system to view frequently asked questions pertaining to the ANSI/TIA-222-G standard.

New submissions and the committee's responses will be automatically uploaded to Wireless Estimator's module located here.

One of the most recent requests for clarification was from a viewer inquiring as to whether there is reciprocity between the ANSI/TIA-222-G standard and the Canadian Standards Association's CSA S37-01.

The TIA TR14.7 Steering Committee members include: Brian Reese, Chairman; John Erichsen, Vice Chairman; Dave Brinker, Mark Malouf, John Wahba and Steven Yeo.

The TR-14 committee recently changed its title to Structural Standards for Communication and Small Wind Turbine Support Structures (formerly Point to Point Communications Systems).

|

Schlekeway to lead NATE's drive for a unified voice

Update: June 22, 2012 - Due to his new position as Executive Director of NATE, Todd Schlekeway said he will not be seeking re-election to the South Dakota State Senate in November.

“Serving the people of District 11 and the city of Sioux Falls in the state legislature the last four years has been an incredible honor and experience. I have enjoyed working with my constituents, legislative colleagues and state government employees during the last four years. “I have loved every minute of it,” Schlekeway said. “Serving the people of District 11 and the city of Sioux Falls in the state legislature the last four years has been an incredible honor and experience. I have enjoyed working with my constituents, legislative colleagues and state government employees during the last four years. “I have loved every minute of it,” Schlekeway said.

_____________

June 13, 2012 – The National Association of Tower Erectors (NATE) headquartered in Watertown, S.D., has announced that Todd Schlekeway has joined the organization as the trade group's Executive Director, replacing Patrick Howey who resigned in Sept.“After a thorough search, we feel fortunate to welcome such an outstanding individual to our organization. We are excited about Todd’s commitment and enthusiasm for our mission of providing a unified voice for safety, standards and education for tower erection, service and maintenance companies. His expertise comes at an essential time as we continue to advance NATE’s mission of safety and pledge continued focus to reduce risk in every project of which we engage. We are pleased to have Todd as our new Executive Director,” said Jim Coleman, NATE Chairman.

Schlekeway joins NATE after working the last seven years in the public affairs industry. As the founder and principal of a public affairs and communications firm called Full Court Strategies Group LLC, Schlekeway has extensive experience in the areas of government relations, media relations, client relations, issue advocacy, event management, strategic planning and budgeting.

Prior to working in the public affairs arena, Schlekeway worked on the U.S. Presidential Inaugural Committee in 2004-2005 and on several high-profile U.S. Senate campaigns in S.D.

Schlekeway has also served two terms in South Dakota’s state legislature where he represented a Sioux Falls legislative district in both the State House and the State Senate.

Schlekeway received his undergraduate college degrees from the University of Sioux Falls (USF) with a B.A. in History/Political Science and a B.S. in Exercise Science. He also earned a Master’s degree in education (M.Ed.) from USF. Todd participated in collegiate athletics as a member of the University of Sioux Falls basketball team during his tenure.

“I am very excited about this exciting professional opportunity to work for a dynamic national association like NATE that is headquartered in my home state,” Schlekeway said. “NATE has an outstanding leadership structure in place led by its Board of Directors. I also look forward to working with NATE’s dedicated and talented staff to continue to advance the mission of the association.”

|

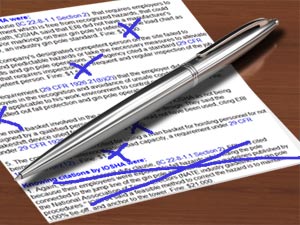

Anatomy of a cell tower death is quickly

cut off by undisclosed payments

June 8, 2012 - An investigation by ProPublica and Frontline into the death of 43-year-old William "Bubba" Cotton who was killed while working on an AT&T UMTS upgrade project has provided an exhaustive look at a fatality that could have been  prevented. prevented.If the need to provide additional cell phone coverage for an upcoming Talladega, Ala. NASCAR race didn't impose deadline pressures upon two contractors, Cotton might still be alive, according to his family members.

Cotton, an employee of Betacom Inc., died immediately on March 10, 2006 after he stepped outside of an equipment shelter and was struck in the head by an antenna that fell from an adjacent guyed tower.

Tower techs from ALT Inc. had been in the process of lowering the antenna when a rigging rope broke at about the 260-foot height of the 400-foot tower. Cotton was not wearing a hard hat, according to OSHA.

Following the fatality, OSHA cited ALT for failing to inspect and remove the defective rope and fined the Missouri-based company $2,000. Betacom received a $4,900 fine for not ensuring that their workers were wearing hard hats.

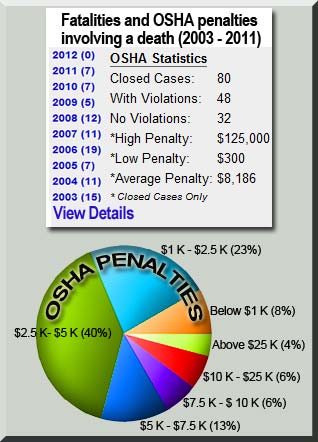

In an industry enured by frequent climber fatalities, especially in 2006 when there were 19 deaths, the accident received no media coverage other than a short overview in Wireless Estimator's fatality database.

However, according to the joint ProPublica/Frontline report written by Liz Day and Ryan Knutson, immediately following the accident, Cotton's daughters filed a wrongful death lawsuit in Talladega County Circuit Court against AT&T and Betacom, later amending it to include ALT, WesTower Communications, Inc. and the owner of the tower, Crown Castle International.

Who controlled the tower site and who was responsible for the safety of the subcontractors working on it were essential questions explored by attorneys.

A personal injury suit was filed in October by Cotton's cousin and co-worker, Charles “Randy” Wheeler, who said he received a back injury after diving away from the falling 8-foot tall, 50-pound antenna.

WesTower and Crown Castle were later dismissed as defendants in both cases.

Remaining unanswered is why Nsoro, the turfing contractor that subcontracted the AT&T work to WesTower, who subcontracted it to ALT, was not a defendant in the lawsuits.

Betacom worked directly for AT&T.

According to court records and depositions, attorneys for Cotton's family and Wheeler argued that AT&T had created a work environment where "time and money took precedence over safety," and had repeatedly pressured subcontractors to meet an "unreasonably dangerous schedule."

Testimony was also obtained from ALT's foreman that he had asked an AT&T project manager to provide additional time to complete the installation because he felt unsafe working above other workers on the site.

AT&T reportedly denied his request. The foreman also related that information to OSHA, but the agency did not open an investigation regarding his charges.

Although it could be argued that AT&T was in a supervisory role on the jobsite because its project manager was directly handling scheduling requests and safety concerns, in a request for a summary judgment, AT&T claimed that the multi employer doctrine that identifies whether the carrier would have any liability at the jobsite, had been abandoned by the agency and was never recognized in the Eleventh Circuit, the jurisdiction where this case was being heard.

Settlements end digging into contractor safety responsibilities

What could have explored important contractor safety issues came to a sudden halt in August 2008.

Without admitting wrongdoing, AT&T entered into a confidential settlement with the Cotton family. In approving the deal, the judge said AT&T’s “potential exposure in this wrongful death case is significantly higher” than the amount of the settlement. Without admitting wrongdoing, AT&T entered into a confidential settlement with the Cotton family. In approving the deal, the judge said AT&T’s “potential exposure in this wrongful death case is significantly higher” than the amount of the settlement.

Two months later a judge dismissed AT&T as a defendant in the Wheeler case, deciding that Wheeler had not proved that the carrier controlled the subcontractors' activities when the accident occurred or that the carrier knew ALT's crew would be working over Betacom's employees that day.

Wheeler appealed the decision, but AT&T notified him that they intended to seek more than $14,000 for the costs associated with the taking and obtaining copies of the transcripts of the more than 20 depositions taken in the case.

Wheeler caved in and dropped his appeal when AT&T agreed to drop its claim for reimbursement.

He did receive an undisclosed settlement amount from ALT. The contractor also settled with Cotton's children.

AT&T LAWSUIT DOCUMENT LINKS:

Through research and Freedom of Information Act requests, ProPublica has provided a number of documents pertaining to the lawsuits and OSHA investigations.

Karen Roth Deposition - AT&T Senior Project Manager Karen Roth is an AT&T Senior Project Manager and was in charge of the Talladega upgrade. As a representative of AT&T, her testimony was key in the plaintiffs being able to prove that AT&T was aware of the potential hazards of multiple crews on a job site and ALT's request that it wanted an extension of time to complete the job safely. It's 72 pages, but many of the more relevant statements are highlighted.

Betacom and Nsoro Agreements with AT&T Nsoro's contract was the result of an RFP that was issued to 9 vendors. The estimated value of the agreement was $4.5 million based on the anticipated award of 40 sites. The contract included liquidated damages for delays and quality defects. The services covered under the agreement also included all construction management activities, but the turfing contractor was not a defendant in the lawsuits.

Nsoro's Talladega agreement with WesTower WesTower Communications, Inc. of Dallas, Tex. was provided the contract to remove nine antennas and install nine new antennas along with installing TMAs, diplexers, running the lines to the new equipment shelter, color code the lines, and test the antennas and lines for $21,000. The company subcontracted the work to ALT.

ALT OSHA documents and Betacom OSHA documents The redacted files pertaining to ALT's investigation and subsequent citation and fine is available along with photographs of the defective rope. The Betacom documents contain photographs of the Talladega cell site and the antenna which fell and killed their employee.

ALT's statement to OSHA regarding site concerns In a statement to OSHA, ALT's foreman said, "I told them that I was not gonna work above others and I was gonna have a hard time completing the job because of poor planning on the job. They made some phone calls on my behalf asking for another week to complete the job. They got denied and told me it needed to be able to test on Tuesday." OSHA did not investigate the foreman's concerns

AT&T's motion for summary judgment In its motion for summary judgment, AT&T said it required the contractors working at the Talladega site to comply only with the contract specifications for the upgrade and to meet the project deadlines. "This level of oversight does not constitute control over the manner in which the independent contractors performed their contractual obligations," AT&T said.

Cottons' civil action complaint The wrongful death suit regarding William Eugene Cotton, II alleged that AT&T repeatedly pressured contractors to meet their deadline and insisted that antennas be replaced at the same time other work was going on above Cotton. It was also purported that there was an unreasonably dangerous schedule and time and money took precedence over safety.

|

Lack of a $10 gate hasp costs AM station $7,000; obstruction light outage is $10,000

June 6, 2012 - An unlocked fence gate of a York, Pa. AM station might have provided WOYK Inc. with a reprimand from FCC agents when it was discovered, but the station  was cited with willful and repeated violations for not having the gate secured. was cited with willful and repeated violations for not having the gate secured.

Based upon the condition of the hasp, the agents said it appeared to have been in disrepair for an extended period of time, allowing unrestricted access to the base of the antenna structure.

Although the president of the station alerted the FCC that he had fixed the problem immediately upon learning of the trouble, the Acting District Director of the Philadelphia office's enforcement bureau, Kevin Doyle, fined him $7,000 on May 22, 2012 for the violation that was discovered on December 17, 2010.

The term “repeated,” according to the FCC, means "the commission or omission of such act more than once or for more than one day." Based upon the condition of the damaged hasp, the agents said the condition had existed for multiple days.

The tower site was near a residential area and the RF potential at its base could have caused serious injuries to those entering the unlocked facility, according to the FCC.

No lights, no camera, FCC takes action

In another FCC Notice of Apparent Liability, a number of obstruction lights on a broadcast tower in Beaumont, Tex. weren’t working when an FCC agent paid a visit on November 28, 2011, resulting in a $10,000 fine for the structure's owner, Martin Broadcasting, issued on June 5, 2012.

According to the FCC agent, who responded to a complaint, the top and midpoint red obstruction lights and the three quarter side lights were not lit. The agent also made phone calls and determined that the FAA had not been informed about the outage.

The agent reached the tower’s owner who stated that he learned of the light outages on the 575-foot tower from previous voice messages left by the agent. He also admitted that the lights on the structure were not being observed on a daily basis by a spotter or with a camera, and that the structure did not have an alarm system to monitor the lights.

|

TR-14 tackles turbines along with towers

June 1, 2012 - The Telecommunications Industry Association (TIA) Technical Committee approved a significant change to the title and identified scope of its TR-14 committee which reflects industry developments that have evolved the work it is doing.

The TR-14 Committee changed its title to Structural Standards for Communication and Small Wind Turbine Support Structures (formerly Point to Point Communications Systems). The TR-14 Committee changed its title to Structural Standards for Communication and Small Wind Turbine Support Structures (formerly Point to Point Communications Systems).

More specifically, the new scope of TR-14 is to: Maintain and provide interpretation of ANSI/TIA-222, “Structural Steel Standards for Steel Antenna Towers and Supporting Structures” and TIA-1019-A, “Structural Standards for Installation, Alteration and Maintenance of Communication Towers, Antennas, and Antenna Supporting Structures”. The committee is also working to develop a design supplement to ANSI/TIA-222 for small wind turbine structures in response to industry demand in this area.

These changes reflect the recent standards development work the committee has been doing in the area of design and analysis of structures supporting small wind turbines. Wind turbines are increasingly being used to power communications towers – an important development as the ICT industry seeks to increase energy efficiency.

Brian Reese, Chairman of TR-14, said, “The program of work in the TR-14 committee has changed as the uses for antenna towers have also modified over time. The change in title and scope for the committee formalizes what the industry has been doing in TR-14.”

“The current direction of the new scope of TR-14 is encouraging to a fledgling product line determined to impress its mark on the tower industry. These standards should bolster our credibility as a real-world alternative energy production platform considerably,” said Kerry Donnelly, president of Windular, a manufacturer of wind turbines for communications structures.

“The timely adoption of such standards could prove to be a boon to proponents of wind energy generation on communications towers. These new standards should provide much needed confidence in new technologies promoting hybrid use of telecom assets for alternative wind energy production.”

“Any time we can apply a well thought out body of standards, modified to apply to cutting edge technologies, makes the adoption of such technologies that much easier for tower owners, carriers and zoning authorities," said Donnelly.

|

Wireless industry veteran Keith Duckwitz passes

June 1, 2012 - Keith M. Duckwitz, 57, passed away May 30, 2012 at Wellstar Kennestone Hospital, Marietta, Ga. after a short illness. Duckwitz was in key management positions for multiple companies in the wireless communications industry such as American Tower Corporation and Gibson Technical Services, Inc.

He owned several businesses with his brother-in-law Cliff Padgett.

Born June 22, 1954 in Alexandria, Va., he is survived by his wife, Sherrie, of Port Orange, Fla.; daughter, Samantha Richardson; sons Brennan M. Duckwitz and Burton Stacey III; and his mother Joanne Davis Prass, and three grandsons and a granddaughter.

The family will hold a memorial service at their home at 2492 E. Cherokee Dr., Woodstock, Ga. on Saturday, June 2, 2012 from 2:00 to 4:00 pm.

In lieu of flowers the family requests you make a donation to your local Humane Society. Online condolences are here.

|

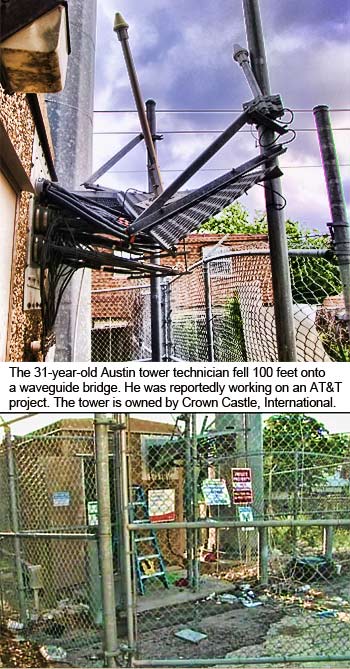

Climber's fall on AT&T project may have forced

Goodman Networks' unconventional stand-down

Update: May, 25, 2012 - 3:30 P.M. ET - A spokesperson for the Austin, Tex. Police Department has identified that the 31-year-old tower technician who fell 100 feet off of a monopole was employed by Goodman Networks. They also said that the last report that they had was that Shad Lierley was in stable condition. A Goodman employee said that they could not find Lierley in the company directory.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

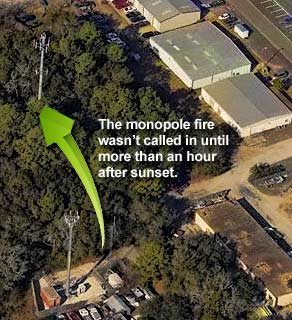

May 25, 2012 - It is still not known if a 31-year-old Austin, Tex. tower technician survived a 100-foot fall from a monopole in Southeast Austin on May 16 around 6:20  p.m. p.m.

Police say that 31-year-old Shad Lierley was working on the structure along with at least one other employee when he fell.

He was transported to University Medical Center at Brackenridge. A hospital spokesperson said earlier this week that they could not release any information regarding his injuries. Today, a spokesperson said that he is no longer at the hospital and would not release information as to whether he was transported to another trauma center.

A spokesperson for the Austin Fire Department said that they and the city's police department had been told by OSHA not to release any information regarding the incident.

Waverly Kennedy of OSHA's Austin area office said he could not provide any details regarding the accident. Wireless Estimator has filed a Freedom of Information Act request with OSHA for all details regarding the incident that are able to be provided as well as a copy of all citations to the unnamed contractor, if the agency does find Lierley's company at fault.

In OSHA's database, there is an inspection information report for Platinum Communications Inc. of Austin that was opened on May 17 for the accident location, but it shows a closed conference date of May 18.

Photographs provided to Wireless Estimator indicate that Lierley was working on an AT&T project when he fell. Following the accident, AT&T's equipment shelter door was open. The Crown Castle-owned tower also has Clearwire as an additional tenant.

Damage to the waveguide bridge indicates that Lierley hit the structure when he fell. An unconfirmed news report stated that a second tower technician also suffered minor injuries to his hand.

AT&T did not respond to a request to verify whether it was an AT&T project that Lierley was working on. The carrier was also asked what turfing contractor was managing the contract.

Industry insiders believe that it might be Goodman Networks, Inc. of Plano. The company manages many AT&T projects throughout the nation.

Speculation is based upon Goodman issuing a stand-down to its contractor after the close of business yesterday.

Stand-downs, a practice where all employees in a company as well as the company's subcontractors are required to stop all of their client's project work until a safety meeting is held addressing specific concerns, is typically required following a spate of fatalities.

However, there is no industry information available that any death has occurred and Goodman's request to their contractors neither addresses a fatality nor any other reason for a mandatory stand-down.

Their request for the immediate training required states that, "This bulletin is being issued as a reminder of the dangers involved in our industry and to remind all of our employees and contractor personnel of the importance of planning safety into every project."

Goodman did not respond to a request by Wireless Estimator inquiring whether the stand-down was a response to Frontline's documentary and ProPublica's articles earlier this week regarding tower construction safety or whether it was a result of the tower technician who fell, or both. The turfing contractor was also asked if they were managing the Austin project at 2230 E. Ben White Blvd.

Goodman is requesting that the stand-down training must be completed by Tuesday, a deadline that a number of contractors told Wireless Estimator was going to prove to be difficult.

"Many of our people are off today because they've requested it months ago so that they could enjoy a long weekend," said one Midwest contractor. "With Monday being a holiday how do they expect us to get everybody together on Tuesday? We can't."

Another contractor registered concern that Goodman's stand-down is going to affect schedules for all of the other projects they are committed to on Tuesday.

Stand-downs have been criticized by many in the industry as being reactive to client concerns rather than a proactive approach to safety.

The joint Frontline/ProPublica investigation identified that the fatalities on AT&T projects totaled 15 since 2003 – more than at the other three major carriers combined over the same period.

Wireless Estimator's fatality database was used as a resource to be able to identify climber fatalities and then complete the additional research necessary.

AT&T did not go on camera with Frontline, but provided a statement emphasizing that fatalities are going down since 2003. They also pointed out that last year there were no fatalities of tower technicians working on their sites.

The company did not discuss the workers who are seriously injured for life on their projects, such as the Austin worker and others who are not captured in media reports.

In 2010, a 35-year-old Massachusetts tower tech survived a 60 foot fall off of a monopole in Hartford, Vt. He was working on an AT&T project.

Comments regarding the stand down

|

Cutting edge second generation of industry

safety tools are a collaborative effort

May 21, 2012 - Wireless Estimator has introduced its second generation Emergency Services Locator and Job Hazard Analysis (JHA) forms to assist the industry in greatly reducing administrative time, but more importantly, to keep workers OSHA compliant and safe.

Using cutting age technology, the all new Emergency Services Locator (ESL) is the nation's only interactive program that - once you enter a job site's address or latitude and longitude - immediately provides fire and law enforcement contact information as well as the nearest hospital information and a route to it along with a map. Using cutting age technology, the all new Emergency Services Locator (ESL) is the nation's only interactive program that - once you enter a job site's address or latitude and longitude - immediately provides fire and law enforcement contact information as well as the nearest hospital information and a route to it along with a map.

The ESL's first version, introduced in 2010, was used to successfully send more than100,000 forms that allowed companies to provide the emergency services information required by OSHA to be accessible on every job site.

Version 2, using three mapping services at one time, a programming breakthrough ensuring accuracy, can also auto-fill a newly introduced JHA that was the collaborative effort of 16 of the industry's leading safety officers in an effort that spanned one year.

The best practices JHA meets and exceeds the ANSI/TIA-1019-A's Check List for Site Evaluation for projects for elevated work that is now required to be used as a minimum assessment. The best practices JHA meets and exceeds the ANSI/TIA-1019-A's Check List for Site Evaluation for projects for elevated work that is now required to be used as a minimum assessment.

Since approximately 40% of all wireless projects do not require elevated work, a best practices JHA is also available for civil, electrical and other work. A forms library is also offered.

Wireless Estimator has also introduced its New Project Tracker where you can easily see where wireless projects are being processed in real time during the past two weeks as well as a year to date summary.

Try the ESL and New Project Tracker once, and like other industry contractors, you'll be hooked.

|

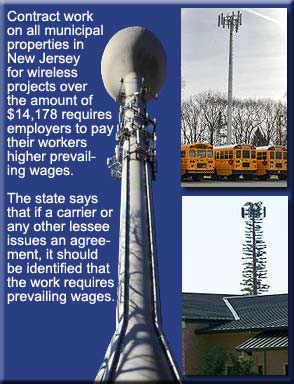

N.J. targeting wireless contractors for not paying prevailing wages to their employees

May 18, 2012 - Prevailing wisdom of many N.J. communications contractors has been that you only have to pay your employees higher prevailing wages if you are working on a project owned and funded by a public agency.

Not so, says the N.J. Department of Labor and Workforce Development, and depending upon the work window of a project a company could be required to compensate a foreman as much as $221 an hour for hanging antennas and lines while he's on the job. Not so, says the N.J. Department of Labor and Workforce Development, and depending upon the work window of a project a company could be required to compensate a foreman as much as $221 an hour for hanging antennas and lines while he's on the job.

If the threshold amount of $14,178 for a project is exceeded for telecom work on any public property, even absent a contract or funding from a public agency, prevailing wages must be paid, said Ashleigh Chamberlain, Section Chief of the Division of Wage and Hour Compliance.

He said that many communications contractors have recently been cited for failure to comply with the state's Prevailing Wage Act and the Public Works Contractor Registration Act.

In addition, a number of investigations are underway of contractors who performed work on cell towers and they could also be fined for violations of the acts, and be required to compensate their employees for lost wages and benefits, Chamberlain said.

Those wages would be the difference between what the employee was originally paid in his hourly rate and company benefits, and what the county in which the project was located in requires to be paid in prevailing wages and benefits - which could be a considerable amount.

As an example, if a company is doing an LTE upgrade on a structure located on public property in Bergen County, a northern county sitting across the Hudson River from New York, a tower technician running lines and installing antennas - required by the state to be identified as a journeyman electrician - would have to be paid $47.29 an hour and receive an additional $27.66 an hour in benefits.

However, like a number of the state's 21 counties, electricians performing elevated work on a tower must receive an additional percentage of the total. It's 21% in Bergen, so the hourly wage for an L&A climber climbs to $57.22 and benefits jump to $33.47.

If a company's benefits are calculated to be $12.00, a typical amount which would include employer contributions such as paid medical premiums, 401K contributions, etc., the difference in the county's required amount must be paid to the employee in cash or placed in an approved benefits plan.

If compensating a tower tech $90.69 per hour seems problematic with some of today's razor-thin margin carrier projects, it will be even more troubling when overtime kicks in.

Since it's rare that a crew will not work a 10 hour day to complete a project, companies will be required to compensate their tech for two hours of overtime at $136.04 an hour.

But company compliance doesn't stop there. On any job where there are two or more tower technicians, one must be a foreman. But company compliance doesn't stop there. On any job where there are two or more tower technicians, one must be a foreman.

And when a carrier informs the contractor that work must be performed on a Sunday, double time kicks in and the prevailing wage compensation for a foreman would be $221.46 an hour.

"In addition to new construction, work constituting repairs, renovations, alterations, and demolition may be subject to the acts," Chamberlain said.

If a tower consolidator or any other entity is going to erect a tower or do renovations or maintenance on structures on any publically owned land such as along the Garden State Parkway or in a municipality's park, police, fire or any other department's property, such as a community's water tower, prevailing wages must be paid, according to the state's Prevailing Wage Act.

L&A installers compensated more than tower erectors

Although prevailing wages for an ironworker's hourly pay in Bergen County are less than an electrician's at $38.84, the benefits that must be provided are higher at $39.47; however, unlike technicians who are installing antennas and lines on a tower who get an additional 21% of their total compensation for working at heights, ironworkers - who are subject to additional dangers while erecting a new tower or installing antenna booms - are excluded from that benefit.

"It makes absolutely no sense," said one veteran N.J. contractor. "The only thing I can think of is that the IBEW was more powerful than the iron workers' union."

New Jersey's wage act requires the tower owner or carrier lessee on public property to identify in their request for proposal to contractors that prevailing wages must be paid if the total is expected to be over the threshold amount.

In addition, they're required to specify in the contract itself what the prevailing wage rate in the locality is for each craft or trade required for the project.

Carriers don't, said two east coast contractors who actively build sites in N.J. Although Verizon is known on occasion during a bid walk to identify that the project is required to be governed by prevailing wages, others don't, they said.

Chamberlain said, although the lessee would be in violation of the Prevailing Wage Act if they did not include this information in their quotation request and issued contract, it does not absolve the contractor from paying his employees the required county-identified compensation.

Although carriers or their turfing contractors and tower developers/owners can be cited and fined for non compliance with the act, N.J. appears to be primarily focused upon ensuring that workers are compensated fairly since there are no known citations given to the lessee of the telecom property.

"I don't know if they (carriers) are ignorant of the fact that the project must be performed under the prevailing wage act or they just don't want bidders to know about it so that they don't have to spend the additional money," said one contractor.

The added contractor cost is substantial. Since oftentimes 90% of the project is labor, prevailing wage requirements could raise the contract price by as much as 140% or more.

State prevailing wage laws vary greatly. In states where organized labor is comparatively weak, such as Neb., the wage determinations are close to the competitive market rates. Where organized labor is powerful, as in N.J., the prevailing wage law mandates rates that are close to or even exactly the same as construction union rates.

The state's tower maintenance contract requires its contractors to compensate their employees with prevailing wages.

A four year maintenance bid, expiring in 2015, was awarded to Jacobs Telecommunications Inc. for their man-hour bid of $145.75. Trains Tower Inc. also shares the state's work at $207 per hour.

The state is required to pay the companies time and one-half and double time when it is required.

|

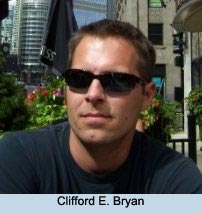

Illinois tower contractor killed in motorcycle crash

May 15, 2012 - Well-known and respected communications contractor Clifford E. Bryan, 36, was killed Sunday afternoon after he reportedly lost control of the  motorcycle he was operating and struck a tree in Bolingbrook, IL. motorcycle he was operating and struck a tree in Bolingbrook, IL.

Bryan was taken to Adventist Bolingbrook Hospital. He was pronounced dead at 7:40 p.m., police said.

Bryan was the President and CEO of Communication Builders, Inc. of Carol Stream since 2002. The company began operations in 1998.

Although he owned the company, he was frequently on site to help his customers conquer their challenging projects.

The full service tower construction and maintenance contractor is also a preferred electrical contractor for a number of carriers.

He is survived by his parents, Judi and Jim Bryan, and his wife, Beth; and their two daughters, Rebecca, 6 and Samantha, 4; and his sister, Shannon.

Visitation will be held at Salerno's Rosedale Chapel, 450 W. Lake St., Roselle, Friday, May 18, 2012, from 3:00-9:00 P.M. A funeral service will be held at 7:00 P.M.

The family is in the process of setting up a trust fund for Cliff’s daughters, and they request that in lieu of flowers donations be made to the fund.

|

LightSquared's future darkens following

Chapter 11 bankruptcy filing

May 15, 2012 - LightSquared Inc., the LTE wholesale network that was heralded in 2010 as the business that would provide robust industry growth for tower owners, contractors and suppliers with its plan to build 40,000 sites that would be up and  running at the end of 2015, pulled the plug on those ambitious plans yesterday with a Chapter 11 bankruptcy protection filing. running at the end of 2015, pulled the plug on those ambitious plans yesterday with a Chapter 11 bankruptcy protection filing.

"Today's filing was not an option the company embraced quickly or easily, but it was necessary to protect LightSquared against creditors who were looking for a quick profit, as opposed to our goal to create long-term market competition, job creation, and the promise of wireless connectivity for every American," said Philip Falcone, whose Harbinger Capital Partners is LightSquared's main backer.

In a press release, LightSquared stated that the bankruptcy filing was meant to give it "breathing room" to battle regulatory hurdles while continuing to operate its network.

The filing is the latest setback for LightSqauared's bid to launch a nationwide wireless- network using airwaves previously reserved for satellite use.

The company received an almost fatal blow in February when U.S. regulators rescinded a decision granting the company the right to build its network, based upon studies that showed that it would interfere with GPS signals used by the military and law enforcement agencies.

The company said it fully expects to continue normal operations throughout this process. All LightSquared distribution partners and customers, including public safety, emergency response, government and military users of LightSquared’s satellite-based communications services can continue to rely on LightSquared to provide them with mission critical communications services, according to their statement.

However, infrastructure suppliers and contractors might be weighing whether they want to continue supporting what may be an inescapable failure.

"I don't know what our position is going to be on accepting any additional orders. We are just going to have to see what their plan is in order to make any valid decision," said one major manufacturer's sales executive whose company has been providing materials for the build-out, but was owed little in project receivables.

SBA Communications was identified as being one of the Reston, Va.-based company's top 20 creditors with unsecured claims. Although the amount is disputed, LightSquared listed owing SBA $178,150.

Boeing Satellite Systems Inc heads the list in the bankruptcy filing at $7,483,005 followed by Alcatel at $7,343,549.

|

FCC issues guidance on antenna structure registrations' environmental process

May 14, 2012 - The FCC has released guidance on the December 2011-approved changes in the process required for applicants to file FCC Form 854, Antenna  Structure Registration and on the new process for members of the public to file requests for environmental review. Structure Registration and on the new process for members of the public to file requests for environmental review.

The public notice also states that in the future the FCC intends to provide additional guidance materials relating to the process on their web site page by today.

To assist filers with questions they may have, the FCC’s Wireless Telecommunications Bureau will be holding a live webcast on the changes to the filing procedures on May 21, 2012, at 11:00 AM, EST. The webcast will be available at www.fcc.gov/live.

The environmental notification process applies to the following types of filings that are submitted in the ASR system:

1. All new tower registrations unless:

• Another federal agency has taken responsibility for the environmental review; or

• An emergency waiver is granted.

2. Modifications to existing tower registrations if:

• An antenna is being placed on an existing tower or non-tower structure and the placement of the antenna would increase the existing height of the structure by more than 10% or 20 feet, whichever is greater; or

• Lighting is being added to a previously unlit tower; or

• Existing lighting is being modified from a more preferred lighting configuration to a less preferred lighting configuration.

3. Amendments to pending applications outlined in 1 and 2 above if:

• There is any change in the type of structure; or

• There is any change in the coordinates of the tower location; or

• There is an increase in the overall height of the structure; or

• There is a change from a more preferred lighting configuration to a less preferred lighting configuration; or

• An Environmental Assessment is added.

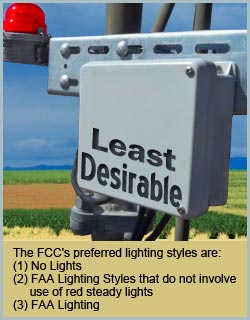

The FCC's preferred lighting styles are (1) No lights; (2) FAA Lighting Styles that do not involve use of red steady lights; and (3) FAA Lighting.

|

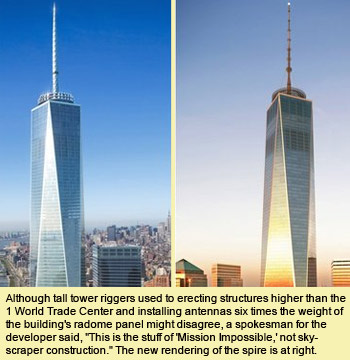

Climber safety and cost cited for change

in design of 1 World Trade Center

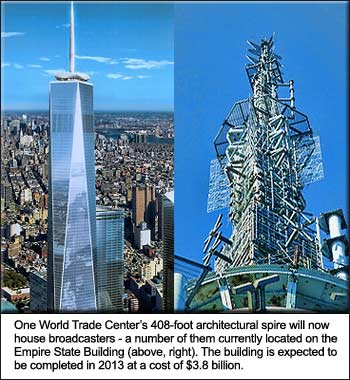

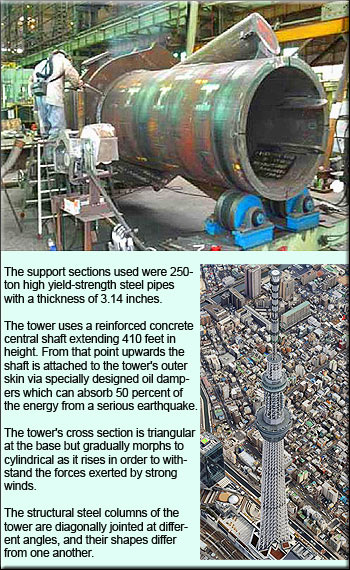

May 12, 2012 - It's challenging to identify if this week's announcement that 1 World Trade Center will not have a radome covering its 408-foot antenna structure was due to a $20-million construction  savings or because the developers were concerned about the safety of climbers accessing it, or both, but what is known is that the change could strip it of its title as North America's tallest building when it's completed in 2013. savings or because the developers were concerned about the safety of climbers accessing it, or both, but what is known is that the change could strip it of its title as North America's tallest building when it's completed in 2013.

Omitting the shroud on the 1,776-foot New York building raises the question of whether the spire at the top would be counted toward the official height of the structure, or whether it would rank as the third-tallest in the nation, at 1,368 feet to the roof—behind Chicago's Willis Tower and a Donald Trump-built tower.

In the traditional way of measuring height, architectural spires are included, while antennas aren't. While the Port Authority of New York and New Jersey and developer Douglas Durst, owners of the building, insist it is still a spire, the authority on such matters—the Council on Tall Buildings and Urban Habitat—hasn't yet weighed in.

"Eliminating this integral part of the building's design and leaving an exposed antenna and equipment is unfortunate," David Childs, the building's lead designer, said in a statement. "We stand ready to work with the Port on an alternate design."

Durst said that it would have been almost impossible to carry out repairs on the exterior of the shell, as maintenance workers wouldn't be able to safely access it. "They should have done a better job designing it," Durst said of the radome.

Removing it "is not the end of the world," he said in an interview in The Wall Street Journal.

Childs also said that the tower's architect, Skidmore Owings & Merrill LLP, had devised a workable maintenance plan with engineering consultants hired for the purpose.

In order to repair or replace a broken panel on the structure's proposed enclosure, a climber would have to scale the spire, attach a cable to the top, lower the cable about 2,000 feet down, and then use it to hoist a 2,000-pound piece of fiberglass back to the top, said Jordan Barowitz, a spokesman for the building's developer, according to the Associated Press.

Although tall tower riggers used to erecting structures higher than the 1 World Trade Center and installing antennas six times the weight of the building's radome panel might disagree, Barowitz said, "This is the stuff of 'Mission Impossible,' not skyscraper construction."

Defending the structure's tallest building status, Barowitz said when the building is complete in 18 months or so, there will be no broadcast equipment on the spire.

"It will be a spire, lit with LEDs. I don’t know how you could call that an antenna. It’s a spire from which broadcast equipment will be suspended.”

For additional information about the possibility of the building being declassified as the U.S.'s tallest building once it is completed, click here.

|

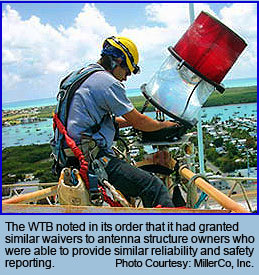

Crown Castle gets a second pass on quarterly lighting inspection requirement

May 9, 2012 - The Wireless Telecommunications Bureau (WTB) of the FCC granted a waiver from the quarterly inspection requirement for antenna structure lighting monitoring to Crown Castle USA Inc. and AT&T Services Inc.

Crown leases 1,564 towers from AT&T that fall under the quarterly inspection requirement. Crown leases 1,564 towers from AT&T that fall under the quarterly inspection requirement.

The country's largest tower owner employs remote automatic monitoring systems on some of the leased towers. The systems are equipped with tracking mechanisms that evaluate the remote monitoring technology.

Crown Castle and AT&T informed the FCC that the quarterly inspections of antenna structure lighting monitoring systems have been rendered unnecessary because of technological advancements associated with the particular monitoring systems that Crown Castle employs -- the Opto 22 B3000 and Simple Com Tools Com 3000 Monitoring Systems, a monitoring system developed by Crown Castle.

The WTB agreed, and issued the order after receiving input from the Airspace and Rules Group of the Federal Aviation Administration that the agency did not oppose Crown's system.

In 2007, the WTP issued Crown Castle and American Tower Corporation a similar waiver.

American Tower's approved monitoring system was the Eagle Monitoring System, a product of Flash Technology.

At that time the Aircraft Owners and Pilots association (AOPA) objected to the annual request, stating that the technology used by American Tower required further evaluation.

AOPA indicated that it favored introduction and use of new technologies, but believed that quarterly inspections should continue until these new technologies have been thoroughly evaluated.

The FCC did not find their concerns persuasive. View article.

|

"Cell Tower Deaths" rescheduled for May 22

May 1, 2012 - The PBS Frontline documentary, "Cell Tower Deaths" - originally scheduled for Feb. 21 - will air on May 22.

A spokesperson for Frontline would not identify why the program had been pulled  from PBS's schedule earlier this year. However, the production company for Frontline had reportedly been filming additional interviews as of mid April. from PBS's schedule earlier this year. However, the production company for Frontline had reportedly been filming additional interviews as of mid April.

Information in their promotional trailer identifies that, according to their interviews and research:

• Independent contractors who are building and servicing America’s cellular infrastructure are 10 times more likely than an average construction worker to die on the job;

• Complex layers of subcontracting insulate the carriers against liability, despite the fact that they set the aggressive schedule that can force subcontractors to cut corners in order to meet deadlines, and those ambitious timeframes may be one of the reasons why workers are dying;

• There is a hidden cost that comes with the demand for better and faster cell phone service.

Although some tower climbers have said that they are under pressure to cut corners, layers of subcontracting make it difficult for OSHA inspectors to determine fault when a tower worker is killed or injured, according to Frontline.

Due to a perceived higher fatality rate on AT&T projects over the years, the carrier is expected to be discussed in the 30-minute program.

An AT&T spokesperson said that the company had been contacted by Frontline, but he declined to state whether they had changed their earlier decision not to appear on camera.

Following Frontline's air date announcement in February, AT&T appeared to be concerned about how the program might impact their image.

"AT&T is concerned that a Frontline investigation is being conducted to provide information for a program they will run later in February," a Black & Veatch Corporation turf director informed the firm's contractors on February 8 in an email, cautioning them to avoid any media contact.

AT&T also fired up its public relations firm, Brunswick Group, to research climber fatalities.

"Cell Tower Deaths" is a joint investigation of Frontline and web-based ProPublica.

ProPublica was a recipient of the 2011 Pulitzer Prize in National Reporting and a 2010 Pulitzer Prize in Investigative Reporting.

See related articles.

|

It's no longer a walk in the park for governments expecting high income from towercos

April 16, 2012 - The lure of easy money from tower companies to help fund operational budgets for county and state parks may not be as available as park directors think, and requests for quotations may go unanswered if legacy revenues are expected, which recently occurred in Miami-Dade County, Fla.

To prop up services, the Parks, Recreation and Open Space's Department put out a proposal to towercos to install and operate cell towers in up to 22 parks across the South Florida county. To prop up services, the Parks, Recreation and Open Space's Department put out a proposal to towercos to install and operate cell towers in up to 22 parks across the South Florida county.

However, not one company offered a proposal for the January bid and Miami-Dade's optimistic annual income of $2.64 million from tower companies is still no closer to being put into county coffers.

Two tower company developers who reviewed the bid for Wireless Estimator believe the revenue baselines were too high.

"Miami is a very mature market, and it looks like the county backed into the numbers based upon an unduly rosy scenario that they found out was impossible to replicate," said tower site developer John Paleski, President of Old Bridge, N.J.-based Subcarrier Communications.

Miami-Dade PROS originally thought that they could receive revenues of $80,000 to $120,000 per cell tower. The presumption was based upon current income being obtained by two towers on park land as well as guidance from a Michigan law firm specializing in telecommunications.

One tower in Tamiami Park had revenue from October 1997 to July 2010 of $1.21 million, averaging $88,000 per year. The second structure in Haulover Park has received an income from its sole tenant, AT&T, of $19,998 per year from 1992 to 2010, according to county documents.

The minimums in the RFP required an annual ground lease of $24,000 and a 3% per year increase as well as a 40% sublicense fee for each of up to four tenants, with an increase to those revenues of 3% per year.

The RFP required individual site bidding with a one-time, non-reimbursable option fee of $5,000.

Paleski, who has been developing and leasing tower sites since 1986, said that the lengths of leases being offered by some park systems and municipalities are oftentimes unacceptable.

Kevin Asher, Supervisor of Special Projects for the Miami-Dade PROS, believes that the RFP might have been a little ambitious in its expectations after he spoke with nine tower companies during a work session in order to review how the bid could be more equitable so that it could be reissued within a month or two.

"They found that when they ran the numbers it didn't make sense for them to bid," he said.

Asher said that the 120-foot limitation for the flagpoles, without a flag, was an issue and it will most likely be changed to 140 feet to accommodate carriers.

The minimum annual ground lease of $24,000 might see a considerable reduction, according to Asher. It is expected that it will be approximately $18,000 and will also include the first tenant.

Revenue sharing from additional tenants may drop from 40% to 30% and the lease term will most likely change to a more palatable 20-year term with two additional five-year options. Miami-Dade originally offered a 10-year term with four additional five-year options.

The bid will also cap the contractor's cost at $50,000 at each site for the bid requirement to provide lightning prediction equipment, security cameras and wireless internet access.

Asher said that one tower company has expressed an interested in a majority of the sites. Nevertheless, it will not be known until bid opening day whether they move forward on placing a $5,000 non-refundable option fee on multiple park locations.

"If they do, it will give them the opportunity to see if they can make the deal work. If they can't they'll just forfeit it. It's small change for them," said Ken Schmidt, President of Steel in the Air, Inc., a tower leasing consulting firm.

Average expected revenue amounts are elusive

A provision in a bill now before the Connecticut General Assembly, An Act Modernizing the State’s Telecommunications Laws (SB 447), would allow communications companies to build towers in state parks and forests, with the approval of the commissioner of the Department of Energy and Environmental  Protection. Protection.

This would fundamentally change the current state practice of not allowing towers on watershed land, state parks or state forests.

Although there are a number of organizations and residents against it, some state park officials are looking forward to the revenue sharing opportunities that will be presented.

However, it will be a work in progress for state officials as they try to find out what are reasonable fees in an industry where there are few common denominators due to site-specific metrics.

Lease rates vary from state to state and even from city to city where leases are on public property.

In example, Miami-Dade failed in its attempt to get a minimum of $24,000 for a ground lease and 40% of tenant revenues, but Ramapo, NY is looking to ink a deal where they will receive $36,000 a year for a Sprint tower and 25% of the revenue from each additional co-locator.

Yet, this week Sprint is building a cell tower on school property in Scottsdale, Ariz. under an agreement where the school district receives an annual payment of $14,400.

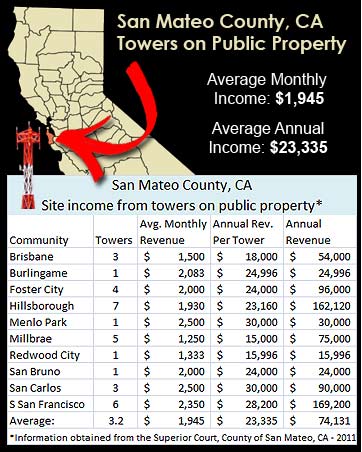

Head 750 miles northwest to San Mateo County in Calif. and you'll find the total annual revenue per tower at $23,335 - see chart above.

Earlier this year the Lynchburg, Va. City Council was approached by a site development company to consider partnering with them.

It was presented during a February council meeting that the fiscal impact upon the city would be: when a tower was built the city would receive a one-time payment of $20,000 and $5,000 each time a carrier co-located on the structure.

In addition, annual revenue of $12,000 would be provided to the city for each carrier that was a tenant on the tower.

The projected $36,000 per three-tenant tower appeared attractive to council members, but the city's staff recommended that proposals should be obtained from other companies if they were to move forward with a tower revenue sharing plan.

With each carrier's revenue to the city of $1,000 per month it is difficult to identify what percentage Lynchburg would be receiving from the carriers, but it could represent as much as 60% or higher.

There is no definitive average price a carrier is paying for a co-location. A pure guesstimate from those entrenched in tower leasing and ownership believe it's anywhere from $1,500 to $2,100 per month.

|

Crop duster survives crash after clipping guy wire

April 10, 2012 - A Colorado crop-duster pilot didn't walk away from a serious accident yesterday, but miraculously only suffered a broken arm, collarbone and severely injured his leg after his 1999 fixed-wing plane crashed at the base of an  American Tower Corporation 306-foot guyed tower in Lakin, Kan. American Tower Corporation 306-foot guyed tower in Lakin, Kan.

The pilot, identified as 58-year-old David Burr, of Montrose, was taken to Kearny County Hospital and later to Wichita's Via Christi-St. Francis Hospital, where he was listed in critical condition Monday afternoon.

The Kansas Highway Patrol said the aircraft's right wing clipped a guy wire on the cell tower. The plane hit the ground nose-first near U.S. 50 and flipped over.

The crop-duster was registered to Tri Rotor Spray and Chemical, in the southwestern town of Ulysses.

The emergency call was reported to KHP dispatch about 9:30 a.m. The plane went down soon after taking off from an airport about three miles east of Lakin. Flying conditions were reportedly cloudy at the time of the accident.

American Tower dispatched a tower crew to identify the damage to the tower and what procedures will be necessary to stabilize the structure.

The Kansas Department of Transportation had closed US-50 in Kearny County, approximately three-and-a-half miles east of the junction of US-50 and K-25.

Hazardous materials teams were also called to scene because the plane was full of chemicals at takeoff.

Last month, neighboring Idaho Gov. C.C. "Butch" Otters signed into law a bill that will assist crop-duster pilots.

Although the new law requires owners of rural towers between 50 feet tall and the minimum Federal Aviation Administration regulation threshold of 200 feet tall to be clearly marked for low-flying aircraft, it excludes communications towers and power poles.

The law was passed after pilots registered their concerns about meteorological towers popping up throughout the state to gather data for siting wind turbines.

|

Cramer's romancing the steel of

American Tower seems to be cooling

April 5, 2012 - CNBC's popular "Mad Money" host Jim Cramer has had a love affair with American Tower Corporation since 2009, calling the Boston-based tower consolidator "the gold standard" to be used for investing in tower  companies. companies.

The financial analyst, who will moderate a May 8 roundtable discussion at the CTIA Wireless 2012 show along with AT&T, Sprint Nextel, T-Mobile and Verizon CEOs, has entitled American Tower the "tsunami" stock to hang on to.

Cramer has highlighted ATC and has had CEO Jim Taiclet on his show more than any other tower company.

"I like that stock so much. I've always been behind it... that is just one smoking good company," Cramer said during a broadcast earlier this year.

But last night the former hedge fund manager announced to over 300,000 viewers that he is now smitten with SBA Communications and it appears that his smoking hot affair with American Tower is cooling. He called SBA a "red hot stock".

Cramer said that both SBA and American Tower are superior to Crown Castle, but among the two, he likes SBA more, "because it has one of the highest quality tower portfolios in the industry, meaning their towers are in the right places. And it's much more of a growth play, given that it's only a quarter of the size of American Tower."

He noted that SBA recently closed a secondary offering of stock which will give investors a rare opportunity to buy shares at a discount to where they would normally trade.

Cramer told his audience to use this weakness to buy in to SBA, stating it's become a "rocket ship" of a stock. Although stocks traded flat in mid morning, American Tower was up $0.41; SBA gained $0.85.

Indian portfolio could be troubling

American Tower's presence in India has always been a primary reason why Cramer believes that the company will do well with its international expansion program.

However, lately India has become one of the more difficult countries for tower owners to maintain their profit levels.

Oversupply of towers in urban areas and viability issues in rural areas have cut into new builds in the country. In addition, cut-throat competition between carriers has forced tower owners to renegotiate lease costs.

Limited fiber and microwave backhaul have created problems in the country where the tenancy rate for towers is 1.6 versus approximately 2.75 in the U.S.

Because more than 70% of towers in India receive grid power for less than 12 hours a day, tower companies must use diesel generators half of the day costing three times more.